GDP (US$ Billion)

2.75 (2018)

World Ranking 165/193

GDP Per Capita (US$)

2,164 (2018)

World Ranking 143/192

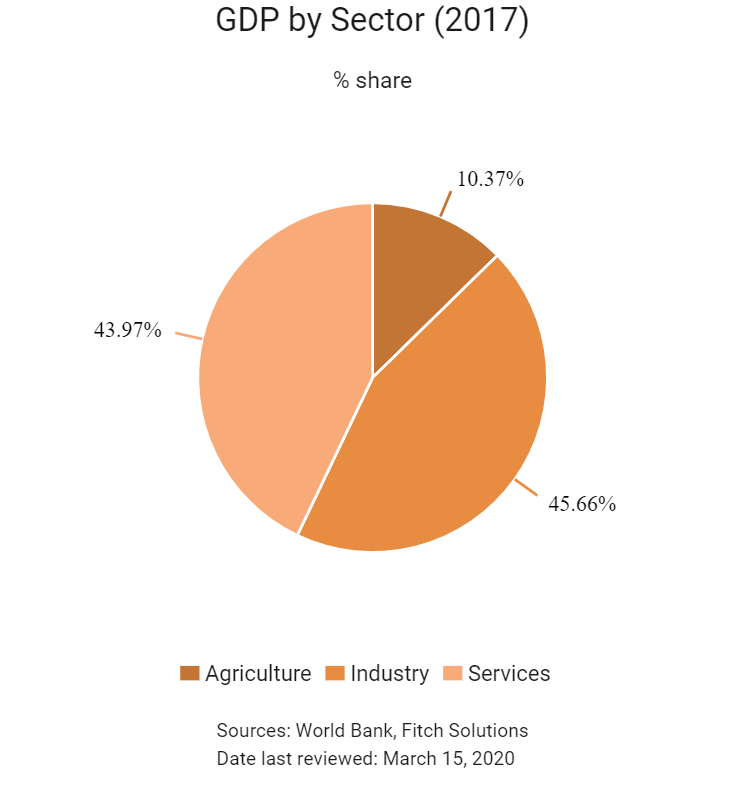

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

63 (2018)

Currency (Period Average)

US Dollar

1per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

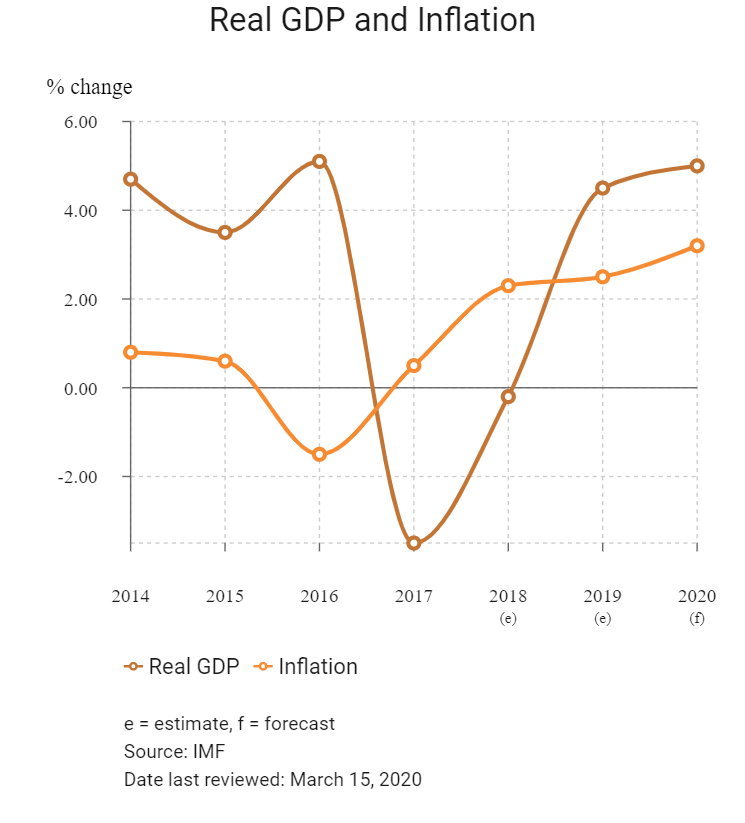

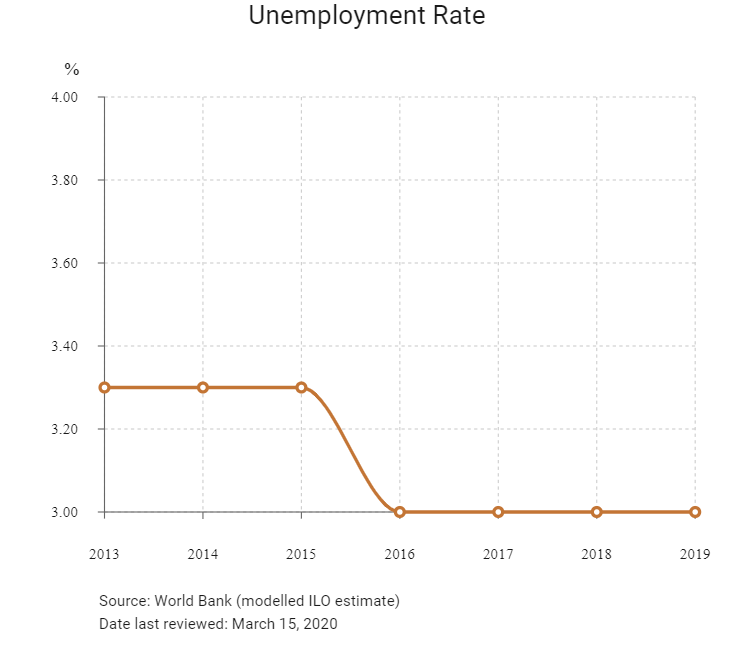

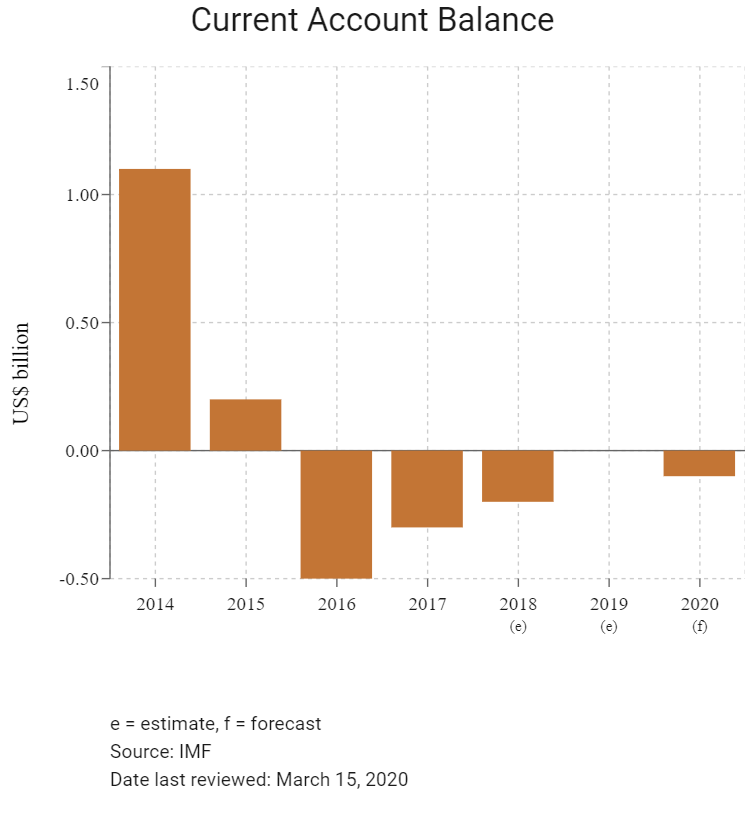

Timor-Leste has made significant gains in poverty reduction and improved social outcomes since gaining independence in May 2002. However, the nation of an estimated 1.3 million people continues to face structural challenges, particularly in the area of labour and logistics risks, while economic stability remains reliant on government spending in the short term and revenues from natural resources.

Source: Fitch Solutions

Major Economic/Political Events and Upcoming Elections

February 2015

Prime Minister Xanana Gusmao made way for Fretilin's Rui de Araujo, which formed a coalition government with Gusmao's National Congress for Timorese Reconstruction (CNRT) in an effort to ease political tensions and stabilise the country.

