GDP (US$ Billion)

203.13 (2018)

World Ranking 53/193

GDP Per Capita (US$)

41,205 (2018)

World Ranking 24/192

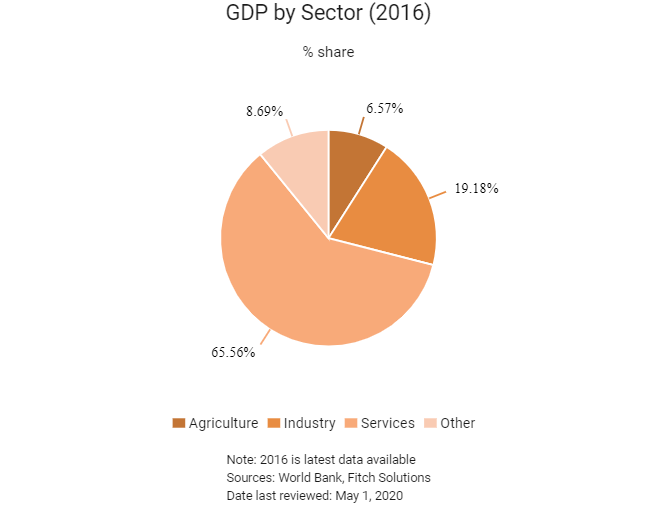

Economic Structure

(in terms of GDP composition, 2017)

External Trade (% of GDP)

55.9 (2018)

Currency (Period Average)

