GDP (US$ Billion)

68.67 (2018)

World Ranking 73/193

GDP Per Capita (US$)

1,300 (2018)

World Ranking 162/192

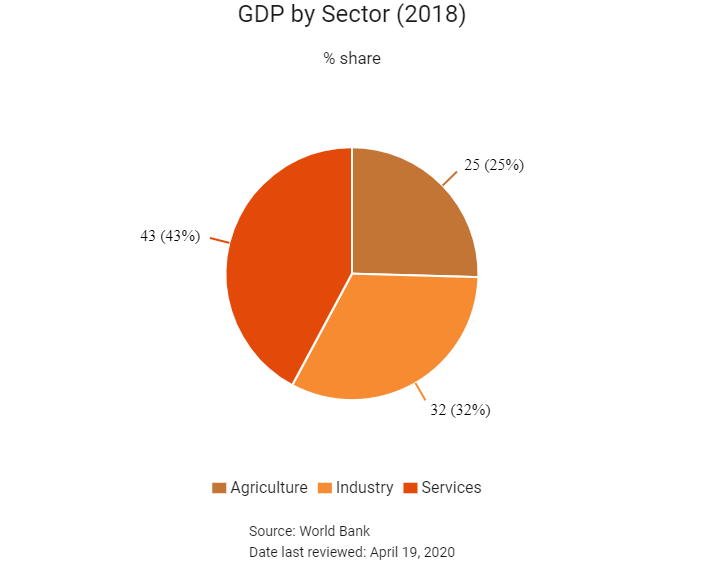

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

60.7 (2018)

Currency (Period Average)

Burmese Kyat

1518.26per US$ (2019)

Political System

Constitutional republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Myanmar is a low-middle income country, and the economy is supported by abundant natural resources and commodities. Its largest export is natural gas, which provides an important revenue stream. Myanmar is currently in a democratic transition: the government has launched new economic policies, finalised new health and education sector strategies, and adopted new priorities – such as nutrition and rural development. However, there remain some challenges to achieving sustainable and inclusive income growth, as well as maintaining stability in the restive regions of the country.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

November 2015

The Opposition National League for Democracy – led by Aung San Suu Kyi – won enough seats in parliament to form a government.

April 2017

Myanmar held scheduled by-elections to fill 19 parliamentary seats.

March 2018

President Htin Kyaw resigned on health grounds and was replaced by Win Myint, a fellow Suu Kyi loyalist.

October 2018

The Japan International Cooperation Agency signed a grant agreement with the government of Myanmar, providing a grant of up to JPY6.03 billion (USD52.96 million) for upgrading Mandalay Port. The project was aimed at developing the port by constructing berthing facilities and a terminal, as well as the mechanisation of cargo handling facilities. The Ministry of Transport and Communications would execute the project.

August 2019

Korea Land and Housing Corporation (LH) signed a memorandum of understanding (MoU) for setting up a joint venture (JV) with the Urban and Housing Development Department and Global Sae-A Co for the construction of an industrial complex in Naypyitaw, Myanmar. Dubbed Korea Myanmar Industrial Complex, the project would be built over 2.24sq km in Nyaungnapin. To be implemented by the JV, the project would entail an investment of KRW130 billion (USD107.4 million). LH and the Myanmar government would hold a 40% interest each in the JV, while the remaining 20% would be held by Global Sae-A. Construction was likely to start in 2020.

November 2019

Groundbreaking of Toyota Myanmar Co took place on its new plant at the Thilawa Special Economic Zone (SEZ) in Yangon, Myanmar. The USD52.6 million manufacturing facility would manufacture 2,500 Toyota Hilux pickup trucks annually using the semi knock-down method. The facility was expected to be commissioned in August 2020, with production to start from February 2021.

November 2019

The Asian Development Bank (ADB) sanctioned a USD51. 2 million financing package for the Rural Roads and Access Project in Myanmar. The scheme involved the modernisation of around 152km of rural roads across 150 villages in the Ayeyarwady and Magway regions with paved surface and climate-resilient features. The ADB was providing a USD45.4 million loan and a USD5.8 million grant from the Asian Development Fund for the project. The scheme, which would also receive USD1.21 million from the Government of Myanmar, was likely to be completed by the end of 2025.

December 2019

A consortium of Myanmarese and Japanese firms reported plans to build a liquefied natural gas (LNG) terminal and a gas power plant at the Thilawa SEZ in Myanmar. The consortium, which included Myanmar Agribusiness Public Corporation, Eden Group, Marubeni Corporation and Mitsui & Co, would implement the USD2.billion project under a 25-year build, operate and transfer mode. The power plant would have a capacity of 1.25GW, and the LNG terminal was expected to facilitate the production of electricity on floating units. The power plant would use LNG from Singapore, Malaysia and Indonesia. Construction was expected begin in March 2020 and was likely to be completed in 30 months.

January 2020

Work on an industrial park project in Yangon, was due to start in March 2020, according to Myanmar Times. The MMK338.7 billion (USD231 million) project would be executed by a partnership between Sembcrop CSSD Myanmar (67%), City Mart Holding (18%) and Myanmar Agribusiness Public Corporation (15%). The development, spanning 5.98sq km in Hlegu, would include general factories, food factories and warehouses. An access road to Thilawa Port via the Yangon-Mandalay Road for the transportation of goods would also be built as part of the project.

February 2020

Myanmar's Urban and Housing Development Department and Amata Asia signed a joint venture (JV) agreement to develop the USD1 billion Yangon Amata Smart and Eco City project. The JV was 80% owned by Amata. The JV had also signed a 70-year land lease agreement with the Yangon regional government to develop the project over 8sq km area near Laydaungkan village, between South Dagon and East Dagon townships. The feasibility study for the project had already been completed and had permit from the Myanmar Investment Commission (MIC). The project envisaged development of an industrial site on 75% of the land and the rest would accommodate commercial and housing facilities. A 600MW power plant, costing between USD500 million and USD600 million, would also be built, together with Thailand's state-owned energy company PTT. The city was expected to house up to 150 factories, with construction of first factory likely to start by Q320 and became operational by 2021.

February 2020

Myanmar's Ministry of Construction issued a request for proposal to 10 pre-qualified bidders for the first phase of the 47.5km Yangon Elevated Expressway. The USD800 million public-private partnership project involved the design, engineering, financing, construction, operation and maintenance of a 27km four-lane elevated toll road in Yangon. The road would link Yangon's central business district with the Yangon Industrial Park while providing a link to Yangon International Airport. The bidders, which included VINCI Highways, China Communication Construction Company, Team Korea Construction and a joint venture between JFE Engineering and Marubeni Corporation, had to submit financial and technical bids for the project by March 31, 2020. A contract was planned to be awarded in May, with preparatory works due to start in June. Construction is slated to be completed in 42 months.

March 2020

Suzuki Motor planned to invest JPY12 billion (USD108.8 million) in the expansion of its automobile plant in Myanmar, according to a press release from the firm. The expansion, which would cover an area of 200,000sq m, involved construction of a new plant for the welding, painting and assembly of automobiles. The facility, to be located at the Thilawa SEZ, would increase the plant's building area from 4,000sq m to 42,000sq m and annual production capacity from 10,000 to 40,000 units. It would be operated by the firm's subsidiary Suzuki Thilawa Motor Co. Construction was planned to start on March 25 and the facility is scheduled to become operational in September 2021.

