GDP (US$ Billion)

504.93 (2018)

World Ranking 26/193

GDP Per Capita (US$)

7,448 (2018)

World Ranking 84/192

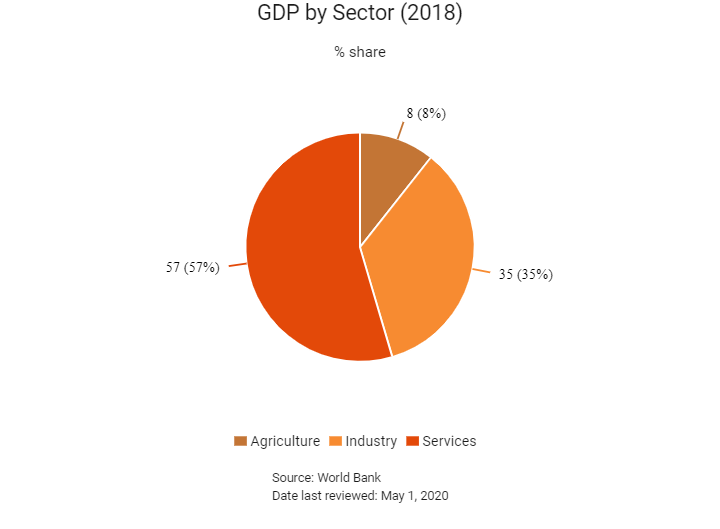

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

110.3 (2019)

Currency (Period Average)

Thai Baht

31.05per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Thailand has made remarkable progress in social and economic development, moving from a low-income country to an upper-income country in less than a generation. Thailand's long-term economic goals are laid out in the country's 20-Year National Strategy (2017–2036) for attaining developed country status. According to the plan, the country will seek to achieve this through broad reforms that address economic stability; human capital (not least through educational improvements); and equal access to economic opportunities, environmental sustainability, competitiveness and effective governance. The sustained pace and quality of the reforms, particularly in promoting innovation in agriculture, as well as their sound implementation, will be crucial for achieving the desired economic outcomes. Lastly, Thailand's large and predominantly youthful population further improves the country's economic prospects. However, its lagging education system will remain a major barrier to its economic prospects in the future.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

May 2019

As part of the government's Eastern Economic Corridor initiative, the cabinet approved a State Railway of Thailand deal for a high-speed rail (HSR) project linking three major airports. The China Development Bank would loan USD6.9 billion to build the rail link, and the development consortium included China Railway Construction Corporation.

June 2019

Mainland China's technology giant Tencent launched WeTV in Thailand. This was its first overseas video streaming service, as part of its diversification from its core gaming business.

June 2019

The 34th ASEAN summit was held in Bangkok, Thailand, and ended with the leaders of the regional bloc promising to work together more closely, most immediately to tackle marine pollution, and then to jointly bid for the 2034 FIFA World Cup.

June 2019

Somphote Ahunai, founder of the country's second-largest electricity generating company Energy Absolute, outlined his plan to dramatically increase the number of electric vehicles in Bangkok by 2020 and ease the city's air pollution. When the company unveiled its Thai-designed and built Mine Mobility passenger EV at the Bangkok Motor Show it received 4,500 orders (mostly from taxi unions) for a car that is cheaper than both the Nissan Leaf and Kia Soul EV. Mainland China's BYD has already stated it plans to deliver 1,100 cars to Bangkok in 2020.

July 2019

A report by Thailand's Electronic Transaction Development Agency revealed that social media commerce was booming in the country, mostly directly with merchants through Facebook and Instagram and propelled by mobile banking apps. According to Facebook, more than half of Thailand's population accessed its website every day.

September 2019

Thai officials announced that the country was planning a 'relocation package' of incentives to attract foreign companies looking to move production from Mainland China because of the ongoing United States-Mainland China trade tensions.

September 2019

According to data released by the Tourism Ministry of Thailand, arrivals from Mainland China surged almost 19% to 1.03 million people in August 2019 for the first time in six months. Tourism was crucial for the Thai economy as it accounted for about one-fifth of the country's economy.

October 2019

Thailand's finance minister approved a stimulus package to boost the country's tourism industry over the remaining three months of 2019. The minister also stated that the aim was to achieve a 3% growth rate in 2019.

October 2019

The Council of the European Union (EU) said in a statement that it intended to resume free trade agreement negotiations with Thailand.

October 2019

The State Railway of Thailand and a Charoen Pokphand Group-led consortium signed a public-private partnership contract for a USD7.4 billion HSR project that would connect three airports in Thailand. The 220km HSR line would run from Don Mueang Airport to the north of Bangkok via Bang Sue and Makkasan to Bangkok Suvarnabhumi Airport. The line would then continue along the SRT's east line via the Bang Pakong River, Chachoengsao, Chonburi and Pattaya to U-Tapao Rayong Pattaya International Airport. The line would allow trains to run at a speed of up to 250km/h. The project was likely to start operations in 2023 and would be transferred to the Thai government after 50-year agreement period.

March 2020

A state of emergency was instituted effective March 26-April 30, under which foreigners were banned from entering the country except for shippers, diplomats, drivers, pilots, foreigners with work permits and others permitted by the prime minister. A 14-day state quarantine had been implemented for travellers entering Thailand from abroad and a nationwide curfew (diplomats exempted) from 22:00 and 04:00 was effective until further notice.

April 2020

The Bank of Thailand had provided some liquidity in the foreign exchange market, thereby avoiding disorderly market conditions while also allowing the exchange rate to adjust as a shock absorber. The policy rate was reduced from 1.25% to 0.75% during Q1 2020.

Q1 2020

In response to the Covid-19 pandemic, the government announced various new fiscal measures, which as of April 2020 totalled THB1.5 trillion (8.9% of 2019 GDP) and range from financial support for employees, businesses and farmers to tax relief.