New Zealand Dollar

1.52per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

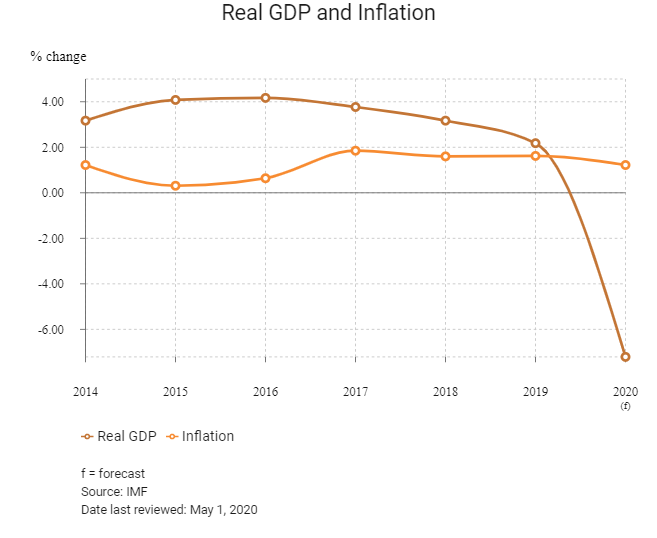

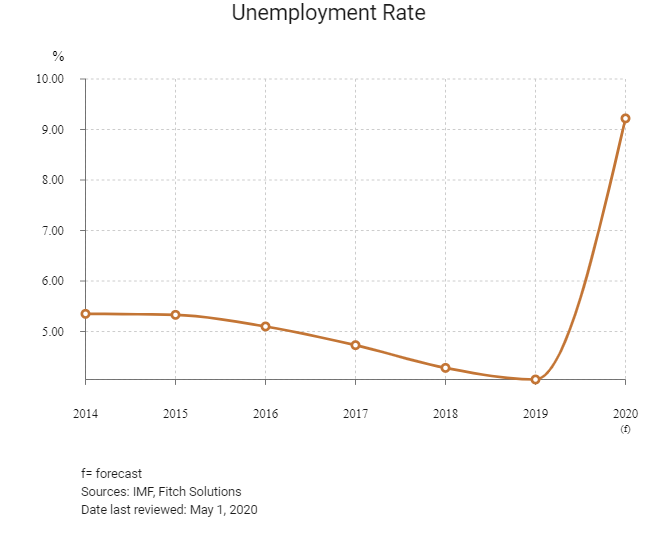

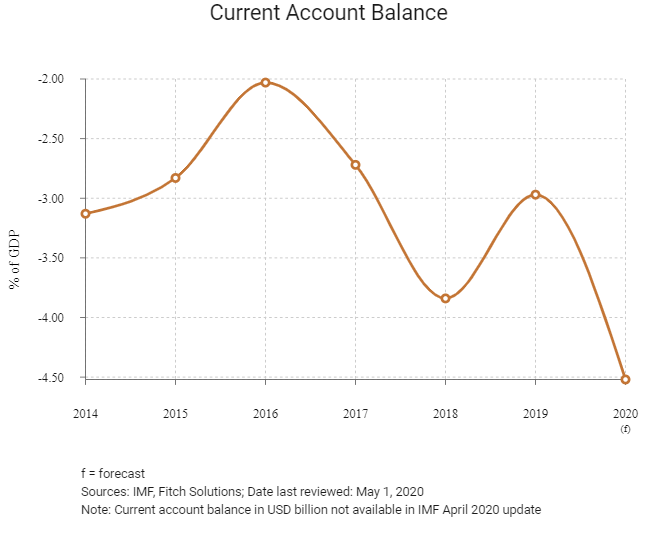

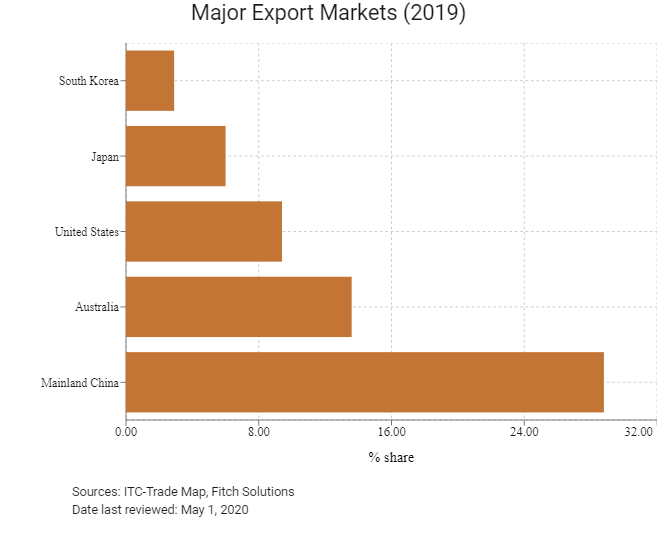

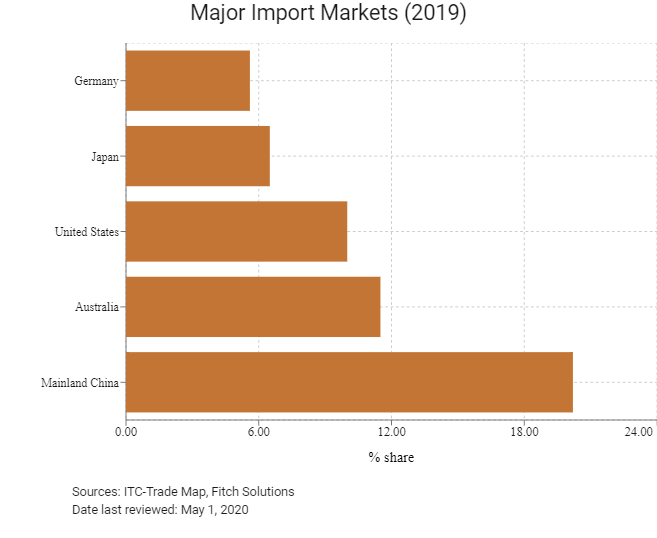

New Zealand has an open, transparent economy where businesses and investors can generally make commercial transactions with ease. Major political parties are committed to an open trading regime and sound rule of law practices. Strong economic growth is largely driven by tourism, private consumption and construction activity. New Zealand is likely to remain one of the most stable states in the world over the coming decade, on the back of lower unemployment and expansionary fiscal measures to be offset by slowing export growth due to a weakening economic outlook across New Zealand’s main trading partners, namely Australia, Mainland China and the United States.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

April 2018

The hourly minimum wage was increased by 5%, effective April 1, 2018.

November 2018

The signing of the 'Crown Minerals Amendment Bill' into law in November 2018 imposed a ban on all new offshore oil and gas exploration in New Zealand’s waters, as part of its efforts to transition to a carbon-neutral economy by 2050.

December 2018

The government announced its intentions to raise the minimum wage by NZD1.2 from April 2019. This would take the minimum wage to NZD17.7 per hour, from the current NZD16.5.

May 2019

New Zealand unveiled its first ever 'wellbeing' budget, which was notable for focusing on wellbeing over GDP growth.

January 2020

The government of New Zealand planed to invest NZD1.1 billion in railway works. The investment would go to four main projects across the country. The works were part of a NZD6.8 billion transport infrastructure investment plan in the country.

February 2020

Fletcher Building had confirmed plans to build a new plasterboard facility in Tauranga in Bay of Plenty region of New Zealand. The project would require an investment of around NZD400 million (USD253.64 million). The facility, which would build Winstone Wallboards-branded plasterboard, would replace a smaller plant in Auckland. The new plant was planned to start operations in 2023, according to a press release from Winstone Wallboards.

March 2020

New Zealand's Ministry of Transport was evaluating ways to introduce 'rapid rail' between Auckland and Hamilton to cut travel time between the two cities to one hour. Transport Minister Phil Twyford stated that the cabinet had sanctioned an initial business case for the rapid rail service, due mid-2020, which would be followed by a detailed business case. The government was mulling two options: a rapid train with only two stops at Hamilton and Auckland, and a fast train which would stop at stations north of Hamilton and in Auckland's southern suburbs. The ministry planned for a tilt train, which could run at around 160km/h. The project would require building an entirely new, straighter line.

March 2020

The government announced fiscal measures amounting to a total of NZD23 billion (7.7% of GDP), to help businesses and households cope with the economic fallout of the Covid-19 outbreak, of which more than half would be disbursed by end-June. Among others, measures included a permanent change in business taxes to help cashflow (NZD2.8 billion or 0.9% of GDP over next four years); a temporary tax loss carry-back scheme (NZD3.1 billion or 1% of GDP over next two years); and support for the aviation sector (NZD0.6 billion or 0.2% of GDP). The government had also approved a NZD0.9 billion debt funding agreement (convertible to equity) with Air New Zealand to ensure continued freight operations, domestic flights and limited international flights. In addition, on March 28 the government announced temporary removal of tariffs on all medical and hygiene imports needed for the Covid-19 response. The government was expediting urgent work on new income support measures for all workers above and beyond the wage subsidy scheme.

April 2020

The New Zealand government, the RBNZ, and the New Zealand Bankers Association announced a number of financial measures to support SMEs and homeowners. These include six-month principal and interest repayment deferrals to mortgage holders and SMEs affected by Covid-19 and a NZD6.25 billion business finance guarantee scheme for SME loans, in which the government covered 80% of the credit risk. The government had also committed to a temporary law change to enable businesses to put existing debt into hibernation for six months.

November 2020

General elections are scheduled on or before November 21, 2020.

Sources: BBC country profile – Timeline, Fitch Solutions,International Railway Journal