April 2020

The Japan International Cooperation Agency (JICA) signed a JPY7.34 billion (USD68 million) loan deal with the government of Myanmar for upgrading a thermal power plant. The project involved installing combined cycle facilities at the 50MW Thilawa Thermal Power Plant in the Thilawa SEZ. The project would be executed by Electric Power Generation Enterprise. A tender for the procurement and installation of combined cycle facilities was planned to be opened in January 2021 and the project is due to be commissioned in May 2024.

April 2020

Income and commercial tax payments due in the second and third quarters of the 2020 fiscal year were extend to end of the fiscal year, and an exemption for the 2% advance income tax (AIT) on exports to the end of the fiscal year was announced. A Covid-19 Fund worth MMK100 billion (USD70 million, 0.1% of GDP) had been established at the Myanmar Economic Bank to provide soft loans to affected business (particularly the priority garment and tourism sectors and SMEs) at reduced interest rates. The Ministry of Hotels and Tourism announced that fee for renewal license of hotels and tourism businesses will be exempted for one year up to end of March 2021.

November 2020

General elections will be held.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

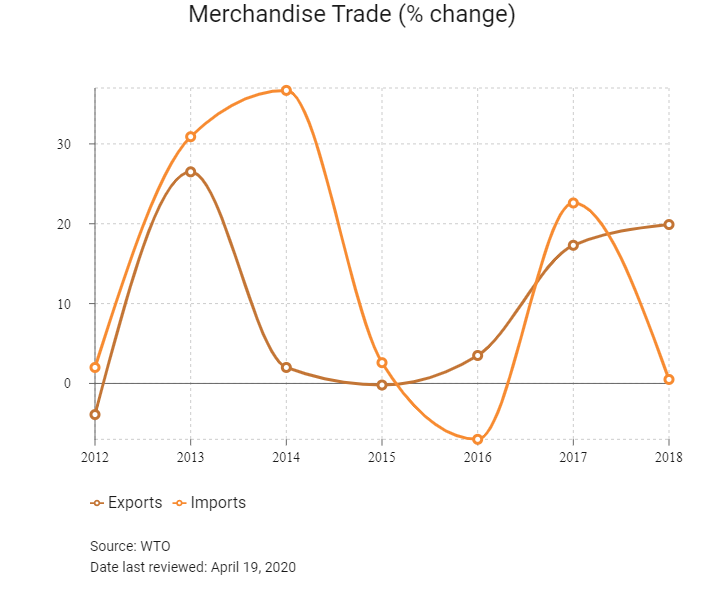

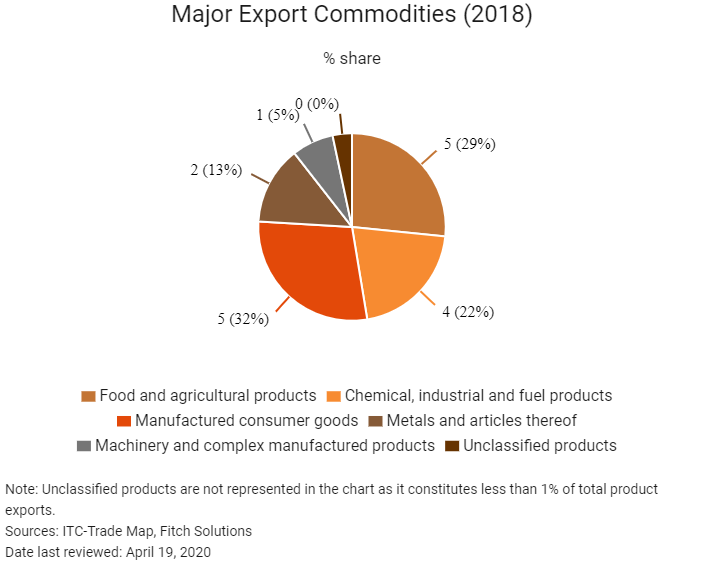

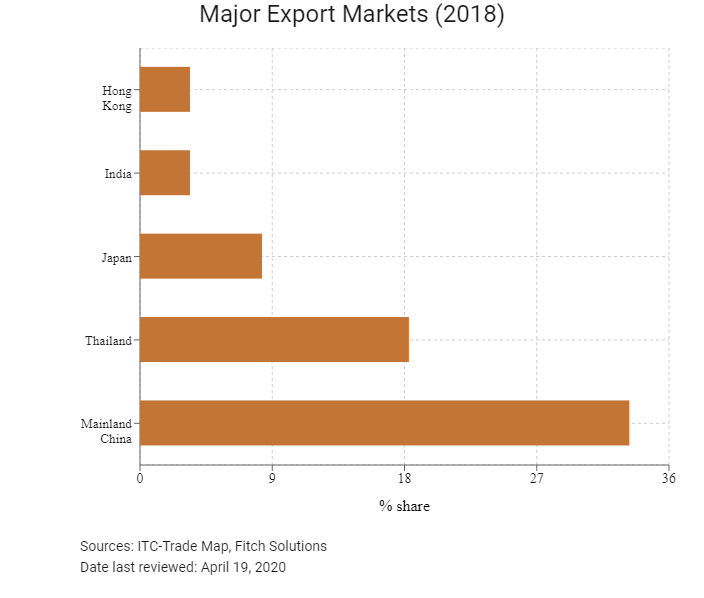

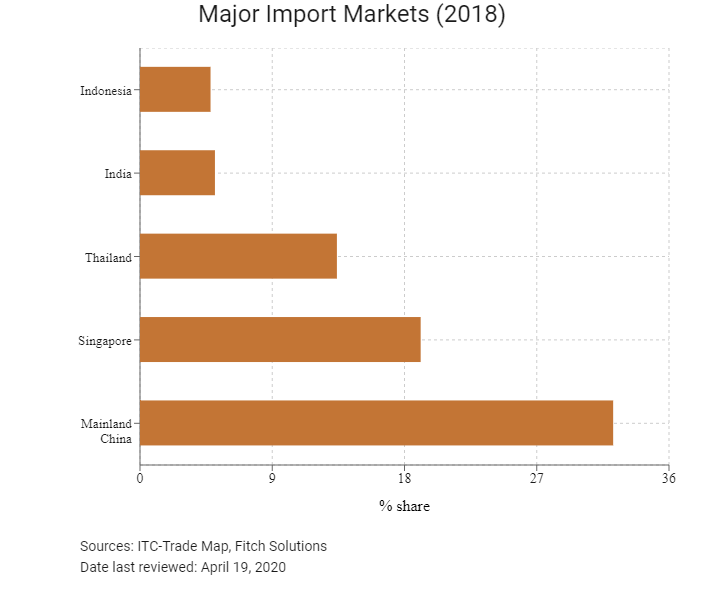

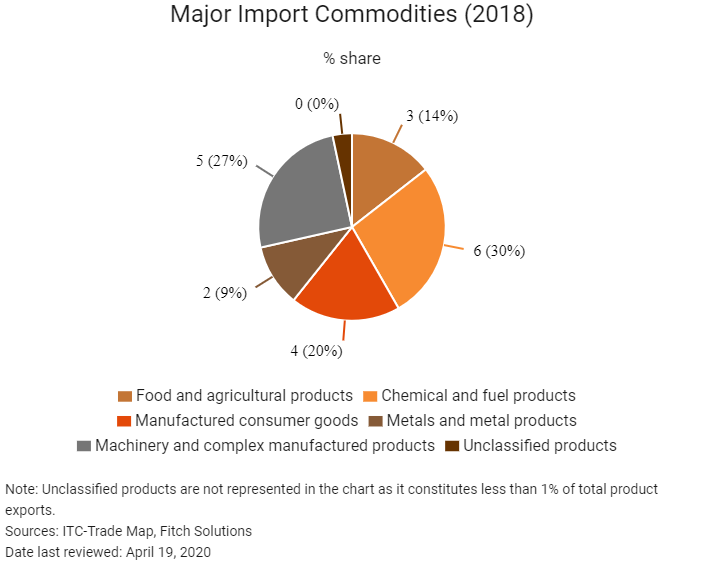

Merchandise Trade

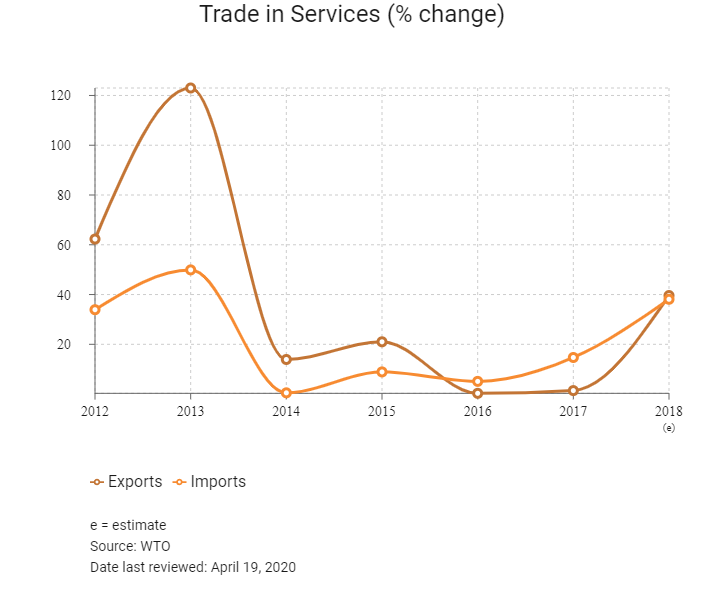

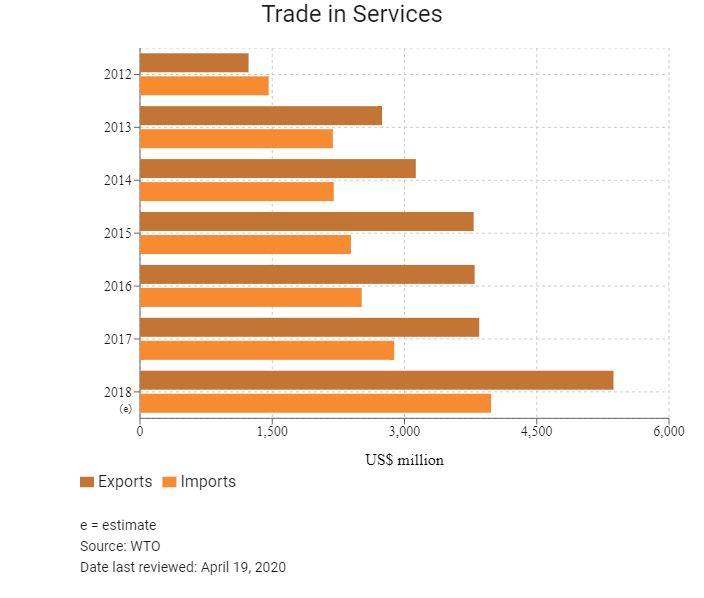

Trade in Services

- Myanmar has been a member of the World Trade Organization (WTO) since January 1, 1995.

- Customs duty is levied under the Customs Tariff of Myanmar (2017) at rates of up to 40%. Companies registered under the MIC/SEZ may, at the discretion of the MIC or SEZ committee, be granted exemption from customs duties during certain stipulated periods.

- Myanmar is a member of the ASEAN Free Trade Area (AFTA) and has committed to the Common Effective Preferential Tariff Scheme to reduce intra-ASEAN import tariffs for 100% of the total tariff. Myanmar has been a member of ASEAN since July 23, 1997.