Sources: BBC Country Profile – Timeline, Reuters, The Guardian, Thailand Revenue Department, Bloomberg, IMF, Fitch Solutions

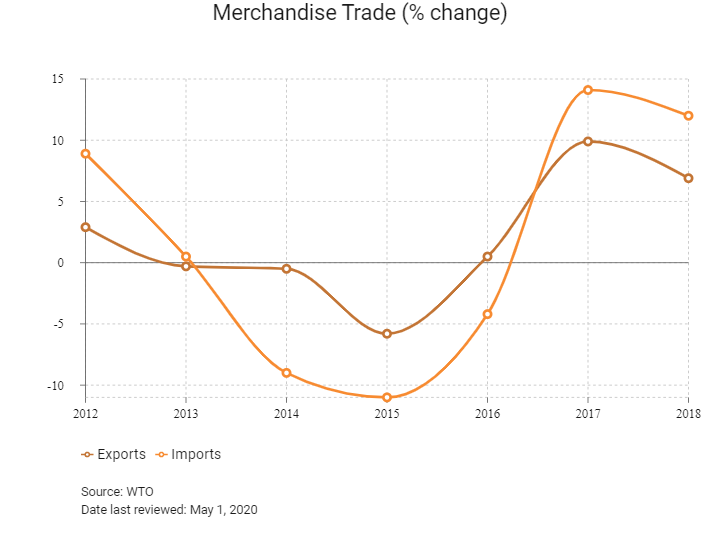

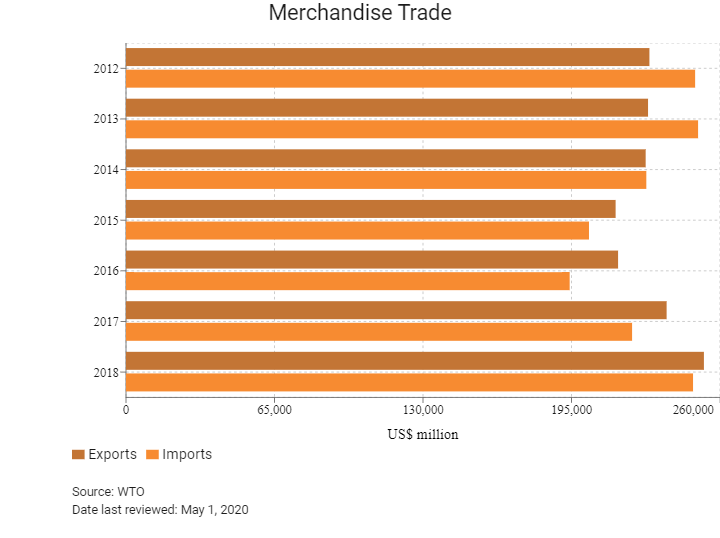

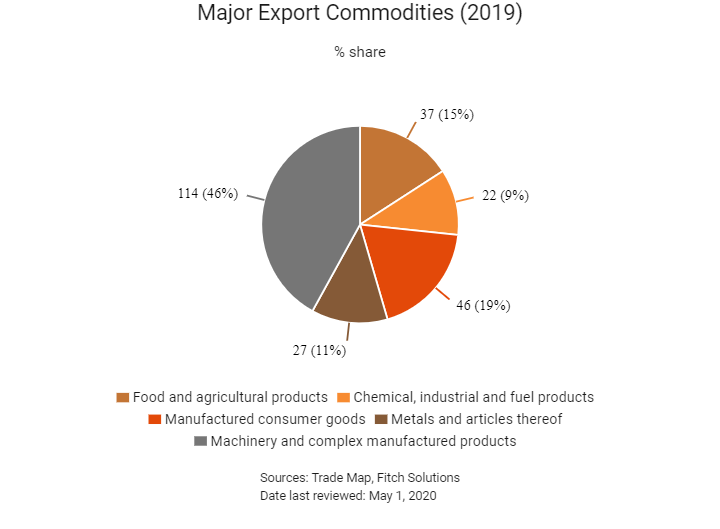

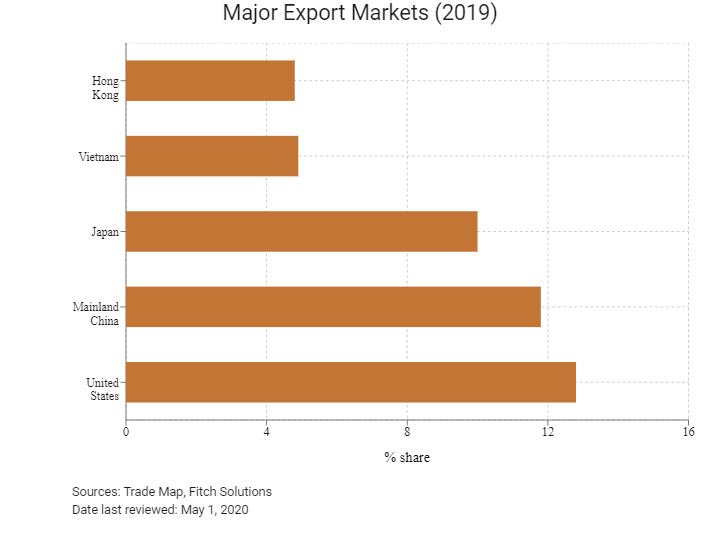

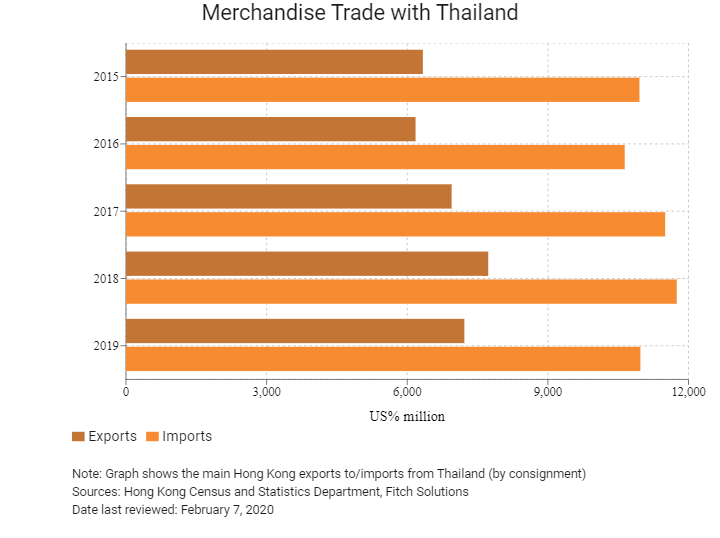

Merchandise Trade

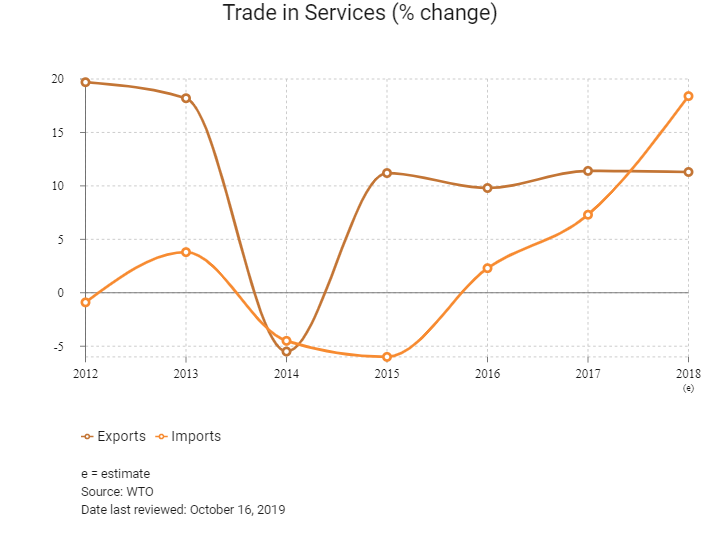

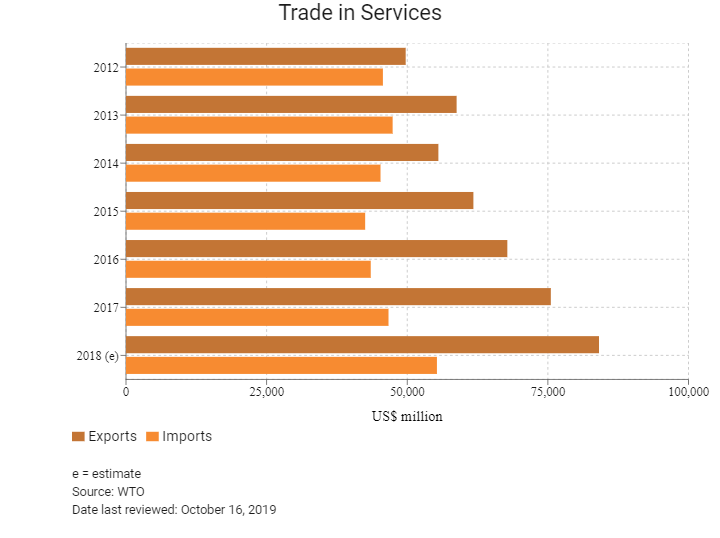

Trade in Services

- Thailand has been a WTO member since January 1, 1995.

- Since 2015 many tariffs between member states of the ASEAN have been removed (other members are Brunei, Cambodia, Indonesia, Laos, Myanmar, the Philippines, Singapore, Malaysia and Vietnam) as ASEAN moves towards customs unification. The implementation of lower tariffs within the area has been beneficial, with regional trade booming in recent years, especially as Malaysia, Singapore, Vietnam, Cambodia and Myanmar are Thailand's major exporting partners.

- Although Thailand has abolished most tariffs, this mainly benefits regional (members of ASEAN) investors and a few other countries with which it has free trade agreements (FTAs). Consequently, high tariffs in many sectors and non-tariff barriers such as licensing requirements and excessively burdensome import requirements remain an impediment to market access. Price controls and excise taxes, often based on an exceedingly complex tax structure, also negatively impact trade in some sectors. Thailand is not a signatory to the WTO Government Procurement Agreement (GPA) although it has observer status in the GPA Committee.

- In May 2017, Thailand repealed the outdated Customs Act of 1926, and a new Customs Act BE 2560 (2017) came into force from November 13, 2017, that heralded a new era in customs and excise control in Thailand. The aim of the new act is to modernise Thailand's customs law, ease customs procedures significantly, introduce transparency and transform the Customs Department from effectively being a regulator into a facilitator of trade. Ambiguities in the present law were removed in order to bring the law closer to international best practices and more in line with Thailand's FTAs. Thailand has been a member of the World Customs Organization since February 4, 1972.

- Thailand has bilateral investment treaties (BITs) with Argentina, Bahrain, Bangladesh, the Belgium-Luxembourg Economic Union (BLEU), Bulgaria, Cambodia, Canada, Mainland China, Croatia, Czech Republic, Egypt, Finland, Germany, Hong Kong, Hungary, Indonesia, Israel, Jordan, North Korea, South Korea, Laos, Myanmar, the Netherlands, Peru, the Philippines, Poland, Romania, Slovenia, Sri Lanka, Sweden, Switzerland, Taiwan, Turkey, the United Arab Emirates, the United Kingdom and Vietnam. Three others are signed but not yet in force.