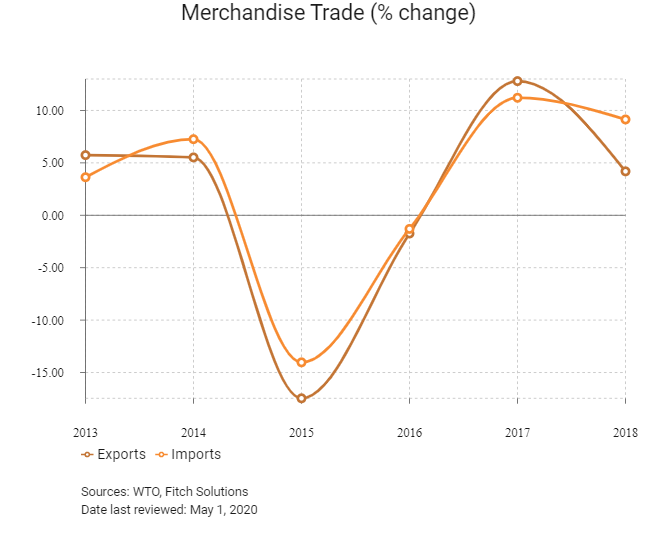

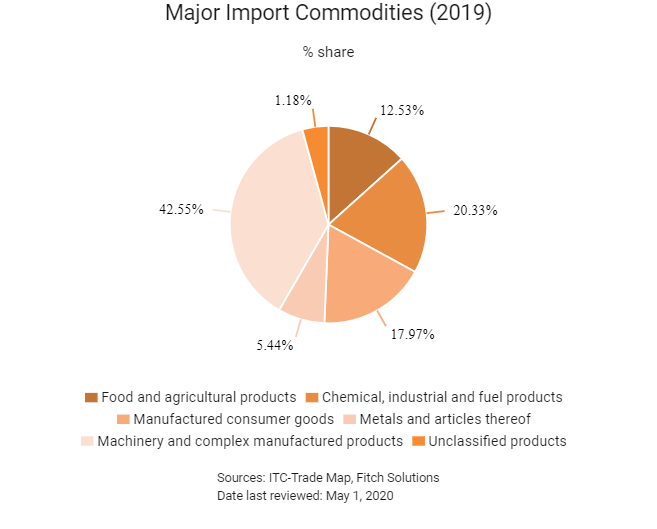

Merchandise Trade

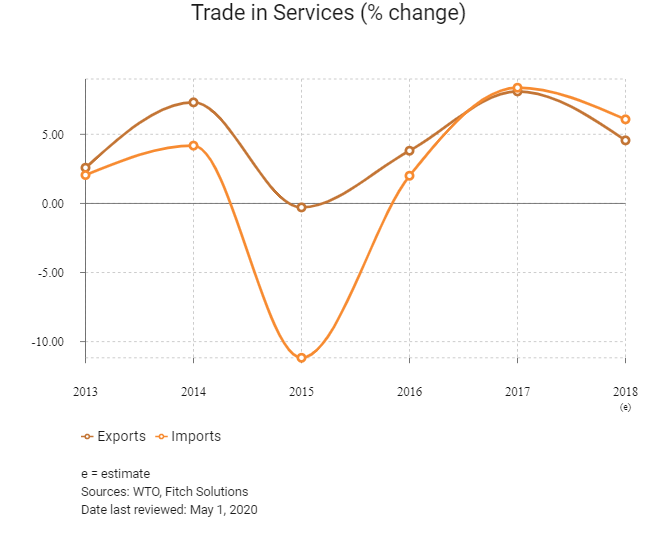

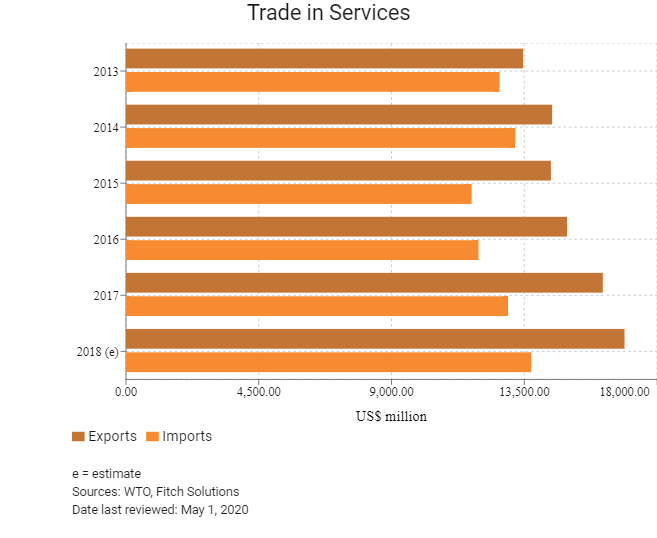

Trade in Services

- New Zealand has been a member of the World Trade Organization (WTO) since January 1, 1995 and a member of the General Agreement on Tariffs and Trade (GATT) since July 30, 1948.

- New Zealand and Australia trade through a Closer Economic Relationship (CER), which is a free trade agreement (FTA) eliminating all tariffs between the two countries. However, the rules of origin under the CER do not permit products to enter Australia duty free from New Zealand unless the products are of at least 50% New Zealand origin. Additionally, the last manufacturing process must be carried out in New Zealand. The enactment of the FTA between Australia and the United States in 2005 removed any tariff disadvantage to firms that choose to re-export products from New Zealand to Australia.

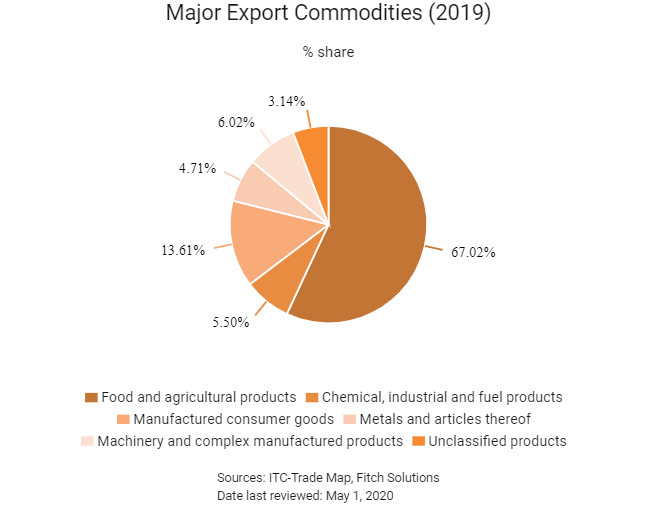

- The vast majority of New Zealand's agricultural production is exported, and no export subsidies are provided for agricultural products.

- New Zealand does not apply an import tariff to most goods imported into the country. However, tariffs of between 5% and 10% apply to some textiles, footwear, processed foods, machinery, steel and plastic products.

- The suspension of anti-dumping duties on residential building materials expired on June 30, 2019.

- International vendors are to collect 15% goods and services tax (GST) on all sales valued at less than NZD1,000 (deemed low-value imported goods). However, customs agencies will continue to collect the relevant duties from the trading of goods falling above the price threshold of NZD1,000. Despite the implementation of the GST from October 1, 2010, the government is cutting import taxes on low-value goods to soften the impact for online shoppers, making certain items less expensive. The initial proposal had classified low-value imported goods as those items falling below NZD400.

Sources: WTO – Trade Policy Review, Ministry of Business, Innovation and Employment, Fitch Solutions

Trade Updates

The Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) could add between USD1.2 billion and USD4 billion to New Zealand's economy once fully implemented, according to government sources.

New Zealand aims to have FTAs covering 90% of New Zealand goods exports by 2030.