- In line with Myanmar's increasing openness to trade and the continued formalisation of its economy, numerous trade barriers have been removed and are expected to continue falling over the medium term. In particular, a dual exchange rate that caused complications for businesses been abolished in 2012, when the Central Bank of Myanmar introduced a managed floating exchange rate which has eased foreign currency controls and improved access to dollars for importers.

- Myanmar, in its obligations to its fellow AFTA members, aims to abolish all import tariffs affecting regional peers. By 2015, 93% of all tariffs affecting AFTA members were eliminated by notification no. 222/2013.

- Commercial tax is charged at a general rate of 5% on the sale of most goods and services although this varies.

- Certain commodities follow a Myanmar-specific customs schedule. Often, the schedule prices commodities in local currency and in terms of their price locally and, therefore, price or tax disparities may favour or disadvantage traders.

- The Myanmar government lifted its ban on the exportation of raw teak and timber from state and privately-owned plantations, but a ban on raw teak and timber from natural forests will remain in place.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

In January 2019, the European Union (EU) implemented tariffs on indica rice imported from Myanmar. These tariffs will be reduced over a three-year period, starting at an estimated USD199 per tonne before being reduced to USD142 per tonne by the final year.

Multinational Trade Agreements

Active

- ASEAN: The AFTA is a trade bloc agreement supporting local manufacturing in all ASEAN countries. Myanmar benefits from increased regional integration and tariff liberalisation that includes the elimination of import duties in various sectors and classes of goods. These factors will help reduce input costs for businesses and increase the country's exporting capacity and industrial base in the long term. As a member of ASEAN, Myanmar's economy is open to other significant trade agreements with key regional markets, such as Mainland China and India.

- ASEAN-Mainalnd China FTA (ACFTA): The Framework Agreement on Comprehensive Economic Cooperation between ASEAN and Mainland China – signed on November 5, 2002 – marked ASEAN's first free trade agreement (FTA) with a dialogue partner. Trade relations between Myanmar and Mainland China benefit from trade preference in terms of tariff exemption or reduction under ACFTA.

