GDP (US$ Billion)

1,720.49 (2018)

World Ranking 10/193

GDP Per Capita (US$)

33,320 (2018)

World Ranking 28/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

76.7 (2019)

Currency (Period Average)

Korean Won

1165.36per US$ (2019)

Political System

Unitary multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

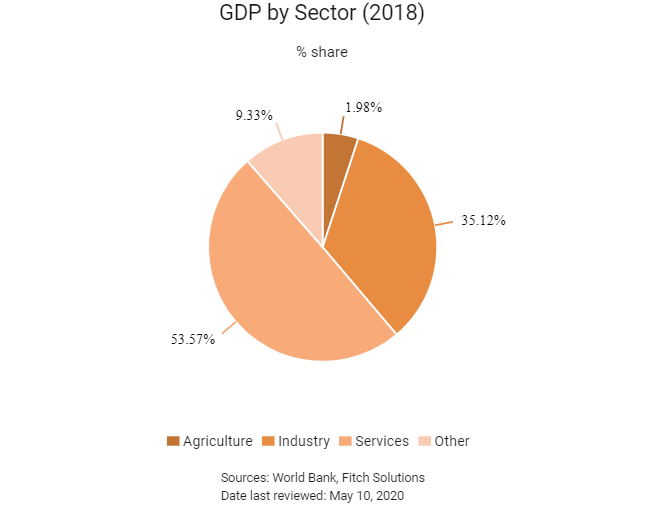

Overview

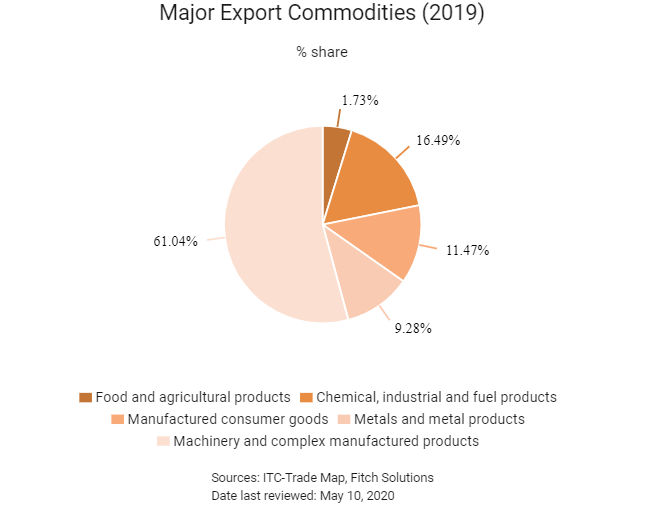

South Korea has experienced significant success by combining rapid economic growth with significant reductions in poverty. The country is now the world's 15th largest economy and is the first former aid recipient to become a member of the Development Assistance Committee of the Organisation for Economic Co-operation and Development. South Korea's rapid growth in the last few decades has largely been driven by exports of manufactured electronic goods and telecommunications equipment, which has earned the country a reputation as a top global producer and innovation hub. The country enjoys important – even dominant – positions in a number of major global industries, including nuclear power, consumer electronics and biotechnology, and has set goals to become a major player in several other areas, including smart-grid technology, the Internet of Things and robotics. However, weak demand in major export markets has the potential to act as a drag on economic growth and result in fewer investment opportunities in the short term. The 2020 budget, announced in late August 2019, focuses on boosting exports and investments amid rising external headwinds.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

April 2018

North Korean leader Kim Jong-un met President Moon Jae-in for talks at the Panmunjom border crossing. The joint summit was the first meeting between leaders of North Korea and South Korea since 2007.

September 2018

The North and South Korean leaders signed a joint agreement on denuclearisation and agreed that Kim Jong-un would visit Seoul, a joint Korean bid would be launched for the 2032 Summer Olympics.

August 2019

South Korea proposed a KRW513.5 trillion (equivalent to 26.2% of GDP) budget for 2020. The budget marked a sharp 9.3% increase in spending compared with the 2019 budget, signalling that the government was looking to rely on fiscal easing alongside conventional expansionary monetary policy to boost the economy. The budget focused on job creation and helping small-and medium-sized enterprises. South Korea also announced a reduction of the securities transaction tax rate for over-the-counter and unlisted security transactions to 0.45% from 0.50% with effect from the second quarter of 2020.

November 2019

On November 22 South Korea conditionally extended its General Security of Military Information Agreement intelligence-sharing pact with Japan.

November 2019

Incheon International Airport Corporation broke ground to build fourth phase of the Incheon International Airport in South Korea, according to the Ministry of Land, Infrastructure and Transport. Nearly KRW4.84 trillion (USD4.15 billion) project aimed to expand Terminal 2, a new runway and connected transportation network. The extension would allow the runway to handle increased operations from larger aircraft as well as reduce the distance between two terminals from 15.3km to 13.2km. In addition, the company would also develop, maintenance, repair and operate the facility near Terminal 2. The expansion, due to be completed by 2024, was expected to increase the airport's annual passenger handling capacity to 160 million.

January 2020

The Bank of Korea kept its base rate on hold at 1.25% at its first monetary policy meeting of the year on January 17.

March 2020

On March 17, the National Assembly passed the first 2020 supplementary budget in response to the Covid-19 pandemic. The supplementary budget included a decline in revenue by KRW0.8 trillion, and additional KRW10.9 trillion spending on disease prevention and treatment, loans and guarantees for business affected, support for households affected, and support for local economies affected.

April 2020

The coronavirus pandemic pushed South Korea’s economy into its biggest contraction since 2008 in the first quarter, as self-isolation measures hit consumption and global trade slumped. Finance minister Hong Nam-ki said in a policy meeting that South Korea’s economy should brace for a bigger shock from the second quarter as demand from major trading partners plummets.

April 2020

The ruling Democratic Party of Korea (DP, also known as Minjoo) delivered a landslide victory in the April 15 legislative elections, winning 163 out of 253 constituencies. Additionally, DP’s satellite party, the Together Citizens' Party, had clinched an additional 17 seats, giving the government a historic supermajority of 180 out of 300 seats in the National Assembly.