Multinational Trade Agreements

Active

- ASEAN-Australia-New Zealand Free Trade Area (AANZFTA): AANZFTA came into force on January 1, 2010. AANZFTA is a comprehensive and single-undertaking FTA that opens up and creates new opportunities for the almost 700 million people of ASEAN (Brunei Darussalam, Cambodia, Indonesia, Laos, Myanmar, Philippines, Singapore, Thailand and Vietnam), Australia and New Zealand. AANZFTA is New Zealand’s largest plurilateral FTA. Through AANZFTA, tariffs will be progressively reduced and eliminated for at least 90% of all tariff lines by 2020. The movement of goods is facilitated via simplified customs procedures and barriers to trade in services have been liberalised. New Zealand's major exports to ASEAN consist of dairy products (milk powder, butter, dairy spreads and cheese), while imports are largely crude and non-crude petroleum oils, biodiesel and commercial vehicles. As a bloc, ASEAN is New Zealand’s fifth largest trading partner, accounting for almost 10% of New Zealand’s total goods exports. Since the FTA has been implemented, two-way trade between New Zealand and ASEAN has grown by almost 30%.

- New Zealand-Australia: New Zealand and Australia trade through a CER, which is an FTA eliminating all tariffs between the two countries. The CER came into force in January 1983. All tariffs and quotas were eliminated by 1990, five years ahead of schedule. New Zealanders and Australians are free to visit, live and work in each other's country under the Trans-Tasman Travel Arrangement. Furthermore, New Zealand and Australia have committed to creating a seamless Trans-Tasman economic environment, making it as easy for New Zealanders to do business in Australia as it is to do business in and around New Zealand. This is known as the single economic market, and builds on the foundation of the CER agreement. Australia is New Zealand’s biggest services trade partner.

- New Zealand-Mainland China: The FTA between New Zealand and Mainland China came into effect on October 1, 2008. Since the FTA was signed, goods exports to Mainland China have quadrupled. The FTA allows for duty free access for 96% of the categories of goods New Zealand exports to Mainland China. This represented about NZD115.5 million in annual savings to exporters at the time of signing, though these savings have substantially risen as trade has increased. New Zealand's major exports to Mainland China are dairy products, wood products and meat, while imports consist of electronics, clothing, furniture and toys. In November 2016, it was decided to upgrade the FTA, with the aim of increasing two-way trade to USD30 billion by 2020.

- New Zealand-Singapore: New Zealand and Singapore trade through a Closer Economic Partnership (CEP), which came into force on January 1, 2001 (less than a year after initial negotiations started) and covers both goods and services. Goods made in New Zealand or Singapore can be traded between the two countries duty free. Singapore is New Zealand’s largest trading partner in South East Asia; in 2018, Singapore was the source market for 3.4% of New Zealand's imports and accounted for 2.2% of total exports. Singapore is also the base of many New Zealand businesses operating in South East Asia. The CEP was upgraded in May 2019.

- New Zealand-Malaysia: The New Zealand-Malaysia FTA came into effect in August 2010 and covers both goods and services. Malaysia is New Zealand's sixth largest goods trading partner and one of its fastest growing export markets. On January 1, 2016 tariffs on 99.5% of New Zealand's exports to Malaysia were eliminated. New Zealand's major exports to Malaysia include dairy, malt extract, lamb and mutton, while imports centre on crude oil and oil cake.

- New Zealand-Hong Kong: New Zealand and Hong Kong signed a CEP which came into effect in January 2011. Major exports to Hong Kong are milk powder and malt extract, while New Zealand mainly imports telephones and cell phones from Hong Kong. Government procurement is included in the agreement, ensuring that New Zealand businesses can compete with Hong Kong businesses for government contracts on a level playing field. The CEP complements New Zealand's FTA with mainland China and enhances the potential for Hong Kong to be used as a platform for trade into mainland China.

- The CPTPP: The CPTPP has now been ratified by the required number of states (seven states, as of November 15, 2018) and entered into force on December 30, 2018. This agreement could add between NZD1.2 billion and NZD4 billion to New Zealand's economy once fully implemented. The other parties to the agreement (Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, Peru, Singapore and Vietnam) account for 31% of New Zealand's goods and services exports and include four of New Zealand's top 10 trading partners (Australia, Japan, Singapore and Malaysia).

Under Negotiation

New Zealand-European Union (EU): Negotiations for a New Zealand-EU FTA formally launched in June 2018. Negotiations are expected to take between two and three years. Two-way trade between New Zealand and the EU is worth nearly NZD26 billion annually. The EU is New Zealand's largest trading partner with which it does not have an FTA, accounting for 16% of total trade in goods and services. The EU includes five of New Zealand's top 20 trading partners (Germany, the United Kingdom (UK), France, Italy and the Netherlands). New Zealand's main goods exports to the EU are agricultural products (particularly wine, fruit and meat), while services exports are dominated by tourism and transportation services. The agreement is expected to be concluded in December 2019.

Sources: WTO Regional Trade Agreements database, New Zealand Ministry of Foreign Affairs and Trade, Fitch Solutions

