GDP (US$ Billion)

22.57 (2019)

World Ranking 113/194

GDP Per Capita (US$)

713 (2019)

World Ranking 179/193

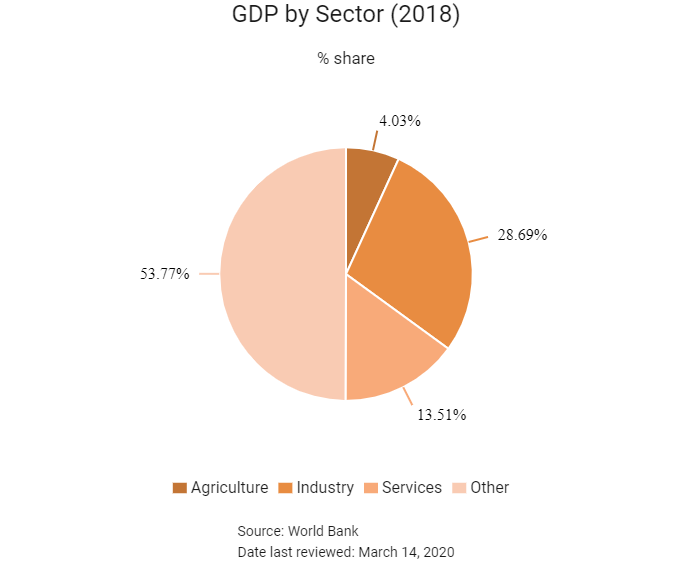

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

N/A (Nil)

Currency (Period Average)

Yemeni Rial

250.25per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

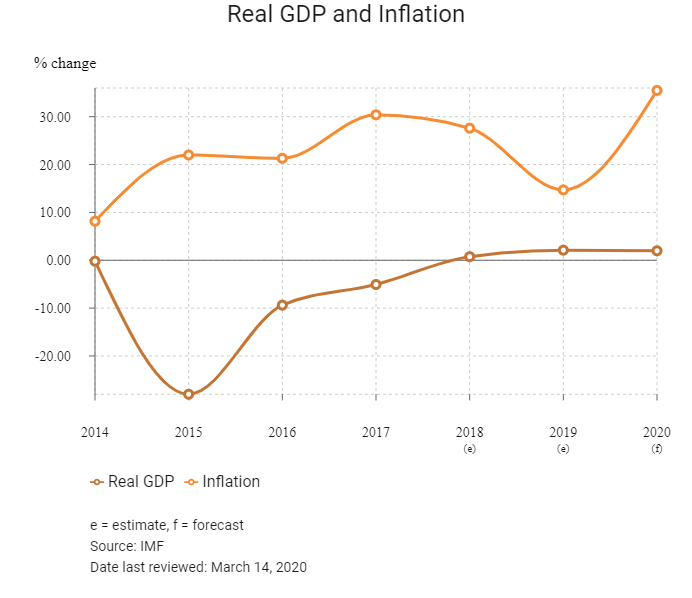

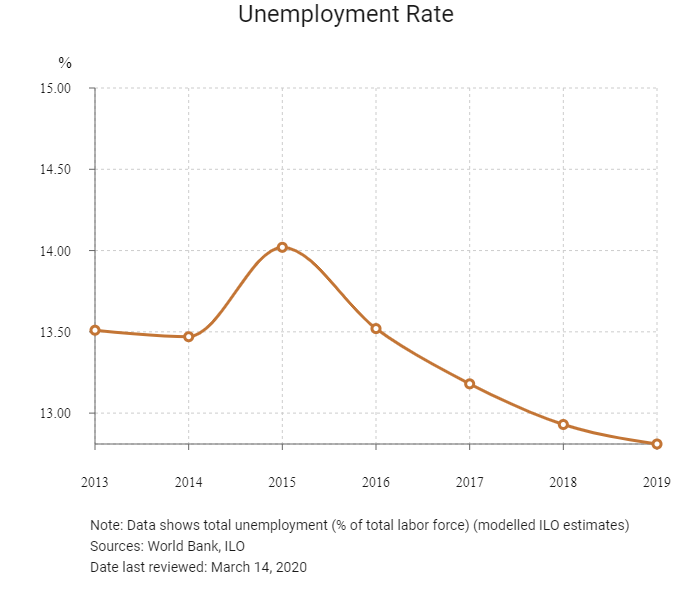

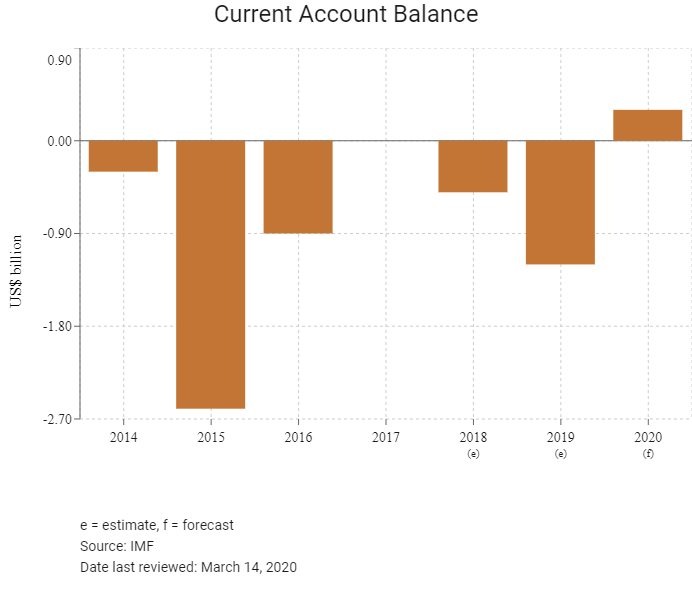

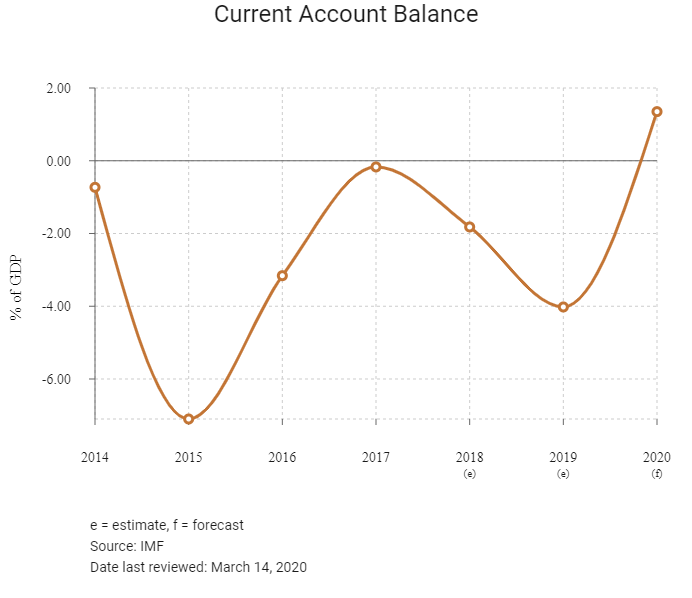

Since the escalation of conflict in the first quarter of 2015, economic activity has significantly slowed. The conflict has caused widespread disruption of productive sectors, with substantial reduction in jobs, private sector operations, and business opportunities. Operating costs rose severely due to insecurity and lack of supplies and inputs, leading to massive layoffs to the country’s formal and informal workforce. Economic prospects in 2020 and beyond will depend on stabilisation of the political and security situation. Saudi Arabia remains the top source of aid funding for Yemen, providing USD968.4 million to the Yemen Humanitarian Response Plan in 2019. While the response plan does include some reconstruction efforts, with Yemen's food crisis escalating the short-term focus will remain on humanitarian relief. Much of the instability in macroeconomic indicators – rapidly growing government debt, accelerating inflation related to money printing for salaries, rapid depreciation of the exchange rate – will improve with an improvement in security, easing of import barriers, the restoration of government services, and a recovery of the private sector.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

June 2015

The leader of Al-Qaeda in Arabian Peninsula, Nasser al-Wuhayshi, was killed in a United States drone strike in Yemen.