- Thailand has double taxation agreements with 61 countries.

- Thailand's improved position in the most recent IMD World Competitiveness Rankings was hailed by the Thailand Board of Investment as an endorsement of the government's Thailand 4.0 policy and the improvements made in the areas of training, technology and the regulatory framework. According to recently released figures, total foreign investments in approved projects had risen by 41% to THB74.9 billion from the same period in 2018.

- Negotiations for a EU-Thailand FTA were launched in March 2013 and put on hold in 2014. In October 2019, the EU announced that it intends to resume its FTA negotiations with Thailand.

Sources: WTO – Trade Policy Review, UNCTAD, Revenue Department of Thailand, ASEAN Briefing, Thailand Board of Investment, Fitch Solutions

Multinational Trade Agreements

Active

- Thailand is a member of the ASEAN alongside Brunei Darussalam, Cambodia, Indonesia, Laos, Myanmar, the Philippines, Singapore, Malaysia and Vietnam. The ASEAN Free Trade Area was signed on January 28, 1992 and entered into force on January 1, 1993.

- ASEAN-Mainland China FTA: The ASEAN-Mainland China FTA and the economic integration agreement (EIA) cover goods and services. The FTA for goods came into force on January 1, 2005, and the FTA for services came into force on July 1, 2007. The agreement aims to eliminate tariffs, encourage investment and address the barriers that impede the flow of goods and services. The ASEAN-Mainland China Free Trade Area was last updated in 2015.

- ASEAN-India FTA: The ASEAN-India FTA and the EIA cover goods and services. The FTA came into force on January 1, 2010 for goods, and on July 1, 2015 for services, with the aim of minimising barriers and deepening the economic links between the parties. The agreement will lead to the progressive elimination of tariffs on all goods.

- ASEAN-South Korea FTA (AKFTA): The AKFTA came into force in January 2010 and October 2010 for goods and services respectively. The ASEAN-South Korea Investment Agreement came into force on September 1, 2009. The agreements aim to create more liberal, facilitative market access and investment regimes between South Korea and ASEAN. A business council was set up in December 2014 to enhance economic cooperation between the parties and boost total trade to USD200 billion by 2020. Total trade between ASEAN and South Korea grew by 68% between 2007 and 2017.

- ASEAN-Japan FTA: This FTA covers goods and came into force on December 1, 2008. Japan provides a huge market for a wide range of goods. This tariff-free trade benefits a number of important sectors, including manufacturing, agriculture, mining and chemical production.

