GDP (US$ Billion)

786.52 (2018)

World Ranking 18/193

GDP Per Capita (US$)

23,539 (2018)

World Ranking 40/192

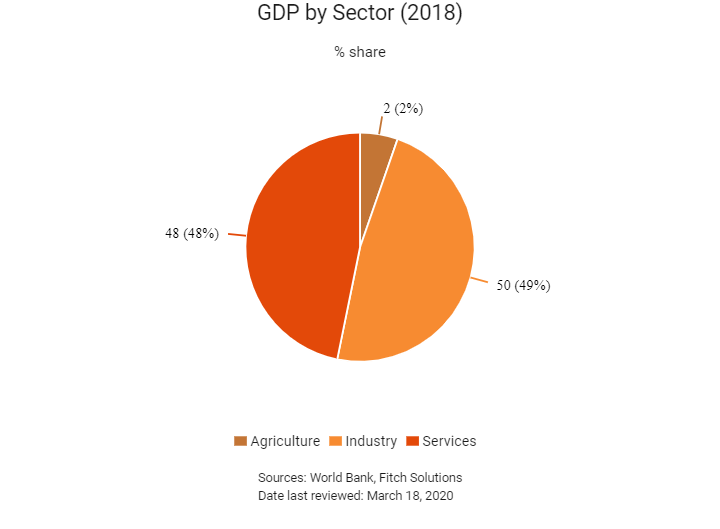

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

62.2 (2019)

Currency (Period Average)

Saudi Arabian Riyal

3.75per US$ (2019)

Political System

Monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Saudi Arabia is an oil-reliant economy with the largest proven crude oil reserves in the world. Ongoing structural reform efforts and an improving outlook for oil exports signal that Saudi Arabia's economic growth will continue to strengthen in the short-to-medium term. In order to shore up economic growth, the government is focussed on increasing economic diversification efforts and attracting foreign direct investment into other sectors. Public finances and growth remain vulnerable to volatility in global energy prices and oil production cuts, while turbulence in global financial markets could affect the cost of financing for both the sovereign and corporates, especially given the financing needed to implement Vision 2030 initiatives. On the upside, lower oil prices may increase the momentum for structural reforms under Vision 2030 and prompt the government to tackle difficult fiscal issues, such as spending on public sector compensation and benefits.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

January 2015

King Salman ascended to the throne after King Abdullah died.

April 2016

The Vision 2030 economic diversification plan was launched.

June 2017

King Salman named his son Mohammed bin Salman first in line to the throne.

September 2017

The ban on women driving formally lifted, it allowed women to drive in 2018.

January 2019

The Saudi Arabian government signed three contracts worth around USD14 billion for implementing major railway projects. The first deal, signed with Mainland China Civil Engineering Construction Corporation, was for the USD10.6 billion Land Bridge project, which was aimed at linking the Red Sea and the Gulf Cooperation Council (GCC) ports via the railways between Dammam and Riyadh. The USD3.6 billion second deal had been signed with a Saudi-Spanish consortium to build Phase Two of the Haramain high-speed train project. The USD267 million third deal had been signed by Saudi Railway Company and United States firm Green Bakery Corporation for the manufacturing of train wagons in the country.

January 2019

Saudi Arabia started construction on NEOM Bay in the first half of 2019. NEOM Bay, which was the first urban area of the USD500 billion NEOM project, included the construction of homes, lifestyle and tourist facilities, innovation centres as well as hotels. The master plan concept for NEOM Bay was approved by Saudi Crown Prince Mohammed, who was also the chairman of the NEOM board. The phase was expected to be completed in 2020.

July 2019

The Organisation of the Petroleum Exporting Countries (OPEC), of which Saudi Arabia was a member, agreed to continue curbing oil production for another nine months, to March 2020, in an effort to bolster the oil price.

July 2019

Saudi Arabia announced plans to list Saudi Aramco, the state oil company, in 2020 or 2021. Previous plans on the initial public offering of the USD2 trillion company were put on hold in 2018.

September 2019

Two major oil refineries were damaged in air attacks, claimed by the Yemeni Houthi movement. The attacks knocked out nearly half of Saudi Arabia’s oil output.

November 2019

On November 3, Saudi Aramco announced its intention to move ahead with its long-awaited IPO on the Saudi stock exchange. The sale looked set to generate large-scale funding for economic diversification projects in Saudi Arabia, helping to alleviate fiscal pressures.

January 2020

Saudi Aramco signed a USD1.85 billion contract with Samsung Engineering for its Hawiyah Unayzah Gas Reservoir Storage project in Hawiyah. The scheme included the construction of gas injection facility of 1.5 billion standard cubic feet per day and a gas reprocessing facility of 2 billion standard cubic feet per day. Under the deal, Samsung would be responsible for the engineering, procurement and construction of the project, which was expected to be completed in 2023.

March 2020

Saudi Arabia and Russia, the world's two largest oil exporters, failed to agree on production cuts to increase global oil prices. As a result, Saudi Arabia drastically decreased the price of its oil, causing the global oil price to drop by about 30%.

Covid-19 lockdowns across various countries resulted in the demand for oil decreasing by about one-third.

Saudi Arabia earmarked a USD32 billion economic stimulus package to mitigate the effects of the Covid-19 pandemic and lower oil prices in the kingdom.

April 2020

Leading oil producers agreed to cut production by approximately 10 million barrels per day, with milder production decreases set to extend into 2021.

Sources: BBC Country Profile – Timeline, Saudi Press Agency, The New York Times, Fitch Solutions