September 2016

The Permanent Court of Arbitration in the Hague took up the decade-long maritime border dispute between Australia and East Timor over lucrative oil and gas reserves in the Timor Sea.

May 2017

Former independence fighter Francisco Guterres (also known as Lu Olo) was sworn in as president.

July 2017

In parliamentary elections, Fretilin and CNRT - already coalition partners in a government of national unity - won the most seats, but neither had enough support to govern alone.

September 2017

Australia and East Timor reached a breakthrough agreement on their maritime border, ending a decade-old dispute.

May 2018

Early parliamentary elections were held in East Timor on May 12, 2018 after the National Parliament was dissolved by President Francisco Guterres on January 26, 2018. The Alliance for Change and Progress, a coalition of three opposition parties, won 34 of the 65 seats in Parliament.

July 2019

Mainland China Harbour Engineering Company (CHEC) started work on the port of Tibar in Timor-Leste and carried out first blasts at a quarry to collect construction materials. The first phase of the project, valued at USD278.3 million, covered construction, equipment and operation of the port. The Timorese government and the private partner were financing the first phase with USD129.5 million and USD148.9 million respectively. Bolloré planned to invest around USD211.7 million in the second phase. The International Finance Corporation was also participating the project.

August 2019

The Asian Development Bank (ADB) was providing a USD44 million loan to rehabilitate and modernise 58km of the Baucau-Venilale-Viqueque national road corridor in Timor-Leste. The project would reduce travel times as well as improve connectivity by providing open access to markets, schools and clinics in the region. The project was likely to be completed in 2022.

January 2020

Prime Minister Taur Matan Ruak, who was the leader of the People’s Liberation Party (PLP), a constituent party in the AMP coalition, resigned after he declared that the collation ‘no longer exists’.

February 2020

A proposal of an alternative government coalition comprising six constituent parties led by the National Congress for Timorese Reconstruction (CNRT) was put forth on February 22. Under this new coalition, which had yet to be named, CNRT would occupy 21 seats in the National Parliament, while the Democratic Party (PD) and Kmanek Haburas Unidade Nasional Timor Oan (KHUNTO) would each occupy five seats. Three smaller parties, namely the United Party for Development and Democracy (PUDD), Frente Mudansa (FM) and the Timorese Democratic Union (UDT), would occupy a seat apiece.