- ASEAN-Australia-New Zealand FTA: The ASEAN-Australia-New Zealand FTA and EIA cover goods and services. The agreement came into force on January 1, 2010.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and ASEAN began negotiating an FTA and an investment agreement in July 2014. After 10 rounds of negotiations, Hong Kong and ASEAN announced the conclusion of the negotiations in September 2017 and forged the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods, and services, investments, economic and technical cooperation, dispute-settlement mechanisms, and other related areas. The agreements will bring legal certainty, better market access and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flows between Hong Kong and ASEAN. The agreements will also extend Hong Kong's FTA and investment agreement network to cover all major economies in South East Asia. The agreement came into force on January 1, 2019, but it will take time for all members of ASEAN to comply because implementation is subject to completion of the necessary procedures. Hong Kong is a key export market and the reduction of tariffs will ease the trading process. Hong Kong's potential as a key export market increases the importance of AHKFTA.

Waiting to be Signed

Regional Comprehensive Economic Partnership (RCEP): This is a regional economic agreement that involves the 10-member ASEAN bloc and their FTA partners: Australia, Mainland China, Japan, New Zealand and South Korea. As at February 7 2020, India is not party to the agreement. The RCEP is envisioned to be a modern, comprehensive, high-quality and mutually beneficial economic partnership agreement that aims to advance economic cooperation, and broaden and deepen integration in the region. The RCEP will lower tariffs and other barriers to the trade of goods among the 15 countries that are in the agreement or have existing trade deals with ASEAN. The agreement was finalised in November 2019 and is expected to be signed in November 2020.

Under Negotiation

- Negotiations for a EU-Thailand FTA started in March 2013. The negotiations aimed to conclude a comprehensive FTA in the short to medium term, and by November 2013 a partnership and cooperation agreement had been finalised, which provides a comprehensive framework for EU-Thailand relations and opportunities to develop cooperation. Further talks stalled because of the military takeover in Thailand in 2014. After Japan, the EU is Thailand's largest investor. Thailand and the EU resumed talks regarding the FTA in October 2019.

- Negotiations for an EU-ASEAN region to region FTA were launched in 2007. Talks were paused in 2009 to allow for bilateral FTA negotiations as building blocks towards a region to region agreement. ASEAN as a whole represents the EU's third largest trading partner outside Europe.

Sources: WTO Regional Trade Agreements database, European Commission, ASEAN, UNCTAD, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- The Thai business climate continues to be positive and welcoming to foreign investment, but local laws favour domestic companies in many aspects. All businesses operating in Thailand must register and obtain a foreign business licence from the Ministry of Commerce. Manufacturing firms must also register with the Ministry of Industry and the Ministry of Labour and Social Welfare. There is a risk that government spending could crowd out private and foreign investors.

- The Foreign Business Act (FBA) of 1999 is the primary piece of legislation with respect to foreign business activities. In spite of some reforms, company ownership restrictions remain in place and foreign nationals may own 49% of a company while it remains majority-Thai owned.

- Certain types of business activities are reserved for Thai nationals only according to the FBA. Generally, foreign investment in these areas cannot comprise more than 50% of share capital unless specifically permitted. Some exemptions can be obtained, such as permission from the director general of the Department of Business Development, with the approval of the Foreign Business Committee together with obtaining a foreign business licence.

- Foreign ownership of wireless or mobile telecommunications services; banking, accounting, bookkeeping and auditing services; tax consultancy; agriculture and forestry; transport; tourism capped at 49%; mining, oil and gas and waste management and water supply is capped at 75%.

- Under the Land Code, the Condominium Act and the Property Leasing Act, foreigners are not allowed to own land in Thailand – save for government industrial estates or Special Economic Zones (SEZs). In addition, a foreign investments in excess of THB40 million are entitles the investor to own 1,600sq m of land for residential use with the permission of the Ministry of Interior. Rather than purchasing, many foreign businesses instead sign long-term leases and then construct buildings on the leased land.

- Under the Condominium Act of 2008, foreign ownership in a condominium building cannot exceed 49%. Property can be expropriated under Thai law, but the risk of asset seizure is low.

- The Alien Employment Act prohibits foreign nationals from working in 39 occupations and professions including but not limited to labourer, goldsmith, farmer, accountant, auditor, engineer, architect, among others. Additionally, companies need to have certain minimum amount of fully paid up capital in order to qualify to employ specific numbers of foreign nationals in Thailand. Other conditions include having at least fifty local employees per expatriate.

- Businesses that are wholly foreign owned and incorporated in Thailand in terms of Thailand's Board of Investment are allowed to employ foreign nationals provided there is a 4:1 ratio of local to foreign nationals employed

- Thailand has a Seven-Year Investment Promotion Strategy (2015-2021) that aims to promote valuable investment in Thailand to overcome the middle-income trap and to achieve sustainable growth in accordance with the sufficiency economy philosophy. The six key investment promotion policies include support for the special economic zones, especially in border areas and those parts of southern Thailand in a way that will support efforts to enhance security in the area.

- On September 6, 2019, Thailand introduced a stimulus package called Thailand Plus that contains a wide variety of measures to attract foreign investment. The Thailand Plus package covers seven key points, such as the introduction of new tax incentives and deductions as well as reforms and initiatives designed to improve the ease of doing business in the country. The seven key points are tax incentives for investments; tax deductions for science, technology, engineering and mathematics development; deductions for investment in automation systems; amendments to the Foreign Business Act; establishment of an investment and steering committee; expanding free trade networks; and development of new special investment zones.

- Thailand is considering making online giants such as Amazon and Facebook collect value-added tax (VAT) on e-commerce sales.

Sources: WTO – Trade Policy Review, International Trade Administration, US Department of State, Thailand Board of Investment, UNCTAD, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Thailand's flagship investment zone is the Eastern Economic Corridor (EEC) built on the existing Eastern Seaboard industrial area. The EEC spans the provinces of Chachoengsao, Chonburi and Rayong, where Thailand's first industrial estates were developed. The Thai government wants to establish the EEC as the primary investment and infrastructure hub in ASEAN, serving as a gateway to East and South Asia. |

- Investors will be able to secure a land lease of 50 years, with the option to renew for up to 49 years.

|

|

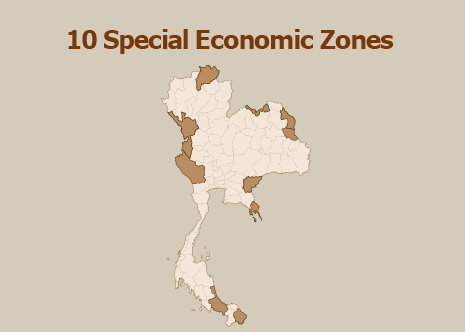

The Industrial Estate Authority of Thailand (IEAT) established 10 SEZs reserved for the location of 13 targeted industries to manufacture only in Thailand. These zones are located in Tak, Mukdahan, Sa Kaew, Trat, Songkhla, Chiang Rai, Nongkhai, Nakhon, Kanjanaburi and Narathiwas. In June 2019, the Thai government invited private sector companies to bid on the Port of Songkhla Improvement Project. |

- SEZs are reserved for the location of industries manufacturing for export only, to which businesses may import raw materials and export finished products duty free (including VAT).