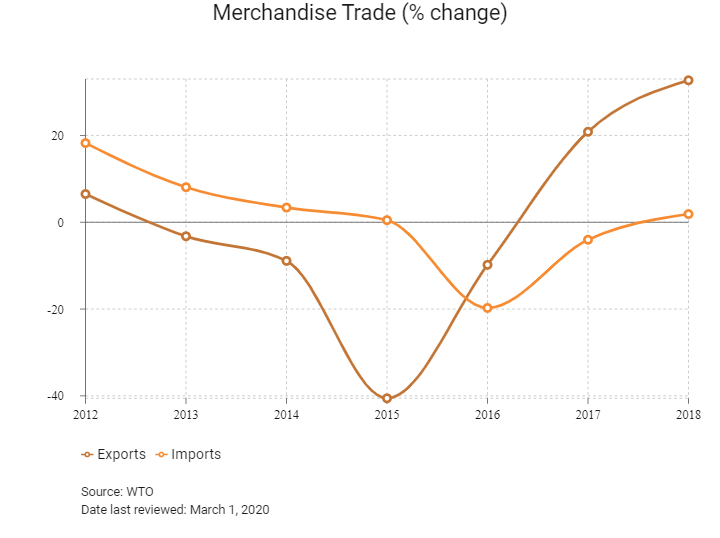

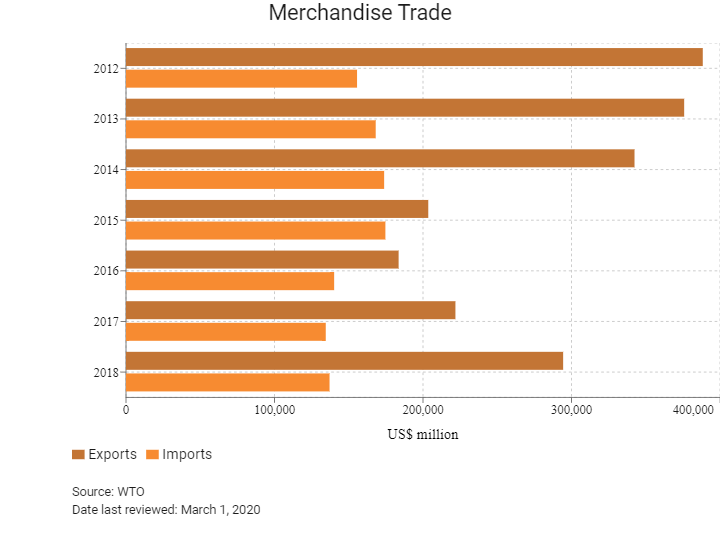

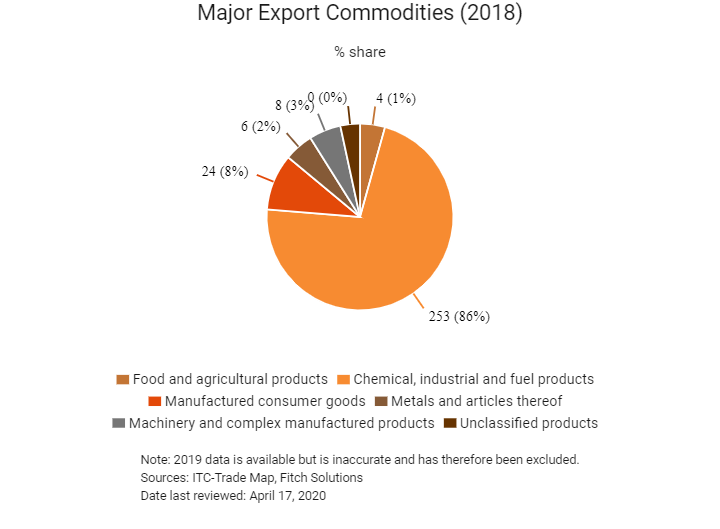

Merchandise Trade

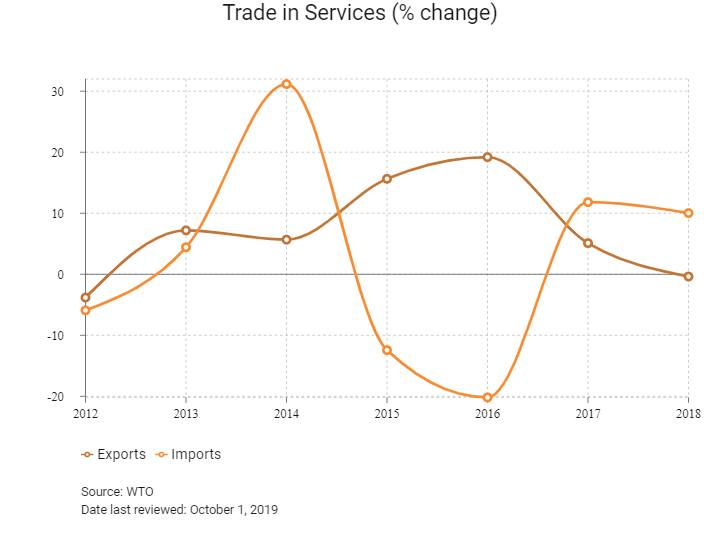

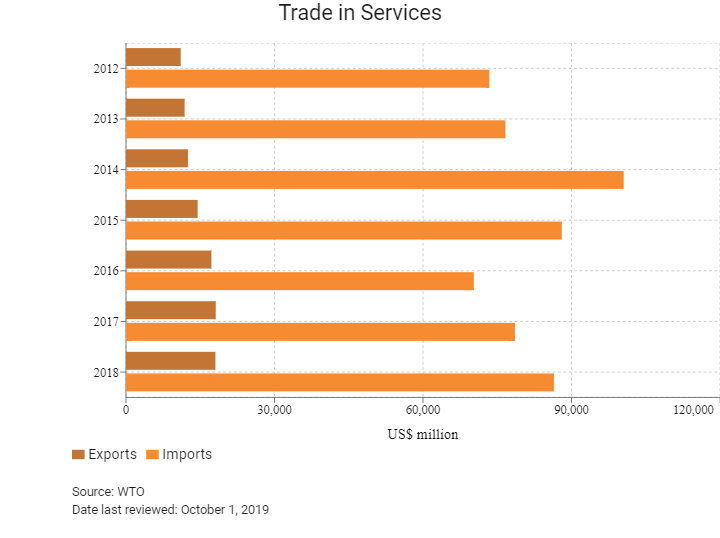

Trade in Services

- Saudi Arabia has been a member of the World Trade Organization (WTO) since December 11, 2005.

- The country's GCC membership means that it is part of a single market and customs union with a common external tariff. A tariff of only 5% is imposed on the majority of items imported to Saudi Arabia from non-GCC countries, and there is a single point of entry where tariffs are collected once imports enter the GCC.

- Overall, the average applied import tariff for goods entering Saudi Arabia is 3.4%. This is the second highest out of all six GCC states – tied with Qatar and just behind the UAE, which has an average applied tariff rate of 3.2%. On average Saudi Arabia has some of the highest import tariffs in the Middle East and North Africa region, and there are significant non-tariff barriers to trade in the country. Times and associated costs for border and documentary procedures in Saudi Arabia (especially imports) are some of the longest and highest in the GCC, reducing the country's competitiveness as a trading destination when compared with its regional peers.

- The Saudi Arabian government grants various subsidies and export incentives to a variety of industries, which reduces the competition of imports.

- For cultural and religious reasons, an import tariff of 200% is levied on cigarettes and tobacco products (GCC tariff).

- A VAT of 5% was introduced in January 2018.

- Saudi Arabia has a domestic metal manufacturing industry which is protected by tariff measures.

- For cultural and religious reasons, all imports of alcoholic beverages are banned.

- Various import bans exist on sensitive goods such as high energy air-conditioners, cars older than five years, and equipment used in water desalination processes.

- In order to import a wide variety of consumer goods (such as basic foodstuffs and packaged pharmaceutical products) to Saudi Arabia, special approval is required from the relevant government authority.