Sources: BBC country profile – Timeline, The Guardian, Fitch Solutions, Business Korea

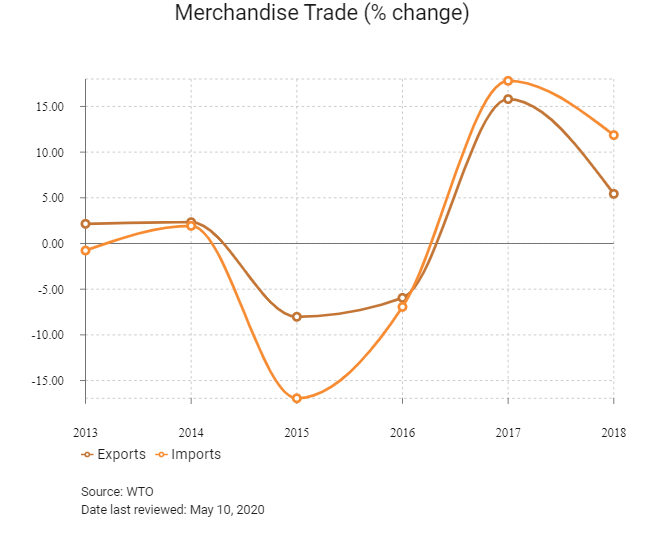

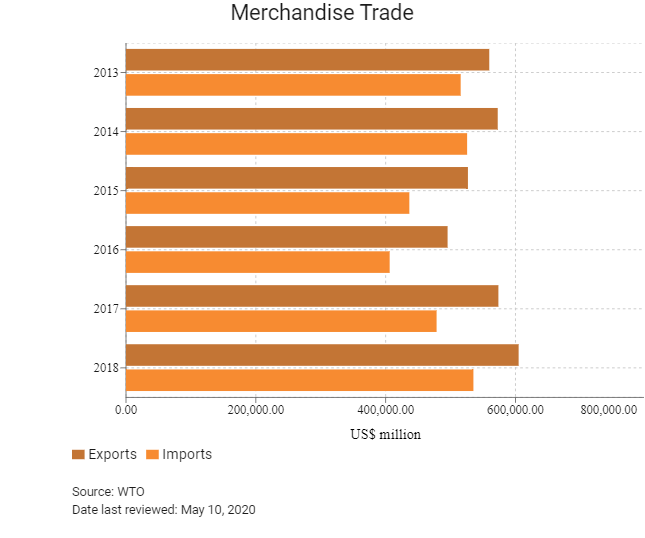

Merchandise Trade

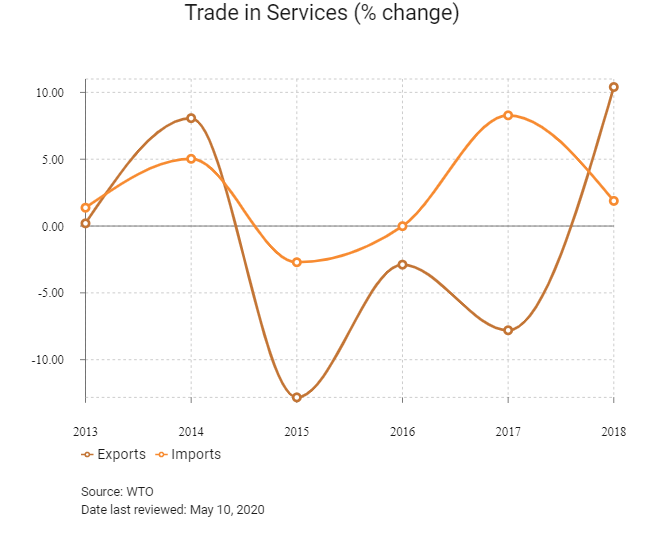

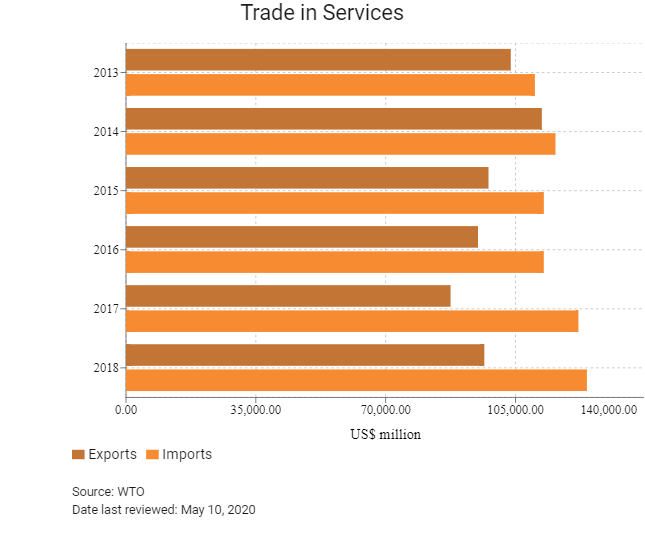

Trade in Services

- South Korea has been a member of the World Trade Organization (WTO) since January 1,1995, and a member of the General Agreement on Tariffs and Trade since April 14, 1967.

- South Korea has adopted an export-oriented growth model. Total exports contribute 45.2% to GDP.

- In the past, South Korea's trade policy placed heavy emphasis on import control and export growth promotion. The South Korean government has revised its trade policy to a more neutral stance in recent years, which includes forging free trade agreements (FTAs) with other countries. South Korea has entered into 17 FTAs covering more than 50 countries, including with the European Union (EU), the United States, the Association of Southeast Asian Nations (ASEAN), Singapore and Mainland China. South Korea is also engaged in negotiations for a further 10 FTAs, including with Ecuador, Mexico, the Gulf Cooperation Council, Indonesia, Mercosur, Israel and Japan.

- In terms of trade barriers, South Korea continues to pursue economic liberalisation and deregulation, with low levels of bureaucracy and streamlined trade procedures easing the overall trading process and lowering import costs. Customs duties can be adjusted every six months, within the limit of the basic rate. South Korea also has a flat 10% VAT on all imports, with a special excise tax of 10-20% levied on the import of certain luxury items and durable consumer goods. Tariffs and taxes must be paid in South Korean won within 15 days after goods have cleared customs. Average import tariff rates currently stand at 4.8% and are the third highest in the East and South East Asia region, behind Cambodia and Laos.

- The South Korean government maintains a tariff quota system designed to stabilise certain domestic commodity markets. Some of the major barriers to trade involve the rice industry, with the Ministry of Agriculture, Food and Rural Affairs implementing a number of measures to support domestic rice production, including rice farmer income subsidies and a hefty rice import tariff. In January 2015, the Government of South Korea implemented a 513% tariff on over-quota imported rice. Imports of rice have a quota of 409,000 tonnes a year. Products such as crude oil are also subject to tariffs, significantly increasing the costs of imported inputs for businesses.

- The trilateral FTA between South Korea, Japan and Mainland China has been under negotiation since 2012, and the 15th round of negotiations was held in April 2019. In addition, South Korea is engaged in negotiations concerning the Regional Comprehensive Economic Partnership, a proposed FTA among 16 countries, including the10 ASEAN countries, Australia, Mainland China, India, Japan and New Zealand.