- Foreign ownership of land, foreign expert employment and permission to employ foreign unskilled labour. |

|

Thailand's Board Of Investment approved the Chana district of Songkhla province as the fourth model city, following the policy to promote investment under the Model City Project. |

-The investment incentives include an eight-year corporate tax exemption for new projects and a five-year exemption for existing projects, as well as other special privileges, such as a 90% reduction of normal import tax for a period of 10 years for raw materials or necessary materials needed for manufacturing products for the domestic market. |

Sources: US Department of State, Thailand Board of Investment, a Guide to Investment in the Special Economic Development Zones, Fitch Solutions

- Value Added Tax: 10%

- Corporate Income Tax: 20%

Source: Thailand Revenue Department

Important Updates to Taxation Information

- On March 14, 2018, Thailand's cabinet passed two provisional royal decrees aimed at regulating the cryptocurrency market. The finance ministry outlined new tax guidelines for the cryptocurrency market. According to Thai regulatory authorities, the measures taken are to protect traders from losing their money. VAT on cryptocurrency came in at 7% on all traders, while capital gains tax came in at 15%.

- In November 2018, Thailand introduced specific transfer pricing provisions into income tax law, applicable on or after January 1, 2019. Thailand has 61 double taxation agreements (DTAs). On June 4, 2019, the Revenue Department announced it had signed a memorandum of agreement with the Electronic Transactions Development Agency to help to develop reliable and secure standards for an e-Tax invoice and e-Receipt system as part of its plan to improve the efficiency of tax collection and to encourage domestic entrepreneurs by reducing costs and increasing convenience.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

20% |

|

Capital Gains Tax |

20%; For personal income, most capital gains are treated as personal income with a few exceptions. |

|

VAT |

- 10% normally but reduced to 7% until September 30, 2019, unless extended further. |

|

Petroleum Income Tax |

Petroleum companies under a concession are taxed at the rate of 50% of their annual net profit from petroleum operations; a production sharing producer is taxed at the rate of 20%. |

|

Property Tax |

12.5% of assessed rental value until January 1, 2020 when a new tax that came into force in March 2019 will be collected from owners of land, buildings or condominiums. The tax base value will be assessed by municipal administrations then collected at rates between 0.01% and 0.7% in the first two years and 0.15% and 3.0% after two years. |

|

Stamp duty |

Stamp duty is levied on 28 different types of documents and instruments, including employment contracts and insurance policies. The rate varies by type of document, but ranges from THB1 per THB1,000 of value on most contracts and agreements to a fixed amount per instrument on most commercial and other documents. |

|

Social security contributions |

Contributions, which are payable by both the employer and employee, are levied at the rate of 5% of the monthly salary of each employee, subject to a maximum per employee of THB750 a month. |

|

Withholding Taxes |

The rate for non-residents is 10% on dividend income and 15% on royalties or interest unless modified by the existence of a taxation treaty. |

Sources: Thailand Revenue Department, Fitch Solutions

Date last reviewed: May 1, 2020

Foreign Worker Permits

Prior to starting employment, all non-Thai nationals are required to obtain a work permit under the Working of Alien Act of 2008. Foreign nationals first need to secure an initial non-immigrant visa, which must be obtained before entering Thailand. The duration of the work permit is generally the same as the applicant's visa. Generally, work permits are issued for one year but are renewable. Foreign nationals are not allowed to perform work that is not permitted by their visa. To change occupations, they need to obtain authorisation from the Ministry of Labour.

Localisation Requirements

The Alien Employment Act (1978) prohibits foreign nationals from working in 39 occupations and professions (such as labourers, goldsmiths, farmers, accountants, auditors, engineers and architects).

According to the Employment and Job Seeker Protection Act (1985), companies need to have a certain minimum amount of fully paid up capital in order to qualify to employ specific numbers of foreign nationals in Thailand. Other conditions include having at least 50 local employees per expatriate. Businesses that are wholly foreign owned and incorporated in Thailand in terms of Thailand's Board of Investment are allowed to employ foreign nationals on a 4:1 ratio of locals to foreign nationals.

Visa/Travel Restrictions

In general, Thailand has an open visa policy. The country has bilateral agreements with a number of countries, that award preferential treatment to nationals of these countries in terms of the number of days granted to stay in Thailand visa free. These agreements give nationals from five countries visa-free access to Thailand for 90 days, six others (including Hong Kong and Macao) have access for 30 days, and one (Cambodia) for 15 days. A tourist visa exemption scheme grants nationals from 49 countries 30 days of visa-free access as well as being allowed to enter Thailand through a land border with a neighbouring country if required, rather than through the country's airports. Nationals from 19 countries, including Mainland China, can get a visa on arrival, entitling a stay of up to 15 days, whereas only a few needs to apply for a visa before departing for Thailand.

As part of a policy to attract talent and technology from abroad, Thailand launched the SMART Visa programme which has five types of visa according to the levels of talent, skills and entrepreneurial start-up investment. SMART visa holders will be granted a maximum four-year permission to stay, exemption from the normal work permit requirements, and entitlement to additional privileges. The government has identified a number of targeted industries, including next-generation automotive, biofuels and biochemicals, and agriculture and biotechnology. An overseas applicant can expect to hear within 60 days whether he or she has been successful. A one stop service centre will endorse or extend an applicant’s SMART Visa during their stay in Thailand.

Sources: Government websites, Ministry of Foreign Affairs of Thailand, Thailand Board of Investment, Ministry of Labour, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Baa1 (Stable) |