Sources: WTO – Trade Policy Review, Government websites, Fitch Solutions

Trade Updates

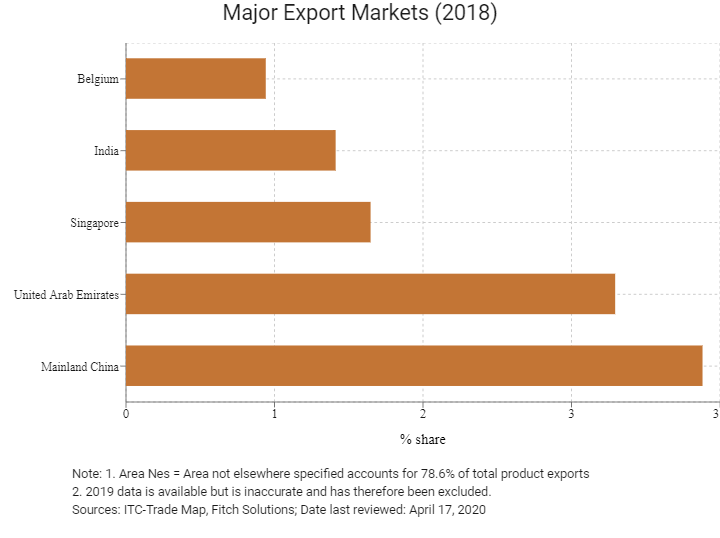

As Saudi Arabia's ties with the West cool, the kingdom is starting to pivot towards the East as part of its 'Vision 2030' plan. In February 2019, the crown prince commenced an Asian tour with the aim of strengthening economic, political and cultural ties.

Multinational Trade Agreements

Active

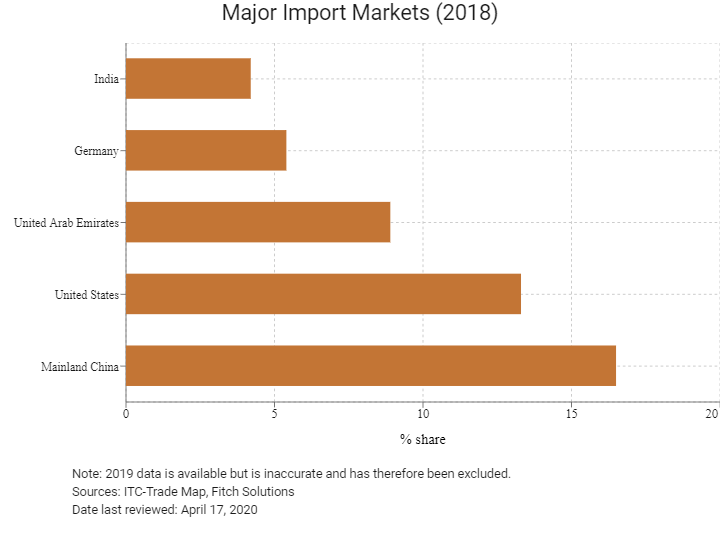

- The GCC: Saudi Arabia is a founding member of the GCC – a political and economic organisation established on May 25, 1981. In January 2015, the GCC implemented a customs union and free trade agreement (FTA) that allows for the free movement of local goods among member states. Saudi Arabia's trade with these countries is tariff free. Other members of the GCC are Bahrain, Oman, Qatar and the UAE. This agreement helps member states to leverage one another's industrial capacity and logistics networks. The geographic proximity of these countries and their general adoption of free trade economic policies foster a competitive business environment. Only imports on certain sensitive goods from GCC countries face tariffs, and there is freedom of movement between GCC countries without customs or non-customs restrictions. In 2018, the GCC was the source market of 11.7% of Saudi Arabia's imports and the destination for 4.5% of Saudi Arabia's exports. Saudi Arabia negotiates FTAs through its GCC membership.

- Greater Arab Free Trade Area (GAFTA): GAFTA came into force on January 1, 1998. In March 2001, it was decided to speed up the liberalisation process, and on January 1, 2005 the elimination of most tariffs among GAFTA members was enforced. The 17 members of GAFTA are Algeria, Bahrain, Egypt, Iraq, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, UAE and Yemen. GAFTA was declared within the Social and Economic Council of the Arab League as an executive programme to activate the Trade Facilitation and Development Agreement, and the elimination of most tariffs among GAFTA members. GAFTA saw tariffs between 17 Arab states rapidly decline from an average of 15% in 2002 to 6% in 2009. Trade liberalisation has been of great benefit to all member states and has aimed to reduce the cost of imports to Saudi Arabia; however, regional instability and domestic security concerns have diminished the effect of this agreement and have created trade barriers.

- GCC-European Free Trade Association (EFTA) (Iceland, Liechtenstein, Norway and Switzerland): The GCC and the EFTA signed an FTA on June 22, 2009 which entered into force on July 1, 2014. The agreement covers the progressive elimination of tariffs in trade in services and manufactured goods as well as investment, and other trade-related issues, such as the protection of intellectual property, and is fully consistent with provisions of the WTO. In addition, bilateral arrangements on agricultural products between individual EFTA states and the GCC form part of the instruments establishing the free trade area between both sides. As a single entity, the EFTA is one of Saudi Arabia's largest import partners. Between 2014 and 2017, total trade between the GCC and EFTA grew by 22%.

- GCC-Singapore FTA (GSFTA): The GSFTA became effective on September 1, 2013. The GSFTA eliminates most tariffs (99%) of Singapore's exports to the GCC. This is a comprehensive agreement covering trade in goods, rules of origin, customs procedures, trade in services and government procurement among others. Key sectors benefitting from the agreement include telecommunication, electrical and electronic equipment, petrochemicals, jewellery, machinery and iron and steel-related industry. The recognition of the halal certification of Singapore's Majlis Ugama Islam Singapura will also pave the way for trade in halal-certified products to gain faster access to GCC countries, such as Saudi Arabia.

Signed But Not Yet In Effect

The Trade Preferential System of the Organization of the Islamic Conference (TPS-OIC): The agreement would see to the promotion of trade between member states by including most favoured nation principles, harmonising policy on rules of origin, exchanging trade preferences among member states, promoting equal treatment of member states and special treatment for least developed member states and providing for regional economic bodies made up of OIC nations to participate as a bloc. The agreement will cover all commodity groups. The OIC comprises 57 members, making the full realisation of such an agreement highly impactful, encompassing approximately 1.8 billion people. Although the framework agreement, the protocol on preferential tariff scheme and the rules of origin have been agreed on, a minimum of 10 members are required to update and submit their concessions list for the agreement to come into effect. As of July 2019, only seven nations had done so.