- In 1997, following the amendment of the Customs Act and its Enforcement Decree, South Korea simplified import procedures and required documentation. Most goods can now be imported without licences, except items restricted for health or security reasons. All of Hong Kong's leading export products can be freely imported into South Korea. Most duties are assessed on an ad valorem basis. For non-agricultural products, about 90% of goods are charged tariff rates from 0% to 10%. Tariff rates for leading import items from Hong Kong (for example, electrical machinery) range between 0% and 13%.

- In addition to tariffs, imports are also subject to other taxes, including VAT. The VAT rate on imports is 10% of the cost, freight and insurance value plus customs levies. A special excise tax or individual consumption tax, which ranges from 2% to 20%, is also levied on certain luxury and durable consumer items.

- The South Korean government maintains a safeguard mechanism in which high tariffs are imposed on certain products, protecting local industries that are vulnerable to global competition. For example, certain agricultural products are subject to duties above 100%. Some non-agricultural products, such as leather and footwear, are taxed up to 16%.

- In July 2014, an individual consumption tax was imposed on imported coal used for power generation. The purpose of the measure was to tackle excessive electricity consumption and rationalise the domestic energy price structure. At the same time, taxes for other alternative imported fuels, such as liquefied natural gas, kerosene and propane, were lowered. Trade bureaucracy in South Korea is generally relaxed, with the country having an increasingly open attitude to imported goods.

- In January 2015, the state-run Export-Import Bank of Korea announced that it will provide a total of USD51 billion in loans and investment and USD22 billion in loan guarantees to finance industrial activities and international development projects involving South Korean companies (which may be favoured over international ones) amid a diminishing quantitative easing trend in the United States and continuous depreciation of the Japanese yen. Financing priority will be given to large projects overseas that are related to engineering, procurement and construction. The amount will total USD25 billion.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Update

Indonesian and South Korea took a key step toward a bilateral agreement that is expected to help boost trade between the two nations by about 50% by 2022. The countries will move forward with 'legal scrubbing' and translation before the official signing of the Indonesia-Korea Comprehensive Economic Partnership Agreement.

Multinational Trade Agreements

Active

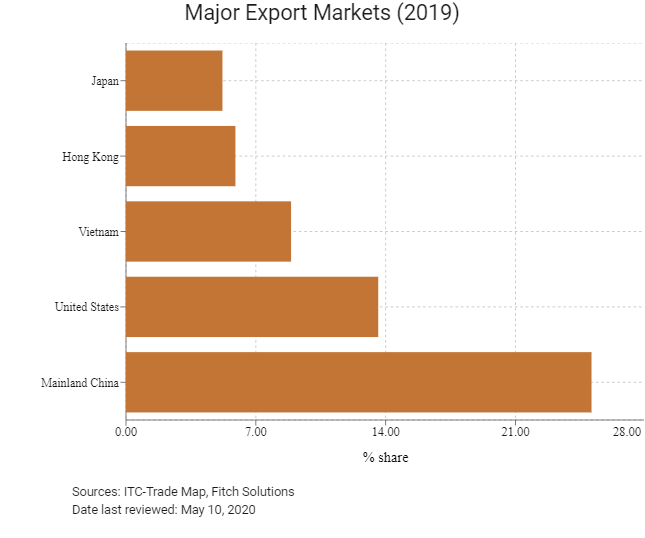

- South Korea-Mainland China FTA: This FTA was implemented on December 20, 2015 and has significant implications for both sides as it aims to eliminate more than 70% and 90% of import tariffs within the next 10 and 20 years, respectively. South Korea's bilateral trade with Mainland China – South Korea's top trading partner – reached USD268.6 billion in 2018. The FTA aims to enhance economic cooperation between the two sides through the facilitation of productive competition and make a substantial contribution to the economic integration of East Asia and the Asia Pacific region.

- EU-South Korea FTA: This agreement came into force on July 1, 2011 and aims to eliminate duties for industrial and agricultural goods in a progressive step-by-step approach. The majority of import duties had already been removed when the FTA came into force. On July 1, 2016 import duties were eliminated on all products except for a limited number of agricultural products. In addition to eliminating duties on nearly all goods, the FTA addresses non-tariff barriers to trade with specific focus on the automotive, pharmaceutical, medical device and electronics sectors. The agreement also creates new opportunities for market access in services and investments and includes provisions in areas such as competition policy, government procurement, intellectual property rights, transparency in regulation and sustainable development. South Korea is the EU's 10th largest export destination.

- South Korea-Australia FTA (KAFTA): KAFTA came into force on December 12, 2014. South Korea is Australia's fourth largest trading partner, and under this agreement tariffs on 84% of Australia's exports to South Korea were eliminated. Tariffs on 96% of current exports will be eliminated within 10 years and by the time the agreement is fully implemented, tariffs on 99.8% of Australia's current exports to South Korea will be eliminated. Products representing about 0.2% of Australia's current exports to South Korea will be excluded from the agreement, namely rice, milk powder, honey, abalone, ginger, apples, pears and walnuts.

- South Korea-United States FTA (KORUS): This agreement came into force on March 15, 2012. Under KORUS, almost 80% of consumer and industrial products exported to the United States from South Korea became duty free on March 15, 2012 – this was subsequently expanded to 95% by 2017. Most remaining tariffs will be eliminated in the medium term. KORUS eliminates tariffs and quotas for a broad range of agricultural products, with almost two-thirds (by value) of South Korea's agricultural imports from the United States becoming duty free. For services, KORUS provides meaningful market access commitments that extend across virtually all major service sectors, including greater and more secure access for international delivery services and the opening up of the South Korean market for foreign legal consulting services. In the area of financial services, KORUS increases access to the South Korean market and ensures greater transparency and fair treatment for United States suppliers of financial services. KORUS addresses non-tariff barriers in a wide range of sectors and includes strong provisions on competition policy, labour, the environment, transparency and regulatory due process.

- South Korea-India FTA: A closer economic partnership agreement between South Korea and India came into force on January 1, 2010. The agreement aims to enhance economic cooperation between the two countries through the facilitation of productive competition. The agreement will gradually remove tariffs on more than 90% of traded goods within two decades. In June 2017, a memorandum of understanding between the Export-Import Bank of Korea and the Export-Import Bank of India was signed in Seoul for export credit of USD9 billion for infrastructural development in India and for the supply of goods and services by India and South Korea as part of projects in third-party countries.