- ASEAN-Japan FTA (AJFTA): The Framework for Comprehensive Economic Partnership between ASEAN and Japan was signed by leaders at the ASEAN-Japan Summit on October 8, 2003 and was aimed at establishing a comprehensive economic partnership agreement between ASEAN and Japan. The ASEAN-Japan Comprehensive Economic Partnership Agreement was concluded in November 2007 and signed on April 14, 2008. The agreement aims to liberalise and facilitate trade in goods between ASEAN and Japan and to promote cooperation in fields such as information and communications technology, intellectual property and small- and medium-sized enterprises development. Trade relations between Myanmar and Japan benefit from trade preference in terms of tariff exemption or reduction under the AJFTA.

- ASEAN-South Korea FTA (AKFTA): ASEAN and South Korea consolidated their partnership by signing the Framework Agreement on Comprehensive Economic Cooperation at the ninth ASEAN-South Korea Summit on December 13, 2005, which provides for the establishment of the AKFTA. Under this framework, three major agreements on trade in goods, trade in services, and investment were subsequently signed on August 24, 2006; November 20, 2007; and June 2, 2009. The agreement provides for a progressive reduction and elimination of tariffs by each country on almost all products. Myanmar benefits from trade preference in terms of tariff exemption or reduction under this agreement. South Korea is a top trade partner and the removal of tariffs benefits both exporters and importers.

- ASEAN-India FTA (AIFTA): The ASEAN-India Trade in Goods Agreement (TIG) was signed at the seventh ASEAN Economic Ministers-India Consultations on August 13, 2009. The agreement came into force on January 1, 2010 for India and some ASEAN member states. The ASEAN-India Trade in Services and Investment Agreements were signed in November 2014. Myanmar benefits from trade preference in terms of tariff exemption or reduction under the AIFTA. This will help Myanmar in terms of trade growth and diversification given the size and performance of the Indian economy and other ASEAN member states.

- The EU Everything But Arms Agreement: EU states are not major trade partners with Myanmar, but duty free access to the EU market will be beneficial for exporters and facilitate the expansion of trade flows.

- The ASEAN-Australia-New Zealand FTA (AANZFTA): Signed on February 27, 2009, is ASEAN's first FTA with two developed countries simultaneously, and the first ASEAN FTA done in a single undertaking. AANZFTA represents ASEAN's most ambitious FTA to date, covering 18 chapters, including new areas that ASEAN had previously never negotiated on, such as competition policy and intellectual property. The AANZFTA also includes an AANZFTA Economic Cooperation Support Programme, which will provide technical assistance and capacity building to the parties of the agreement with the aim of supporting the implementation of it as well as to support the overall regional economic integration process. The agreement came into force for all parties in 2012, and work is currently underway to resolve and implement the built-in agenda as stipulated under the agreement. The agreement aims to eliminate tariffs on 99% of exports to key ASEAN markets by 2020.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and ASEAN commenced negotiations of an FTA and an investment agreement in July 2014. After 10 rounds of negotiations, Hong Kong and ASEAN announced the conclusion of the negotiations in September 2017 and signed the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods, trade in services, investments, economic and technical cooperation, dispute settlement mechanisms, and other related areas. The agreements will bring legal certainty, better market access, and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flows between Hong Kong and ASEAN. The agreements will also extend Hong Kong's FTA and investment agreement network to cover all major economies in South East Asia. The agreement came into effect on June 11, 2019 for Vietnam, Laos, Myanmar, Singapore and Thailand, but it will take time for all members of ASEAN to comply as implementation is subject to completion of the necessary procedures. Hong Kong is a key export market, and the reduction of tariffs will ease the trading process. Hong Kong's potential as a key export market increases the importance of AHKFTA.

Under Negotiation

Regional Comprehensive Economic Partnership (RCEP): Negotiations on a framework agreement for the RCEP have stalled after India announced its withdrawal from the trade pact at a RCEP summit held in Bangkok in November 2019. Expectations had been for negotiations to conclude in 2019, paving the way for the agreement to enter force by late 2020. RCEP negotiations without India may now be concluded in 2020, but the withdrawal of India represents a setback to attempts to counter the growing wave of protectionism in the United States and other parts of the world. RCEP will have broader and deeper engagement with significant improvements over existing regional FTAs and agreement will need to be reached on politically sensitive issues, including trade in services, investment rules and protection for intellectual property rights, as well as tariffs, where the target is to remove trade barriers on at least 92% of products within ten years. Formally launched in 2012, RCEP is a Mainland China and ASEAN-led project which, before the withdrawal of India, involved 16 countries, namely the 10 ASEAN countries and the ASEAN Free Trade Partners (Australia, Mainland China, India, Japan, South Korea and New Zealand). It would have been the world’s largest trade pact covering nearly half the world’s population, one third of global GDP and around 29% of global trade.

Sources: WTO Regional Trade Agreements database, Hong Kong Trade and Industry Department, Fitch Solutions