Under Negotiation

- GCC-Australia FTA: Australia and the GCC commenced FTA negotiations in July 2007. Australia and the GCC share a significant economic relationship, encompassing trade and investment across a broad range of goods and services. Total trade between Australia and the GCC reached USD8.4 billion in 2017. The GCC is a key market for agricultural exports, such as livestock, meat, dairy products, vegetables, sugar, wheat and other grains. The agreement provides an opportunity to address a range of tariff and non-tariff barriers related to food exports that will benefit the food and drink sectors in Saudi Arabia. With a large proportion of world petroleum resources and a rapidly growing population, the GCC's prospects for continued trade growth are strong. The agreement will also help maintain a level playing field for automotive imports to the GCC market. These factors, along with a plurilateral FTA, will help sustain growth in Saudi Arabia's trade and investment relations with the country.

- GCC-Mainland China FTA: The first-round negotiations of the GCC-Mainland China FTA commenced on April 27, 2005. Greater trade liberalisation will help develop the industrial and service sectors. Saudi Arabia mainly exports commodities, such as oil, to Mainland China, and imports electrical goods and machinery from Mainland China. Trade liberalisation with the GCC will help the group integrate and grow with mutual cooperation and comprehensive tariff reduction. In 2017, Mainland China accounted for 12% of the GCC's total global trade.

- United States-Middle East Free Trade Area (US-MEFTA): In May 2003, the US-MEFTA initiative was proposed, with the eventual goal of establishing an FTA between the United States and a range of countries in the Middle East. The countries targeted to join the MEFTA are Algeria, Bahrain, Egypt, Iran, Iraq, Israel (and through Israel, the Palestinian Authority), Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia and Yemen. US-MEFTA includes a wide range of trade and investment issues, such as market access, intellectual property rights and labour and environmental issues. The initiative will help in growing commercial and investment opportunities by identifying and working to remove impediments to trade and investment flows between member states. This expands the scope of markets for businesses in Saudi Arabia to export products to and will significantly reduce trade costs. In July 2003, the United States and Saudi Arabia signed into force the Trade and Investment Framework Agreement, with the aim of regulating all commercial matters between member states.

- India-GCC FTA: The agreement is expected to remove restrictive duties, push down tariffs on goods and pave the way for more intensive economic engagement between the nations. More than 50% of India's oil and gas comes from the GCC countries.

- Japan-GCC FTA: This agreement will seek to reduce tariffs and liberalise services trade and investment. Japan mainly imports aluminium, natural gas, liquid natural gas and petroleum products from the GCC, while Japan mainly exports electronics, vehicles, machinery and other industrial products to the GCC.

- Other: A number of other GCC FTAs are currently under negotiation. The countries engaged in negotiations include Pakistan, New Zealand, South Korea, the MERCOSUR bloc and Turkey.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