- ASEAN-South Korea Free Trade and Economic Integration Agreement: This FTA, which came into force on October 14, 2010, allows 90% of the products being traded between the ASEAN and South Korea to enjoy duty-free treatment. The agreement is significant given the high trade flows between the countries.

Under Negotiation

- South Korea-Japan FTA (KJFTA): KJFTA will be of benefit to businesses, owing to the high trade volumes between the two countries, and will create potential for businesses to explore new markets in the region. The scope of the KJFTA can be categorised into three main areas: trade liberalisation and market access through concessions for trade in goods and services, enhanced cooperation for non-trade areas, and institutional arrangements centred on a dispute settlement mechanism. Japan is an important trading partner, accounting for 5.1% of South Korea's total exports and 10.2% of total imports in 2018.

- Regional Comprehensive Economic Partnership (RCEP): This is intended to be an FTA between the 10 member states of ASEAN and six states – Australia, Mainland China, India, Japan, South Korea and New Zealand – with which ASEAN has existing FTAs. The agreement will speed up the economic integration of the states and increase South Korea's export competitiveness in the global market. South Korea already has an FTA with ASEAN, and RCEP will expand the breadth of South Korea's export market diversification. Some progress was reported in the latest round of negotiations that took place in Melbourne, Australia from June 22 to July 3, 2019, but there is still some way to go before agreement is reached on the outstanding 11 chapters.

Sources: WTO Regional Trade Agreements database, The Hindu Business Line, Fitch Solutions

Foreign Direct Investment

Foreign Direct Investment Policy

- Invest Korea is South Korea's national investment promotion agency, established as part of the Korea Trade Investment Promotion Agency (KOTRA) to support the entry and establishment of foreign businesses in South Korea. To promote inward foreign direct investment (FDI), the South Korean government offers various incentives.

- Following the onset of the financial crisis in 2008/2009, the South Korean government took active steps to promote FDI. In 2008-2010, corporate taxes were reduced, administrative procedures were streamlined and the maximum amount of foreign capital that can be lent or borrowed without reporting the transaction was increased. In addition to strengthening the rights of foreign investors, the South Korean government has also taken measures to simplify procedures for mergers and acquisitions, reform bankruptcy laws, introduce short-term measures to facilitate asset transfer, permit the establishment of holding companies, and allow foreign investment companies to freely acquire land without limitations on the size and use of land.

- To bolster less-developed regions outside Seoul through private investment, the South Korean government announced a series of pro-investment measures in 2014, which included deregulations and tax incentives. For example, development restrictions will be lifted to allow the construction of commercial facilities in green-belt areas. In 2015 the Bank of Korea enlarged the Bank Intermediated Lending Support Facility by KRW5.0 trillion (USD4.5 billion), providing additional financial support, such as trade financing and credit loans to small- and medium-sized enterprises (SMEs) and tech start-ups. In 2017 a new set of measures were introduced to spur investment, which include creating a tourism brand in the southern coastal area, allowing the distribution of beer made by microbreweries and using apartment complex parking lots for paid parking space during the day.

- The Ministry of Strategy and Finance administers tax and other incentives to stimulate advanced technology transfer and investment in high-technology services. There are four types of special areas for foreign investment - free economic zones, free trade zones, free investment zones and tariff free zones – where favourable tax incentives and other support for investors are available.

- South Korea's Financial Services Commission introduced the omnibus account system for foreign investors in stocks trading in March 2017, which is an integrated and simplified registration system for foreigners to make it easier for foreign investors to trade locally listed stocks on the South Korean stock market. In the past, foreign investors had to open an account not only in South Korean banks but also in South Korean securities companies to make an investment in South Korean stocks, and they had to handle all financial transactions themselves. The omnibus account was extended to cover bonds and derivatives trading in June 2017.

- Despite an increasingly open economy, there remain market access issues relating to certain aspects of the South Korean economy. Products that compete directly with current or future offerings of South Korean chaebols (large conglomerates) would likely continue to be protected by the South Korean government in the medium term.

- The Foreign Investment Promotion Act (FIPA) is the basic law pertaining to foreign investment in South Korea. FIPA and related subordinate regulations categorise business sectors as being either open, conditionally or partly restricted, or closed to foreign investment.

- Restrictions on foreign ownership remain for 27 industrial sectors, three of which (nuclear power generation, radio broadcasting and television broadcasting) are completely closed to foreign investment. Relevant ministries must approve investment in conditionally or partly restricted sectors. Most applications are processed within five days; cases that require consultation with more than one ministry can take 25 days or longer. South Korea's procurement processes comply with the WTO Government Procurement Agreement, but some implementation problems remain.

- The South Korean government reviews restricted sectors from time to time for possible further openings. Relevant ministries must approve investments in conditionally or partly restricted sectors. According to the Ministry of Trade, Industry and Energy, the number of industrial sectors open to foreign investors is well above the Organisation for Economic Co-operation and Development average. Currently, restrictions on foreign ownership of public corporations remain – although ownership limit levels have been raised. Foreign ownership is limited to 49% for government-controlled utilities, such as telecommunications and cable networks. Although government efforts to privatise government-owned assets have been slowed by labour union protests, foreign investors are allowed to participate in privatisation programmes provided they comply with the ownership restrictions stipulated for the 27 industrial sectors.

- There are currently 34 South Korean state-owned enterprises which exert significant control over certain segments of the economy. However, the government has increasingly tried to attract more private participation, especially in the real estate and construction sectors. The state-owned Korea Land and Housing Corporation is given preferential access to developing state-owned real estate projects, notably housing.

- The court system functions independently and gives equal treatment to SOEs and private enterprises. Generally, SOEs are subject to the same regulations and tax policies as private sector competitors and do not receive preferential treatment when it comes to government contracts, resources and financing.

- The South Korean government has sought to control the market through a series of capital control measures under a macro-prudential stability policy. This has included lowering foreign exchange forward-position limits for foreign bank branches in 2010, re-introducing a withholding tax on foreign investors' government bond purchases and imposing a bank levy on non-deposit financing in foreign currency from August 2011. To date, the government has lowered the forward-position limits again and has changed bank levy provisions to promote long-term financing.