Sources: BBC Country Profile – Timeline, Fitch Solutions

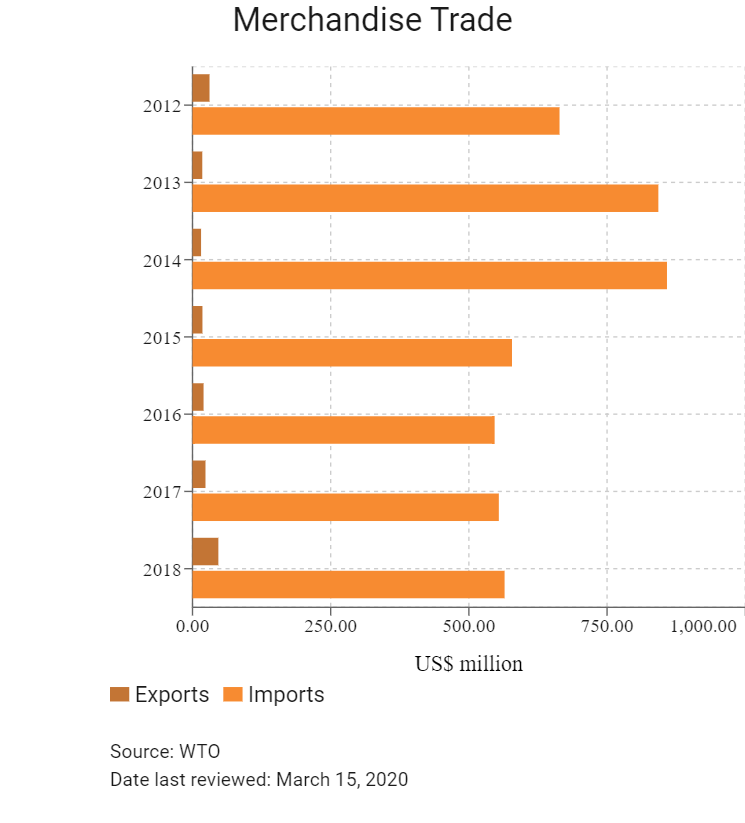

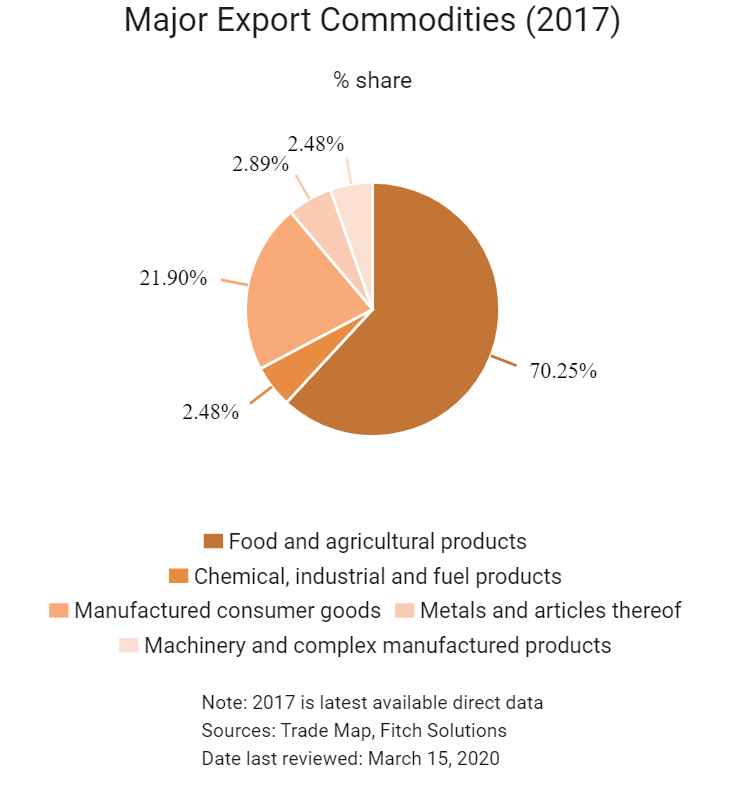

Merchandise Trade

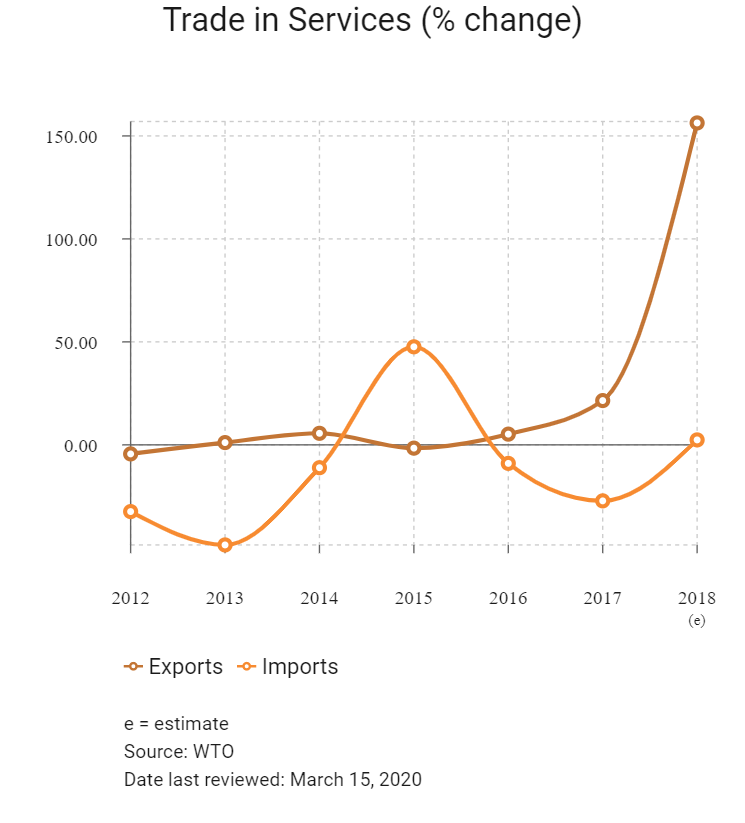

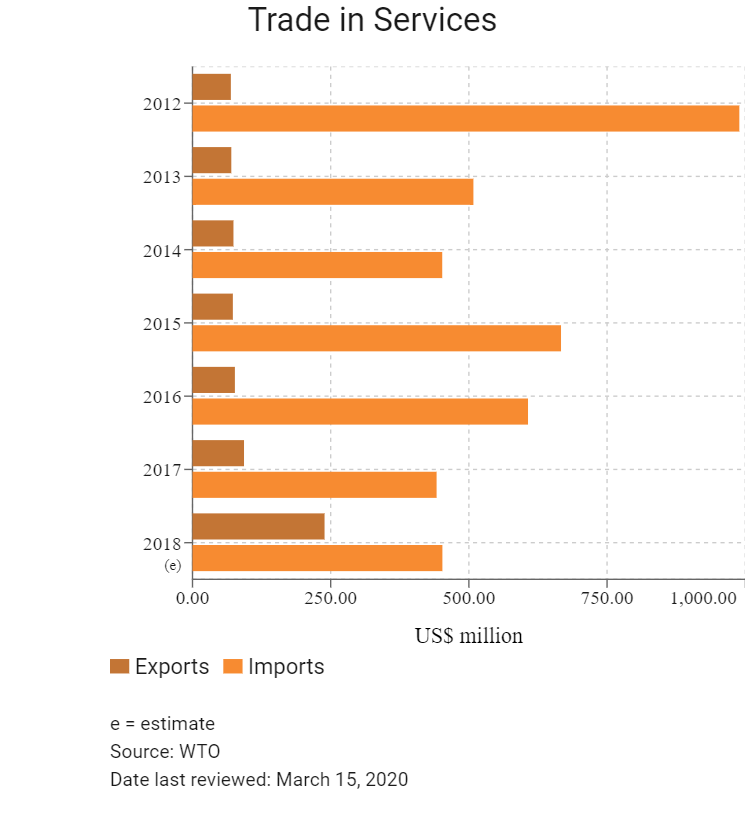

Trade in Services

- In 2016, Timor-Leste was granted observer status by the World Trade Organization (WTO). Timor-Leste's Working Party was established on December 7, 2016. The government sees accession to the WTO as a complementary process to Timor-Leste's accession to the Association of Southeast Asian Nations (ASEAN) and as an important facilitator of economic participation in the region. The ASEAN statement to the General Council in Geneva read 'ASEAN welcomes the application of Timor-Leste to accede to the WTO. ASEAN notes Timor-Leste's commitment to the WTO accession process and its efforts to undertake social and economic reforms to this end. ASEAN urges all members to support Timor-Leste in its accession process and its integration into a multilateral trading system.

- The Timorese government has also been taking steps to develop the tourism sector in the country by strengthening infrastructure and seeking to improve air connectivity and these efforts are slowly gaining traction. To date, the government has concluded an air services agreement with Indonesia, Singapore and Australia in a bid to increase air routes to the country. According to Abel Guterres, Timor-Leste's ambassador to Australia, the government is hoping to negotiate a similar agreement with Papua New Guinea in 2018 to further bolster its air links. Furthermore, it appears that the government is aware that the poor condition of Timor-Leste's roads and transport infrastructure presents headwinds to its tourism plans and is undertaking major road construction to connect all 13 municipalities, ports and airports across the country.

- In March 2018, Australia and Timor-Leste signed an agreement that draws the first maritime border between the two nations. Both nations agreed to split revenue from the Greater Sunrise oil and gas deposit, but negotiations were ongoing at the time of writing. Australia has offered 80% of oil and gas revenue if processing happens in its country and Timor-Leste wants 70% of revenue, but with processing on its own shores. The deal, signed at the United Nations in New York, will go some way towards ending the longstanding dispute over oil and gas reserves in the Timor Sea and boost the country's trade competitiveness.

- Timor-Leste is applying for full membership of ASEAN and served as President of the Community of Portuguese Language Countries (CPLP) from 2014-2016 and is also part of the Macao Economic Forum (between Mainlan China and the CPLP).

- The United States dollar is the official currency of Timor-Leste. There are no official currency controls, although the central bank of Timor-Leste imposes reporting requirements for the importation or exportation of cash above USD5,000 and requires explicit authorisation for sums in excess of USD10,000. The four foreign banks operating in Timor-Leste – Bank Mandiri, BRI, ANZ Bank and Banco Nacional Ultramarino – may also impose reporting requirements for transactions above a certain amount in order to comply with home-country anti-money laundering regulations in addition to the requirements stipulated by the central bank. Foreign citizens must have a tax identification number that demonstrates residency in Timor-Leste in order to maintain an individual bank account.

- Import duty applies to imported goods (except for specifically exempted goods) at 2.5% of the 'customs value' of the goods. Customs value is the fair market value, including cost, insurance and freight, as stated in the General Agreement on Tariffs and Trade (GATT) rules. The following goods are exempted from import duty:

- Goods accompanying a person arriving in Timor-Leste from another territory (some limitations apply)

- Imports exempted under specific international conventions

- Goods re-imported in the same condition as when they were exported

- Goods, other than alcohol or tobacco, imported by registered charitable organisations, registered under any law of Timor-Leste, provided the goods are to be used for charitable purposes of humanitarian assistance and relief, education, or healthcare

- Other goods for temporary admission, if the importer has provided security for the import duty in the prescribed manner

- Goods for consumption by international staff of the United Nations Integrated Mission in Timor-Leste or members of peace keeping forces from contingent countries, provided the goods are sold in conformity with prescribed rules of sale

- Certain infant and feminine hygiene products

- Other goods imported into Timor-Leste as personal goods accompanying a traveller and where the import duty that would be imposed on the import would be USD10 or less

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Awaiting Accession

WTO: Timor-Leste was accepted as an observer to the WTO in 2016 and its Working Party for accession was established in December 2016.

Under Negotiation

- ASEAN: Timor-Leste is applying for full membership of the ASEAN. Reforms currently underway in Timor-Leste's fiscal and economic systems aim to bring the country into compliance with ASEAN standards. The government views building these international ties as part of its effort to increase investment opportunities within the country.

- Timor-Leste-Indonesia-Australia: Timor-Leste is also pursuing trilateral economic cooperation with Indonesia and Australia to boost cross-country investment. Indonesian producers are exempt from 10% value-added tax when they export directly to Timor-Leste.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