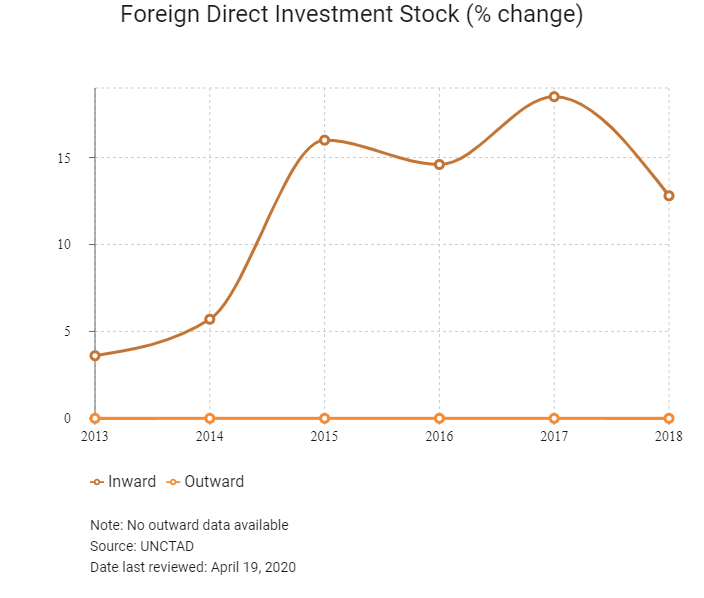

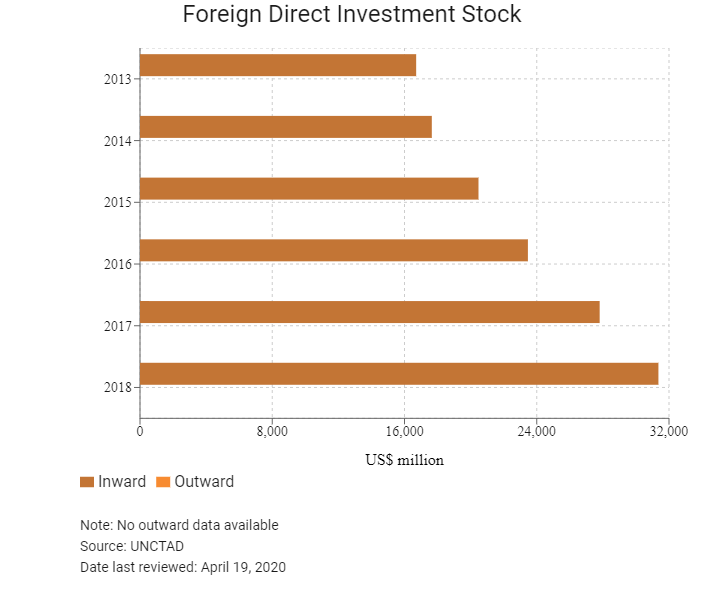

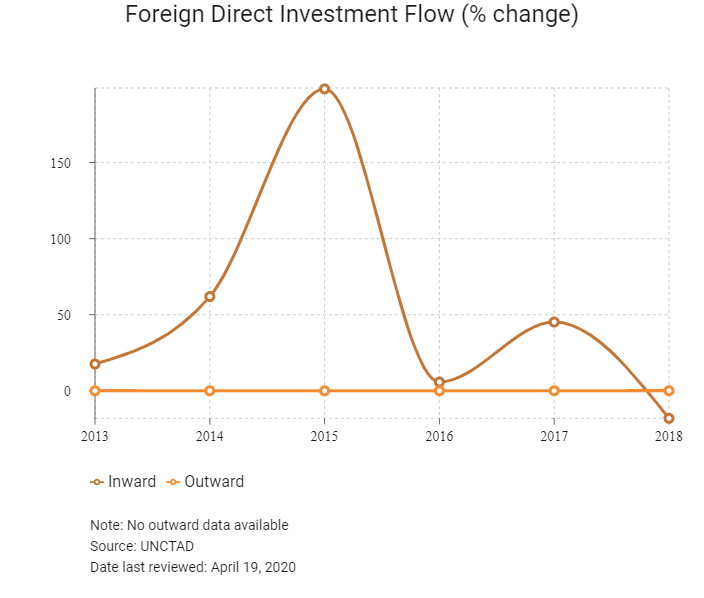

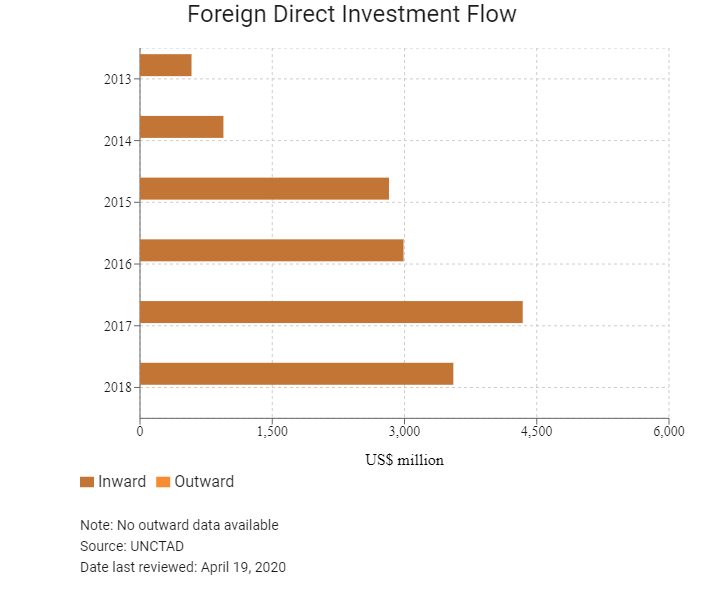

Foreign Direct Investment

Foreign Direct Investment Policy

- The MIC is responsible for investment into the country (providing verification and approval) and was established in 1994. Myanmar continues to publish a negative list of sectors that are not open to foreign involvement or reserved for state-owned enterprises. This restricts the ability of foreign firms to participate in some of the country's most lucrative industries, particularly resource extraction, banking and telecommunications. The MIC is responsible for reviewing and approving all foreign investment projects, a process which is subject to a high level of discretion.

- Through its membership in ASEAN, Myanmar is also party to the ASEAN Comprehensive Investment Agreement, which contains an investment chapter that provides protection standards to qualifying foreign investors.

- New foreign enterprises must have a workforce made up of at least 25% of Myanmar citizens in the first two years of operation. This figure rises to 50% in the subsequent two years and a further 75% by the third two-year period. The law also grants the MIC the power to extend the time limit to employ local workers for knowledge-based business.

- Myanmar's expropriation regime does not protect investors against indirect expropriation and there is no specific provision in Myanmar's legislation against expropriation without compensation.

- Foreign investors may register their companies under the Myanmar Companies Act (CA) or in conjunction with the Myanmar Investment Law (MIL) or Myanmar SEZ Law. New rules governing the implementation of the new MIL were enacted on March 30, 2017. Investment permits issued under the old investment laws continue to be valid.

- The differences between companies registered under the CA and the MIC or SEZ are in relation to their eligibility for tax incentives and longer land-use terms, as well as minimum foreign share capital requirements.

- Resident companies are taxed on a worldwide basis, and income from sources outside Myanmar is taxable. Non-resident companies are taxed only on income derived from sources within Myanmar.

- The new MIL 2016 was enacted in October 2016. The new MIL is a consolidation of the Myanmar Citizen Investment Law (2013) and the MFIL (2012). The Myanmar Citizen Investment Law and MFIL have been repealed with effect from October 18, 2016.

- Foreign investors may invest under the Myanmar SEZ Law of 2014. The main regulatory body handling foreign investment under the Myanmar SEZ Law is the Central Body for the Myanmar SEZ. The Myanmar SEZ Law contains provisions relating to the exempted zone, business promoted zone, other zone, exempted zone business, other business, developers and investors, exemptions and reliefs, restrictions, duties of developers or investors, land use, banks and finance management and insurance business, management and inspection of commodities by the customs department, quarantine, labour and guarantee of non-nationalisation, dispute resolution, among others.

- Investors seeking to register an entity under the SEZ need to obtain an investment permit from the relevant SEZ management committee.

- Under the Myanmar Investment Promotion Plan (MIPP) – unveiled on October 8, 2018 – the country is targeting more investment from fellow East Asian states. The MIPP replaces the Foreign Direct Investment (FDI) Promotion Plan (2014) and will prioritise export businesses, domestic import-substitution businesses as well as businesses involved in natural resources. Furthermore, discussions related to investment laws and procedures will be held regularly and efforts will be made to enact policies which will attract FDI as well as make the investment process easier.

-

According to the World Bank Ease of Doing Business 2020, Myanmar has strengthened the protections of minority investors by requiring greater disclosure of transactions with interested parties, increasing director liability and requiring greater corporate transparency.

Myanmar has 10 bilateral investment treaties (BITs) in place, which include investment flows to and from Mainland China, India, Japan, South Korea, Laos, the Philippines, Thailand, Israel, Vietnam, and, more recently in September 2019, Singapore.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, national sources, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Incentives under the Myanmar SEZ law are SEZs located at Thilawa (existing), Dawei and Kyaukpyu (the latter are under construction). |

- Income tax holidays for the first seven years. |

|

Income tax exemption for the first 7 years |

- Income tax exemption for the first seven years. |

|

Free zones and promotion zones |

- Income tax exemption for the first seven years. |

Sources: National sources, Thilawa SEZ Management Committee, Myanmar-Directorate of Investment and Company Registration, Fitch Solutions

- Specific Goods Tax: 5%

- Corporate Income Tax: 25%

Source: Internal Revenue Department

Important Updates to Taxation Information

- On September 24, 2019 Pyidaungsu Hluttaw (the Union Parliament) passed the Union Tax Law 2019 (UTL 2019) which came into effect on October 1, 2019. Under the UTL 2019, the special commodity list remains the same except the tax rates for various kinds of cigarettes and cheroots has been increased; and the tax rates and value tiers for various kinds of liquor have changed. Furthermore, sales income generated from exporting natural gas is no longer subject to special commodity tax. Previously, an 8% tax at was applicable.