- In early November 2019, the country’s parliament passed a legislation that will allow the use of the Asia Region Funds Passport in South Korea. This was a cross-border initiative launched in 2018 that will ease foreign investment transactions across the Asia Pacific.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Invest Korea

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

FIZs: 25 locations and foreign-exclusive rental industrial complexes in Gyeonggi Province (Hyeongok, Poseung, Chupal and Eohyeon-Hansan) |

- These FIZs and four rental complexes are designed to provide inexpensive plant sites, with the national and local governments providing assistance for leasing or selling in such sites at discounted rates. |

|

FEZs: Incheon FEZ (near Incheon Airport, to be completed in 2020); Busan/Jinhae FEZ (in South Gyeongsan Province, to be completed in 2020); Gwangyang Bay FEZ (in South Gyeongsan Province, to be completed in 2020); Yellow Sea FEZ (in South Chungcheong Province, to be completed 2020); Daegu/Gyeongbuk FEZ (in North Gyeongsan Province, to be completed in 2020); Saemangeum/Gunsan FEZ (in North Jeolla Province, to be completed in 2020); East Coast FEZ (in Donghae and Gangrung) and Chungbuk FEZ (in North Chungcheong Province) |

- The eight FEZs differ from other zones designated for foreign investment in that their focus is on creating a comprehensive living and working environment with biotechnology, aviation, logistics, manufacturing and other industrial clusters, as well as international schools, recreational facilities and international hospitals. |

|

FTZs: Donghae, Suncheon, Gunsan, Daebul, Masan, Ulsan, Gimje, Yulchon, and seven logistics areas near airports and harbours |

- In FTZs, companies may pursue their business with government support without the usual legal requirements, such as approval procedures for exports and imports and customs duties. |

Sources: Fitch Solutions, Invest Korea

- Value Added Tax: 10%

- Corporate Income Tax: 10-25%

Sources: National Tax Service Korea, Fitch Solutions

Important Updates to Taxation Information

- The South Korean government announced a series of new tax measures in August 2017 that would come into effect for fiscal years starting after January 1, 2018. The main focus of the 2018 Corporate Income Tax (CIT) Law reform is to encourage job creation by reforming the existing tax credits for corporate investment. The most important of these measures for businesses is the addition of a new CIT rate of 25% for taxable income of more than KRW300 billion.

- The 2019 CIT Reform aims to embrace the base erosion and profit shifting (BEPS) initiatives taken by the Organisation for Economic Co-operation and Development (OECD). In line with this, the government has abolished a number of incentives and benefits offered to foreign companies in order to attract foreign direct investment. The new rules apply for financial years starting from January 1, 2019.

- South Korea's 2020 tax reform bill states that when a qualified in-kind contribution is made to form a new Korean holding company or convert an existing Korean company to a Korean holding company, any capital gains tax on the contribution will be paid in instalments over three years, beginning in the fifth year of the in-kind contribution. This rule applies to in-kind contributions/share transfers occurring on or after 1 January 2022.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

Progressive: |

|

Local Income Tax |

Local income tax is taxed in addition to the CIT mentioned above and also follows a progressive schedule: |

|

Capital Gains Tax |

Generally, capital gains are taxed at the same CIT rate as ordinary taxable income. |

|

VAT |

10% |

|

Acquisition Tax |

Ranges between 2% to 7% according to the asset classification |

|

Securities Transaction Tax |

Transfer of shares are taxed different amounts according to whether or not the shares are listed: |

|

Social Security Contributions |

Employers and employees both contribute 8.5% of salaries towards the following: |

|

Property Tax |

- Annual tax ranging between 0.1% and 0.5% |

|

Withholding Taxes |

Dividends: 0% for domestic companies; 22% for foreign companies |

Sources: National Tax Service Korea, Fitch Solutions

Date last reviewed: May 10, 2020

Foreign Worker Permits

South Korea is increasingly opening itself to immigration in the face of falling fertility rates and labour shortages. By 2002 unauthorised workers represented 70% of South Korea's total foreign labour force. Since 2002 South Korea has taken a number of steps to overhaul its labour migration system. This has resulted in gradually loosening controls and a declining unauthorised population. In 2003 the South Korean government introduced the Employment Permit System (EPS), a guest worker scheme that provides a framework for the entry of foreign labour. The EPS is divided into two subsystems:

- The General EPS which is based on memoranda of understanding drawn up between the South Korean government and sending countries (16 countries as of 2019).

- The Special Case EPS which grants foreign nationals of South Korean ancestry visiting worker status so they can get a job in South Korea.

Skilled workers, including researchers and language teachers, are welcome to temporarily work and live in South Korea. When they have valid employment contracts, skilled workers can easily acquire work visas and can renew their visa status. Certain skilled international workers, including technology workers, can move to South Korea through an express procedure. Under the General EPS, South Korean employers can enter into employment contracts with foreign workers who pass a South Korean language proficiency test and are deemed to be in good health.

Localisation Requirements

Employers who wish to employ low-skilled foreign labour must first demonstrate that they have spent at least 14 days (seven days in some cases) attempting to find South Korean workers by requesting help from public employment centres.

Any foreigner planning on a long-term stay or permanent residency must register as a foreigner or file a domestic residence report within 90 days of arrival.

Visa/Travel Restrictions

There are 16 visa statuses that allow employment in South Korea:

- short-term employment (C-4)

- professorship (E-1)

- foreign language instructor (E-2)

- research (E-3)

- technology transfer (E-4)

- professional employment (E-5)

- arts and performances (E-6)

- special occupations (E-7)

- employed trainee (E-8)

- non-professional employment (E-9)

- vessel crew (E-10)

- residency (F-2)

- overseas Koreans (F-4)

- permanent residency (F-5)

- working holiday (H-1) and

- working visit (H-2)

Foreign workers brought in under the General EPS receive E-9 non-professional employment visa status, while those under the Special Case EPS are given H-2 visiting worker status. H-2 visa holders do not need an employment contract before entering South Korea and there are no restrictions on employment sectors and workplace changes for them. E-9 visa holders need an employment contract, are tied to their employer and are restricted to certain sectors, including agriculture, construction, fishing and manufacturing. Family members of low-skilled foreign workers are not allowed to settle in South Korea.