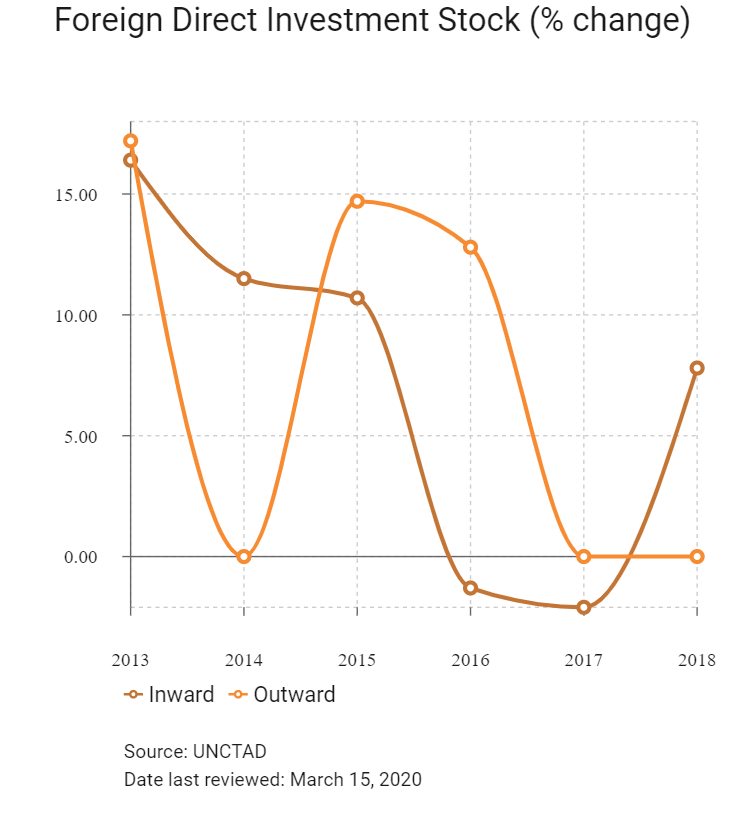

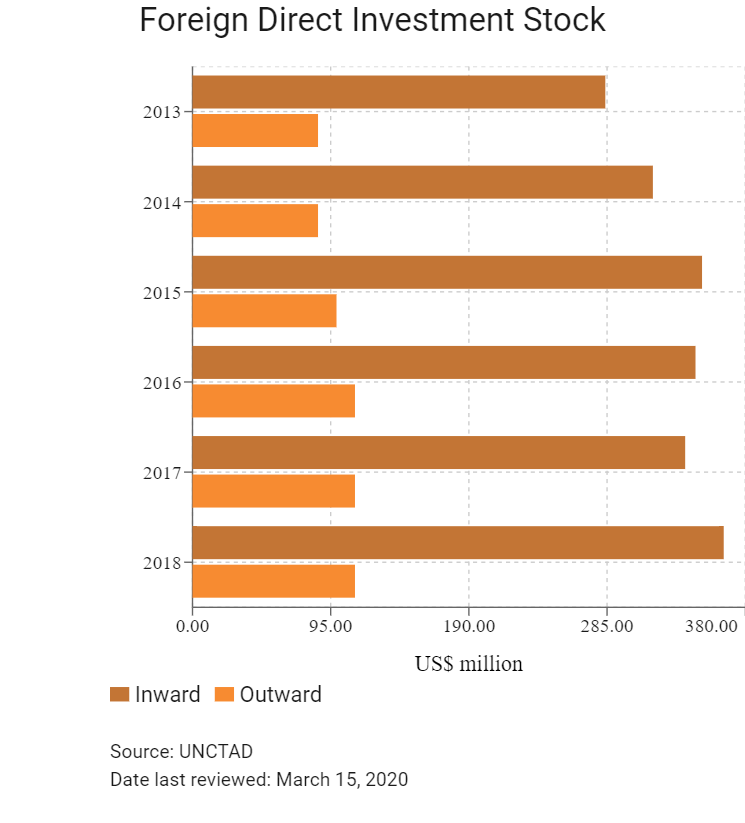

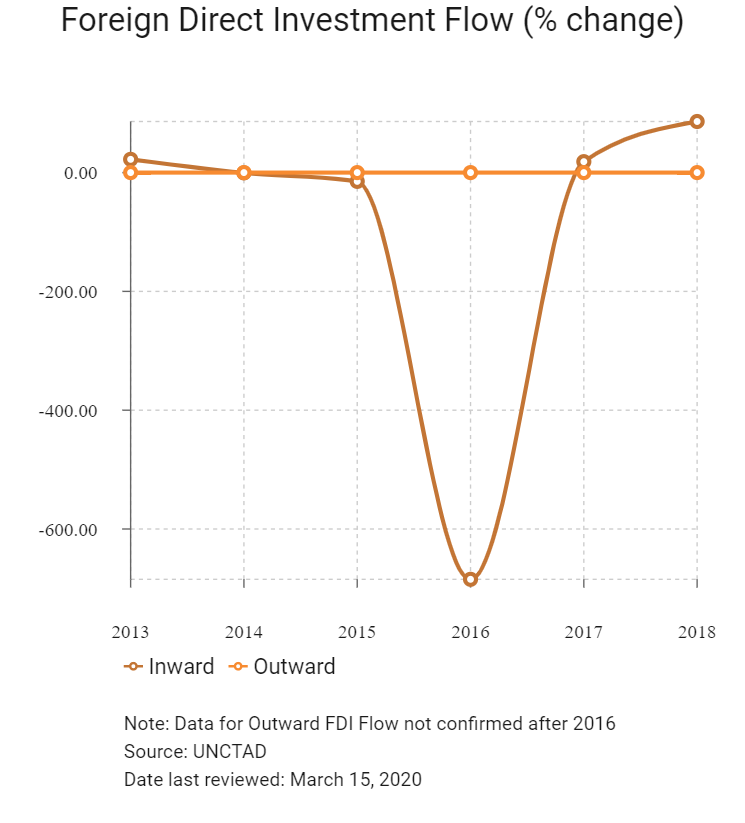

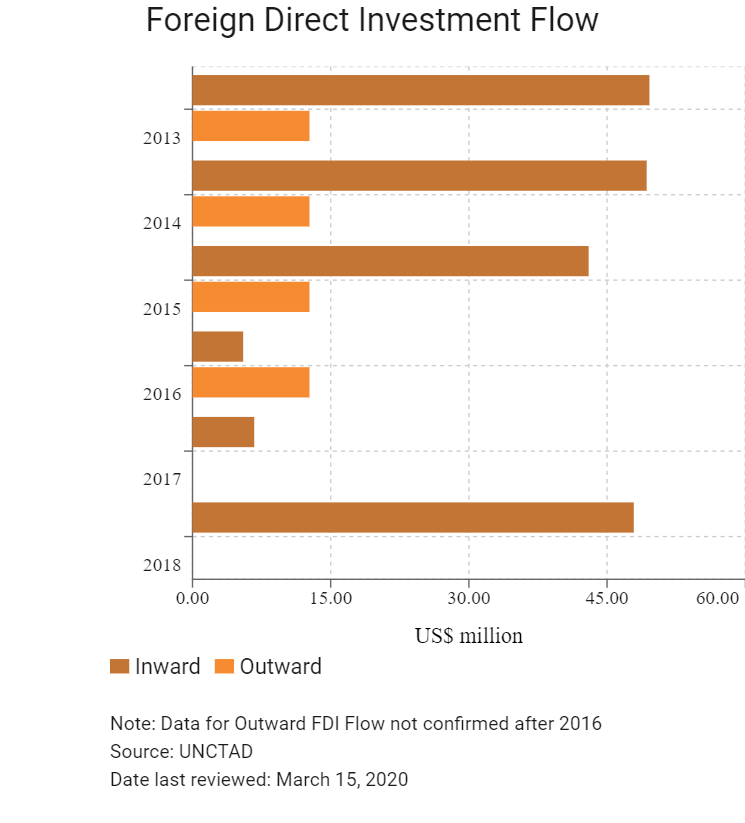

Foreign Direct Investment

Foreign Direct Investment Policy

- The Private Investment Law (2011) specifies the conditions and incentives for both domestic and foreign investment and guarantees full equality before the law for international investors. Other major laws affecting incoming foreign investment include the Companies Code of 2004, the Commercial Registration Code, and the Taxation Act of 2008. In accordance with article 30 of the Private Investment Law, the government of Timor-Leste announced the establishment of a Specialised Investment Agency, a one-stop-shop for investment and export promotion, on January 5, 2015. The agency became TradeInvest Timor-Leste in November 2015.

- TradeInvest Timor-Leste, the main investment and export promotion agency, aims to facilitate and support potential investors in Timor-Leste and assist foreign companies in identifying projects among the array of business opportunities that are emerging in Timor-Leste. TradeInvest is a one-stop-shop that provides services such as: licensing, taxes, investment opportunities, permits, tariffs, or linking importers with the right procedures. TradeInvest reviews foreign investment applications which are then presented to the Private Investment Commission for further study and evaluation. The Executive Director of TradeInvest chairs the Private Investment Commission, which is composed of directors general or equivalent from the relevant government ministries in the areas of taxation, customs, land and properties, economic activities of licensing, professional training, labour, immigration, building and housing, territorial planning and the environment.