September 2015

President Abdrabbuh Mansur Hadi returned to Aden after Saudi-backed government forces recaptured the port city from Houthi forces and launched an advance on Aden.

April 2016

United Nations (UN)-sponsored talks between the government and Houthis and former President Saleh's General People's Congress (GPC) commenced.

January 2017

A United States raid on several suspected Al-Qaeda militants and civilians marked the first United States military action in Yemen under President Donald Trump.

July 2017

Mainland China provided a grant of USD22.5 million in relief assistance to the Yemeni government.

December 2017

Former president Saleh was killed after fierce fighting in the capital Sanaa.

January 2018

Southern Yemeni separatists – backed by the United Arab Emirates – seized control of Aden.

September 2018

Yemen's central bank hiked rates on certificates of deposit to 27%, up from the 15% level that it had held constant since 2014.

February 2019

A UN conference that took place in Switzerland raised USD2.6 billion in aid contributions towards Yemen.

November 2019

UN seeked to negotiate a cease-fire, after months of fighting around the key Houthi-held port of Hudaydah and a mounting humanitarian crisis.

January 2020

The Saudi Development and Reconstruction Program for Yemen (SDRPY) broke ground on the first phase of a project which involved the modernisation and expansion of Aden International Airport in Yemen. The project would be executed in three phases. The first phase involved providing electricity, employing safety measures, studying and redesigning external main gates and roads, and providing passenger transport buses. The second phase would cover building and connecting key service systems, such as telecommunications, navigation and air traffic control. It would also include rehabilitation of the runway, taxi areas and gates. The final phase would involve aligning airport facilities and operations with International Civil Aviation Organization standards.