Sources: Korean Immigration Service, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Aa2 (Stable) |

12/05/2020 |

|

Standard & Poor's |

AA (Stable) |

08/08/2016 |

|

Fitch Ratings |

AA- (Stable) |

21/02/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

4/190 |

5/190 |

5/190 |

|

Ease of Paying Taxes Index |

24/190 |

24/190 |

21/190 |

|

Logistics Performance Index |

25/160 |

N/A |

N/A |

|

Corruption Perception Index |

45/180 |

39/180 |

N/A |

|

IMD World Competitiveness |

27/63 |

28/63 |

N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

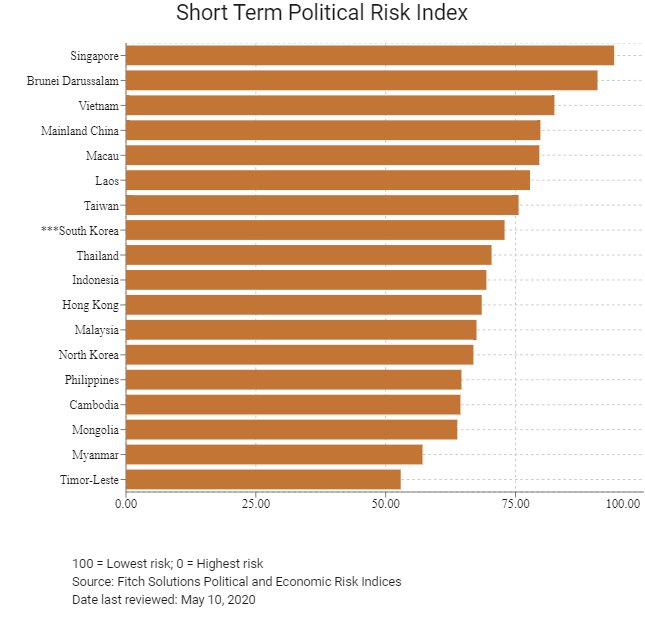

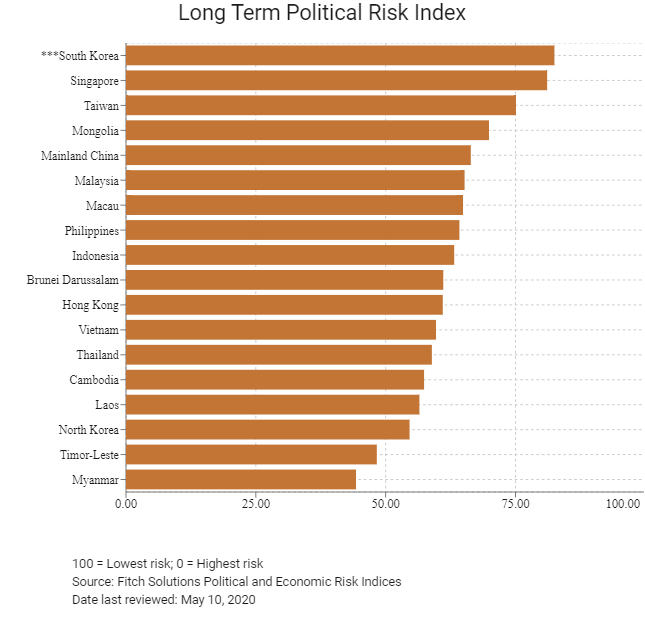

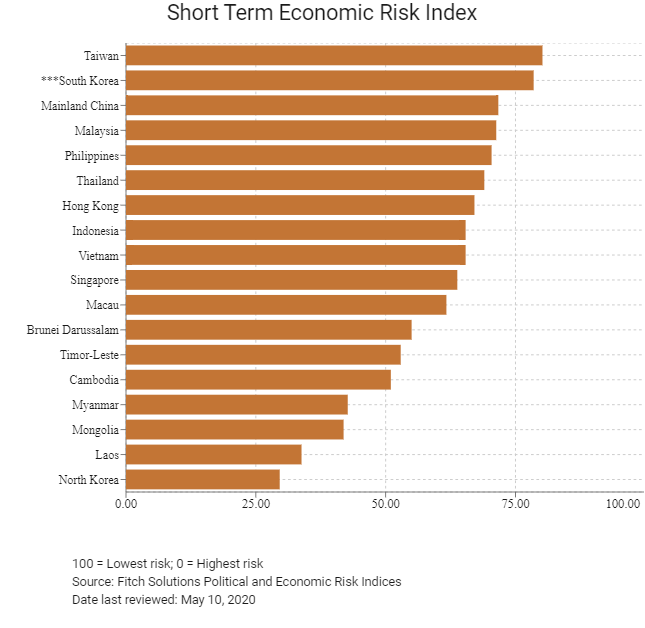

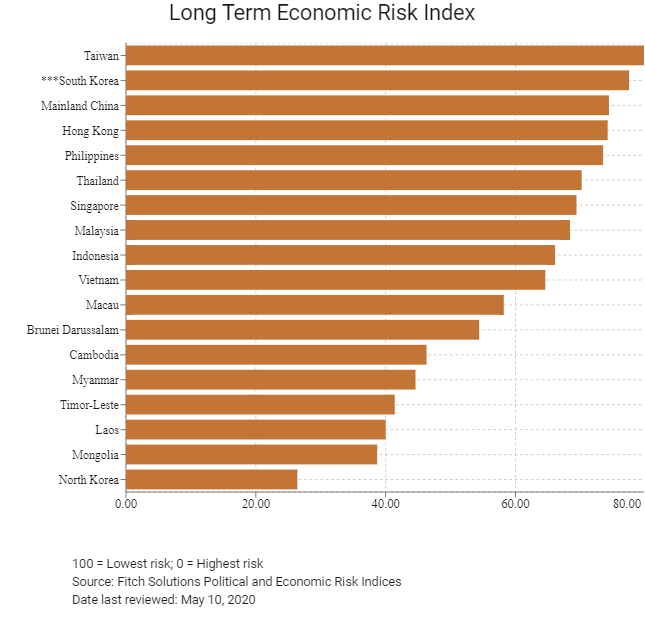

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

2/202 |

7/201 |

8/201 |

|

Short-Term Economic Risk Score |

84.0 |

77.1 |

78.5 |

|

Long-Term Economic Risk Score |

80.4 |

78.4 |

77.5 |

|

Political Risk Index Rank |

25/202 |

25/201 |

22/201 |

|

Short-Term Political Risk Score |

72.1 |

71.6 |

72.9 |

|

Long-Term Political Risk Score |

82.5 |

82.5 |

82.5 |

|

Operational Risk Index Rank |

26/201 |

20/201 |

26/201 |

|

Operational Risk Score |

70.9 |

71.8 |

70.8 |

Source: Fitch Solutions

Date last reviewed: May 10, 2020

Fitch Solutions Risk Summary

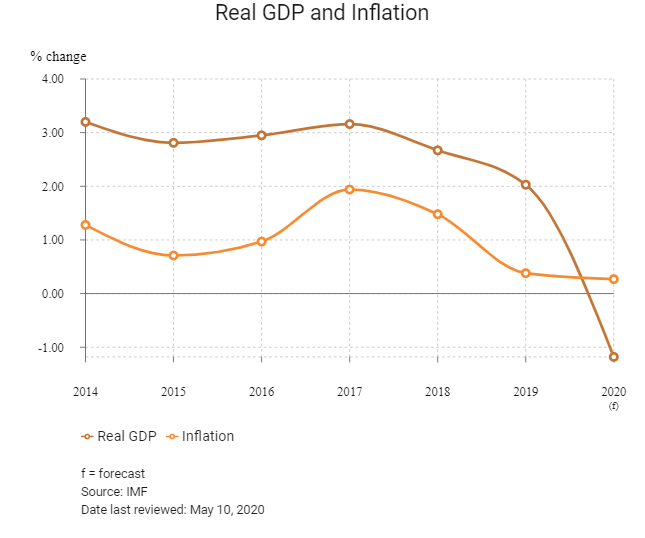

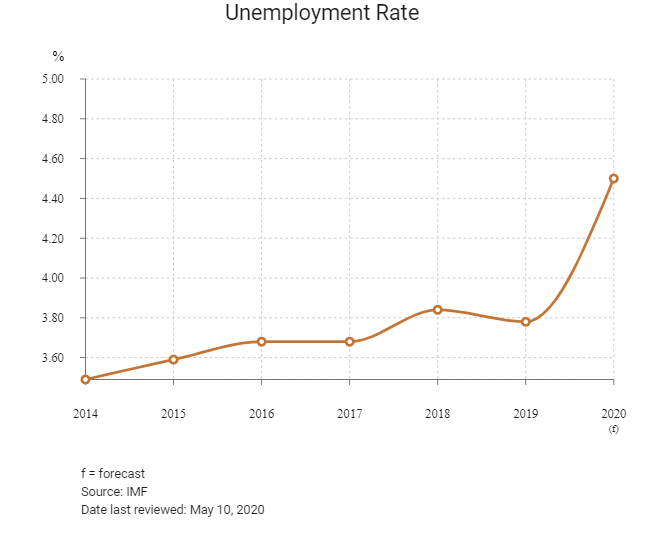

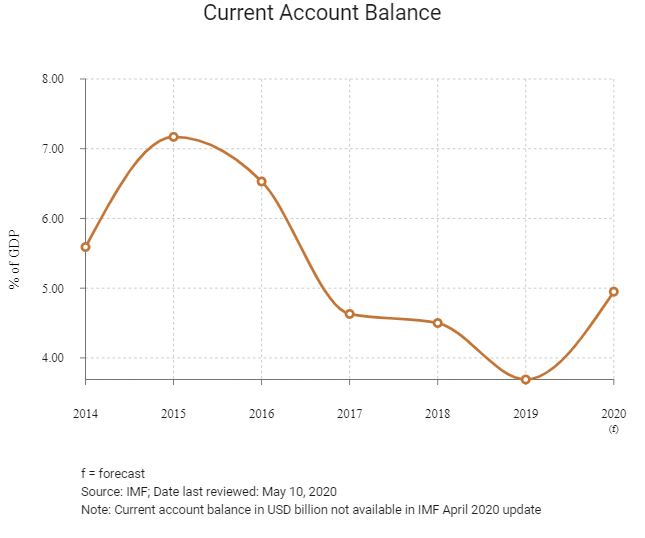

ECONOMIC RISK

Ongoing weakness in the South Korean economy characterise its short term economic risk. In 2020, the economy will contract owing to a recession in the global economy due to the Covid-19 pandemic. That said, we believe that a combination of fiscal and monetary policy measures implemented by policymakers will cushion the economy and help it to emerge from the pandemic on a better footing than most other countries in the region. South Korea's long-term outlook is comfortably above that of its regional