China Takes Global Number Two Outward FDI Slot: Hong Kong Remains the Preferred Service Platform

China Takes Global Number Two Outward FDI Slot: Hong Kong Remains the Preferred Service Platform

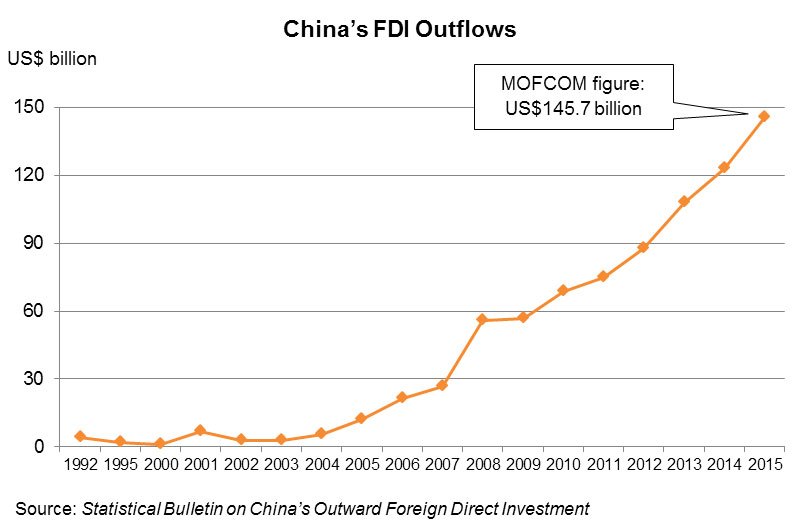

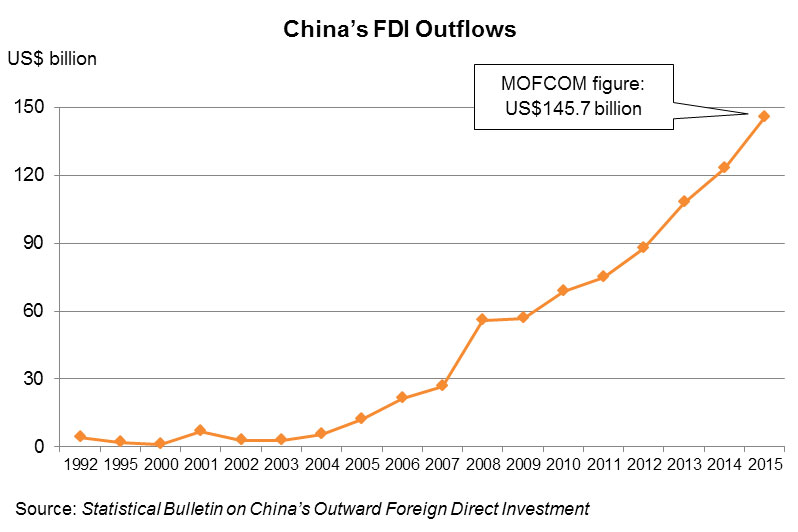

While the pace of global economic growth is slackening, Chinese enterprises are actively making outward foreign direct investments (FDI) and expanding their businesses overseas. Together with the country’s efforts in advancing the Belt and Road Initiative, and strengthening various forms of economic co-operation with business partners in countries along the Belt and Road routes, this has contributed to the continued growth of China’s outbound FDI. China is now one of the world’s leading sources of FDI, its outflows in 2015 ranking second globally only to the US. During the same period, China’s outward FDI exceeded its inbound FDI, making the country one of the world’s net capital exporters.