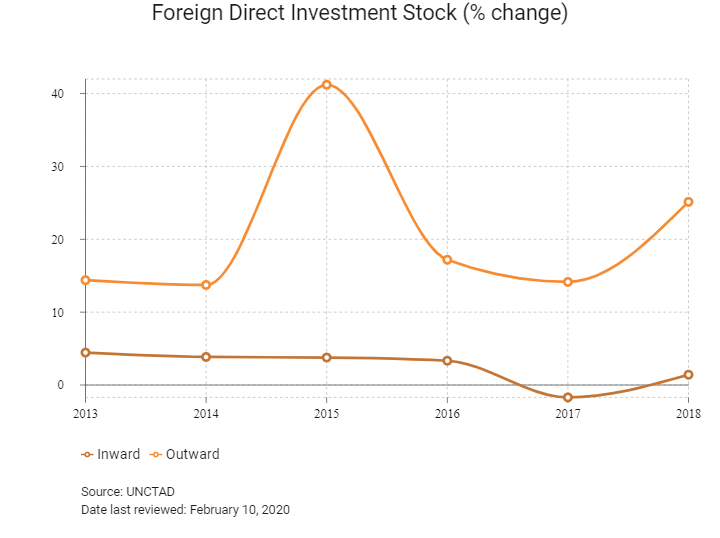

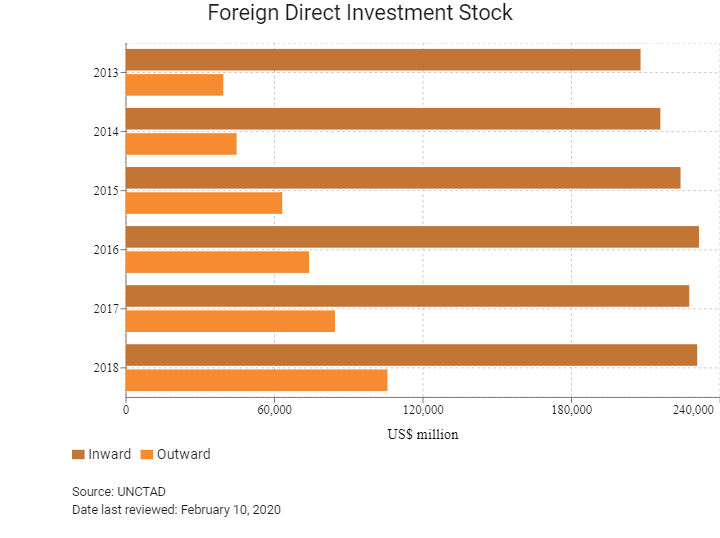

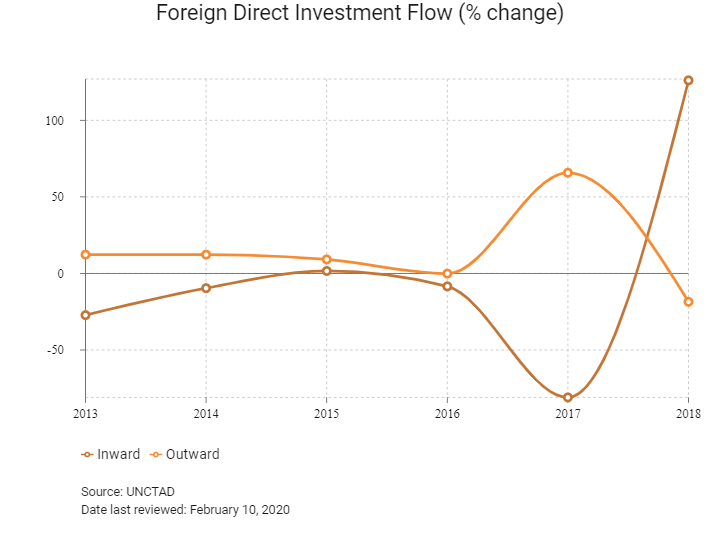

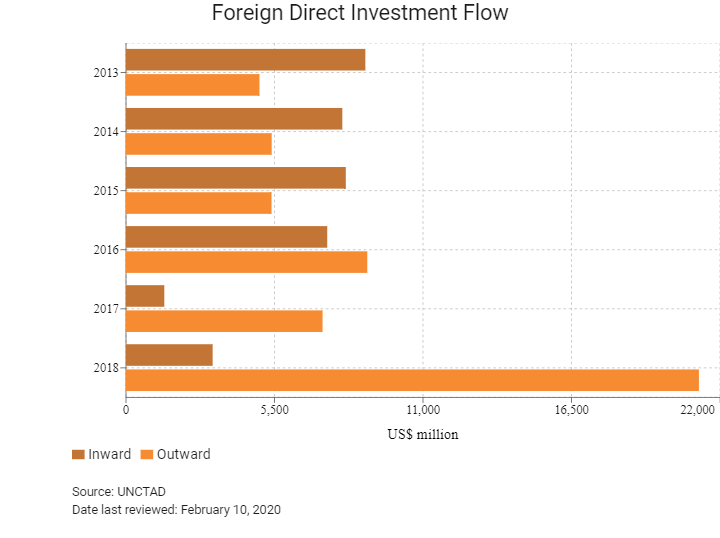

Foreign Direct Investment

Foreign Direct Investment Policy

- The Saudi Arabian General Investment Authority (SAGIA), established in April 2000, is responsible for foreign direct investment (FDI) promotion, licensing and regulation, as well as offering support services to foreign investors. The agency provides information, licences and support services to foreign investors, which has greatly improved the framework for incoming businesses. SAGIA's primary goal is to facilitate and encourage investment wherever possible. FDI is particularly encouraged in key infrastructure sectors such as utilities, transport and real estate, as well as for high value-add businesses and knowledge-based industries, including education, health and life sciences. Foreign investors are eligible for a number of incentives through SAGIA, including heavily subsidised utility costs, reduced rent for industrial land and customs duty exemptions on imported raw materials (for five years) and machinery (for three years).

- Businesses face relatively higher trade and investment risks in Saudi Arabia compared with regional peers. Despite the kingdom having some of the largest trade turnover and inward FDI stock volumes in the region, Saudi Arabia remains fairly closed off to international trade and foreign investment by virtue of its undiversified economy and export partner portfolio. The global slump in crude prices has highlighted the necessity of diversifying the economy and opening it up further to private and foreign investment. In this regard, there have been several positive developments, specifically with the release of the 'Vision 2030' economic diversification plan, the opening up of Saudi stock exchanges to foreign portfolio investment and the allowance of 100% foreign ownership in certain sectors. Nevertheless, while these developments are positive, it will take time for the impact of these policies to filter through to diversifying Saudi Arabian export revenues away from crude oil and opening the country up even further to foreign investment.

- Related laws and regulations on foreign investment are well established; however, some restrictions remain for FDI, such as limits on foreign ownership and business activity in core sectors of the Saudi Arabian economy, including upstream oil and gas production.

- In January 2018, the Saudi government took further steps to open up its stock market to foreign investors. This has been done by allowing foreign (whether resident or non-resident) holdings of an entity's securities listed on Saudi stock exchanges to amount to 49%. The ceiling of the total percentage of shares that a single qualified foreign investor can own of a listed entity has been increased to 10% (it was previously set at 5%). The authorities have also lowered the minimum assets under management that an investor must have to be recognised as a 'qualified foreign investor' from around USD1 billion to around USD500 million. These amendments formally came into effect on January 1, 2018.

- There are a number of subsidised or soft loans available to foreign investors, primarily through the Saudi Industrial Development Fund (SIDF) which provides medium-to-long term funding for new projects or the expansion of existing facilities. Low-cost credit is allocated on a geographic basis, with businesses located in less developed regions benefitting from more generous financing options. Accordingly, loans covering either 50%, 60% or 75% of project costs are available on a time frame of either 15 or 20 years. Facilities based in the underdeveloped regions of Hail, Jazan, Najran, Al Baha, Al Jouf and the Northern Borders enjoy additional benefits, including a tax reduction of 50% of annual expenses for employing and training Saudi workers, a further tax reduction of 50% on gross salaries of Saudi employees and tax exemption up to 15% of the value of the non-Saudi's share of capital.

- Non-residents are permitted to own property without a Saudi partner or sponsor. There are also fewer barriers to foreigners owning land in the kingdom than in some other GCC states.

- Saudi investment law allows 100% ownership of projects by foreigners (except for activities ruled out by the negative list) and relaxes rules for sponsoring foreign employees.

- Industries barred from foreign involvement are published in the country's negative investment list. This includes upstream oil production, manufacturing of military hardware, real estate in Mecca and Medina, recruitment and employment services, some printing and publishing activities, media services and land transportation. In addition, special licensing requirements are in place for a wider range of industries, including pharmaceuticals, air and maritime transport, hydrocarbon exploration, ports, livestock farming and advertising and media.

- Local worker hiring requirements are in place. Government efforts to encourage the employment of Saudi nationals over expatriates have been enshrined in a clear plan known as Nitaqat, by which every company is divided into a sector with a different quota for the employment of Saudi workers, depending on the size of the firm. Businesses that meet the criteria are classed as platinum or green, those that fail are classed as yellow or red. Expatriate employees may move freely from the latter categories to the former (employers' permission is usually required), while companies under the former categories gain advantages in terms of employing expatriate workers.

- Though the law no longer requires that non-resident companies must find local partners, this method remains the most effective way of doing business in Saudi Arabia as domestic entities will have a greater knowledge and experience of dealing with licensing, procurement and other bureaucratic procedures.

- Saudi Arabia began offering tourist visas for citizens of 49 countries in September 2019.

- The government of Saudi Arabia is aiming to rival the UAE and Qatar by incentivising foreign investment through its special economic zones. Through the Economic Cities (ECs) initiative in Rabigh, Hail, Madinah and Jazan regions, the government aims to develop vibrant urban areas with a business-friendly environment. This would leverage the country's competitive advantages, namely low-cost energy and strategic locations. EC projects are not only large industrial zones, but are also cities that will nurture new businesses and residential communities in areas that have had limited investment to date. They are expected to translate into employment growth in the cities; as a result, the ECs are expected to see positive growth in population, resulting in higher demand for real estate in the ECs.

- The government of Saudi Arabia is aiming to rival the UAE and Qatar by incentivising foreign investment through its special economic zones. Through the ECs initiative in Rabigh, Hail, Medina and Jazan regions, the government aims to develop vibrant urban areas with a business-friendly environment. This would leverage the country's competitive advantages, namely low-cost energy and strategic locations. EC projects are not only large industrial zones, but also cities that will nurture new businesses and residential communities in areas that have had limited investment to date. They are expected to translate into employment growth in the cities; as a result, the ECs are expected to see positive growth in population, resulting in higher demand for real estate in the ECs.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Prince Abdulaziz Bin Mousaed Economic City in Hail, Knowledge Economic City in Madinah, King Abdullah Economic City in Rabigh, and the Jazan Economic City |

- No restrictions on sponsoring foreign employees |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 5%

- Corporate Income Tax: 20%

Sources: Saudi Arabia Ministry of Finance , General Authority of Zakat and Tax (GAZT), Fitch Solutions

Important Updates to Taxation Information

- Saudi Arabia has double taxation agreements (DTA) and Investment Promotion and Protection Agreement (IPPA) with Mainland China. The DTA with Hong Kong entered into force on September 1, 2018.