Sources: BBC country profile - Timeline, Fitch Solutions

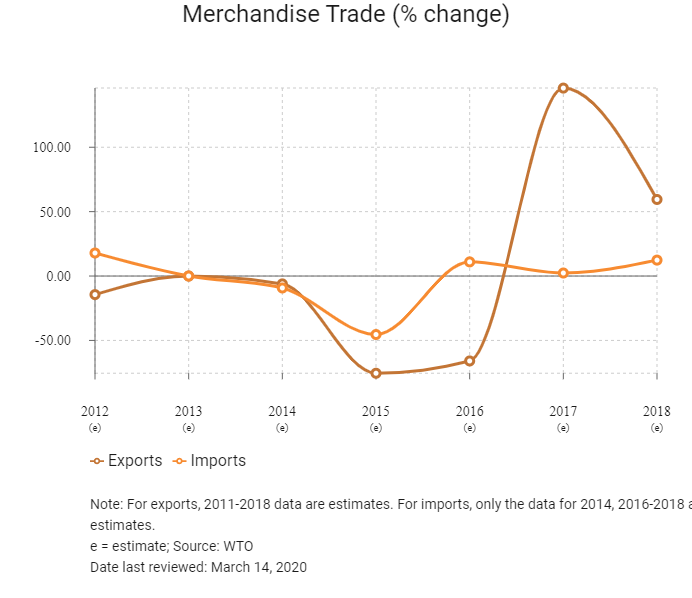

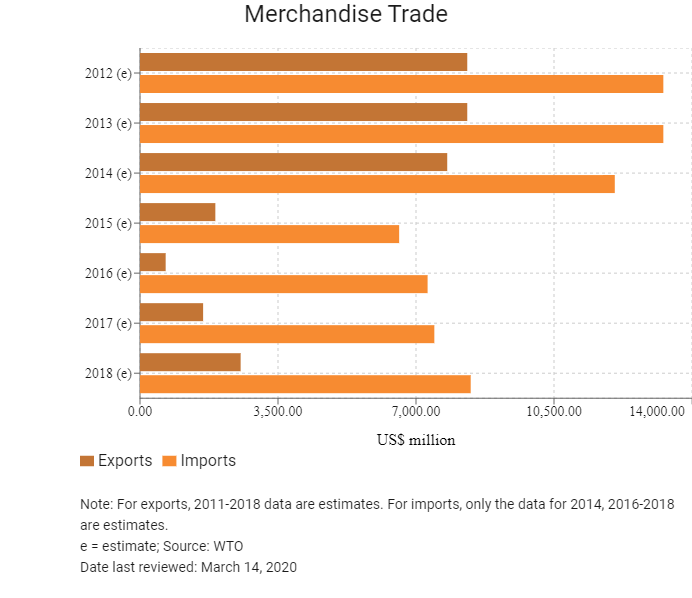

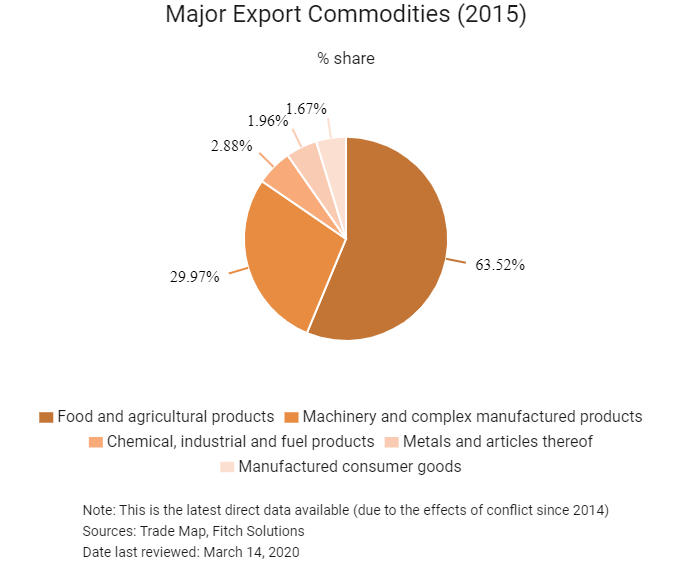

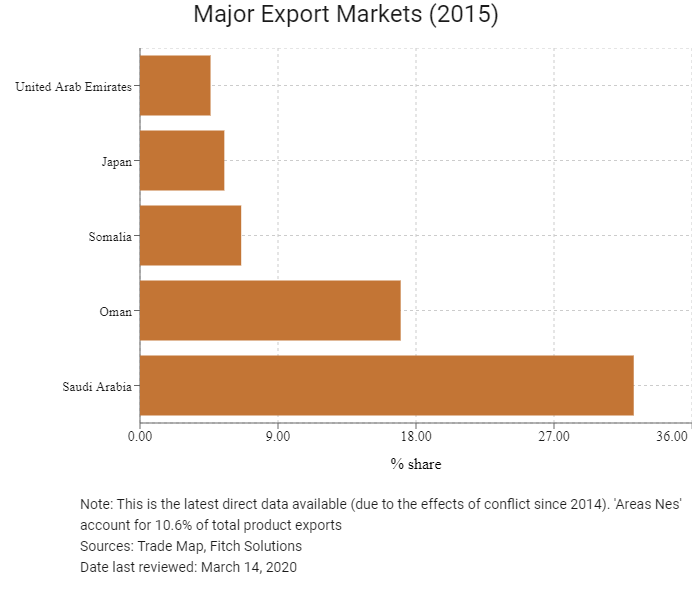

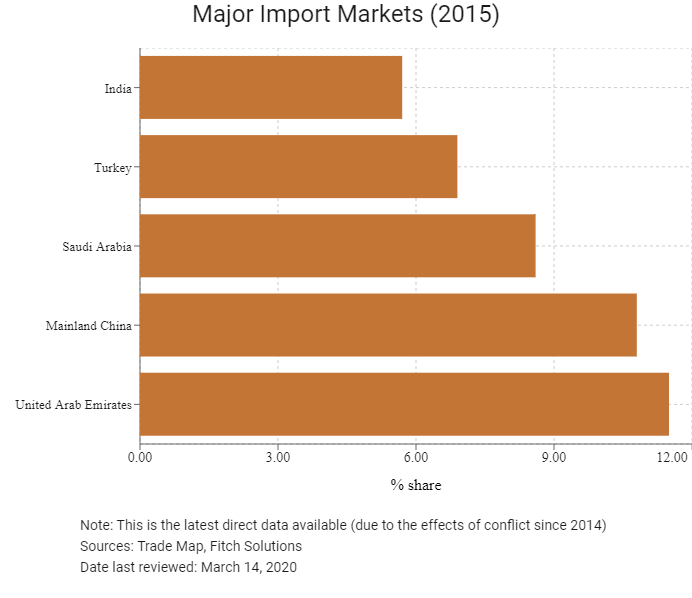

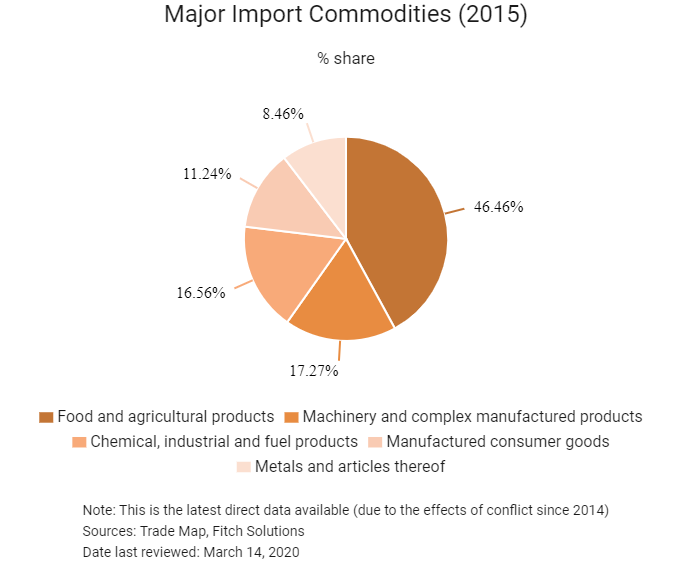

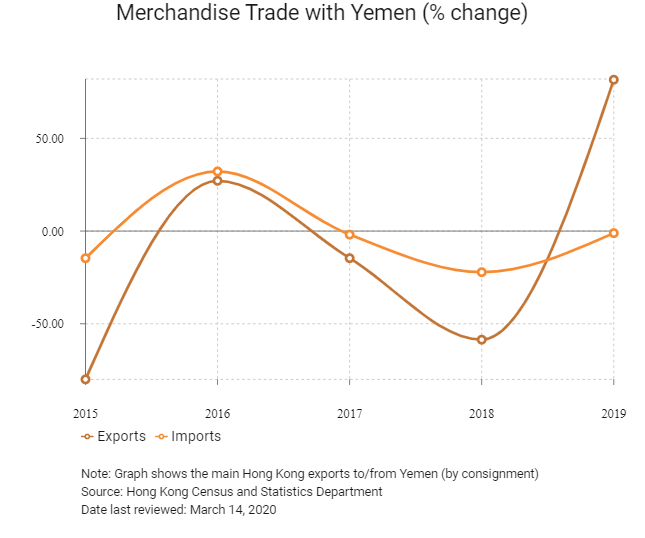

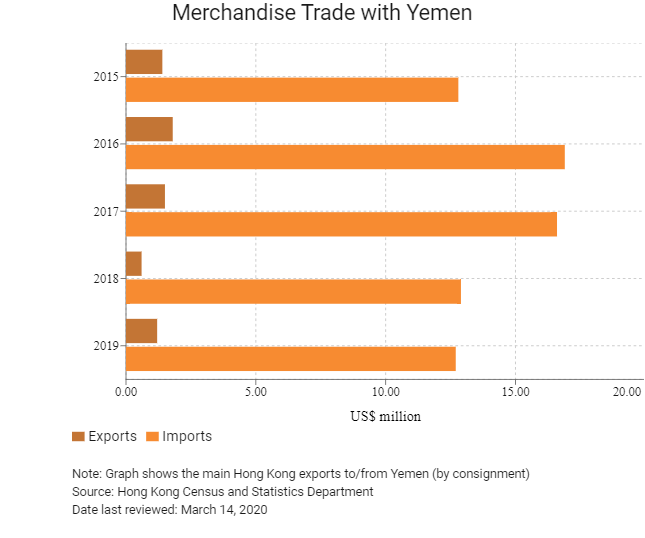

Merchandise Trade

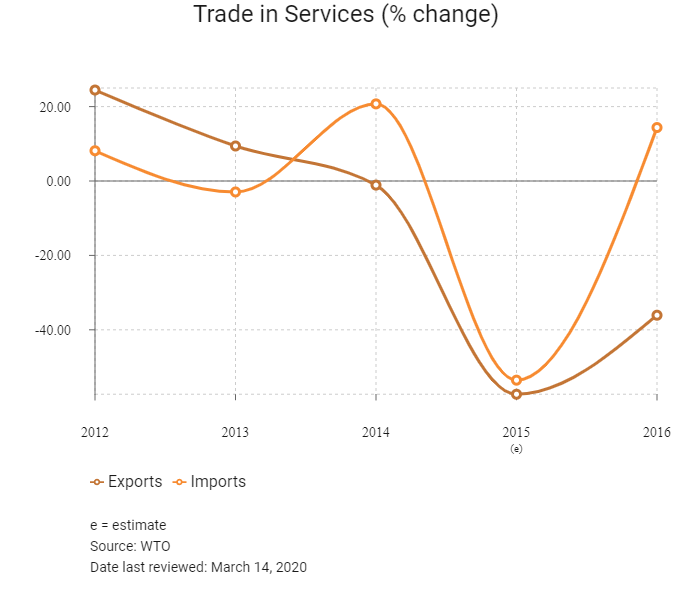

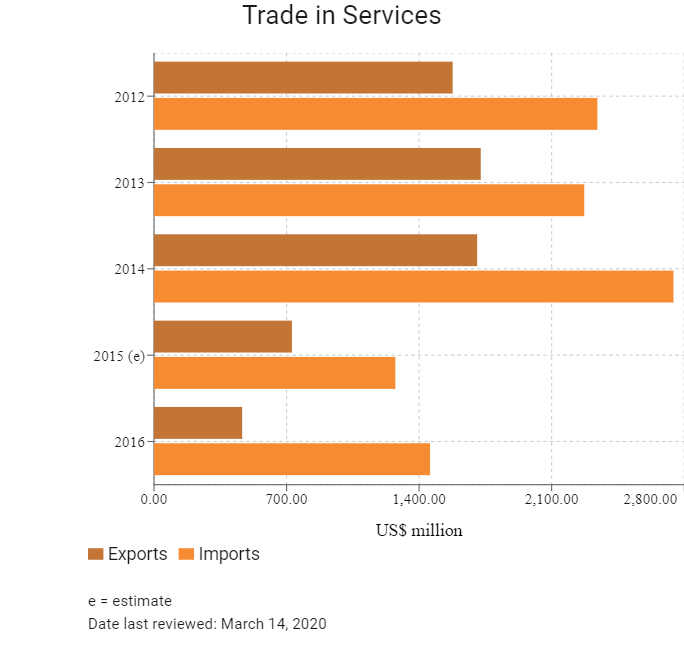

Trade in Services

- Yemen acceded to the World Trade Organization (WTO) in 2014. Yemen's WTO accession may eventually lead to a freer and more open investment climate for international investors in the years ahead.

- Yemen has expressed a desire to join the Gulf Cooperation Council (GCC). GCC member states are the primary trading partners with Yemen and are the most significant importers of Yemeni products (particularly for non-oil sectors, including agriculture and fisheries). Commercial relations between Yemen and the GCC gained additional significance in recent years due to the signing of numerous economic and commercial agreements and protocols. The GCC secretariat and Yemen have established joint ministerial councils, committees and working groups to study the commercial legislative and legal aspects in Yemen and the GCC states as part of a process for full membership to join the GCC. Yemen is now a member of certain committees of the GCC.