peers, reflecting favourable opinions about the country's long-term growth prospects. The South Korean economy is susceptible to sharp drops in international investor risk appetite and trade slowdowns in developed markets. For example, it was significantly hit by the 1997 Asian financial crisis, and the global downturn in late 2008 caused a dramatic sell-off of the won. The government is gradually ramping up reform efforts to support sustained economic growth amid rising headwinds in the external sector. In doing so, the current administration has not only embarked on providing more funding for research and development – which it has ample resources to provide given years of prudent spending and high capital buffers – but has also eased regulations to spur foreign investment. A milder concern is South Korea's high levels of household and external debt, which could constrain growth if rapid deleveraging were forced upon the economy.

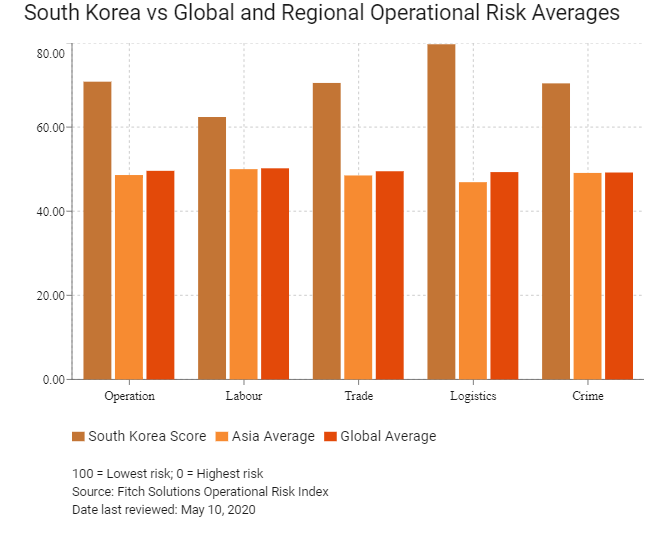

OPERATIONAL RISK

South Korea has one of the best operating environments in the East and South East Asian region. This is largely a result of the country's superior logistical and trade and investment environments as it has highly developed utilities and transport networks and is considered to host one of the better legal environments in the region. South Korea has developed into a highly industrialised and sophisticated economy with a skilled workforce, which provides an excellent environment for international trade and foreign investment. A weak point to emphasise is that the country's labour market is bogged down by its high national minimum wage and rigid labour policies which make it almost impossible to dismiss workers once they are deemed a permanent employee by South Korean labour law. These two factors are attributed to being some of the biggest causes of the country's high youth unemployment rate, which is currently emerging as one of the biggest problems faced domestically.