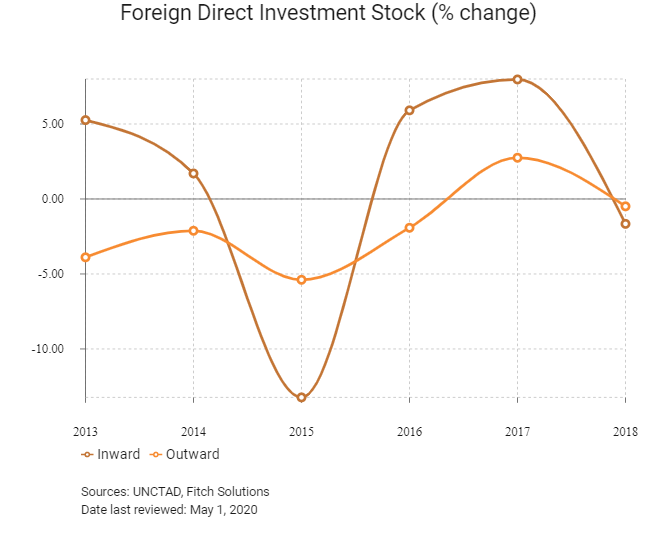

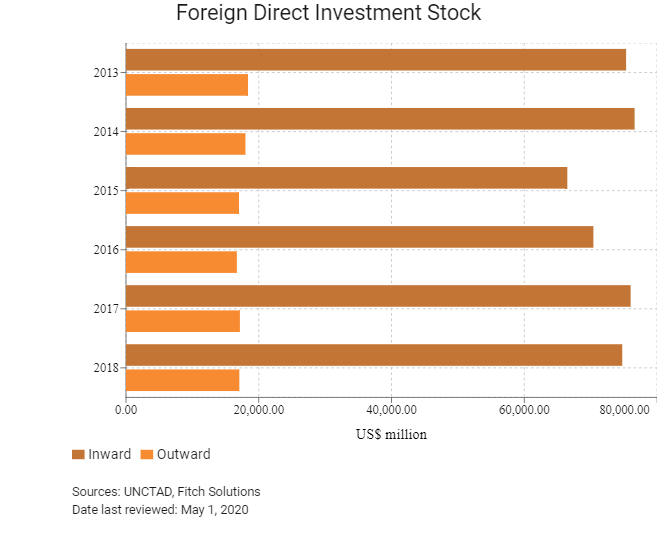

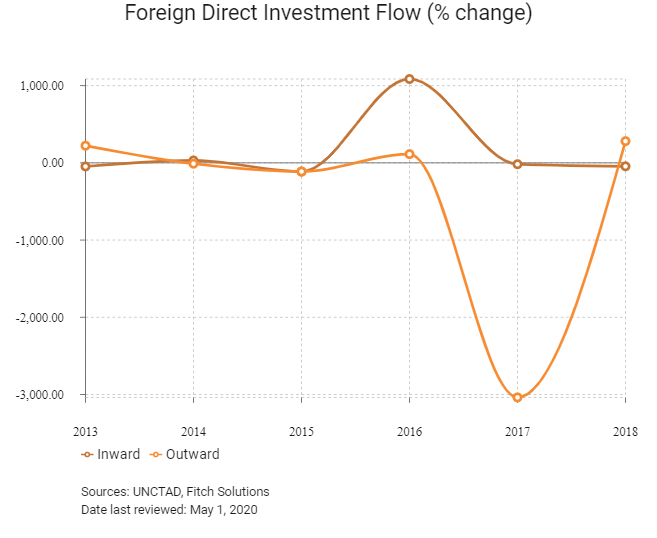

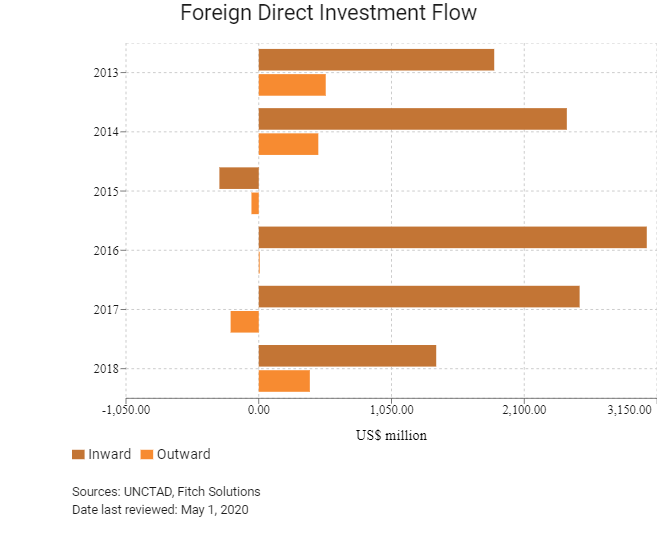

Foreign Direct Investment

Foreign Direct Investment Policy

- The New Zealand Trade and Enterprise (NZTE) is New Zealand's primary investment promotion agency, responsible for economic development and strengthening New Zealand's trade with the world. NZTE provides strategic advice, research and market intelligence for new exporters, as well as support for already established export companies. Export credit insurance is also available for exporting companies.

- New Zealand has an open economy that works on free market principles. Major political parties are committed to an open trading regime and sound rule of law practices. This is regularly reflected in high global rankings in the World Bank's Ease of Doing Business report and Transparency International's Perceptions of Corruption Index.

- As part of its strategy, the New Zealand government aims to leverage existing offshore networks of the Ministry of Foreign Affairs and Trade (MFAT), NZTE, Immigration New Zealand (Immigration NZ), and Kea New Zealand (a New Zealand government business networking initiative) to generate investment leads. International firms currently employ about 20% of New Zealand's workforce.

- In May 2019, the government enacted the research and development (R&D) tax credit on eligible expenditure for businesses undertaking R&D in New Zealand. The incentive package introduces a 15% tax credit (with a minimum expenditure of NZD50,000 and a cap of NZD120 million).

- Under its Business Growth Agenda, New Zealand aims to attract foreign investment in innovation-enhancing sectors to generate economic growth, create jobs and enhance productivity. The Investment Attraction Strategy targets investment in primary industries, premium food and beverages, specialised manufacturing, infrastructure, oil, gas and mining, information communication technology/digital and shared services sectors. The strategy includes cross-agency participation in initiatives that involve the Ministry of Business, Innovation and Employment, the MFAT, the Ministry for Primary Industries, NZTE, Immigration NZ and the New Zealand Treasury.

- New Zealand's Overseas Investment Office is responsible for administering the government's overseas investment policies and processing applications from overseas persons intending to invest in sensitive New Zealand assets, such as 'sensitive land' and 'significant business assets'. Both terms are defined in the Overseas Investment Act 2005.

- New Zealand has signed bilateral investment treaties with Argentina (August 1999), Chile (July 1999), Mainland China (November 1988) and Hong Kong (July 1995). Only the treaties with Mainland China and Hong Kong have entered into force.

- The Overseas Investment Amendment Act 2018 prevents overseas people from buying residential property in New Zealand but provides exceptions for Australian and Singaporean citizens. Anyone who is not a New Zealand citizen or is not ‘ordinarily resident’ in New Zealand, is an overseas person.

Sources: WTO – Trade Policy Review, the International Trade Administration, US Department of Commerce, NZTE, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Free trade zones |

New Zealand does not have any foreign trade zones or duty-free ports. The government, through its bodies such as Tourism New Zealand and the New Zealand Trade and Enterprise, provides assistance in certain sectors, such as tourism and the export of locally manufactured goods. |

|

Sector incentives |

New Zealand has various incentives that are sector dependent. |

Source: Fitch Solutions

- Goods and Services Tax: 15%

- Corporate Income Tax: 28%

Source: Inland Revenue Department New Zealand

Important Updates To Taxation Information

- In December 2018 it was announced that the government would apply GST to low-value goods located outside of New Zealand at the time of supply and delivered to a New Zealand address. Businesses making more than NZD60,000 of taxable supplies to New Zealand per year are required to register for New Zealand GST and remit GST of 15% on the sale of low-value goods. The changes come into effect on December 1, 2019.