- Yemen acceded to the WTO in 2014 and is a member of the Greater Arab Free Trade Area (GAFTA). Yemen has been a member of the League of Arab States since March 1945. The league consist of 22 members, including GCC and other Arab countries. Nevertheless, Yemen still applies regionally high custom fees on regionally traded products. Some import restrictions apply and duties are applied to protect local industries.

- Use of non-tariff barriers has sometimes led to the delay or rejection of goods shipped to Yemen, but this is not common practice. In the past, Yemeni importers have experienced extended delays in customs clearance for the reason of reciprocity when Saudi customs stops or bans Yemeni agriculture products for health or other reasons. Restrictions on Saudi transportation trucks, in addition to regional insecurity and high transportation costs, affect the handling and delivery performance of export and import products.

- The existence of some trademarks infringements shows that intellectual property rights (IPR) enforcement is still a nascent area in the country.

- According to the latest available data, goods that enter the territory of Yemen are subject to customs fees as per the following: raw materials 5%, semi-manufactured materials 10% and ready materials 15%. Other items face the highest rate of customs fees: 25%. Customs fees are charged on imports on the basis of the ordinary value of the goods and includes shipment charges and insurance.

- In terms of the basic labelling requirements, production and expiry dates must be printed clearly on the packaging of all foodstuff or pharmaceutical products imported into Yemen in both Arabic and English.

- For all other products, GCC or International Standards apply. Imported beef and poultry products require a health certificate and a halal certificate issued by an approved Islamic centre in the manufacturer country.

- The import of pork and pork products, coffee, alcohol, narcotics, some fresh fruit and vegetables, weapons and explosives and rhinoceros horn is prohibited.

- A health certificate is required for shipments to Yemen of animal stocks, food and agricultural products. Imports of pharmaceuticals require a free sale certificate stating that the commodities in question are in free circulation in the country of export.

- All freight insurance on imports must be placed in Yemen.

- Yemen has stated that it will continue to implement the primary aspect of the Arab anti-Israel boycott.

- Yemen is a small oil-producing country outside of OPEC. Yemen allows foreign oil companies to exploit its oil fields in light of their capital and technological resources. Prior to the civil war, the oil sector accounted for 65% of its fiscal revenue and one-quarter of its GDP. Yemen's oil exports have been suspended since early 2015, with the ongoing conflict disrupting oil production, including facilities operated by foreign investors. Small-scale oil exports from Yemen resumed in 2017. International oil companies in Yemen, such as Austria's OMV, are also looking to resume oil production in south Yemen in the near term.

Sources: WTO - Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- The GAFTA: GAFTA was established in order to create an Arab economic bloc that could effectively compete with other countries, while ensuring that each country increased trade with each other. Its 17 nation members are Yemen, Jordan, United Arab Emirates, Bahrain, Saudi Arabia, Oman, Morocco, Syria, Lebanon, Iraq, Egypt, Kuwait, Tunisia, Libya, Sudan, Qatar and Palestine. The most important aspect of the agreement was that over the first 10 years (out to 2008 from inception in 1998) each member country would seek to carry out a 10% reduction in customs fees per annum, as well as the gradual elimination of trade barriers. In March 2001, the member countries decided to reduce the period over which the reductions in tariffs could be made so as to speed up the process, and in January 2005, the elimination of most tariffs among the GAFTA members was enforced. For Yemen, GAFTA provides dynamic potential gains associated with the flow of exports and imports for members at preferential rates, which supports improved productivity and lowers trade cost.

- The Council of Arab Economic Unity (CAEU): Yemen is a member of the CAEU, which was established by Egypt, Iraq, Jordan, Kuwait, Libya, Mauritania, Palestine, Somalia, Sudan, Tunisia, Syria, United Arab Emirates and Yemen on June 3, 1957. It became effective on May 30, 1964, with the ultimate goal of achieving complete economic unity among its member states. The group aims to formulate regulations, legislations and tariffs, aiming at the creation of a unified Arab custom area, coordinate foreign trade policies with a view to ensure the coordination of the region's economy with the world economy, coordinate economic development and formulate programmes for the attainment of a joint Arab development project. The group also aims to harmonise policies related to agriculture, industry and internal trade.

- Trade and Investment Framework agreement (TIFA) with the United States: In 2004, Yemen signed a TIFA with the United States. The agreement creates a joint council for discussing a wide range of commercial issues and sets out a permanent dialogue with the expectation of strengthening bilateral trade and investment between the United States and Yemen. It is also considered to be the gateway to a free trade agreement with the United States.