- The Private Investment Commission evaluates applications for foreign investment permits, verifying the following:

- Compliance of the application with requirements established in applicable legislation (such as the National Development Plan, in the Procedural Regulation for Foreign Investment)

- Suitability, capacity, experience, and availability of financial resources necessary for the implementation and operation of the proposed investment enterprise

- Capacity, experience, and business or technical characteristics of the promoter or its managers in order to guarantee implementation and operation of the enterprise

- Positive operational balance of the business, according to the project proposal

- Environmental, infrastructural, and social implications which could condition the viability of the enterprise or that can result from its implementation

- Guaranteeing availability of necessary land for installation and functioning of the investment enterprise

- Ensuring consistency of the expected new jobs to be created in the short and medium term

- Establishing interconnection with other economic sectors

- The Timorese legal system is based on a mix of Indonesian laws and regulations, acts passed by the United Nations Transitional Administration, and post-independence Timorese legislation. The country is still working on a review of its legislation to harmonise the system, but has yet to undergo a comprehensive overhaul of the overlapping yet disparate systems. Timor-Leste has two official languages, Tetun and Portuguese, and two working languages, Indonesian and English; all new legislation is enacted in Portuguese and is based on the civil law tradition. A new private investment policy, tax codes and customs agencies are part of the ongoing fiscal reform effort that is designed to align Timorese legislation and regulation with best practices in ASEAN (under the ASEAN Comprehensive Investment Agreement) and under United Nations Conference on Trade and Development (UNCTAD).

- Timor-Leste does not have a competition or anti-trust law. Foreign investors may invest in any sector other than postal services, public communications, protected natural areas, and weapons production and distribution, as these are specifically reserved for the state. Investors are also prohibited from investing in sectors otherwise restricted by law (such as criminal activities).

- While Timor-Leste does not yet have a separate expropriation law, both Article 54 of the Constitution and the Private Investment Law permit the expropriation or requisition of private property in the public interest only if just and proper compensation is paid to the investor. The Private Investment Law calls for the equal treatment of foreign and national investors in expropriation cases and prohibits nationalisation policies or land policies that deliberately target the property of investors. Furthermore, before expropriation occurs, the affected claimants/occupants are given 30 days to leave the property and 10 days for filing cases at the local courts. Over 2012 to 2017, the cases of expropriation that did occur, primarily affected urban squatters occupying state property. Two large government development projects have relocated significant numbers of residents, while two known private investments have negotiated with the government to remove residents as part of the investment agreement.

- Timor-Leste is a member state to the International Centre for Settlement of Investment Disputes (ICSID Convention). Timor-Leste’s Court of Appeals must first recognise a foreign judgment or arbitral award in order for it to be enforced in the country. The country is not a signatory party to the convention of the Recognition and Enforcement of Foreign Arbitral Awards (1958 New York Convention).

- The government, through its autonomous agency, the National Petroleum and Minerals Authority (ANPM), has contracted with foreign firms to explore and develop offshore oil and gas deposits. In 2011, the government’s National Strategic Development Plan was approved unanimously by the National Parliament. The plan focuses on using petroleum revenues to support non-petroleum economic development and help the country to become a middle-income country by 2030. The government ostensibly recognises that international investment and business partnership are a key part of developing a diversified and sustainable economy in Timor-Leste.

- As outlined in the government’s Strategic Development Plan, key investment areas are oil and gas, agro-industry, forestry and livestock, fisheries, tourism, energy, infrastructure, civil construction, and transportation. Information as to opportunities in the country, has been disseminated both in domestic and international expositions and business and economic forums.

- Section 54 of Timor-Leste’s constitution grants the right of land ownership exclusively to Timorese nationals, either individuals or corporate entities; however, foreigners may conclude long-term leases (up to 50 years). There is no comprehensive national legislation governing land ownership, and investors who wish to lease property must often sort through competing claims from the Portuguese colonial administration, the Indonesian occupation era, and the post-independence period.

- The documents required for investments include:

- TradeInvest application form

- Descriptive project summary (project briefs, technical plans)

- Identification of promoters, professional CV/Firm Corporate Capability

- Bank credentials (bank statement, bank reference)

- Business plan

- Documents of land ownership

- Lot location

- Budget for construction/remodelling

- Environmental Impact Assessment (environmental licensing)

- Criminal records (original/certified copy)

- TradeInvest can issue a certificate of investment to projects approved by the Private Investment Commission that are valued at less than USD20 million. Investments of more than USD20 million or that require more than 5 hectares of state land for tourism, or 100 hectares of state land for agriculture, livestock, or forestry, require approval from the Council of Ministers. Investors can also request a Special Investment Agreement, through TradeInvest, prior to submitting the project to the Council of Ministers for approval. According to the TradeInvest website, application fees are USD500 for national investors and USD2,000 for international investors, and investment decisions are issued within 30 days.

- Timor-Leste has not yet conducted any investment policy reviews through the Organisation for Economic Co-operation and Development (OECD), WTO, or UNCTAD. Timor-Leste and Portugal have signed an Agreement on Mutual Protection and Promotion of Investment. Timor-Leste also signed a Bilateral Investment Treaty (BIT) with Germany in 2005, and with Qatar in 2012, but they have not entered into force.

- The government offers investment incentives to offset some of these challenges, including five-, eight-, or ten-year tax holidays depending on the location and nature of the investment. Investment opportunities outside of the oil and gas sector are increasing, with interest growing in the agricultural, construction, telecommunications, and tourism sectors.

- The government is also working on a major petroleum sector infrastructure project along the country’s southern coast and has created Special Economic Zones in Oecusse exclave and Atauro Island.

Sources: WTO – Trade Policy Review, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Special Zone for Social Market Economy (ZEESM) |

There are no free trade zones (FTZs) in Timor-Leste. Law No.3/2014 defines and regulates an FTZ in the Oecusse exclave, the ZEESM. The ZEESM as stipulated in the law will prioritise activities of a socioeconomic nature to promote the quality of life and well-being of the community. The government has approved a decree law on the development of Atauro (an island outside Dili) as part of the ZEESM, and is pursuing the possibility of creating another FTZ. These zones make it easier and less costly for potential investors with respect to business start-up, operations, protection and incentives, and how this compares with international best practice. |

|

General incentives |

Timor-Leste offers various investment incentives, including tax credits and import duty exemptions, to both domestic and international investors. - For domestic investments worth over USD50,000, foreign investments of over USD1.5 million, and joint foreign and national resident investments, where the national resident controls at least 75% of shares, of USD750,000, investors benefit from a five-year exemption from income, sales, and service taxes, as well as exemptions of customs duties for goods and equipment used in the construction or management of the investment, and also guaranteed contract for up to 100 years (50 years to renovate plus another 50 years’ lease). - The period of exemption is extended to eight years for investments in Rural Zones (outside of the cities of Dili and Baucau) and to ten years for investments in Peripheral Zones (the exclave of Oecusse and the island of Atauro). Even after these periods have expired, investors may deduct from their tax obligations up to 100% of the costs of constructing or repairing transportation infrastructure. - The new private investment policy and taxation law that is currently under discussion will change this incentive structure, if adopted. |

Sources: US Department of Commerce, Fitch Solutions

Value Added Tax: 2.5%

Corporate Income Tax: 10%

Sources: National sources, Fitch Solutions

Important Updates to Taxation Information

A Social Security scheme was introduced in November 2016, with both employers and employees required to make contributions. The scheme provides cover for loss of income/benefits due to work-related accidents, maternity, old age and death. It would appear that Social Security contributions should be deductible to employers. Implementing regulations for this scheme are still outstanding.

There are no local taxes on income in Timor-Leste. Other significant regulations issued include the Private Investment Law, which came into effect in January 1, 2018.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax (CIT) standard rate |

10% |

|

The rate of CIT for oil and gas contractors |

30% |

|

The rate of CIT for oil and gas subcontractors |

6% |

|

Non-residents without a permanent establishment |

10% Withholding Tax |

|

Sales Tax (standard) |

2.5% |

|

Services Tax |

5% on any gross consideration of more than USD500 received by a taxpayer for the provision of hotel, restaurant and bar, or telecommunication services |

Note: Supplemental Petroleum Tax (SPT) also applies for oil and gas contractors and is imposed on 'accumulated net receipts' using a specific formula. SPT is deductible for CIT calculation purposes. Overall, separate tax arrangements apply for petroleum activities in the Joint Petroleum Development Area.

Sources: Timor‑Leste Revenue Services, Fitch Solutions

Date last reviewed: March 15, 2020

Visa Requirements

Timor-Leste's visa policy differentiates between several different groups of passengers and arrival points. According to the terms of a bilateral agreement between Timor-Leste and Portugal, Portuguese nationals of good health and character who present a Portuguese passport on arrival and who seek to enter for tourism are exempted from having to obtain a Class 1 visa on arrival. In accordance with the law, citizens of all countries except Cape Verde and the Schengen Area must obtain a visa upon arrival or prior to arrival. A visa application may also be submitted to any diplomatic mission or consular office of Timor-Leste. Only Indonesian or Portuguese may obtain a visa or entry clearance on arrival at a land border. All other nationalities are required to apply for a 'visa application authorisation' prior to entering at a land border crossing.