- Under UTL 2019, gemstones are also now no longer subject to special commodity tax. Previously, special commodity tax was levied at the rate of 15% on uncut jades, 10% on other uncut gemstones (excluding diamonds and emeralds), and 5% on polished gemstones and gemstones embedded in jewelry (excluding diamonds and emeralds). In addition, gemstones are no longer subject to a 5% commercial tax.

- Tax Administration Law (TAL) 2019 was enacted on June 7, 2019 and will be effective from October 2019. TAL aims to provide a proper guide and simplification of the administrative procedures in relation to tax matters (covering income tax, commercial tax, specific goods tax, and other taxes that will be assigned to the Director General of the Internal Revenue Department) for all the taxpayers in Myanmar.

- Companies involved in imports and exports will be required to pay an advanced income tax (AIT) of 2% from May 1, 2019, according to Notification 38/2019 issued by the Ministry of Planning and Finance. This reverses a previous notification issued on January 22, 2018 exempting companies under the self-assessment system (SAS) from the 2% AIT. The new requirement will increase the tax burden on companies.

- The UTL 2018 was enacted on March 30, 2018; the provisions of the law have been effective from April 1, 2018. In particular, the law has introduced changes to the fiscal year end of taxpayers, commercial tax and specific goods tax regime.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

25% |

|

Capital Gains Tax |

Standard rate: 10% |

|

Commercial Tax |

Standard rate 5%, but can range from 0% to 8%, levied as a turnover tax on goods and services |

|

SGT |

Ranges from 5% to 60% |

|

Dividends (Withholding Tax) |

None |

|

Interest (Withholding Tax) |

- 0% on interest paid to residents of Myanmar |

|

Royalties (Withholding Tax) |

- 10% on interest paid to residents of Myanmar |

|

Social security contribution |

3% of an employee's wage (paid by employer); the maximum limit is MMK9,000 |

Source: Internal Revenue Department

Date last reviewed: April 19, 2020

Business Visa

The Business Visa is valid for 70 days. A Multiple Entry Business Visa can also be acquired if the individual has two single-entry business visas. A recommendation letter from the employer and an invitation letter from a registered companies are needed to apply for this visa.

Multiple Entry Business Visa (MEBV)

The allocation of this visa is determined on a case-by-case basis. The visa itself allows for unlimited entries during a period of three months, six months or one year. People with this visa may not be in the country for a single period longer than 70 days.

Stay Permit

This permit should be applied for in order to remove the 70 day limitation applied to both the MEBV and the Business Visa. Permit holders can stay in Myanmar for continuous stretches of three months, six months or one year. The Stay Permit is only valid for one entry into the country. Re-entering Myanmar requires another permit or employees will have to apply for a Multiple Journey Special Re-entry Visa. The Stay Permit falls under the auspices of Myanmar's Ministry of Immigration and Population.

Multiple Journey Special Re-entry Visa (MJSRV)

Individuals holding an MEBV may apply for a MJSRV. The visa acts as a combination of the Stay Permit and the MEBV and is valid for three months, six months, or a year. The MJSRV falls under the auspices of Myanmar's Ministry of Immigration and Population. The Stay Permit and the MJSRV have the same requirements although the MJSRV has a set of stricter additional requirements.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