21/04/2020 |

|

Standard & Poor's |

BBB+ (Stable) |

13/04/2020 |

|

Fitch Ratings |

BBB+ (Stable) |

17/03/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

26/190 |

27/190 |

21/190 |

|

Ease of Paying Taxes Index |

67/190 |

59/190 |

68/190 |

|

Logistics Performance Index |

32/160 |

N/A |

N/A |

|

Corruption Perception Index |

99/180 |

101/180 |

N/A |

|

IMD World Competitiveness |

30/63 |

25/63 |

N/A |

Sources: World Bank, IMD, Transparency International, national sources

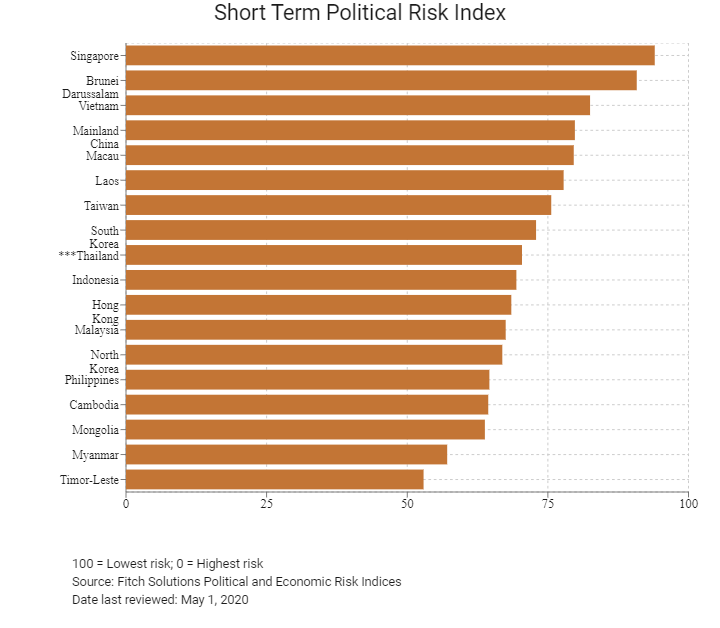

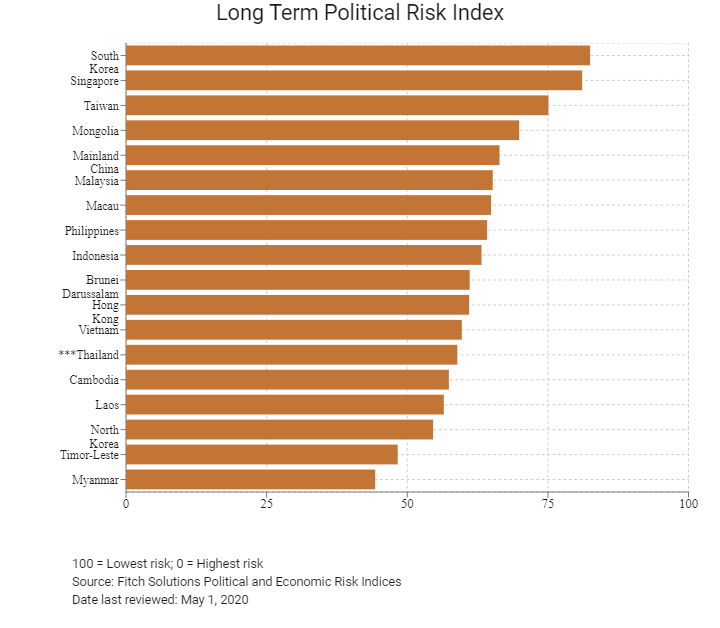

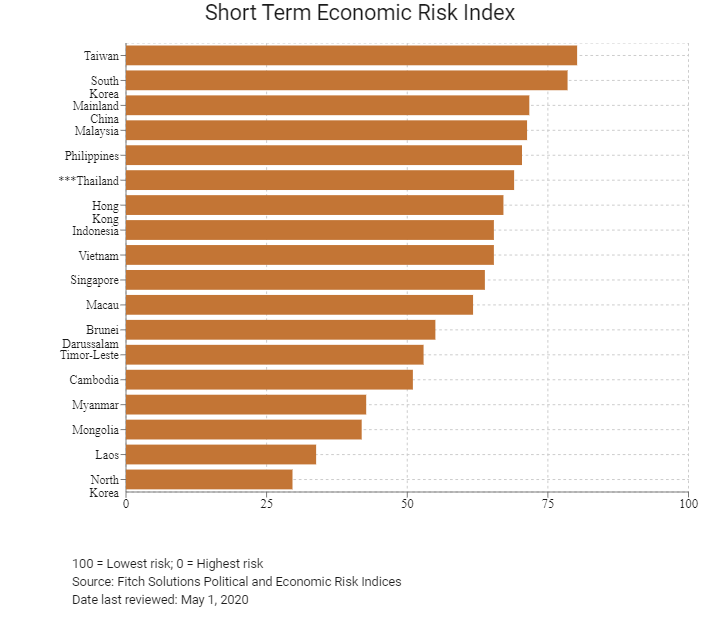

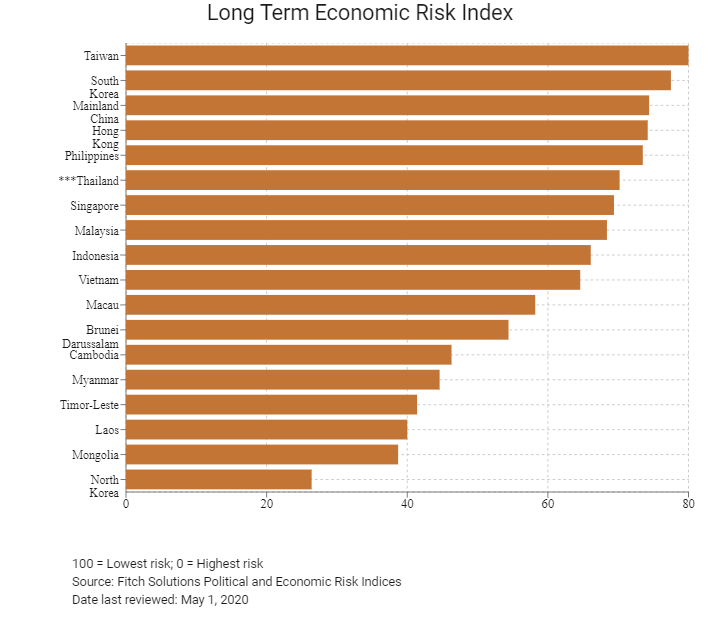

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

33/202 |

36/201 |

35/201 |

|

Short-Term Economic Risk Score |

72.3 |

64.8 |

69.0 |

|

Long-Term Economic Risk Score |

70.1 |

69.0 |

70.2 |

|

Political Risk Index Rank |

115/202 |

113/201 |

112/201 |

|

Short-Term Political Risk Score |

70.2 |

70.4 |

70.4 |

|

Long-Term Political Risk Score |

58.9 |

58.9 |

58.9 |

|

Operational Risk Index Rank |

58/201 |

56/201 |

56/201 |

|

Operational Risk Score |

58.9 |

60.4 |

60.7 |