Stay Requirements

Visitors may apply for a visa on arrival at the Presidente Nicolau Lobato International Airport or at the Dili Sea Port. Travellers of any nationality may obtain a tourist and business visa on arrival if arriving at Dili International Airport or Dili Seaport. Visas on arrival are granted for 30 days' stay, single entry. Permitted travellers may stay in the country for up to 90 days from the date of arrival (applies to multiple entry visas). The stay period may be extended up to a further 90 days after arrival on application to the Department of Immigration, where that further stay is justified on exceptional grounds. To demonstrate sufficient funds for a stay in Timor-Leste, each foreigner must have access to funds equivalent to:

- USD100 for each entry

- USD50 for each day expected to remain in the country

Localisation

Some individual investment agreements and government contracts specify local content requirements. One such contract mandated 30% local employment, but the specific requirements vary depending on the agreement.

Work Permits

Timor-Leste’s current immigration laws are not onerous and permit workers to apply for work permits in-country after entry on a 30-day visa acquired upon arrival. Timor-Leste has passed a new immigration and asylum law, which will change the visa structure and may streamline the process.

Residence Permits

There are two main avenues for foreigners wishing to obtain a Temporary or Permanent Resident permit. The first involves initially applying for and obtaining a Visa to Establish Residence. The other is via family reunification. Foreigners are unable to apply for and be granted a Resident Permit unless they have first been granted the Visa to Establish Residence visa, or are granted family reunification as immediate family of a person granted a Resident permit. Foreigners who have been granted the Visa to Establish Residence and entered the country on this basis, may then apply to the Immigration Service in Dili for a Residence Permit. The residence permit cannot be processed on arrival as this service is only available at the offices of the Immigration Service in Dili to those who are in the country.

To obtain a residence permit, the applicant must:

- Possess a visa to establish residence (where applying for the first resident permit)

- Demonstrate that (s)he does not have a criminal or police record of residence

- Be physically present in the country

Additional criteria for granting of Permanent Residence:

- Must have been a legal resident in the country for at least 12 consecutive years

- Must not have been sentenced for criminal offences to a prison term that, separately or cumulatively, exceeds one year, during the residence period

Residence permits are valid for 2 years from the date of issue, renewable for the same period. There is no time limit for permanent time residence, but a permit card must be renewed every 5 years.