Not rated |

Not rated |

|

Standard & Poor's |

Not rated |

Not rated |

|

Fitch Ratings |

Not rated |

Not rated |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

171/190 |

171/190 |

165/190 |

|

Ease of Paying Taxes Index |

125/190 |

126/190 |

129/190 |

|

Logistics Performance Index |

137/160 |

N/A |

N/A |

|

Corruption Perception Index |

132/180 |

130/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International

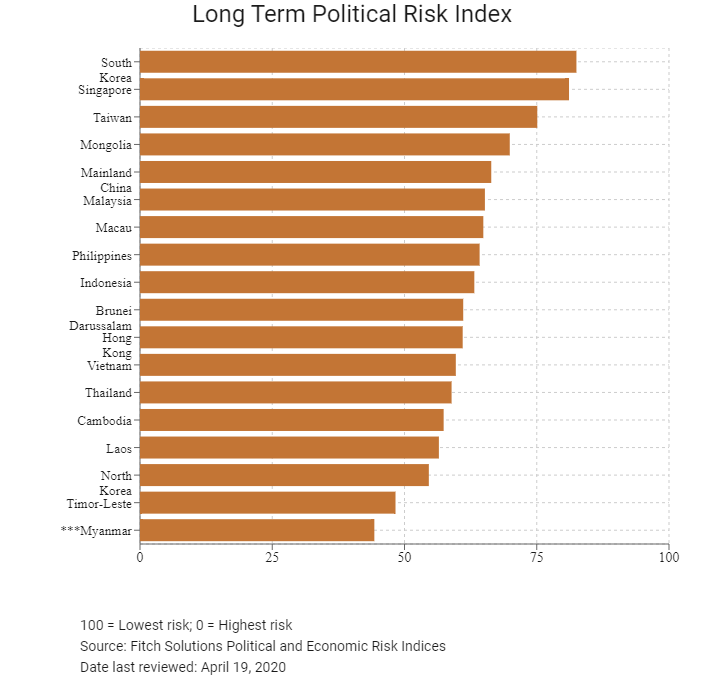

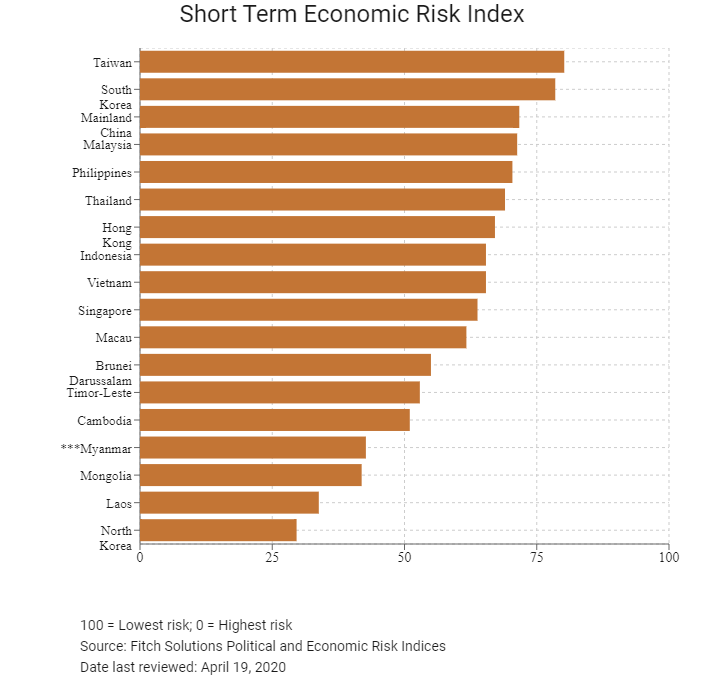

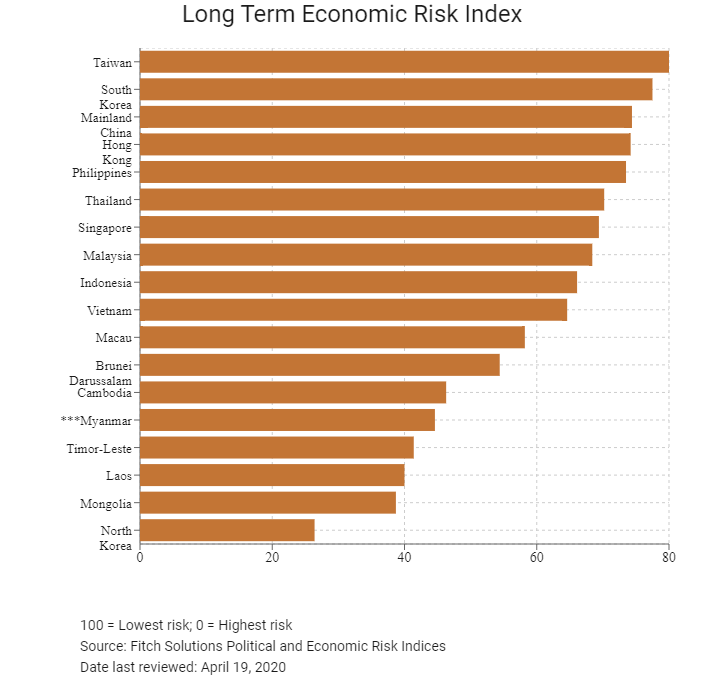

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

107/202 |

139/201 |

147/201 |

|

Short-Term Economic Risk Score |

51 |

42.3 |

42.7 |

|

Long-Term Economic Risk Score |

50.9 |

46.2 |

44.6 |

|

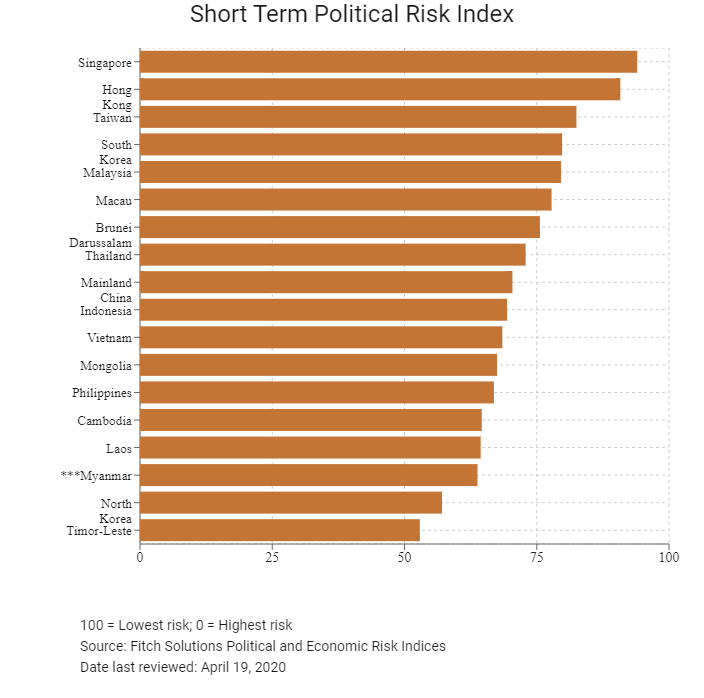

Political Risk Index |

175/202 |

173/201 |

173/201 |

|

Short-Term Political Risk Score |

57.9 |

57.9 |

57.1 |

|

Long-Term Political Risk Score |

44.3 |

44.3 |

44.3 |

|

Operational Risk Index |

174/201 |

177/201 |

165/201 |

|

Operational Risk Score |

32.1 |

30.3 |

33.1 |

Source: Fitch Solutions

Date last reviewed: April 19, 2020

Fitch Solutions Risk Summary

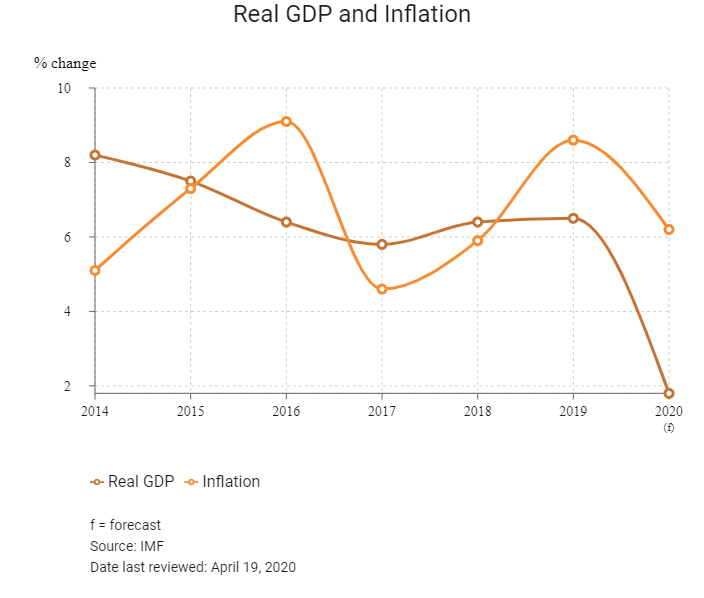

ECONOMIC RISK

Economic growth will likely accelerate in the near term, on greater infrastructure investment and robust manufacturing activity. Meanwhile, recent reform efforts will support greater inflows of foreign investment. On the other hand, global economic uncertainty, potential loss of preferential market access to the EU and the Covid-19 pandemic pose significant risks. An under-diversified trade structure that relies heavily on natural resource exports also raises the economy’s exposure to external risk.

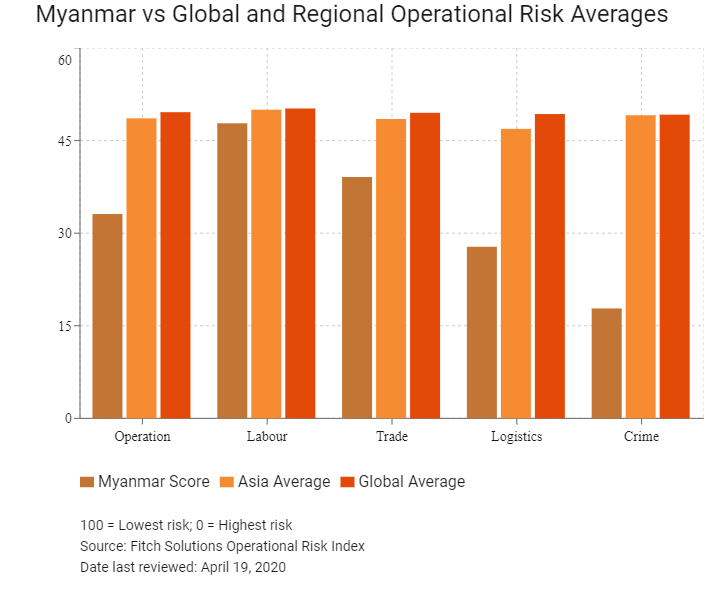

OPERATIONAL RISK

The country's wealth of natural resources and low levels of development indicate that there is considerable room for economic development. However, in order to reap the rewards of the country's largely untapped market, investors must navigate a series of operational risks, mostly stemming from an underdeveloped logistics network, legal risks and numerous layers of red tape. The passing and eventual implementation of Myanmar's new Companies Act aimed at increasing foreign participation in the economy is a positive sign that the government is seeking to improve the business environment and will likely encourage stronger FDI inflows in the years ahead.