Source: Fitch Solutions

Date last reviewed: May 1, 2020

Fitch Solutions Risk Summary

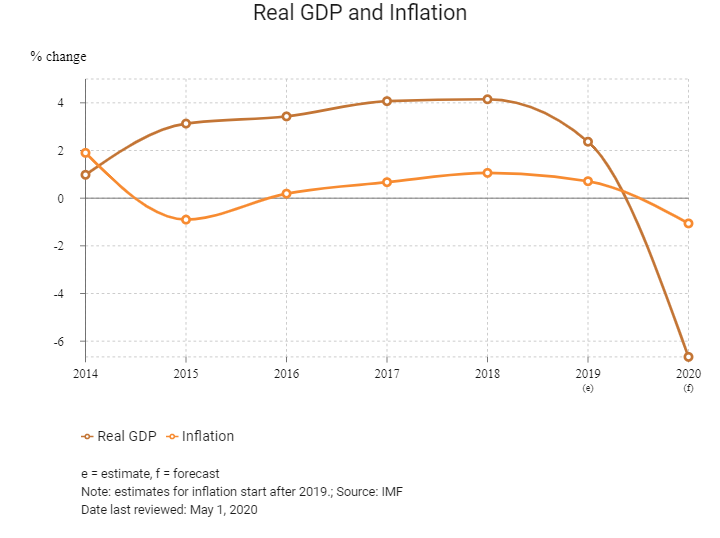

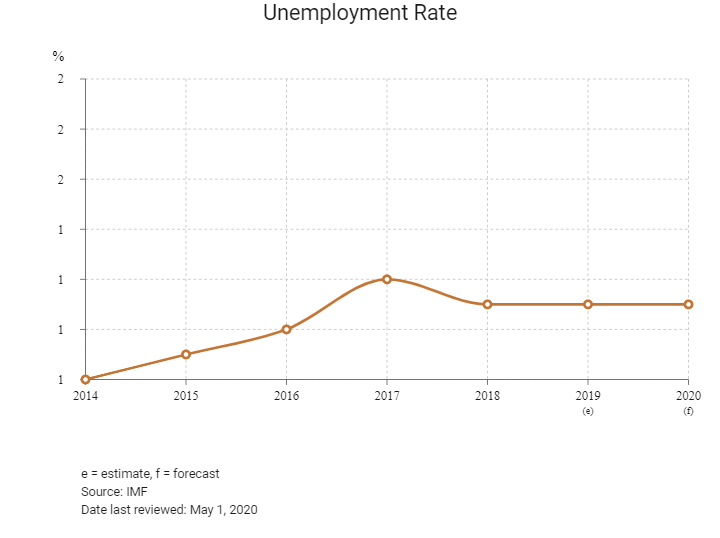

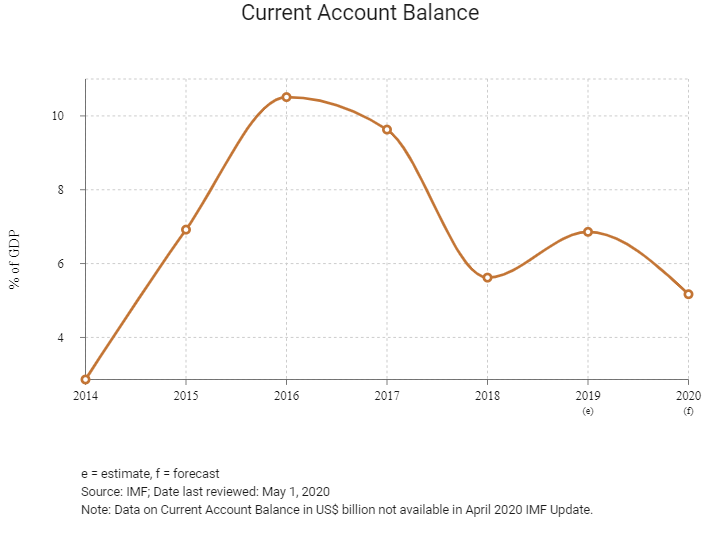

ECONOMIC RISK

Thailand relies on massive revenue from the export sector, accounting for around 70% of the country's GDP. The economy is expected to contract in 2020 due to the Covid-19 pandemic, which will weigh heavily on global trade, manufacturing and tourism. The government’s fiscal stimulus, coupled with monetary policy action, should cushion the downturn somewhat; however, it will be insufficient to prevent a contraction. On the internal front, high household debt further clouds the economic outlook.

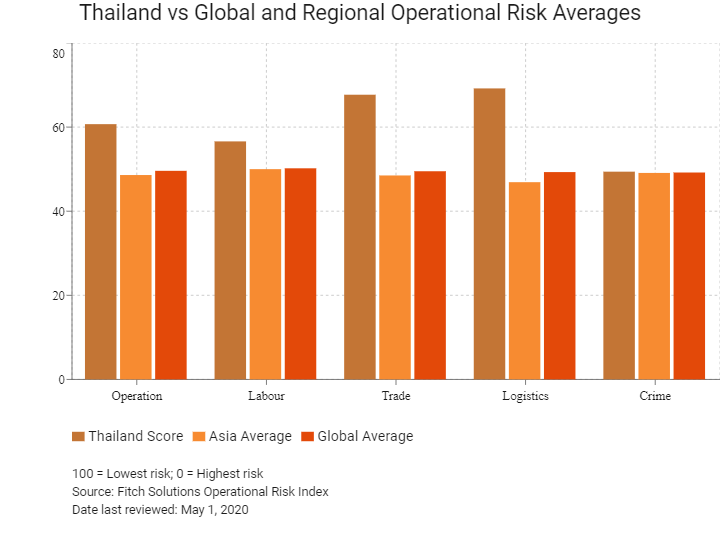

OPERATIONAL RISK

Thailand offers investors an operational environment with considerable advantages, which include a large, predominantly youthful workforce with basic literacy and numeracy skills, increasing levels of foreign economic participation and trade, and a developed logistics network. However, significant risks exist, such as conflict risks in the south of the country and high exposure to financial and organised crime.