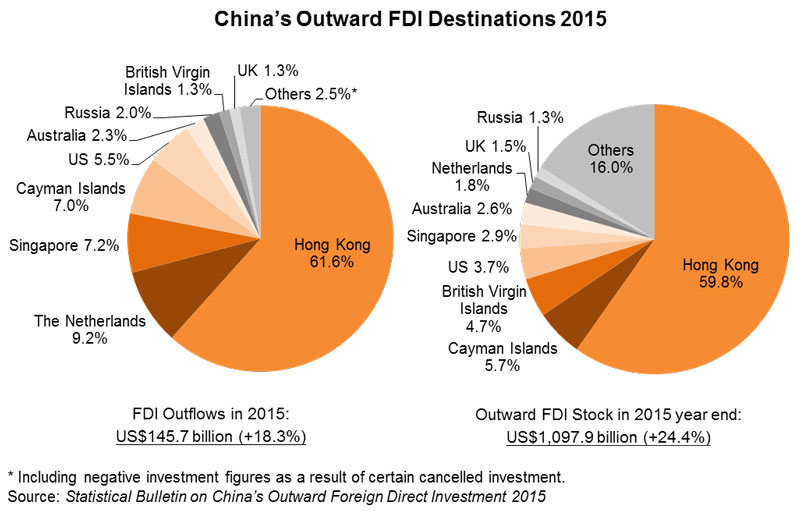

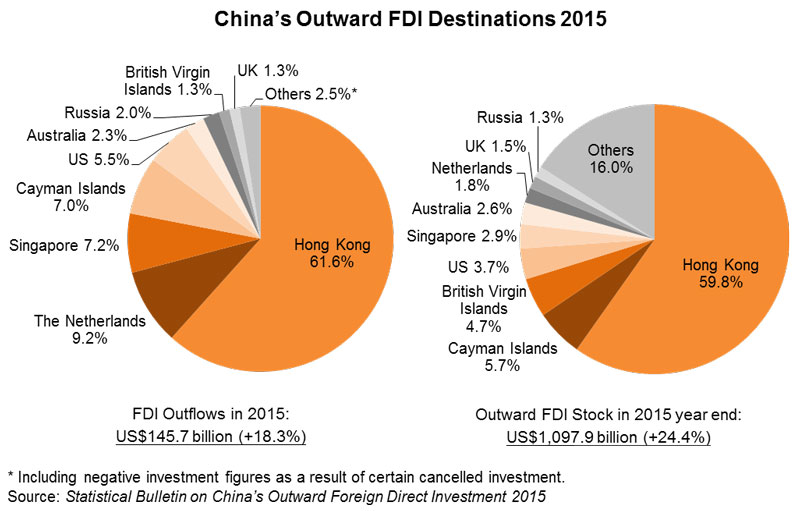

In recent years, the Chinese government has substantially relaxed the relevant administrative measures for overseas investments, whereby enterprises may now make outward FDI according to their own development plans. Currently, about 60% of the mainland’s outbound investment flows to Hong Kong, and it is believed that most of this is subsequently channelled overseas through Hong Kong’s service platform for different kinds of investment activities.

Hong Kong has always been the preferred service platform for mainland enterprises looking to invest abroad, helping industry players in the coastal areas and inland regions to handle matters involving investment and trade in foreign markets. Hong Kong is also the preferred location for mainland enterprises seeking professional services to capture opportunities arising from the Belt and Road Initiative. Its full range of professional services covers such areas as finance, legal service, tax, risk assessment of sustainable operations, and international testing and certification. As the mainland accelerates its pace of “going out” and advances the Belt and Road development strategy, its outward FDI activities will continue to expand, providing more business opportunities for professional service suppliers in Hong Kong.