Sources: Fitch Solutions, WTO Regional Trade Agreements database

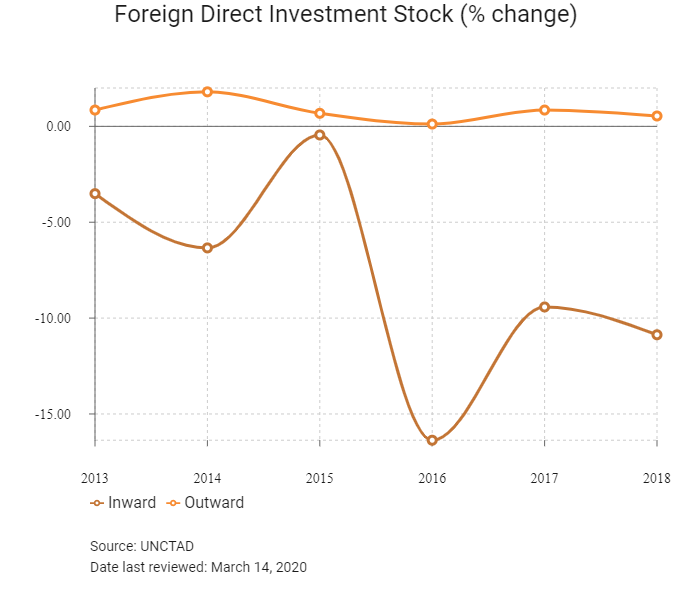

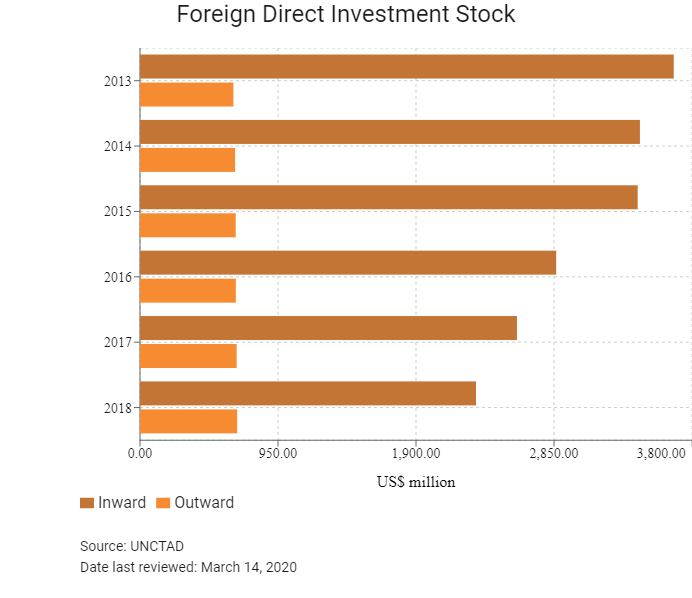

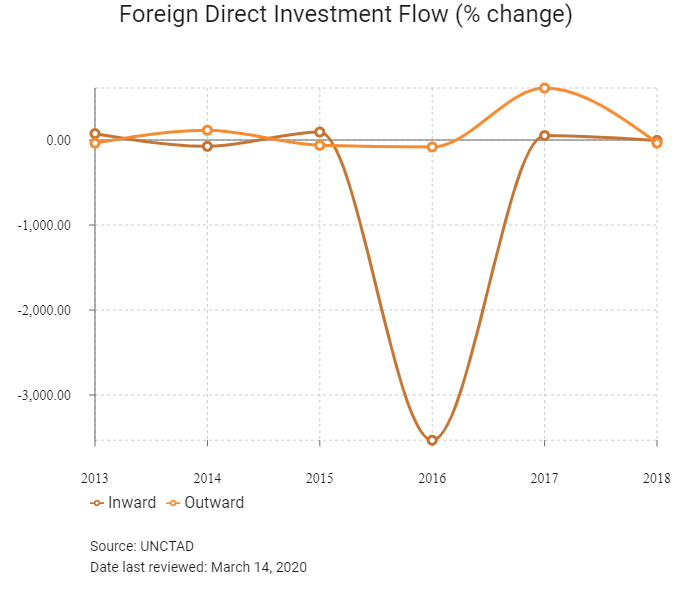

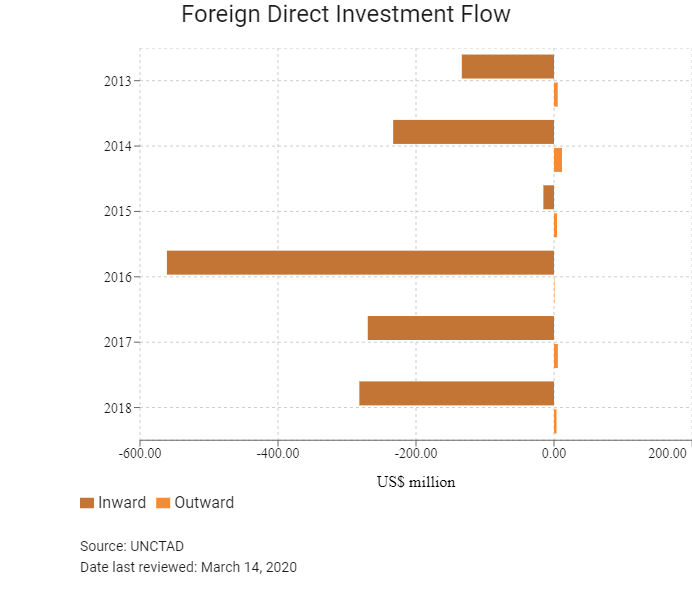

Foreign Direct Investment

Foreign Direct Investment Policy

- Yemen’s General Investment Authority (GIA) is the national agency for FDI promotion and coordination. Incentives are offered to foreign companies investing in sectors targeted for development, including agriculture, transport, housing, tourism and industrial zones. In 1992, the government adopted a uniform investment code for both domestic and foreign investors which created the GIA to coordinate work among eight government agencies.

- In attending the Belt and Road Summit in Beijing in May 2017, the Yemeni delegation presented the country’s needs to reconstruct and develop infrastructure, calling for investment in the energy and mineral sectors. In July 2017, China provided a grant of USD22.5 million in relief assistance to the Yemeni government. Apart from trade with Yemen, many Chinese enterprises have invested in the country, particularly in the oil fields exploration (e.g. Sinopec) and telecoms infrastructure (e.g. Huawei).

- In 2002, GIA worked with the World Bank's Foreign Investment Advisory service to update Yemen’s investment laws, reducing customs duties by 50% on imported raw materials and 100% on raw materials produced locally for agricultural and fisheries projects. Investments in the oil, gas, and mineral sector are subject to special agreements under the authority of the Ministry of Oil and Minerals and do not fall under GIA’s authority. Other sectors not covered by GIA include weapons and explosives manufacturing, banking and money exchange activities, and wholesale and retail imports.

- Since the unification of North and South Yemen in 1990, Yemen has embarked on a series of reforms aimed at stabilising the economy and increasing foreign investment. Reforms include the introduction of a General Sales Tax (GST) and a reduction in domestic petroleum and food subsidies. The IMF has helped introduce indirect monetary policy instruments, such as open market operations, rediscount facilities, and reserve requirements.

- Between 2003 and 2004, eight state-run companies were privatised, seven of them by public auction, with the remaining company being transferred to the Yemeni Economic Corporation (YEC). In 2007, the government announced the privatisation of an additional 15 factories.

- The Central Bank of Yemen (CBY) has made an effort to improve commercial banks’ accounting procedures and loan recovery rates. The banking system remains weak, however, with most commercial banks owned by large families who are reluctant to lend outside small circles. Foreign investors generally seek capital from outside the country.

- Investors may transfer funds in foreign currency from abroad to Yemen for the purpose of investment and may re-export invested capital, whether in kind or in cash, upon liquidation or project disposal. Net profits resulting from investment of foreign funds may be transferred freely outside of Yemen. Cash transfers are limited to USD10,000. Transfers above that amount must be approved by the CBY.

- Since Yemen’s unification in 1990, there have been no cases of outright expropriation of property owned by foreign investors. Yemen's investment law stipulates that private property will not be nationalised or seized, and that funds will not be blocked, confiscated, frozen, withheld, or sequestered by other than a court of law. Real estate may not be expropriated except in the national interest, and expropriation must be according to a court judgment and include fair compensation based on current market value.

- Yemen’s collective body of investment laws does not specify performance requirements as conditions for establishing, maintaining, or expanding investment. Law 23 of 1997 (as amended) regulates agencies and branches of foreign companies and firms and outlines the requirements for establishing a Yemeni agent. Chapter 3 of Law 23 permits foreign companies and firms to conduct business in Yemen by establishing foreign-owned and managed branches. Foreign commercial entities wishing to open branches in their own name must obtain a permit from the Ministry of Industry and Trade.

- In March 2008, the government amended a 1991 investment law allowing foreigners to operate businesses in Yemen without a Yemeni partner. Under a 2002 investment law, foreigners can own 100% of the land and can execute projects without a Yemeni agent and without obtaining import/export license from the Ministry of Industry and Trade or implementing Law 23 of 1997 (the investment law implemented in October 2002 has precedence over other laws). The 2002 investment law appears to contradict longstanding Yemeni commercial laws, however, which limit foreign ownership to 49%. The government is reviewing the laws in an attempt to remove inconsistencies, although work on the issue was temporarily suspended in 2011 as a result of the political crisis.

- Mortgage lending in Yemen is rare because of the reluctance of the court system to uphold the payment of interest or to accept land as a form of collateral – all products in this arena must be Shari'a compliant. In addition, Yemen has a long history of incomplete or inaccurate land records and frequent land ownership disputes, making the use of real estate as collateral difficult. In 2006, various agencies and ministry departments dealing with land ownership were merged into a common General Land Survey and Planning Authority. This new organisation oversees land ownership and registration, as well as modest government urban planning efforts.

- Yemen has a record of inadequate protection of IPR, including patents, trademarks, designs and copyrights. In late 2004, the Cabinet approved the Berne Convention for the Protection of Literary and Artistic Works, as well as the International Agreement on Protecting IPR. Parliament has yet to ratify these agreements. Yemen has yet to accede to any international IPR conventions and its IPR Law Number 19 of 1994 is not compliant with the WTO's Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). In December 2010, the legislation of trademarks and geographical indications, the amendment on trade registration law, the legislation of industrial design, patent and author law were passed and approved by parliament.

- Outside investors are best served by establishing a partnership with a Yemeni entity that knows the system, including an international arbitration clause in their contracts, establishing an escrow account and, where appropriate, demanding as much of the payment as they can get up front. In cases involving interest, most judges use Shari'a (Islamic) law as a guideline, under which claims for interest payments due are almost always rejected. Local commercial banks are sensitive to this problem, and lend primarily to large established trading houses well known to them.