- In May 2019, the government enacted the R&D Tax Credits Act which introduces a 15% tax credit on eligible R&D expenditure.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax (CIT) |

28% |

|

Capital Gains Tax (CGT) |

0% |

|

GST |

15% |

|

Branch Tax Rate |

28% |

|

Withholding Taxes |

Non-residents: |

Sources: Inland Revenue Department New Zealand, Fitch Solutions

Date last reviewed: May 1, 2020

Localisation Requirements

New Zealand residents and citizens should be considered for vacant roles before hiring individuals from overseas. Employers must provide evidence that no suitably qualified New Zealanders can perform the job offered to the foreign applicant. Exceptions exist for employers who are accredited with Immigration New Zealand and for some work visa categories, such as specific purpose work visas, essential skills work visas and work to resident talent (accredited employer) visas. Entrepreneurs and investors are eligible for special visas on a case-by-case basis.

Regional Exemptions

Citizens and permanent residents of Australia usually do not require a work permit, but the state has the right to request work visas in certain cases.

Visa/Travel Restrictions

In general, all visitors to New Zealand must apply for a visa to enter the country. However, some visitors and transit passengers can travel to New Zealand without a visa if they get an NZeTA (New Zealand Electronic Travel Authority) before they travel. Australian citizens and individuals who hold a current Australian permanent residence visa or a resident return visa do not need to formally apply for a New Zealand visa to enter the country. United Kingdom passport holders who produce evidence of the right to reside permanently in the United Kingdom can be granted a visitor visa for up to six months on arrival in New Zealand. Individuals from certain jurisdictions, including Hong Kong and Singapore, who will be in New Zealand for less than three months as a visitor, do not need to apply for a visa before travelling to New Zealand.

Sources: Immigration New Zealand, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Aaa (Stable) |