World’s Second-Largest FDI Source

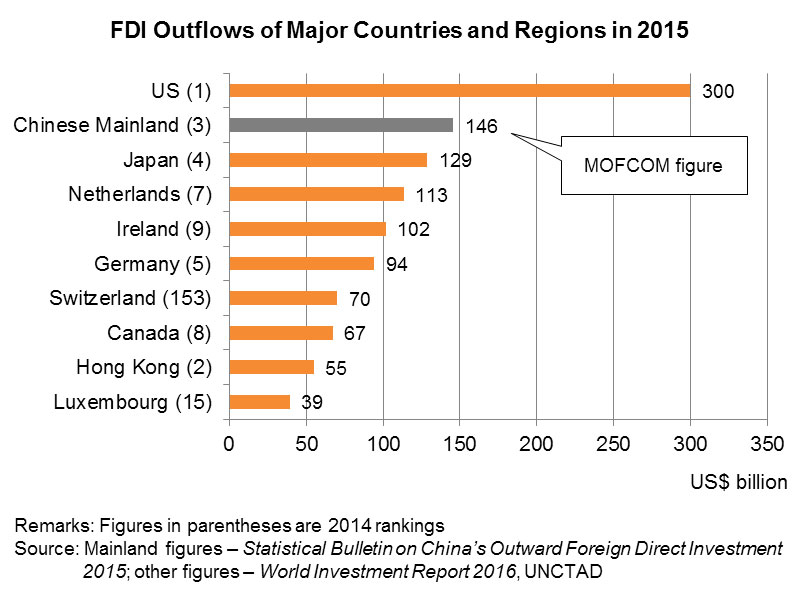

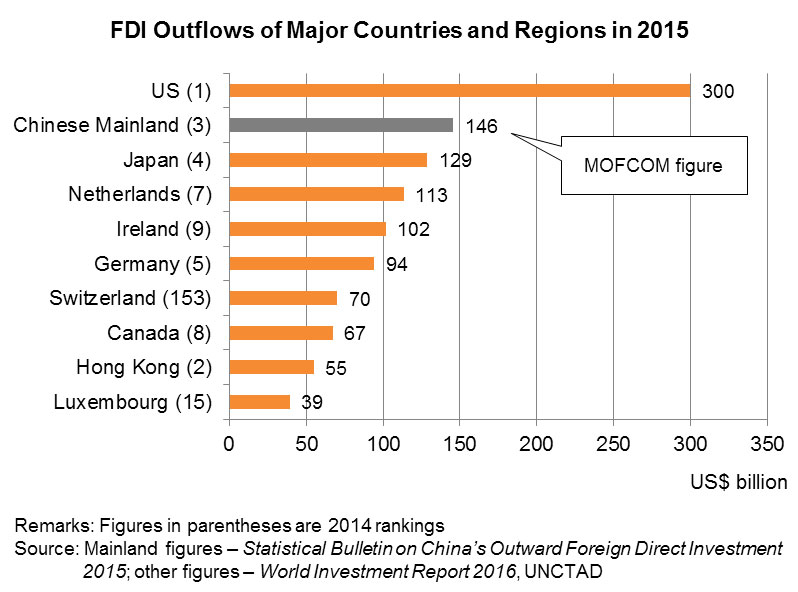

According to figures released in September 2016 by the Ministry of Commerce, China’s outward FDI flows in 2015 reached US$145.7 billion (up 18.3% year on year), for the first time ranking as the world’s second-largest source of FDI. Its investment amount, second only to the US (US$300 billion) but higher than third placed Japan (US$128.7 billion), accounted for 9.9% of the global total of FDI outflows in the same period.

Meanwhile, in 2015, China’s outward FDI also exceeded the amount of its utilised foreign direct investment (US$135.6 billion), making the country a net capital exporter. It is worth noting that in this two-way capital flow involving the inflow of foreign investment into the mainland and outflow of Chinese investment abroad, Hong Kong serves as an important platform.

In particular, where outbound investment is concerned, China has substantially relaxed the relevant administrative measures for offshore investments in recent years, including, since May 2014, the introduction of the record-filing system for general outward FDI projects valued at less than US$1 billion. The National Development and Reform Commission (NDRC) further announced at the end of 2014 that the authority of approving[1] general outward FDI projects valued at and more than US$1 billion (not involving sensitive countries, regions or industries) was to be revoked. Since then, apart from outward FDI projects involving sensitive countries, regions or industries, all general outward FDI projects in China no longer require approval and are only subject to record-filing management.

Consequently, Chinese enterprises may now expand their businesses overseas and make outbound investments in countries of their choice according to their own development strategy. In spite of this, many enterprises still choose Hong Kong as their main conduit for outward investment. In 2015, the mainland’s FDI flows to Hong Kong reached US$89.8 billion (up 27% year on year), accounting for 62% of the country’s total outward FDI and reinforcing Hong Kong’s position as the leading destination of mainland outbound investments. In terms of cumulative outward investment as of the end of 2015, the stock of FDI outflows from the mainland to Hong Kong stood at US$656.9 billion, accounting for 60% of the total outward FDI stock at that time.