- The Yemen Free Zone (YFZ) Public Authority was established in 1991 to develop the Aden Free Zone (AFZ). Yeminvest, a joint venture between the Port of Singapore Authority and the Bin Mohfoud Group of Saudi Arabia, was awarded the concession to develop the area. Dubai Ports World (DPW) now operates the Aden Container Terminal) in the AFZ. An industrial and warehousing estate called Aden District Park (ADP) was launched in November 2002. Furthermore, investment opportunities in light industry, repackaging and storage/distribution operations are welcomed. The free zones bill stipulated prospects for the establishment of other free zones in Yemen and the AFZ Public Authority is undertaking the relevant studies identifying such zones and relevant investment opportunities.

- In October 2018, The Qatar Fund for Development (QFFD) announced that it had signed a memorandum of understanding to fund the water and sanitation sector in Yemen. The financial assistance is being provided in co-operation with the United Nations Children's Fund. The funding will be used for the rehabilitation of water networks, and distribution and drainage networks in the country.

- Saudi Arabia announced plans in November 2018 to finance the redevelopment of Marib Airport in Yemen. The airport project will be financed under the SDRPY.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

| The YFZ Public Authority was established in 1991 to develop the AFZ |

Free zone incentives include the possibility of 100% foreign ownership, no personal income taxes for foreigners, and a corporate tax holiday for 15 years (renewable for 10 additional years), 100% repatriation of capital and profits, no currency restrictions, and no restrictions on, or sponsoring required, for the employment of foreign staff. |

|

General incentives |

Incentives permitted under the law include, but are not limited to, exemption from customs fees and taxes levied on fixed assets of the project, tax holidays on profits for a period of seven years (renewable for up to 18 years maximum), the right to purchase or rent land and buildings and the right to import production inputs and export products without restrictions and registration in the import or export register. |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax/Goods and Services Tax: 5%

- Corporate Income Tax: 20%

Source: Yemeni Tax Authority

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Tax (standard) |

20% |

|

Corporate Tax (other rates by sector) |

- 50% rate for mobile telecommunications companies |

|

Corporate Tax for investment projects registered under law |

15% |

|

Corporate Tax for small and medium sized enterprises |

Range from 10%-20% |

|

Dividends, Interest (no Withholding Tax) |

10% |

|

Royalties, Technical service fees (Withholding Tax) |

10% |

|

Social security contributions (all employers) |

9% of gross salaries |

|

Vocational training fund (employer contribution) |

1% of gross salaries |

|

Zakat |

2.5% of working capital |

|

VAT/GST (standard) |

5% (10% for telecommunications services) |

|

Property Tax |

1% of sale price or 15% of annual rental value |

Source: Yemeni Tax Authority

Date last reviewed: March 14, 2020

Entry requirements

Visitors to Yemen must obtain a visa from one of the Yemeni diplomatic missions unless they come from one of the visa countries whose citizens may obtain a visa on arrival. Until January 2010, Yemen had a visa on arrival policy for some 50 countries (predominantly Muslim). Tourist and/or business Visas are required by all except nationals of Iraq, Jordan and Syria, but citizens of these states must still get a doctor to confirm that they are good health. All applications are referred to Yemen and can take one to two months for the approval. Single entry visas are valid for three months, and multiple entry visas are valid for six months. Visitors must register with Yemeni authorities if they plan on staying in Yemen for longer than two weeks.

Conditions of stay

Yemeni law requires that all visitors/tourists register at a Yemeni police station or at the Passport and Immigration Authority within two weeks after arrival to Yemen. Failure to register will result in complications upon departure and a possible fine.

Work permits – requirements for employees

Getting a work visa for Yemen is difficult. Applicants will first need to get a Work Permit from the local authorities in Yemen. The Yemeni-based employer must assist in procuring the work permit and then the applicant must consult the consulate to find out specific terms for getting the work visa. According to the labour law of Yemen, foreign employees will be at risk of having their work permit revoked if they do not perform the works for which they are employed or lose vital qualifications that are required to execute the job.

1. Any employer who wishes to engage foreigners shall submit an application for permission to bring them into the country in the form to be specified by the Ministry, provided that such application shall include the following information:

- the name of the employer, his nationality, occupation and main place of work;

- the name and surname of the worker whose immigration is requested, his nationality, religion, date of birth, original place of residence and family status;

- the nature of the work to be performed by the worker and the nature of his previous work;

- the period for which the worker is expected to be employed;

- whether the worker has previously entered Yemen and the reason for and date of such entry, and the date of exit and reasons for leaving, the total number of foreign workers employed by the employer, the number of such workers engaged in the same work as that to be performed by the worker concerned and the number of Yemeni workers working for the employer and any such other information as may be required by the ministry or its competent office.

2. An application shall be submitted together with:

- a certificate from the Ministry or its competent office establishing that there are no Yemeni nationals available to perform the work to be done by the foreigner;

- a certificate establishing the technical qualifications and experience of the worker whose employment is requested, together with a certified Arabic translation thereof if the certificate is in a foreign language;

- a copy of the prospective contract of employment to be concluded with the worker, specifying in sufficient detail the amount of his remuneration and of any allowances and benefits in cash or kind; and

- a description of the projects and work being carried out by the employer at the time of the application, supported by the necessary documentary evidence; a description of the projects and work being carried out by the employer at the time of the application, supported by the necessary documentary evidence, and some other related documents or information as the ministry or its competent office may request.

3. Any employer employing a non-Yemeni worker must:

- within two weeks of the date of commencement of work, record, in a special register, the worker's name and all the information given in his work permit;

- appoint a Yemeni counterpart to the non-Yemeni worker, where such local counterpart is available with adequate qualifications and skills, for the entire duration of the non-Yemeni's employment, provided that a period of training is obligatory for both the non-Yemeni worker and his counterpart;

- notify the Ministry immediately of any changes in the non-Yemeni worker's status.

Residence permits

Residence permits are issued by the Passport and Immigration Authority, which is a department of the Ministry of Interior (the Ministry of Interior is located on Airport Road in Sana’a). In order to obtain a residence permit, foreign citizens must be sponsored by a Yemen-based individual or organisation. Foreign citizens with a valid residence permit wishing to leave Yemen are required to obtain an exit visa. The exit (and re-entry) visa is valid for two months from the date of issuance or until the date the residence permit expires, whichever comes first.

Denied entry

Visitors holding Israeli visas (or other Israeli entry documents) are denied entry to Yemen.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Not Rated |