- VAT is expected to become one of the major sources of non-oil revenue in Saudi Arabia, according to the 2019 budget statement. Enterprises with taxable or expected sales of SAR1 million or more were required to register before December 20, 2017 and transfer VAT collected to the General Authority for Zakat and Tax. Enterprises with annual sales of SAR375,000 or more were required to register before December 20, 2018.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate income tax (CIT) |

-20% on a non-Saudi’s share in a resident corporation; |

|

CIT in the natural gas sector |

-30% |

|

Corporate income tax in the oil sector |

-50-85% |

|

Dividends |

-5% on net earnings (except for firms in the oil and gas sector) |

|

Capital gains tax |

-Treated as taxable income; gains on depreciable assets and on certain securities are exempt |

|

Withholding tax |

-Resident: N/A |

|

Value added tax |

-5% |

|

Zakat (religious levy, imposed on the shareholders in Saudi Arabian companies that are Saudi or GCC nationals) |

-2.5% on Zakat base |

|

Social security contributions – payable by employer |

-12% of employee's salary for Saudi employees and an accident insurance of 2% of employee's salary for non-Saudi employees |

Sources: Saudi Arabia Ministry of Finance , GAZT, Fitch Solutions

Date last reviewed: April 17, 2020

Localisation Requirements

The Saudi Arabian government has launched a local workforce hiring localisation policy called 'Saudisation', which is intended to boost the employment of Saudi nationals and reduce reliance on foreign labour. Foreign firms are, therefore, required to employ and train Saudi nationals. In line with Saudi Arabia's economic diversification strategy 'Vision 2030', the Saudi Arabian government has ramped up the enforcement of its 'Saudisation' policies in order to try and achieve its aim of 50% of all employment in the country's private sector to be occupied by Saudi Nationals. Employers must consider Saudi nationals for any positions before they hire a foreign worker. Before a company can apply for a work permit for a foreign national it wants to employ, it must advertise the job opening for two weeks on a government jobs portal.

Certain positions are reserved strictly for Saudi nationals and businesses must pay certain charges for every foreign national they hire. There are also specific 'Saudisation' targets set for specific firms or sectors, and if these are not complied with there is strong potential for businesses not to get the work permits of their foreign workers renewed or to be denied work permits for new foreign employees.

Obtaining Foreign Worker Permits for Skilled Workers

Applicants must have an offer of employment by an employer willing to sponsor their application and from there the applicant must provide proof of education qualifications and various medical records. Due to the Saudi Arabian government's drive to promote local employment these are becoming increasingly difficult to obtain, especially as the government is becoming stricter with the implementation of its policies. This could have negative repercussions for future foreign worker permit applications or renewals.

Visa/Travel Restrictions

All citizens of non-GCC states must apply for a visa before entering the country. However, in January 2020, the Saudi Commission for Tourism & National Heritage (SCTH) announced that visitors with United Kingdom, United States and Schengen-area country visas will be able to obtain a Saudi Arabia visitor visa at airport arrival halls, regardless of their citizenship. The only requirement is that the visitor must have previously used the visa to travel to any one of these countries before entering Saudi Arabia. In September 2019, Saudi Arabia also announced that it would begin offering visas for the first time to non-religious tourists from 49 countries. Holders of Israeli passports or holders of passports with an Israeli stamp are likely to be denied entry.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A1 (Negative) |