Source: Fitch Solutions

Date last reviewed: April 20, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Myanmar Score |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

East and Southeast Asia Average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia Position (out of 18) |

16 |

15 |

15 |

17 |

18 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

31 |

19 |

23 |

30 |

34 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

165 |

115 |

139 |

175 |

188 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 19, 2020

Hong Kong’s Trade with Myanmar

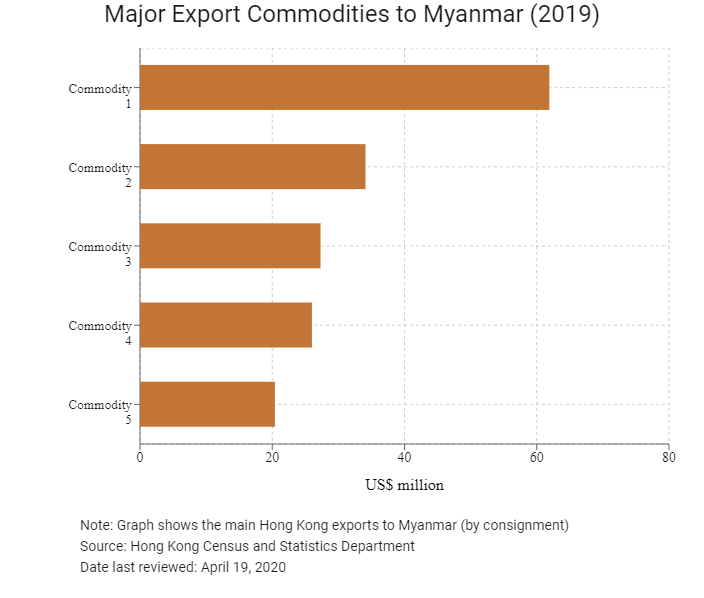

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Textile yarn, fabrics, made-up articles, and related products | 61.9 |

| Commodity 2 | Photographic apparatus, equipment and supplies and optical goods; watches and clocks | 34.1 |

| Commodity 3 | Miscellaneous manufactured articles | 27.3 |

| Commodity 4 | Telecommunications and sound recording and reproducing apparatus and equipment | 26.0 |

| Commodity 5 | Manufactures of metals | 20.4 |

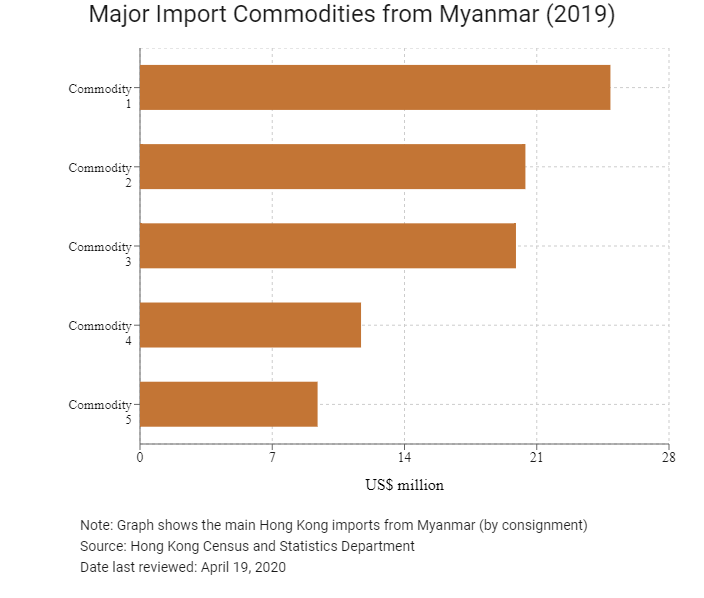

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Fish, crustaceans, molluscs and aquatic invertebrates, and preparations thereof | 24.9 |

| Commodity 2 | Photographic apparatus, equipment and supplies and optical goods, n.e.s.; watches and clocks | 20.4 |

| Commodity 3 | Office machines and automatic data processing machines | 19.9 |

| Commodity 4 | Articles of apparel and clothing accessories | 11.7 |

| Commodity 5 | Telecommunications and sound recording and reproducing apparatus and equipment | 9.4 |

Exchange rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

|

2019 |

Growth rate (%) |

|

Number of Myanmar residents visiting Hong Kong |

9,149 |

-23.9 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Sources: Hong Kong Tourism Board, Fitch Solutions

|

|

2019 |

Growth rate (%) |

|

Number of East Asians and South Asians residing in Hong Kong |

2,834,871 |

3.4 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Sources: United Nations Department of Economic and Social Affairs – Population Division, Fitch Solutions

Date last reviewed: April 19, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Myanmar companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Source: Hong Kong Census and Statistics Department

Treaties and Agreements between Hong Kong and Myanmar

Myanmar has a BIT with Mainland China that entered into force in May 2002.

Source: UNCTAD

Chamber of Commerce (or Related Organisations) in Hong Kong

Hong Kong Macau and Myanmar Chamber of Commerce & Industry

Address: Room 2309, 23/F, Fortis Tower, 77-79 Gloucester Road, Wan Chai, Hong Kong

Email: secretariat@hkmmcci.org

Tel: (852) 2529 3800

Fax: (852) 2529 1628

Source: Hong Kong Macau and Myanmar Chamber of Commerce & Industry

Myanmar Hong Kong Chamber of Commerce and Industry

Email: clara@mhkcci.org

Tel: (951) 925 5131

Website: www.mhkcci.org

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

The Republic of the Union of Myanmar Consulate General in Hong Kong

Address: Room 2401, Sun Hung Kai Centre, 30 Harbour Road, Wan Chai, Hong Kong

Email: myancghk@biznetvigator.com

Tel: (852) 2845 0810 / 2845 0811

Fax: (852) 2845 0820

Source: The Republic of the Union of Myanmar Consulate General in Hong Kong

Visa Requirements for Hong Kong Residents

Under the Tourist Visa Exemption Pilot Scheme of Myanmar, starting from now till 30 September, 2020, HKSAR passport holders do not need a visa for visiting Myanmar for a stay of up to 30 days.

Source: Visa on Demand

Date last reviewed: April 19, 2020

Myanmar

Myanmar