N/A |

|

Standard & Poor's |

Not Rated |

N/A |

|

Fitch Ratings |

Not Rated |

N/A |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

186/190 |

187/190 |

187/190 |

|

Ease of Paying Taxes Index |

80/190 |

83/190 |

89/190 |

|

Logistics Performance Index |

140/160 |

N/A |

N/A |

|

Corruption Perception Index |

176/180 |

177/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

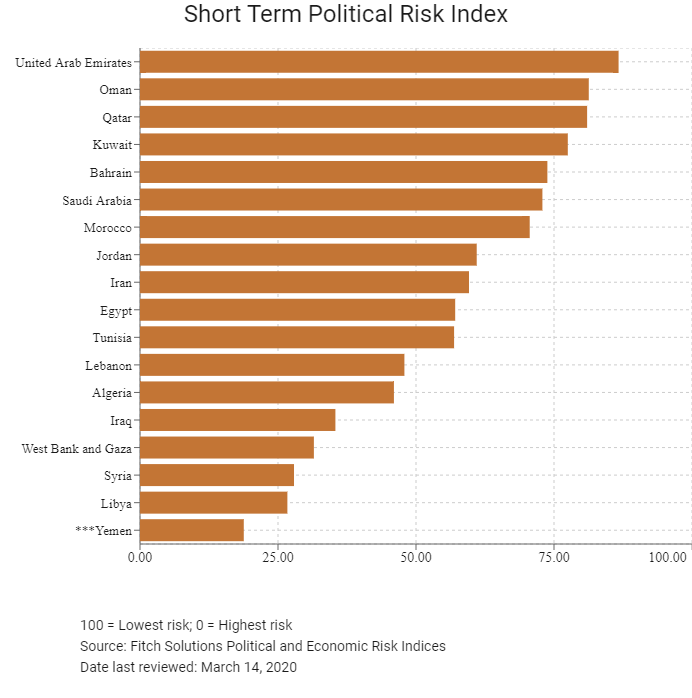

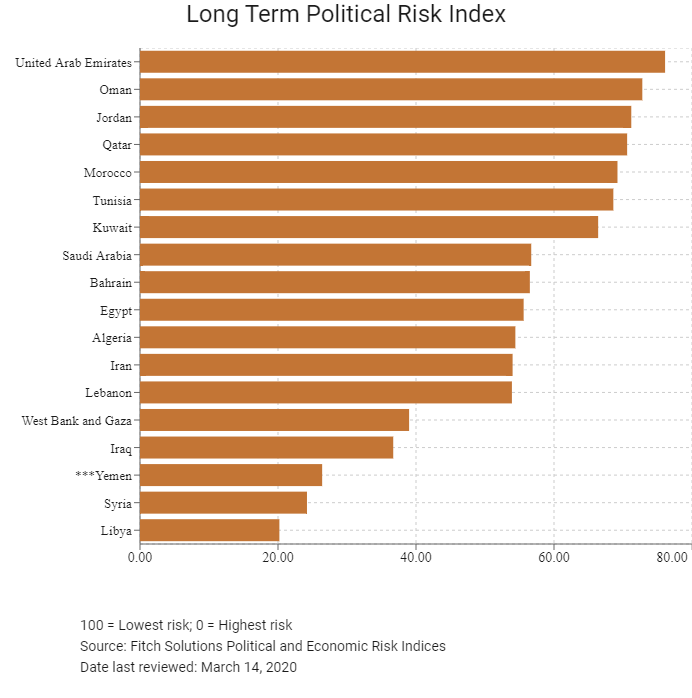

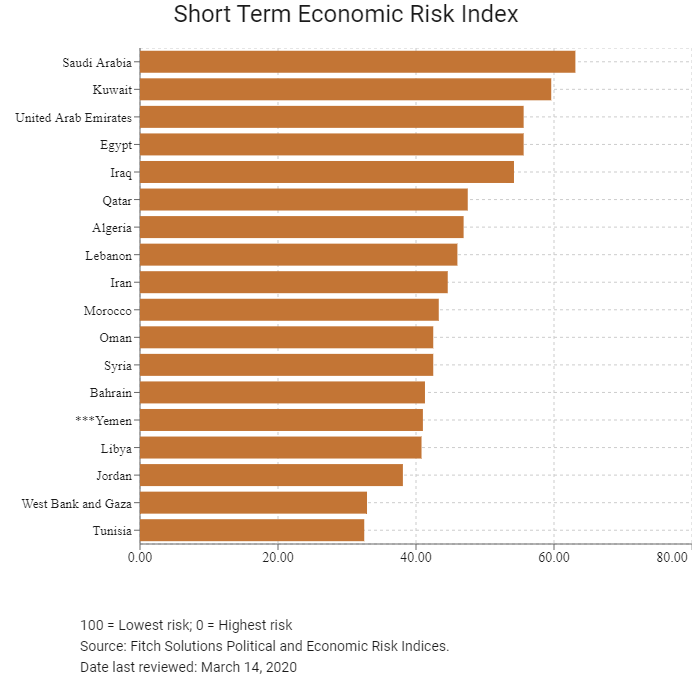

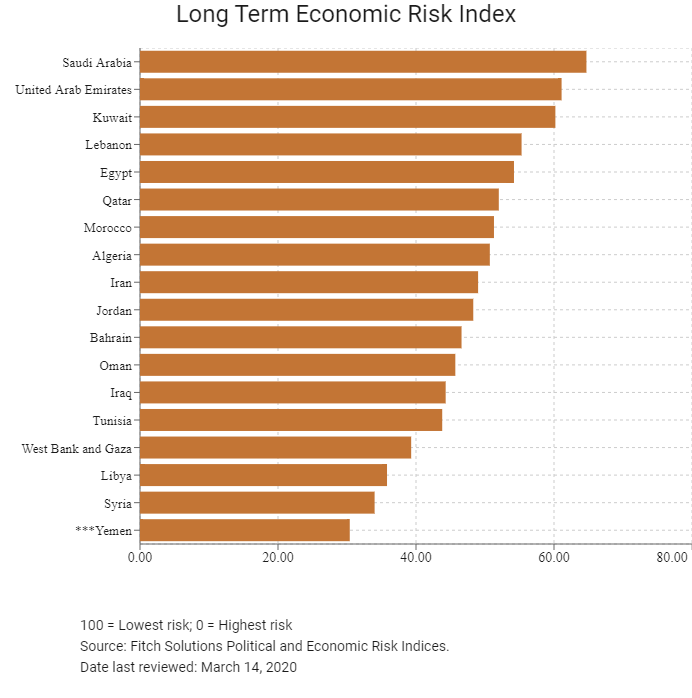

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2019 |

|

|

Economic Risk Index Rank |

202/202 |

191/201 |

195/201 |

|

Short-Term Economic Risk Score |

17.9 |

35.4 |

41.0 |

|

Long-Term Economic Risk Score |

20.9 |

33.1 |

30.4 |

|

Political Risk Index Rank |

197/202 |

196/201 |

196/201 |

|

Short-Term Political Risk Score |

19.6 |

19.6 |

18.8 |

|

Long-Term Political Risk Score |

26.4 |

26.4 |

26.4 |

|

Operational Risk Index Rank |

198/202 |

198/201 |

197/202 |

|

Operational Risk Score |

22.0 |

21.9 |

23.2 |

Source: Fitch Solutions

Date last reviewed: March 14, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The economic gap between Yemen and the rest of the Middle East remains considerable. In order to improve the situation, Yemen needs investment in education, economic diversification through the development of its non-hydrocarbon sectors and infrastructure; however, against the backdrop of internal conflict, this is unlikely to be forthcoming. The ongoing conflict will prevent a sustained uptick in Yemen's hydrocarbon exports over the quarters ahead, ensuring continued depreciation of the rial and associated elevated inflation. Together with the government's challenges in paying public sector salaries, this will cause consumption to fall in the near term. Yemen's economic recovery will rely on foreign assistance and the country remains highly vulnerable to external shocks. In 2020, the country could see some upside as oil output from some of Yemen’s more stable oil-producing governorates will continue to rise gradually in the quarters ahead, as federal and local authorities work to increase production capacity. Oil and Minerals Minister Aws al-Awd stated on January 2, 2020 that his government targeted output of 80,000 barrels per day (b/d) in Q120, up from an estimated 50,000b/d currently. Efforts to complete hydrocarbon transport facilities and arrange gas exports are reportedly also being made, with the assistance of Saudi Arabia. This should help encourage some export growth over 2020, although volumes look set to remain small relative to the levels seen prior to the outbreak of conflict.

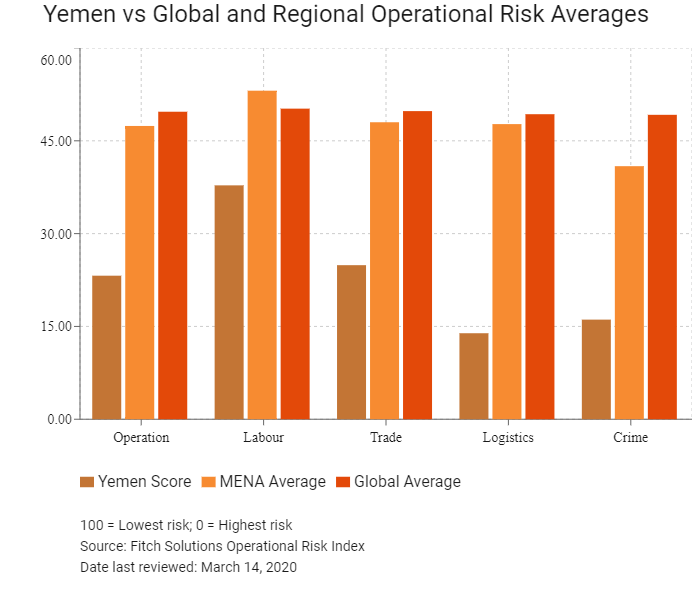

OPERATIONAL RISK

Yemen is a small oil-producing country outside of OPEC with limited economic diversification outside the oil sector. Security challenges in Yemen impede educational attainment in affected areas, as well as logistics capacity enhancements in the short- to medium term. According to the World Bank, almost 55% of power infrastructure such as power stations and transmission lines in Yemen have been damaged by the conflict with around 8% of facilities destroyed. Reconstruction works will be heavily reliant upon regional funding, most likely from the United Arab Emirates and Saudi Arabia. A lack of domestic expertise and capacity will also necessitate the involvement of foreign construction companies.