Blessed with such advantages as free flow of capital, wealth of global communications resources, world-class professional services and a sound legal system, Hong Kong has attracted large numbers of mainland enterprises to “go out” and invest overseas via its business platform.

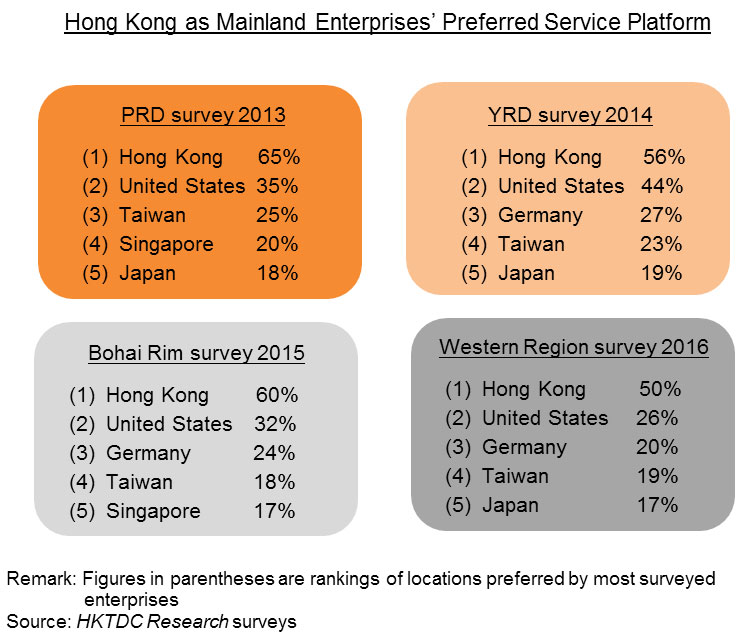

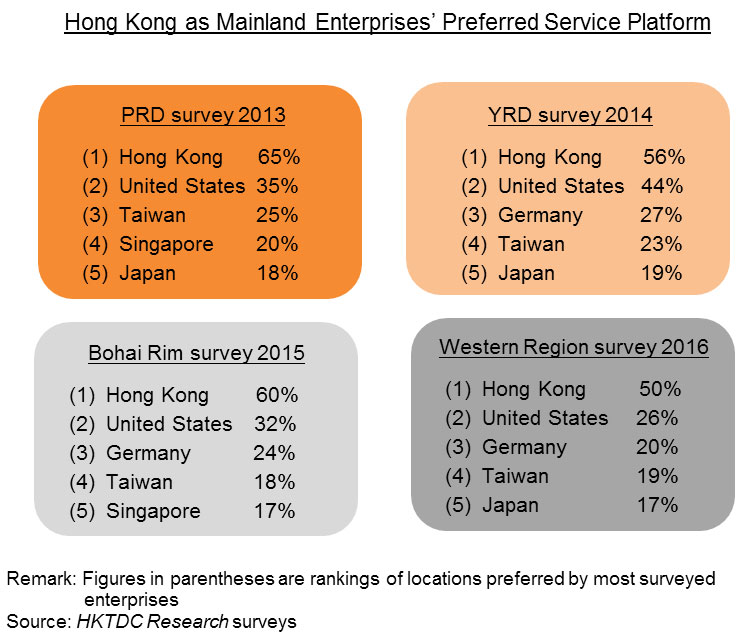

Macro factors aside, according to four questionnaire surveys conducted by HKTDC Research in different regions of the mainland between 2013 and 2016, the majority of surveyed mainland enterprises pointed out that they were interested in making use of the “going out” strategy to “bring in” the advantages of foreign business partners, while further tapping both the mainland and overseas markets. These enterprises also indicated that they needed all kinds of professional services, including brand design and promotion, marketing strategies, product development, and design services, in order to support their ventures of “going out” to expand businesses overseas.