Sources: National sources, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

N/A |

N/A |

|

Standard & Poor's |

N/A |

N/A |

|

Fitch Ratings |

N/A |

N/A |

Competitiveness and Efficiency Indicators

|

|

World Ranking |

||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

178/190 |

178/190 |

181/190 |

|

Ease of Paying Taxes Index |

139/190 |

140/190 |

136/190 |

|

Logistics Perfoamance Index |

N/A |

N/A |

N/A |

|

Corruption Perception Index |

105/180 |

93/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

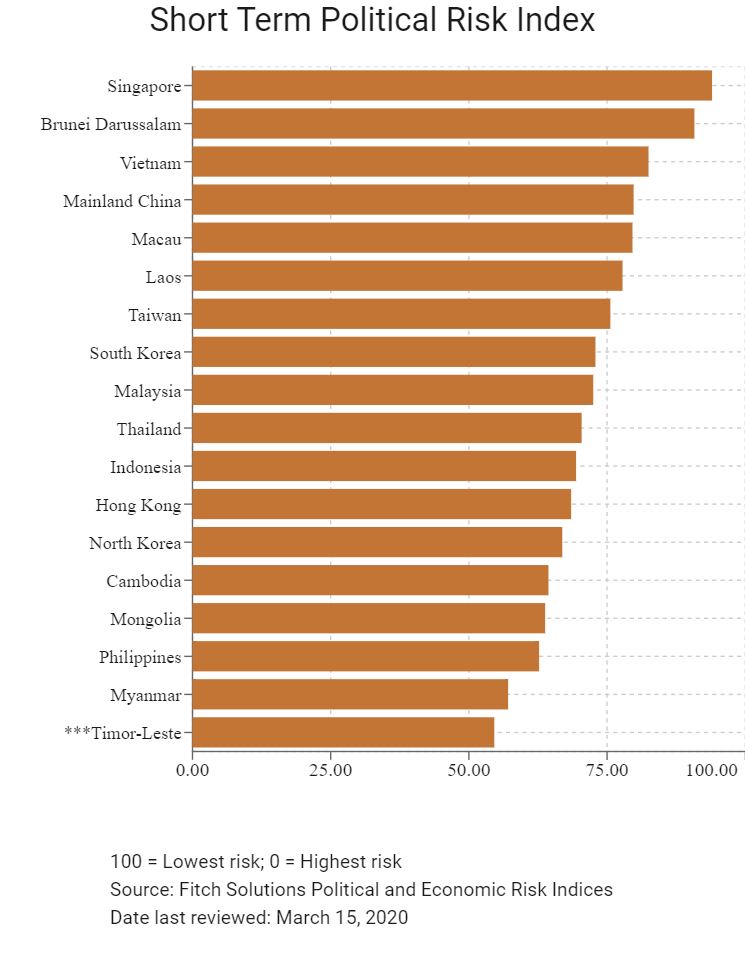

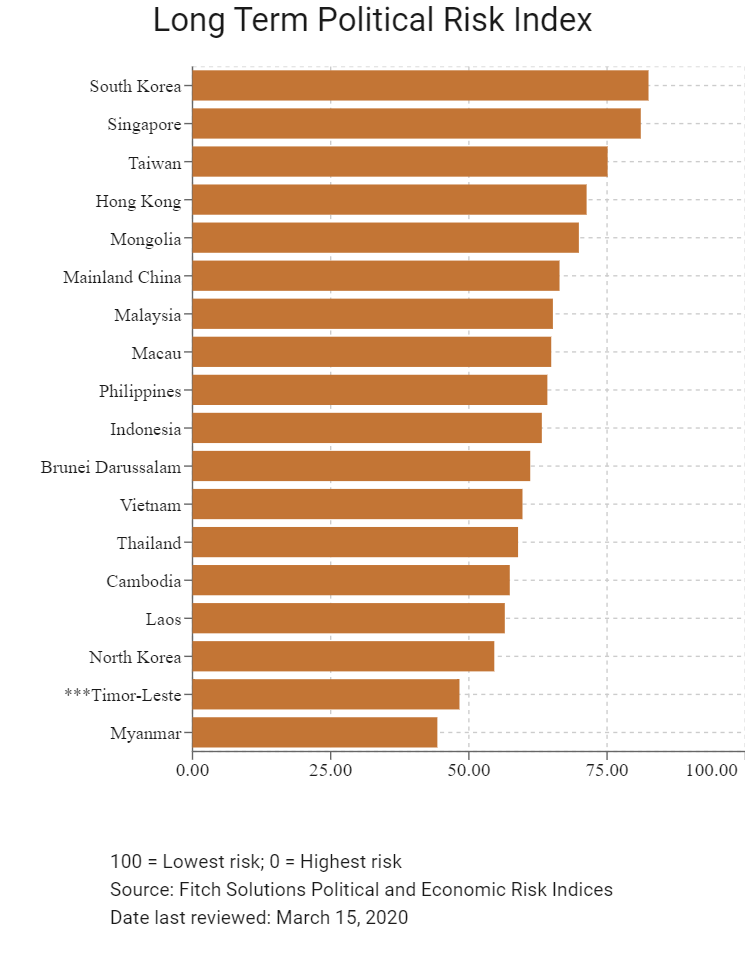

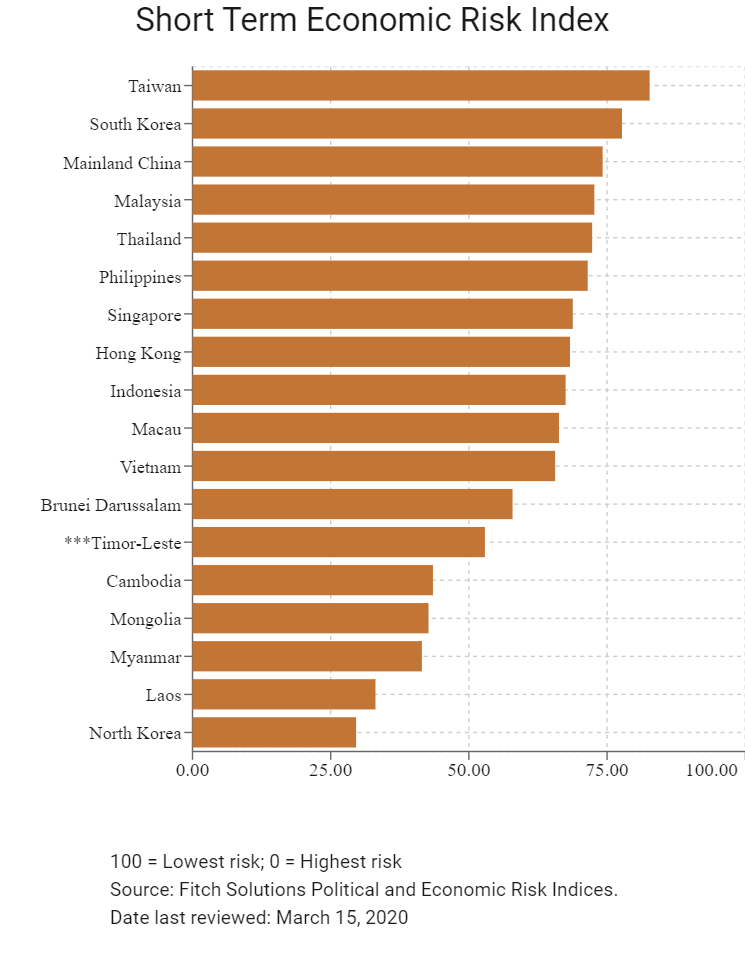

Fitch Solutions Risk Indices

|

|

World Ranking |

||

|

2018 |

2019 |

2020 |

|

|

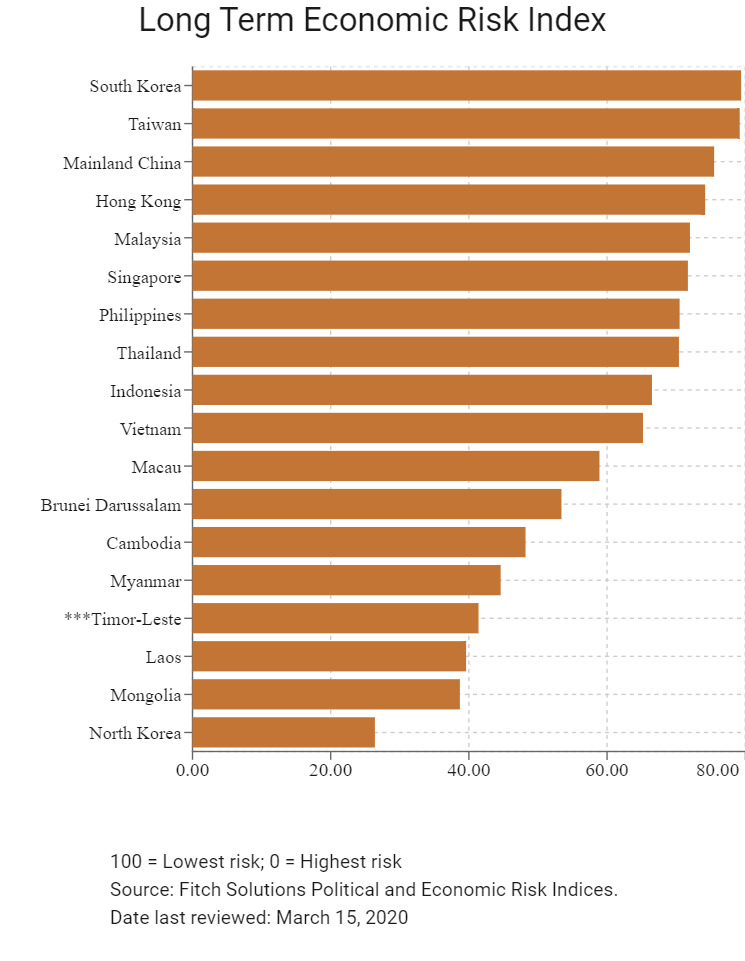

Economic Risk Index Rank |

151/202 |

154/201 |

162/201 |

|

Short-Term Economic Risk Score |

51.3 |

57.1 |

52.9 |

|

Long-Term Economic Risk Score |

42.9 |

43.4 |

41.4 |

|

Political Risk Index Rank |

162/202 |

162/201 |

162/201 |

|

Short-Term Political Risk Score |

53.8 |

54.6 |

54.6 |

|

Long-Term Political Risk Score |

48.3 |

48.3 |

48.3 |

|

Operational Risk Index Rank |

179/201 |

179/201 |

178/201 |

|

Operational Risk Score |

30.1 |

29.9 |

30.7 |

Source: Fitch Solutions

Date last reviewed: March 15, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Timor-Leste has been gradually seeking to develop alternative engines of growth in a bid to wean itself off of its overreliance on oil and gas revenues. A key initiative of the government is to invest in mega infrastructure projects to improve the country's connectivity. We believe that continued spending on such projects will be positive for overall fixed asset investment, and we expect this to be a main driver of economic growth. With these initiatives still in the initial stages, the Timorese economy remains reliant on oil and gas revenues and higher oil prices will be positive for growth in the near term. The signing of the treaty drawing the maritime boundary between Australia and Timor-Leste in March signals another positive step in obtaining a long-lasting resolution to the maritime dispute. The agreement paves the way for the development of the Greater Sunrise field oil and gas project, and would be positive for Timor-Leste's long-term prospects. However, challenges remain, as the final terms have yet to be fully agreed upon.

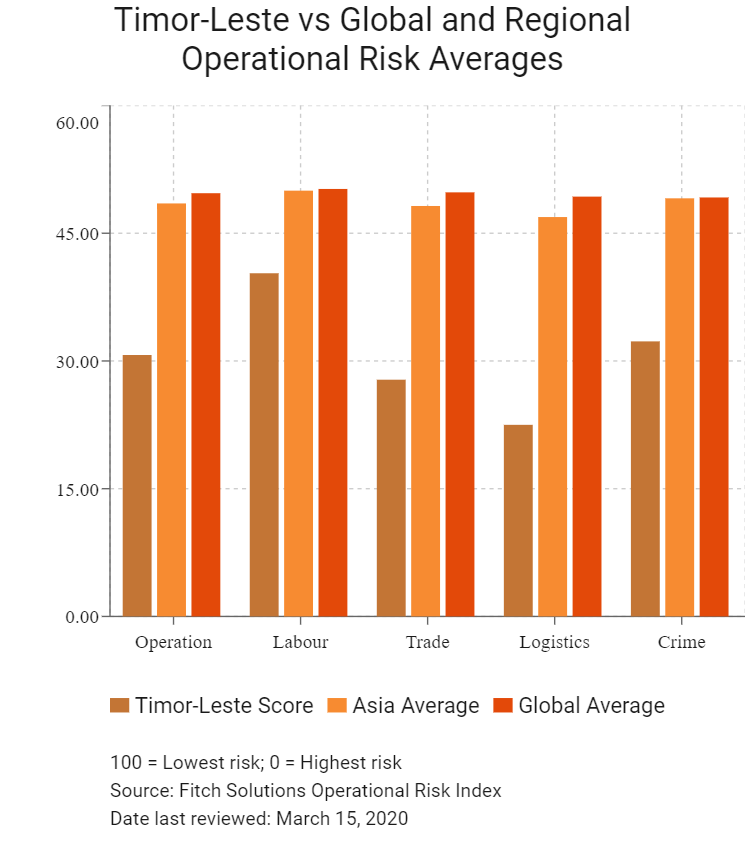

OPERATIONAL RISK

Timor-Leste has experienced sustained peace and stability since 2008 and peaceful presidential elections in 2017 are a further signal of the country's readiness to move forward. The government is making a concerted effort to improve the country's basic infrastructure, including roads, airports, electricity and telecommunications, and is also implementing a fiscal and economic reform process that will bring its system into compliance with best practices, as it seeks to join the ASEAN. However, challenges remain as the country is still struggling with incomplete and unclear legislation, inadequate regulatory mechanisms, corruption, insufficient human capital and deficient infrastructure. The private sector is small and primarily dependent on government contracts, and the government's ability to regulate industry is limited.