Source: Fitch Solutions

Date last reviewed: August 14, 2019

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Yemen Score |

23.2 |

32.8 |

24.9 |

13.9 |

16.1 |

|

MENA Average |

47.4 |

53.1 |

48.0 |

47.7 |

40.9 |

|

MENA Position (out of 18) |

18 |

18 |

15 |

18 |

16 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

197 |

171 |

188 |

201 |

192 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

UAE |

72.0 |

71.2 |

79.1 |

68.7 |

70.5 |

|

Qatar |

65.9 |

65.0 |

61.8 |

71.6 |

61.2 |

|

Bahrain |

65.0 |

62.2 |

61.9 |

64.5 |

69.2 |

|

Oman |

64.5 |

63.1 |

69.5 |

71.5 |

53.6 |

|

Saudi Arabia |

62.6 |

67.2 |

62.1 |

62.7 |

57.7 |

|

Jordan |

56.5 |

56.9 |

60.7 |

59.0 |

52.3 |

|

Kuwait |

54.3 |

43.2 |

63.8 |

54.8 |

53.2 |

|

Morocco |

54.2 |

54.2 |

51.2 |

52.5 |

56.2 |

|

Egypt |

48.7 |

49.9 |

45.7 |

56.4 |

42.9 |

|

Tunisia |

46.5 |

42.2 |

56.2 |

47.3 |

42.3 |

|

Lebanon |

44.1 |

53.0 |

51.9 |

41.4 |

29.7 |

|

Iran |

43.2 |

49.5 |

36.7 |

50.8 |

34.4 |

|

Algeria |

39.2 |

46.1 |

31.1 |

42.9 |

36.2 |

|

West Bank and Gaza |

32.5 |

48.8 |

37.4 |

32.0 |

17.0 |

|

Syria |

27.3 |

47.2 |

22.1 |

29.3 |

17.1 |

|

Libya |

27.3 |

45.5 |

23.7 |

27.0 |

15.0 |

|

Iraq |

26.9 |

43.7 |

24.8 |

28.6 |

12.4 |

|

Yemen |

23.2 |

32.7 |

24.9 |

15.8 |

16.1 |

|

Regional Averages |

47.4 |

52.3 |

48.0 |

48.7 |

40.9 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 14, 2020

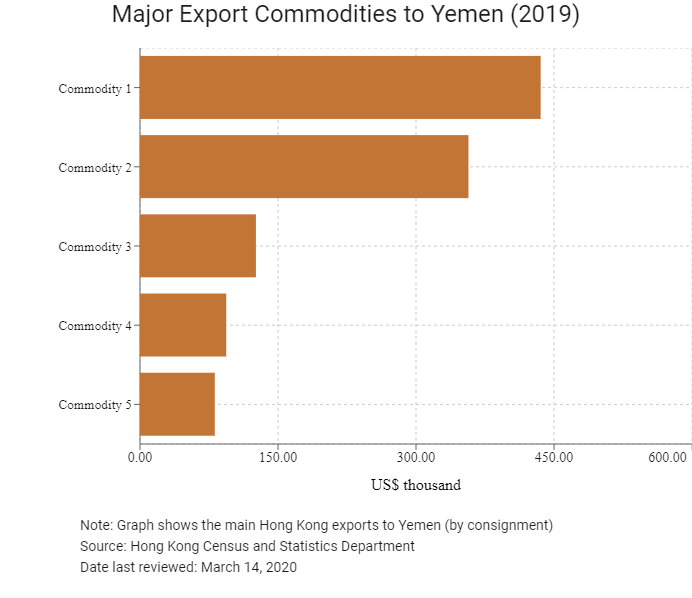

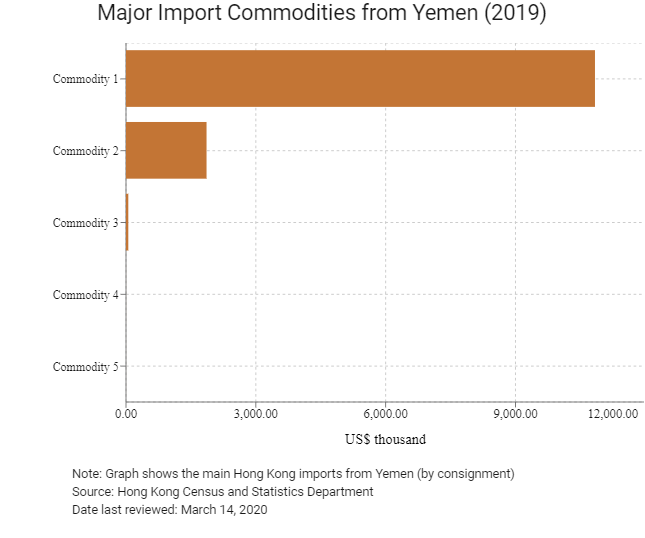

Hong Kong’s Trade with Yemen

| Export Commodity | Commodity Detail | Value (US$ thousand) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 435.5 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 357.0 |

| Commodity 3 | Professional, scientific and controlling instruments and apparatus | 126.0 |

| Commodity 4 | Office machines and automatic data processing machines | 93.7 |

| Commodity 5 | Miscellaneous manufactured articles | 81.3 |

| Import Commodity | Commodity Detail | Value (US$ thousand) |

| Commodity 1 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 108,37.3 |

| Commodity 2 | Metalliferous ores and metal scrap | 1,861.3 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 53.3 |

| Commodity 4 | Office machines and automatic data processing machines | 2.6 |

| Commodity 5 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 2.4 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Yemeni residents visiting Hong Kong |

505 |

-4.2 |

|

Number of Middle East residents visiting Hong Kong |

113,849 |

-12.8 |

Source: Hong Kong Tourism Board

Date last reviewed: March 14, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Yemeni companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong and Yemen

Yemen has a Bilateral Investment Treaty with the People's Republic of China which entered into force in April 2002.

Source: UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

Commercial and Economic Section in Hong Kong

The Arab Chamber of Commerce & Industry (ARABCCI) was established in Hong Kong in 2006 as a leading organisation at promoting commercial ties between Hong Kong/mainland China and the Arab World.

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org / secretariat@arabcci.org

Tel: (852) 2159 9170

Source: The Arab Chamber of Commerce & Industry

Yemeni Honorary Consulate in Hong Kong

Address: Units 8-12, 1/F, Heng Ngai Jewelry Centre, 4 Hok Yuen Street East, Hung Hom, Kowloon, Hong Kong

Email: yemen.consulate@aaronshum.com

Tel: (852) 2334 8612

Fax: (852) 2334 7427

Source: Protocol Division Government Secretariat

Visa Requirements for Hong Kong Residents

- HKSAR passport holders do not require a visa for up to 30 days. It is necessary to obtain confirmation of good health from a doctor.

- Yemeni law requires that all visitors/tourists register at a Yemeni police station or at the Passport and Immigration Authority within two weeks after arrival to Yemen. Failure to register will result in complications on departure and a possible fine.

Source: Hong Kong Immigration Department

Date last reviewed: March 14, 2020

Yemen

Yemen