05/01/2020 |

|

Standard & Poor's |

A- (Stable) |

17/02/2016 |

|

Fitch Ratings |

A (Stable) |

04/09/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

92/190 |

92/190 |

62/190 |

|

Ease of Paying Taxes Index |

76/190 |

78/190 |

57/190 |

|

Logistics Performance Index |

55/160 |

N/A |

N/A |

|

Corruption Perception Index |

58/180 |

51/180 |

N/A |

|

IMD World Competitiveness |

39/63 |

26/63 |

N/A |

Sources: World Bank, IMD, Transparency International

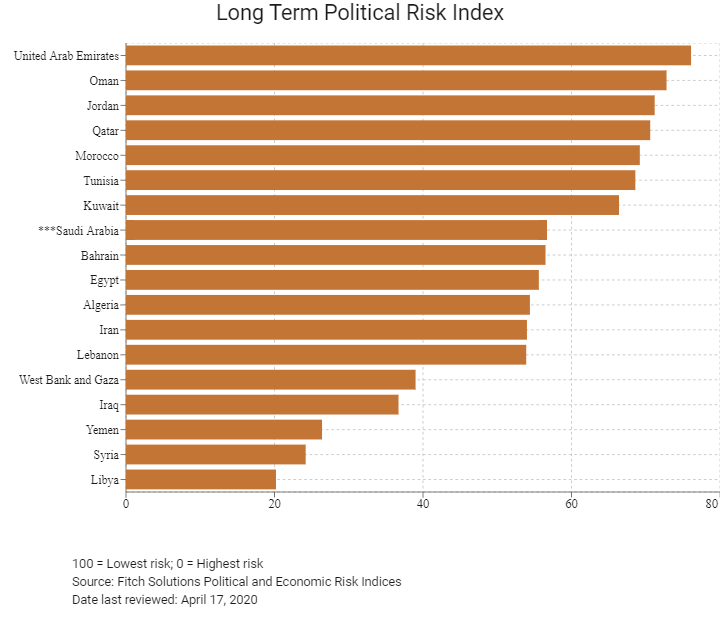

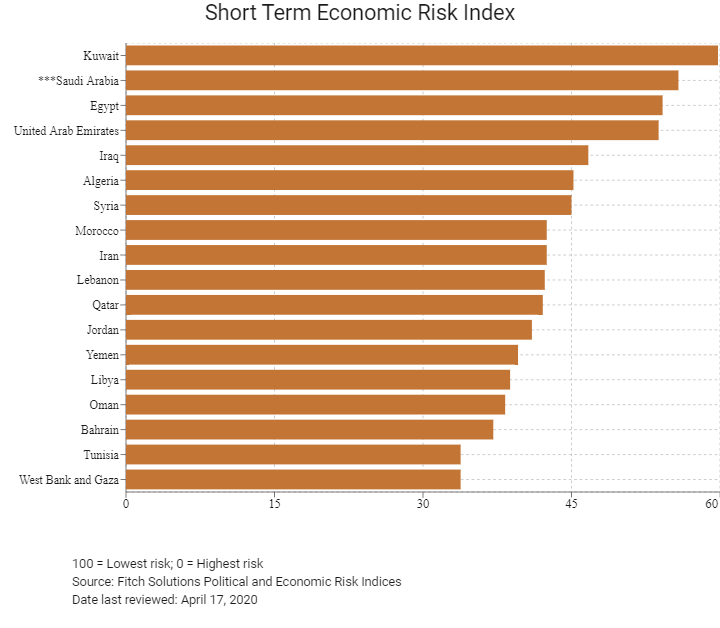

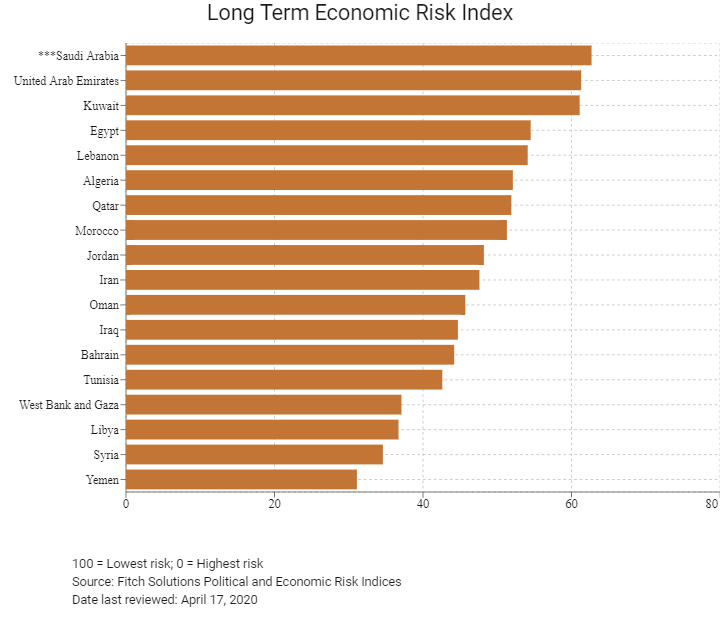

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

40/202 |

49/201 |

56/201 |

|

Short-Term Economic Risk Score |

67.5 |

63.8 |

55.8 |

|

Long-Term Economic Risk Score |

67.1 |

65.5 |

62.7 |

|

Economic Risk Index |

117/202 |

125/201 |

124/201 |

|

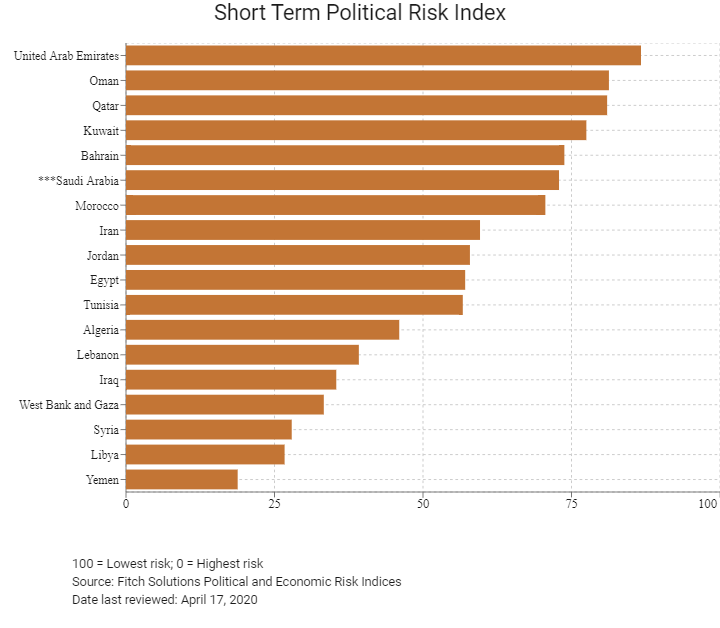

Short-Term Political Risk Score |

72.5 |

72.9 |

72.9 |

|

Long-Term Political Risk Score |

58.7 |

56.7 |

56.7 |

|

Operational Risk Index |

52/201 |

51/201 |

47/201 |

|

Operational Risk Score |

61.5 |

62.3 |

63.6 |

Source: Fitch Solutions

Date last reviewed: April 17, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Saudi Arabia's economic fortunes are heavily tied to global oil and gas prices, such that lower for longer oil prices pose significant economy-wide risks. The Covid-19 outbreak and resultant negative effects on oil demand and prices may have a negative impact on the government's financial commitment towards infrastructure and social services. Moreover, although growth in non-oil activities should remain in positive territory, a more restrictive budget will likely slow dynamics in some sectors, while volatile oil prices represent a key downside risk. That said, the Vision 2030 plan is expected to provide much-needed economic diversification and long-term benefits for private sector growth and FDI levels in the decades ahead.

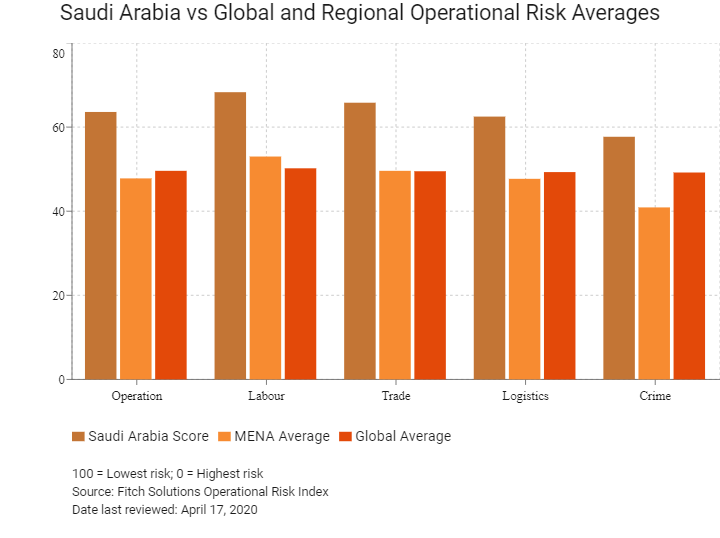

OPERATIONAL RISK

Saudi Arabia remains one of the top regional performers in terms of its operating environment. This competitiveness is largely associated with the kingdom's larger trade volumes and inward FDI flows compared to its peers, its well-developed taxation and financial systems, and its superior logistics network to those of many other Middle Eastern states. The construction of numerous railway networks will diversify internal transport options and further facilitate trade flows in the long run. The kingdom's considerable oil and gas wealth ensures low electricity and fuel costs, and a high degree of availability for both utilities, benefiting business in terms of lower operating costs and reliability. As the main OPEC producer, Saudi Arabia is in a strong position within the cartel. Even though Saudi Arabia is on the path of diversification to stimulate foreign investment and economic activity in non-crude sectors through its Vision 2030 plan, it will take some years before these measures have a significant impact. King Salman and his influential son Mohammed have shown greater willingness to grapple with economic reforms, restructuring the country's economy, administrative apparatus and pushing through fiscal consolidation measures.