Source: Fitch Solutions

Date last reviewed: March 16, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Timor-Leste Score |

30.7 |

40.3 |

27.8 |

22.5 |

32.3 |

|

East and South East Asia Average |

55.6 |

56.4 |

56.7 |

55.6 |

53.6 |

|

East and South East Asia Position (out of 18) |

18 |

17 |

17 |

18 |

16 |

|

Asia Average |

48.5 |

50.0 |

48.2 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

33 |

29 |

34 |

34 |

31 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

178 |

161 |

180 |

193 |

164 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

82.8 |

77.8 |

89.9 |

74.9 |

89.7 |

|

Hong Kong |

81.5 |

71.2 |

88.5 |

77.0 |

89.5 |

|

Taiwan |

73.2 |

66.4 |

74.3 |

73.4 |

79.2 |

|

South Korea |

71.0 |

63.5 |

67.5 |

79.6 |

73.1 |

|

Malaysia |

69.3 |

61.6 |

73.5 |

75.7 |

60.5 |

|

Macau |

63.2 |

64.2 |

66.9 |

52.0 |

68.0 |

|

Brunei Darussalam |

61.7 |

62.8 |

57.2 |

55.0 |

70.6 |

|

Thailand |

60.6 |

56.7 |

65.2 |

68.4 |

45.2 |

|

Mainland China |

57.9 |

53.9 |

52.2 |

66.3 |

54.4 |

|

Indonesia |

54.0 |

52.6 |

55.5 |

55.6 |

51.3 |

|

Vietnam |

53.2 |

51.5 |

53.9 |

56.8 |

48.4 |

|

Mongolia |

51.4 |

57.8 |

52.4 |

40.9 |

54.1 |

|

Philippines |

47.5 |

51.3 |

47.3 |

42.4 |

31.3 |

|

Cambodia |

40.8 |

46.7 |

46.0 |

37.7 |

39.5 |

|

Laos |

38.2 |

44.2 |

38.0 |

34.2 |

36.7 |

|

North Korea |

32.4 |

49.6 |

20.3 |

31.5 |

30.8 |

|

Myanmar |

31.3 |

45.5 |

28.2 |

30.0 |

24.9 |

|

Timor-Leste |

30.7 |

40.3 |

27.8 |

22.5 |

32.3 |

|

Regional Averages |

55.6 |

56.5 |

55.8 |

54.1 |

54.4 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: March 15, 2020

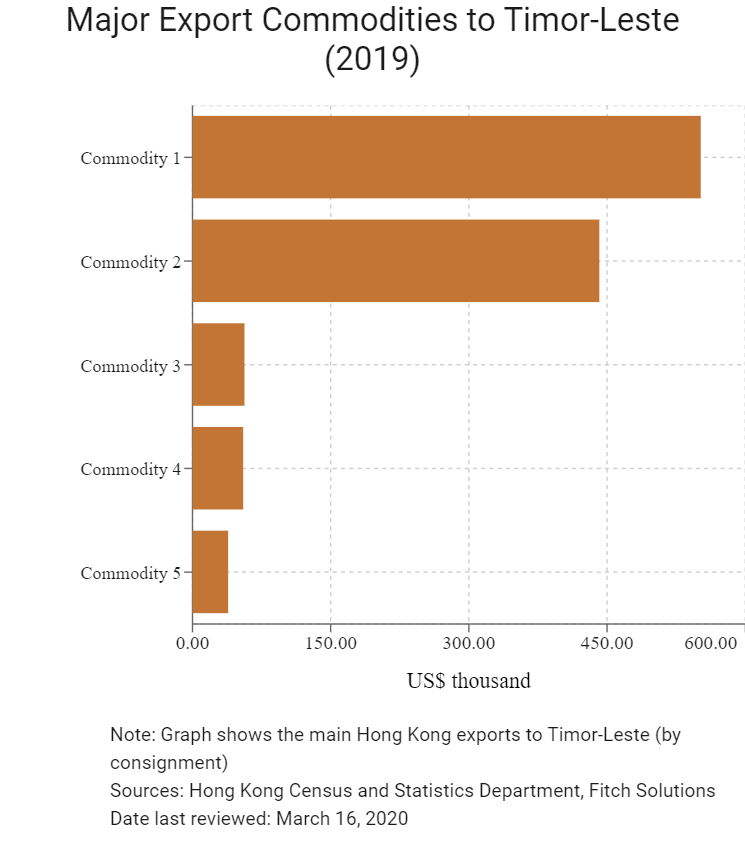

Hong Kong’s Trade with Timor-Leste

|

Export Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

551.7 |

|

Commodity 2 |

Miscellaneous manufactured articles |

441.6 |

|

Commodity 3 |

Special transactions and commodities not classified according to kind |

56.4 |

|

Commodity 4 |

Office machines and automatic data processing machines |

55.0 |

|

Commodity 5 |

General industrial machinery and equipment, and machine parts |

38.7 |

|

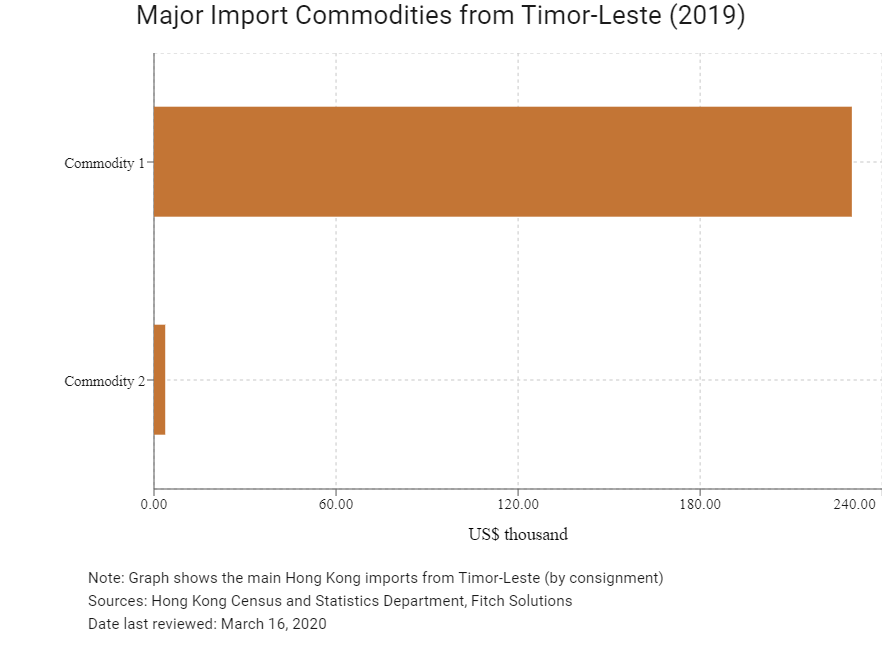

Import Commodity |

Commodity Detail |

Value (US$ thousand) |

|

Commodity 1 |

Telecommunications and sound recording and reproducing apparatus and equipment |

230.0 |

|

Commodity 2 |

Special transactions and commodities not classified according to kind |

3.7 |

|

2019 |

Growth rate (%) |

|

|

Number of Timor-Leste residents visiting Hong Kong |

270 |

26.2 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Sources: Hong Kong Tourism Board, Fitch Solutions

|

2019 |

Growth rate (%) |

|

|

Number of East Asians residents residing in Hong Kong |

2,788,077 |

3.0 |

Note: Growth rates for resident data is for 2015 to 2019. No UN data available for intermediate years.

Sources: United Nations Population Division, Fitch Solutions

Date last reviewed: March 16, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of Timor-Leste companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Visa Requirements for Hong Kong Residents

Travellers may obtain a tourist and business visa on arrival at Dili International Airport or Dili Seaport. Visas on arrival are granted for single entry up to 14 days' stay.

Source: Hong Kong Immigration Department

Date last reviewed: March 16, 2020

Timor-Leste

Timor-Leste