The majority of the surveyed enterprises remarked that they were most interested in seeking professional services support and co-operation partners in Hong Kong, with 65% of the enterprises in the Pearl River Delta (PRD), 56% in the Yangtze River Delta (YRD), 60% in the Bohai Rim and 50% in the western region saying so. In other words, no matter whether these enterprises are located in the coastal areas or the western region, Hong Kong is their preferred service platform in “going out” to make investment abroad.

[Remarks: For findings of the surveys conducted by HKTDC Research in the PRD, YRD, Bohai Rim and western region, please see the following reports – Guangdong: Hong Kong Service Opportunities Amid China’s “Going Out” Strategy (December 2013); Jiangsu/YRD: Hong Kong Service Opportunities Amid China's "Going Out" Initiative (September 2014); China’s “Going Out” Initiatives: Professional Services Demand in Bohai (September 2015); and China's “Going Out” Initiative: Service Demand of Western China to Tap Belt and Road Opportunities (July 2016).]

Belt and Road Initiative Adds Growth Momentum to Outward Investment

Meanwhile, China’s great efforts in advancing its Belt and Road development strategy[2] and encouraging more enterprises to conduct various kinds of trade and investment activities in countries along the Belt and Road routes have also contributed to the rapid growth of China’s outward FDI.

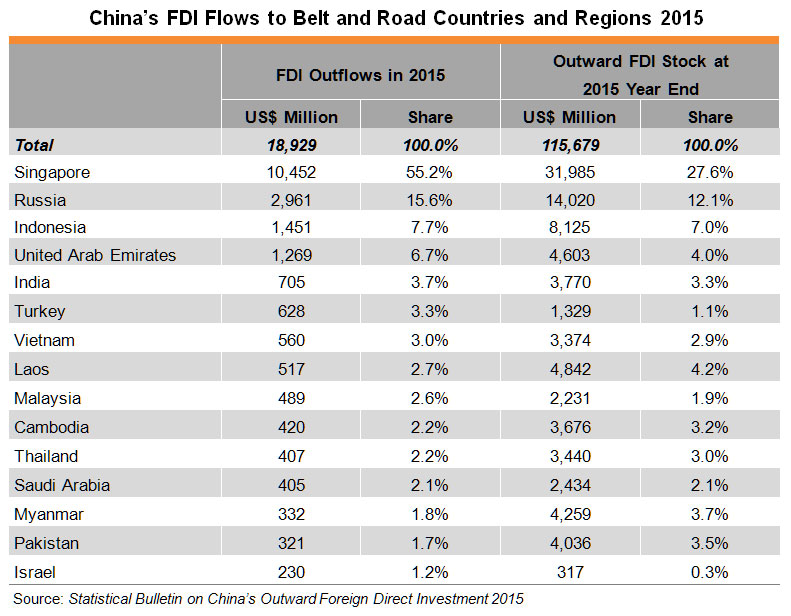

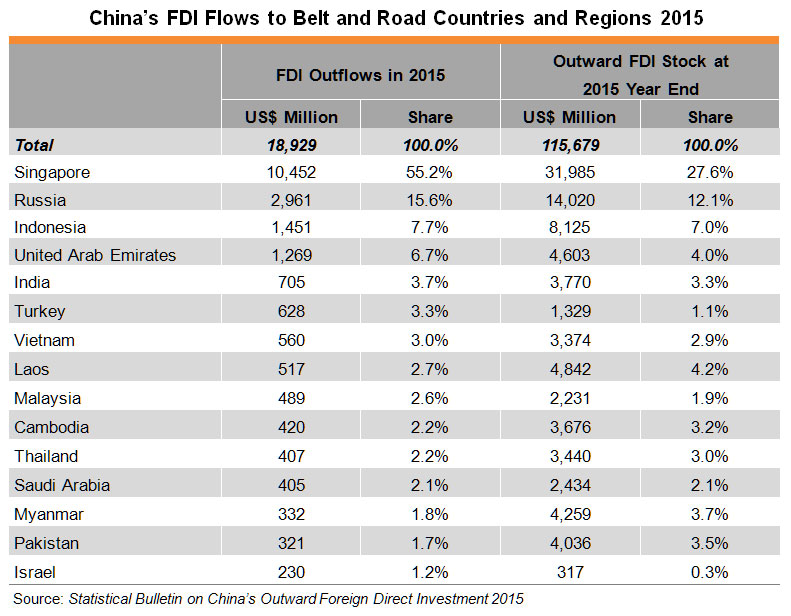

In fact, China’s FDI outflows to Belt and Road countries rocketed to US$18.9 billion in 2015 from about US$400 million in 2004, with average annual growth between 2004 and 2015 amounting to some 43%, higher than the 35% average annual growth of China’s total FDI outflows during the same period. In 2015, China’s investment in the Belt and Road countries and regions rose 38.6% year-on-year, more than twice the 18.3% annual growth rate of its total outward FDI for the same period. Moreover, the share of China’s outward FDI flows to the Belt and Road locations in its total outward FDI also climbed to 13% in 2015 from about 7% in 2004. In 2015, China’s investment in the Belt and Road Initiative mainly flowed to Singapore, Russia, Indonesia, the United Arab Emirates and India.

Strong Demand for Hong Kong Services

As mainland enterprises “go out” further to invest offshore and develop overseas business and expand foreign markets along the Belt and Road routes while seeking foreign technologies, brands, production materials and other resources to enhance their competitiveness, it can be expected that China’s outward FDI, including outflows to countries along the Belt and Road routes, will further increase in the years to come.