Source: Fitch Solutions

Date last reviewed: April 26, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Thailand Score |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

East and Southeast Asia Average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia Position (out of 18) |

8 |

9 |

7 |

7 |

10 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

8 |

9 |

7 |

7 |

17 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

56 |

58 |

36 |

40 |

101 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest Risk; 0 = Highest Risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 1, 2020

Hong Kong’s Trade with Thailand

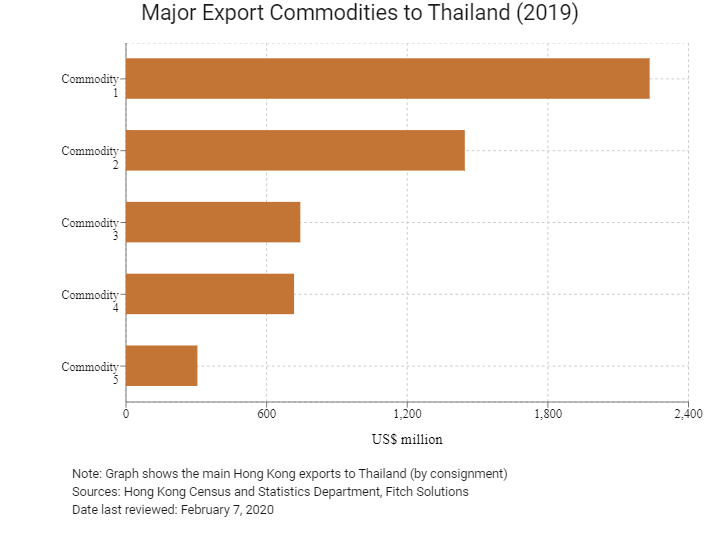

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 2,234.2 |

| Commodity 2 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 1,445.6 |

| Commodity 3 | Office machines and automatic data processing machines | 743.8 |

| Commodity 4 | Non-metallic mineral manufactures | 717.1 |

| Commodity 5 | Miscellaneous manufactured articles | 304.7 |

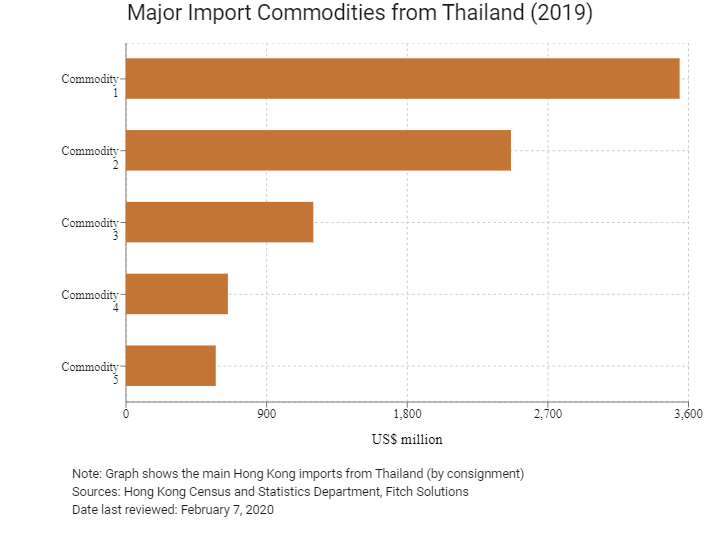

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 3,543.2 |

| Commodity 2 | Office machines and automatic data processing machines | 2,463.6 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 1,198.8 |

| Commodity 4 | Vegetables and fruit | 652.1 |

| Commodity 5 | Non-metallic mineral manufactures | 574.4 |

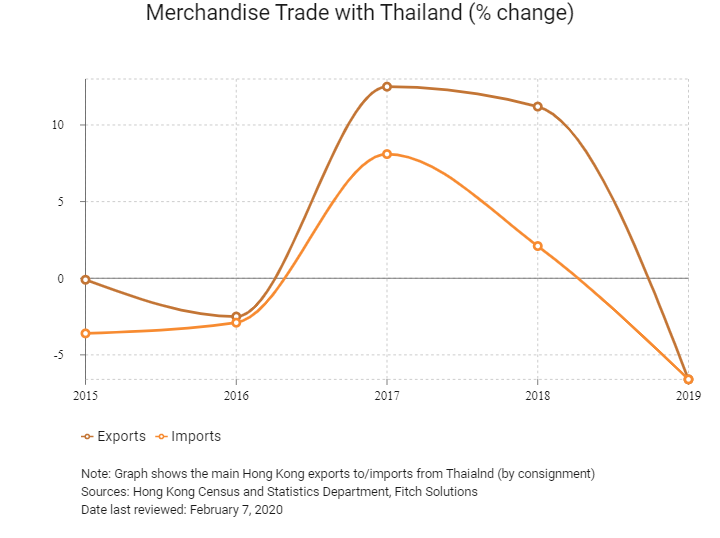

Exchange rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Thais residing in Hong Kong |

24,865 |

29.6 |

|

Number of East Asians and South Asians residing in Hong Kong |

2,834,871 |

3.4 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of Thai residents visiting Hong Kong |

467,048 |

-18.3 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Note: Growth rate is from 2015 to 2019, no UN data available for intermediate years

Source: United Nations Population Division – Department of Economic and Social Affairs

Date last reviewed: May 1 , 2020

Commercial Presence in Hong Kong

|

2017 |

Growth rate (%) |

|

|

Number of Thai companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Thailand

- Thailand has a BIT with Mainland China that came into force on December 13, 1985, and one with Hong Kong that came into force on April 18, 2006.

- Thailand has a DTA with Mainland China that came into force on December 29, 1986.

- Thailand has a comprehensive DTA with Hong Kong that came into force on December 7, 2005.

- Mainland China and ASEAN signed an investment agreement that came into force on January 1, 2010. Hong Kong and ASEAN signed an FTA and an investment agreement on November 12, 2017.

Sources: UNCTAD, Inland Revenue Department of Hong Kong, Hong Kong Trade and Industry Department

Chamber of Commerce or Related Organisations

Hong Kong-ASEAN Economic Cooperation Foundation (HKAECF)

The main activities of HKAECF are to contribute to the fostering, promoting and facilitating of economic cooperation between Hong Kong and the 10 member countries of ASEAN ('1+10'), and between the ASEAN region and Mainland China ('10+1') with Hong Kong serving as a high value-adding and facilitating key international hub, bridge, connector, promoter and investor.

Address: G.P.O. Box 12779, Hong Kong

Email: secretariat@hk-asean.com

Source: Hong Kong-ASEAN Economic Cooperation Foundation

Thai-Hong Kong Trade Association

Email: thai-hongkong@thta.or.th / bangkok.office@hktdc.org

Tel: (66) 2 343 9008

Website: www.thta.or.th

Please click to view more information.

Source: Federation of Hong Kong Associations Worldwide

Royal Thai Consulate-General, Hong Kong

Address: 8/F, Fairmont House, 8 Cotton Tree Drive, Central, Hong Kong

Email: sthai01@thai-consulate.org.hk

Tel: (852) 2521 6481 / 2521 6485

Fax: (852) 2521 8629

Source: Royal Thai Consulate-General, Hong Kong

Visa Requirements for Hong Kong Residents

HKSAR passport holders are permitted to stay for up to 30 days under the bilateral agreement with Thailand if entering via an international airport or through a land border checkpoint from a neighboring country. Since September 2018, Hong Kong residents have been able to use the automatic immigration service channnels when entering Thailand.

Source: Royal Thai Consulate-General, Hong Kong

Date last reviewed: May 1, 2020

Thailand

Thailand