Source: Fitch Solutions

Date last reviewed: May 10, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

South Korea Score |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

East and Southeast Asia Average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia Position (out of 18) |

4 |

5 |

5 |

2 |

4 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

4 |

5 |

5 |

2 |

4 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

26 |

31 |

26 |

15 |

34 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 10, 2020

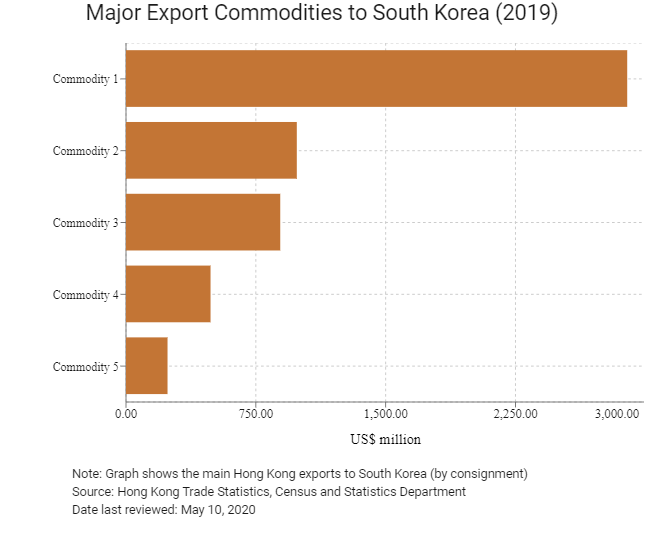

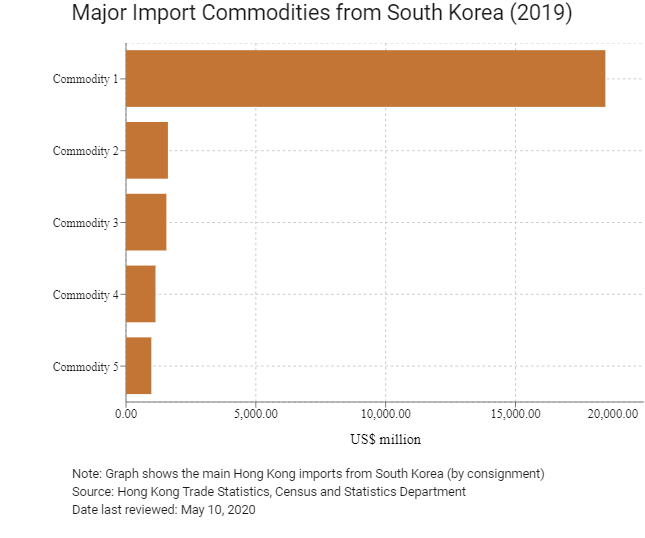

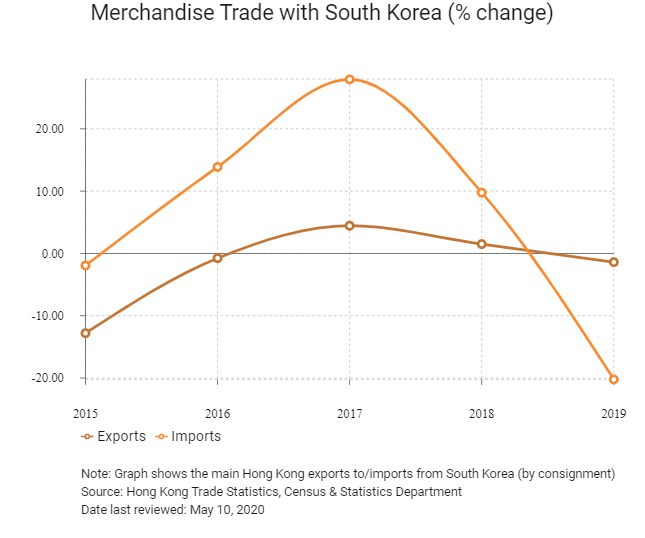

Hong Kong’s Trade with South Korea

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Electrical machinery, apparatus and appliances; and electrical parts thereof |

2,895.5 |

|

Commodity 2 |

Telecommunications and sound recording and reproducing apparatus and equipment |

986.8 |

|

Commodity 3 |

Office machines and automatic data processing machines |

891.1 |

|

Commodity 4 |

Miscellaneous manufactured articles |

488.4 |

|

Commodity 5 |

Articles of apparel and clothing accessories |

239.9 |

|

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Electrical machinery, apparatus and appliances; and electrical parts thereof |

18,462.2 |

|

Commodity 2 |

Telecommunications and sound recording and reproducing apparatus and equipment |

1,614.6 |

|

Commodity 3 |

Office machines and automatic data processing machines |

1,555.0 |

|

Commodity 4 |

Petroleum, petroleum products and related materials |

1,136.1 |

|

Commodity 5 |

Essential oils, resinoids and perfume materials; and toilet, polishing and cleansing preparations |

975.6 |

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of South Korean residents visiting Hong Kong |

104,254 |

-26.7 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Sources: Hong Kong Tourism Board, Fitch Solutions

|

2019 |

Growth rate (%) |

|

|

Number of East Asians and South Asians residing in Hong Kong |

2,834,871 |

3.4 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: February 19, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth Rate (%) |

|

|

Number of South Korean companies in Hong Kong |

152 |

4.8 |

|

- Regional headquarters |

10 |

33.3 |

|

- Regional offices |

47 |

0.0 |

|

- Local offices |

95 |

5.6 |

Source: Business Expectation Statistics Section of the Hong Kong Census and Statistics Department

Treaties and Agreements Between Hong Kong/Mainland China and South Korea

- Double taxation agreement between Hong Kong and South Korea (effective date: September 27, 2016)

- Investment promotion and protection agreement between Hong Kong and South Korea (effective date: July 30, 1997)

- Bilateral investment treaty between Hong Kong and South Korea (effective date: July 30, 1997)

- Double taxation agreement between Mainland China and South Korea (effective date: September 27, 1994; amended July 4, 2006)

- Bilateral investment treaty between Mainland China and South Korea (effective date: December 1, 2007)

Sources: Inland Revenue Department, Trade and Industry Department, UNCTAD, OECD

Chamber of Commerce or Related Organisations

Korean Chamber of Commerce in Hong Kong

The Korean Chamber of Commerce in Hong Kong, founded in 1976, aims to provide business information and business networking opportunities, and promote commercial trade through various activities to help members build up their business networks.

Address: 16/F, Yat Chau Building, 262 Des Voeux Road, Central, Hong Kong

Email: info@kocham.hk

Tel: (852) 2544 1713, 2544 2791

Fax: (852) 3905 8313

Sources: Korean Chamber of Commerce in Hong Kong, Fitch Solutions

Hong Kong-Korea Business Association

Email: hkkba@naver.com / bglee96@naver.com

Tel: (82) 10 2414 0454

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Consulate General of the Republic of Korea in Hong Kong

Address: 5/F, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong

Email: hkg-info@mofa.go.kr

Tel: (852) 2529 4141

Fax: (852) 2861 3699

Source: Consulate General of the Republic of Korea in Hong Kong

Visa Requirements for Hong Kong Residents

HKSAR passport holders and BNO passport holders respectively enjoy 90-day and 30-day visa free access.

Source: Visa on Demand

Date last reviewed: May 10, 2020

Republic of Korea

Republic of Korea