02/04/2020 |

|

Standard & Poor's |

AA (Positive) |

31/01/2019 |

|

Fitch Ratings |

AA (Positive) |

22/01/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

1/190 |

1/190 |

1/190 |

|

Ease of Paying Taxes Index |

9/190 |

10/190 |

9/190 |

|

Logistics Performance Index |

15/160 |

N/A |

N/A |

|

Corruption Perception Index |

2/180 |

1/180 |

N/A |

|

IMD World Competitiveness |

23/63 |

21/63 |

N/A |

Sources: World Bank, IMD, Transparency International

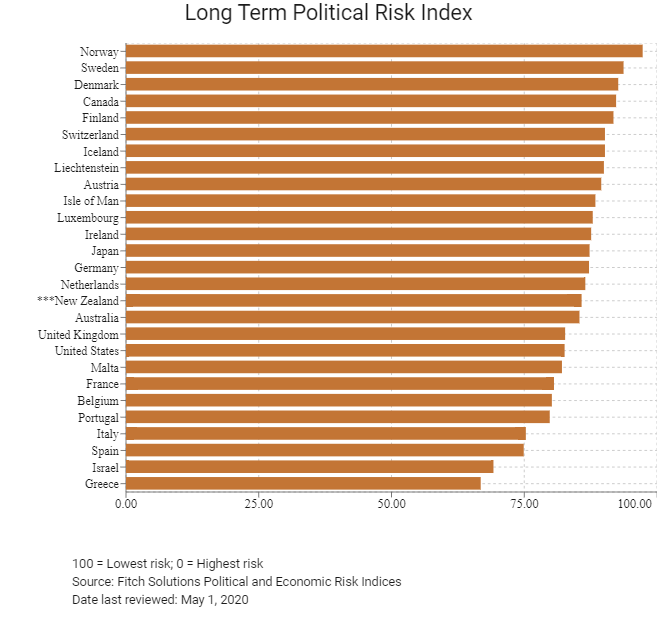

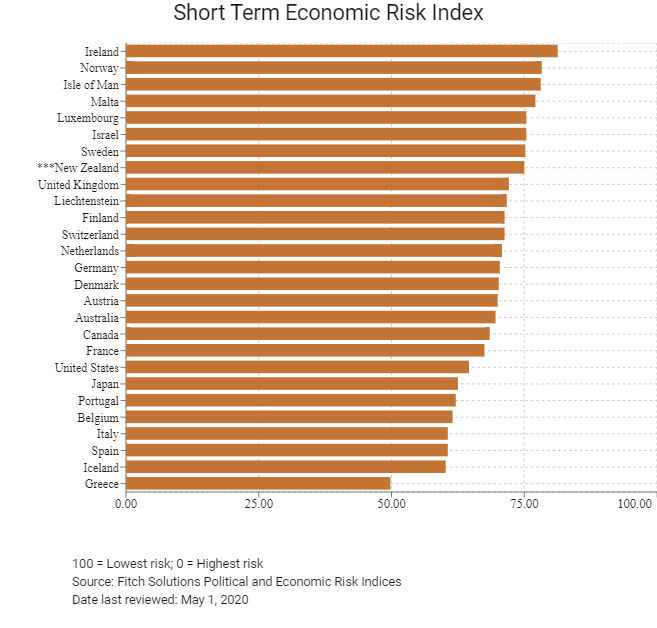

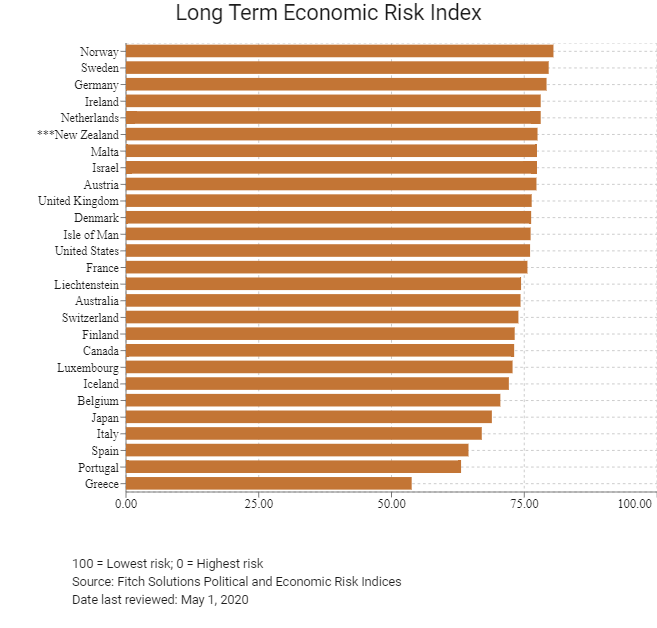

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

6/202 |

11/201 |

8/201 |

|

Short-Term Economic Risk Score |

71.7 |

74.2 |

75.0 |

|

Long-Term Economic Risk Score |

77.8 |

77.5 |

77.5 |

|

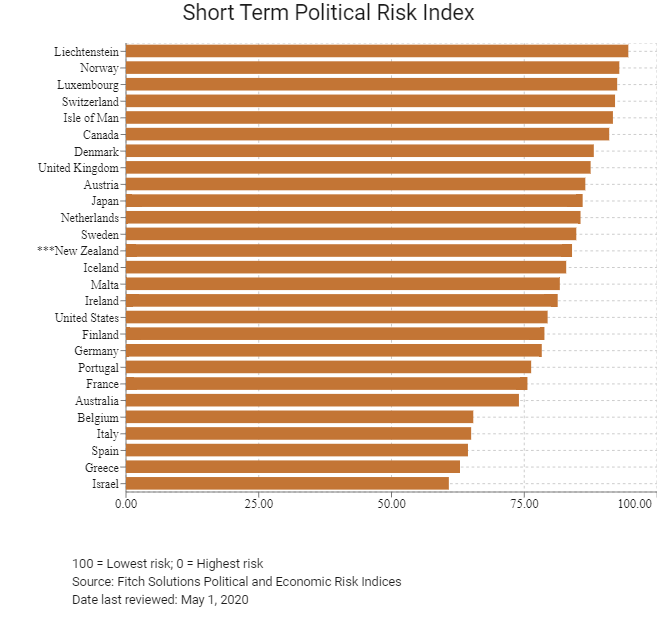

Political Risk Index Rank |

19/202 |

18/201 |

17/201 |

|

Short-Term Political Risk Score |

82.7 |

84.0 |

84.0 |

|

Long-Term Political Risk Score |

85.8 |

85.8 |

85.8 |

|

Operational Risk Index Rank |

7/201 |

8/201 |

8/201 |

|

Operational Risk Score |

77.5 |

77.6 |

76.9 |

Source: Fitch Solutions

Date last reviewed: May 1, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The New Zealand economy is boosted by the country's low unemployment and strong fiscal health. Nevertheless, there appears to be growing dependence on its dairy exports to Mainland China, as well as a reliance on external financing, and the economy faces downside risks due to a still precarious property market. New Zealand's reliance on agricultural and forestry exports makes it vulnerable to swings in export prices and adverse weather conditions. There are also significant downside risks to the economy amid the Covid-19 pandemic. We believe that household spending is likely to slow over the coming months as consumers refrain from patronising brick-and-mortar retail stores and entertainment outlets, and cut back on social gatherings. Additionally, we expect businesses to cut back on capital spending and investment amid the uncertain economic outlook. That said, we expect the combination of monetary and fiscal stimulus to lend support to the domestic economy and prevent an economic contraction from occurring in 2020.

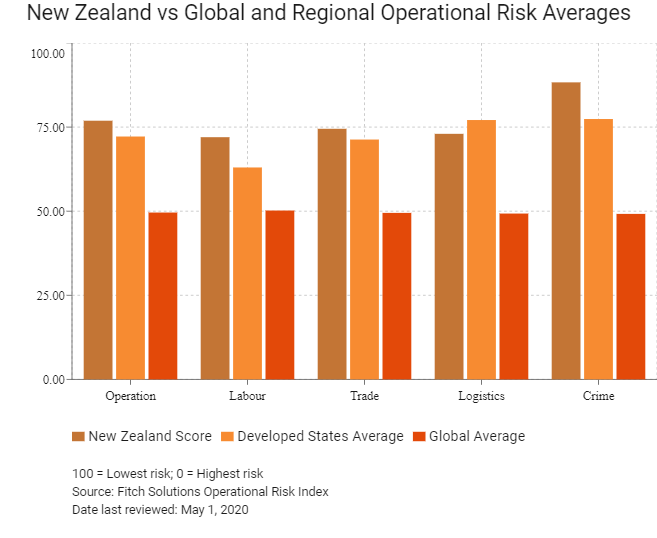

OPERATIONAL RISK

New Zealand offers one of the most favourable business environments globally owing to the country’s low operational risks. Factors that boost New Zealand’s attractiveness as an investment destination include a highly skilled labour force, a highly developed logistics network, an open economy with few financial and trade barriers, together with a robust law enforcement apparatus that ensures a relatively crime-free environment. The government has also promised to boost spending in developing infrastructure, with additional opportunities via public-private partnerships. However, New Zealand faces strong competition from neighbouring Australia and the small size of its local market makes it difficult to capture economies of scale in manufacturing.