Source: Fitch Solutions

Date last reviewed: April 17, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Saudi Arabia Score |

63.6 |

68.3 |

65.8 |

62.5 |

57.7 |

|

MENA Average |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

MENA Position (out of 18) |

5 |

2 |

3 |

5 |

4 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

47 |

15 |

44 |

57 |

69 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

UAE |

71.6 |

70.6 |

77.5 |

68.0 |

70.5 |

|

Bahrain |

66.5 |

65.5 |

75.4 |

71.6 |

53.6 |

|

Qatar |

66.0 |

66.7 |

62.3 |

73.7 |

61.2 |

|

Oman |

64.9 |

62.7 |

63.4 |

64.2 |

69.2 |

|

Saudi Arabia |

63.6 |

68.3 |

65.8 |

62.5 |

57.7 |

|

Jordan |

57.1 |

58.4 |

62.9 |

54.8 |

52.3 |

|

Kuwait |

55.5 |

58.7 |

56.2 |

50.8 |

56.2 |

|

Morocco |

54.6 |

45.0 |

65.3 |

54.9 |

53.2 |

|

Egypt |

49.4 |

50.7 |

48.8 |

55.2 |

42.9 |

|

Tunisia |

47.1 |

41.0 |

58.5 |

46.7 |

42.3 |

|

Lebanon |

43.6 |

54.0 |

49.8 |

40.9 |

29.7 |

|

Iran |

43.1 |

48.7 |

36.4 |

52.8 |

34.4 |

|

Algeria |

39.6 |

48.6 |

32.7 |

41.0 |

36.2 |

|

West Bank and Gaza |

31.6 |

48.3 |

34.1 |

27.1 |

17.0 |

|

Libya |

29.3 |

43.4 |

29.9 |

26.6 |

17.1 |

|

Syria |

28.6 |

42.6 |

29.2 |

27.6 |

15.0 |

|

Iraq |

26.7 |

43.5 |

24.1 |

26.9 |

12.4 |

|

Yemen |

21.8 |

37.8 |

19.6 |

13.9 |

16.1 |

|

Regional Averages |

47.8 |

53.0 |

49.6 |

47.7 |

40.9 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 17, 2020

Hong Kong’s Trade with Saudi Arabia

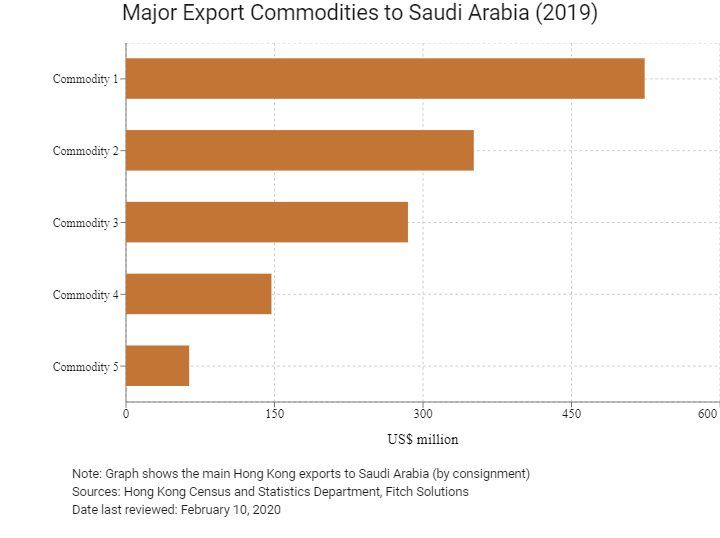

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 523.9 |

| Commodity 2 | Power generating machinery and equipment | 351.3 |

| Commodity 3 | Miscellaneous manufactured articles | 284.8 |

| Commodity 4 | Office machines and automatic data processing machines | 146.9 |

| Commodity 5 | Articles of apparel and clothing accessories | 63.8 |

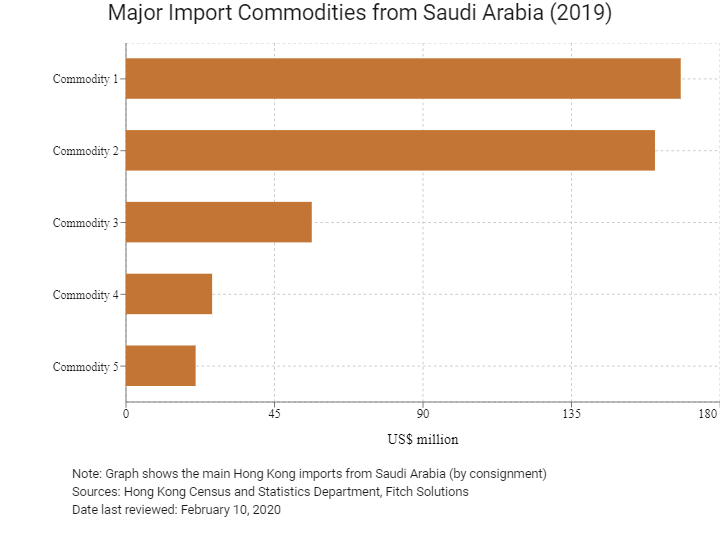

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Power generating machinery and equipment | 168.1 |

| Commodity 2 | Plastics in primary forms | 160.3 |

| Commodity 3 | Miscellaneous manufactured articles | 56.3 |

| Commodity 4 | Telecommunications and sound recording and reproducing apparatus and equipment | 26.1 |

| Commodity 5 | Organic chemicals | 21.1 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Saudi residents visiting Hong Kong |

8,881 |

-21.1 |

|

Number of Middle East residents visiting Hong Kong |

131,849 |

-12.8 |

Source: Hong Kong Tourism Board

Date last reviewed: April 15, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Saudi Arabian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong and Saudi Arabia

Saudi Arabia and Mainland China entered into a bilateral investment treaty in May 1997. Saudi Arabia has DTA and an investment promotion and protection agreement with Mainland China, and concluded the DTA with Hong Kong in August 2017. The DTA with Hong Kong entered into force in September 2018.

Source: Hong Kong Department of Justice, UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate of the Kingdom of Saudi Arabia in Hong Kong

Address: Suite 6401-3, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong

Email: info@saudiconsulate.org.hk

Tel: (852) 2520 3200

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

Visa applications must be completed prior to travel. It is important to note that the passport must not contain any evidence of prior or intended travel to Israel. Since September 27, 2019 Mainland and Chinese HKSAR passport holders and are granted entry to Saudi Arabia for tourism reasons by applying for a one-year, multiple entry eVisa.

Source: Visa on Demand

Date last reviewed: April 17, 2020

Saudi Arabia

Saudi Arabia