Hong Kong, as the preferred service platform for mainland enterprises “going out” to invest offshore, has many ways to help mainland enterprises make direct investment and expand overseas business in developed countries including the US and those in Europe. Hong Kong also serves as the ideal service platform outside the mainland for most Chinese enterprises seeking support to tap opportunities arising from the Belt and Road Initiative.

Findings of the questionnaire survey conducted by HKTDC Research in south China in 2016 show that among the many locations outside the mainland, Hong Kong is where the largest number of surveyed companies (50%) wish to seek support in developing their Belt and Road businesses. Such support includes various market-promotion services in Belt and Road markets as well as professional services related to investments in these markets, such as legal, accounting and consultancy services.

(Remarks: For findings on the questionnaire survey conducted by HKTDC Research in south China, please see: Chinese Enterprises Capturing Belt and Road Opportunities via Hong Kong: Findings of Surveys in South China)

For many years, Hong Kong service suppliers have been assisting large numbers of mainland enterprises in handling matters related to their investment and trade activities in Hong Kong and overseas markets. Hong Kong offers many advantages in supporting mainland enterprises to invest overseas, including the free flow of capital, wealth of global communications resources, and a full range of world-class professional services, covering such areas as finance, legal service, tax, risk assessment of sustainable operations, and international testing and certification. Hence, Hong Kong is the preferred service platform for mainland enterprises “going out” to make offshore investment. As the mainland further relaxes the administrative measures for outward investment, encourages enterprises to “go out” to invest overseas, and advances the Belt and Road development strategy, more business opportunities are set to emerge for service suppliers in Hong Kong.

[1] NDRC Order No.20: Decision of the National Development and Reform Commission on Amending Relevant Articles in the Administrative Measures for the Approval and Record Filing of Outward Investment Projects and Administrative Measures for the Approval and Record Filing of Foreign Investment Projects (27 December 2014)

[2] China is advancing the Belt and Road (i.e., the Silk Road Economic Belt and 21st Century Maritime Silk Road) development strategy. In March 2015, China issued a document titled “Vision and Actions on Jointly Building the Silk Road Economic Belt and 21st Century Maritime Silk Road”, proposing to accelerate the building of the Belt and Road in a move to better co-ordinate economic policies of countries along the route, promote the orderly and free movement of economic factors, and advance efficient resources distribution and in-depth market integration in creating an open, inclusive, balanced and mutually-beneficial regional economic co-operation framework.

| Content provided by |

|