Source: Fitch Solutions

Date last reviewed: May 3, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

New Zealand Score |

76.9 |

72.0 |

74.5 |

73.0 |

88.3 |

|

Developed States Average |

72.2 |

63.0 |

71.3 |

77.1 |

77.4 |

|

Developed States Position (out of 27) |

6 |

4 |

9 |

19 |

1 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

8 |

7 |

17 |

29 |

1 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Denmark |

79.5 |

70.5 |

76.6 |

88.5 |

82.3 |

|

Switzerland |

78.4 |

74.4 |

76.9 |

79.3 |

83.2 |

|

Netherlands |

78.3 |

65.4 |

78.2 |

88.8 |

80.7 |

|

United States |

77.7 |

79.7 |

75.8 |

85.9 |

69.3 |

|

Sweden |

77.3 |

66.8 |

76.9 |

86.7 |

78.6 |

|

New Zealand |

76.9 |

72.0 |

74.5 |

73.0 |

88.3 |

|

Canada |

76.2 |

73.6 |

74.4 |

75.1 |

81.6 |

|

United Kingdom |

76.1 |

70.2 |

77.9 |

78.3 |

78.2 |

|

Norway |

76.0 |

63.8 |

71.1 |

81.2 |

87.9 |

|

Austria |

74.8 |

61.9 |

72.1 |

83.6 |

81.5 |

|

Finland |

73.9 |

54.9 |

72.2 |

84.7 |

83.7 |

|

Ireland |

73.5 |

66.6 |

78.1 |

70.4 |

79.0 |

|

Luxembourg |

73.4 |

54.3 |

77.6 |

82.5 |

79.3 |

|

Australia |

72.4 |

68.7 |

72.5 |

68.4 |

79.9 |

|

Germany |

72.1 |

66.2 |

67.9 |

80.8 |

73.6 |

|

Spain |

71.9 |

61.0 |

70.0 |

80.6 |

76.0 |

|

France |

71.5 |

60.7 |

70.1 |

82.6 |

72.8 |

|

Belgium |

71.4 |

57.0 |

75.1 |

82.3 |

71.1 |

|

Iceland |

71.4 |

59.8 |

67.6 |

70.0 |

88.1 |

|

Japan |

71.2 |

69.9 |

65.9 |

77.5 |

71.5 |

|

Portugal |

70.0 |

52.5 |

67.4 |

81.7 |

78.4 |

|

Israel |

67.9 |

71.3 |

67.3 |

70.2 |

62.7 |

|

Malta |

64.9 |

54.3 |

68.6 |

63.0 |

73.7 |

|

Isle of Man |

64.4 |

49.9 |

68.6 |

56.6 |

82.4 |

|

Italy |

63.8 |

55.1 |

59.8 |

76.2 |

64.3 |

|

Liechtenstein |

63.1 |

47.0 |

57.1 |

65.1 |

83.2 |

|

Greece |

57.9 |

53.2 |

48.9 |

69.9 |

59.6 |

|

Regional Averages |

72.2 |

63.0 |

71.3 |

77.1 |

77.4 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 1, 2020

Hong Kong’s Trade with New Zealand

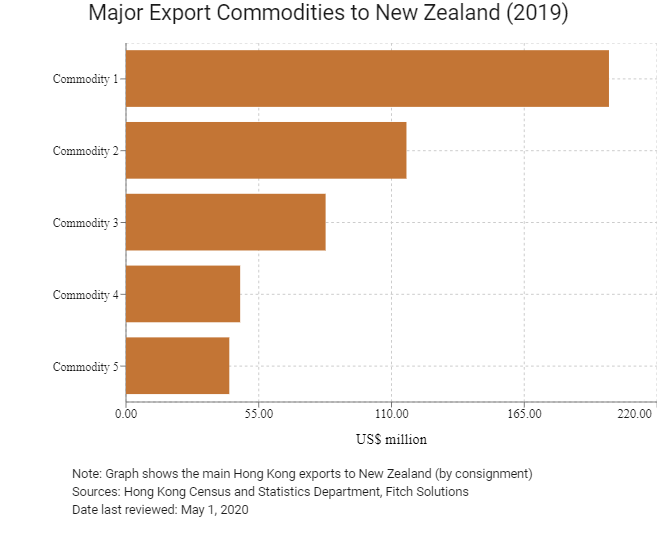

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 200.1 |

| Commodity 2 | Power generating machinery and equipment | 116.2 |

| Commodity 3 | Office machines and automatic data processing machines | 82.7 |

| Commodity 4 | Miscellaneous manufactured articles | 47.3 |

| Commodity 5 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 42.8 |

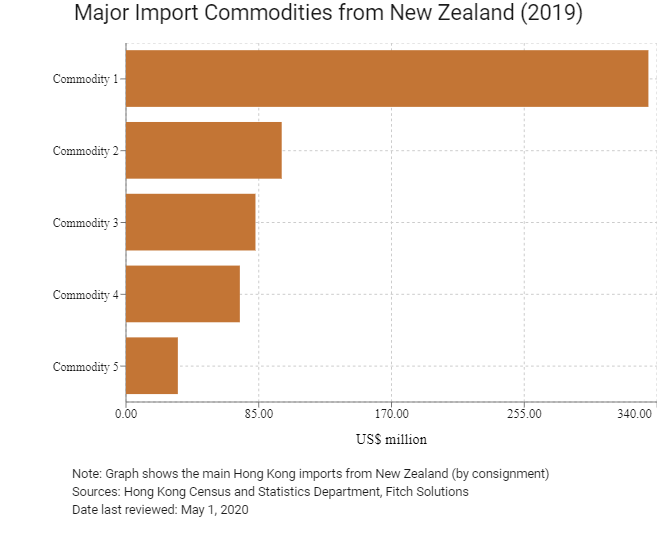

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Dairy products and birds' eggs | 334.5 |

| Commodity 2 | Vegetables and fruit | 99.7 |

| Commodity 3 | Power generating machinery and equipment | 82.9 |

| Commodity 4 | Meat and meat preparations | 72.9 |

| Commodity 5 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 33.2 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of New Zealand citizens residing in Hong Kong |

2,911 |

29.6 |

|

Number of developed state citizens residing in Hong Kong |

83,786 |

29.6 |

Note: Growth rate is from 2015 to 2019. No UN data available for intermediate years.

Source: United Nations Department Of Economic And Socal Affairs – Population Division

|

2019 |

Growth rate (%) |

|

|

Number of New Zealand residents visiting Hong Kong |

92,422 |

-15.7 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Source: Hong Kong Tourism Board

Date last reviewed: May 1, 2020

Commercial Presence in Hong Kong

|

2020 |

Growth rate (%) |

|

|

Number of New Zealand companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and agreements between Hong Kong and New Zealand

- New Zealand has bilateral investment treaties (BITs) with mainland China (which entered into force on March 25, 1989) and Hong Kong (which entered into force on August 5, 1995) and these are the only BITs which the countries has that have entered into force. Besides these treaties, the country has concluded a number of economic agreements that contain provisions on investment.

- A new double taxation agreement (DTA) between New Zealand and Mainland China was signed on April 1, 2019, replacing the 1986 agreement. The earliest date for the new DTA to enter into force is January 1, 2020.

New Zealand and Hong Kong entered into a DTA which came into effect on April 1, 2012. An update to the existing DTA between New Zealand and Hong Kong was signed in June 2017. The new protocol allows automatic and spontaneous exchanges of tax information. The amendment entered into force on August 9, 2018.

Sources: Hong Kong Inland Revenue Department, OECD, Fitch Solutions

Chamber of Commerce or Related Organisations

The New Zealand Chamber of Commerce in Hong Kong

Address: 801 Winning House, 10-16 Cochrane Street, Central, Hong Kong

Email: exec.officer@nzcchk.com

Tel: (852) 5931 8841

Source: New Zealand Chamber of Commerce in Hong Kong

Hong Kong New Zealand Business Association

Email: hk@hongkong.org.nz

Tel: (649) 307 1216

Fax: (649) 309 1198

Website: www.hongkong.org.nz

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

New Zealand Consulate General in Hong Kong

Address: 6501, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong

Email: nzcghkg@biznetvigator.com

Tel: (852) 2525 5044

Fax: (852) 2845 2915

Visa Requirements for Hong Kong Residents

HKSAR passport holders have visa-free access to New Zealand for short-term visits of up to three months.

Source: New Zealand Ministry of Foreign Affairs and Trade

Date last reviewed: May 1, 2020

New Zealand

New Zealand