GDP (US$ Billion)

358.58 (2018)

World Ranking 37/193

GDP Per Capita (US$)

11,072 (2018)

World Ranking 67/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

123.1 (2019)

Currency (Period Average)

Malaysian Ringgit

4.14per US$ (2019)

Political System

Federal constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

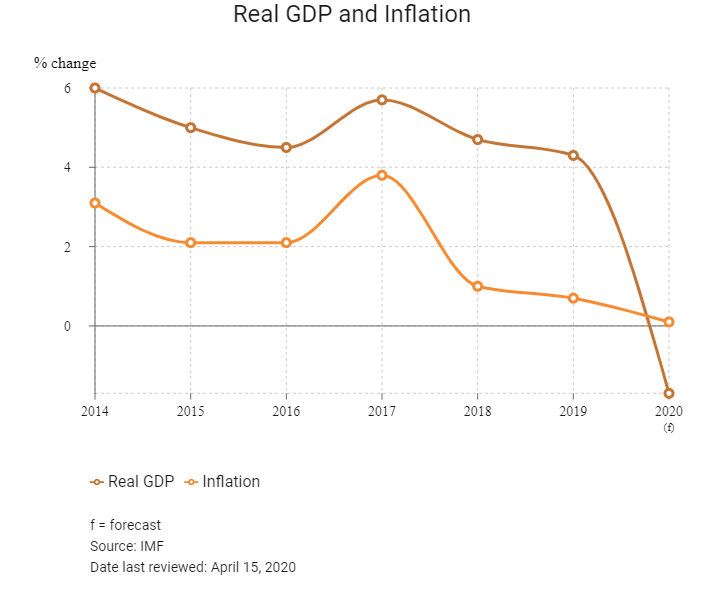

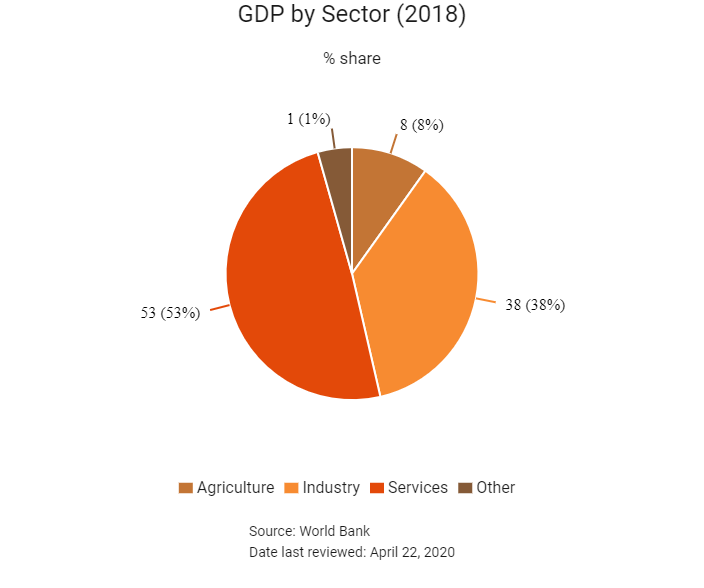

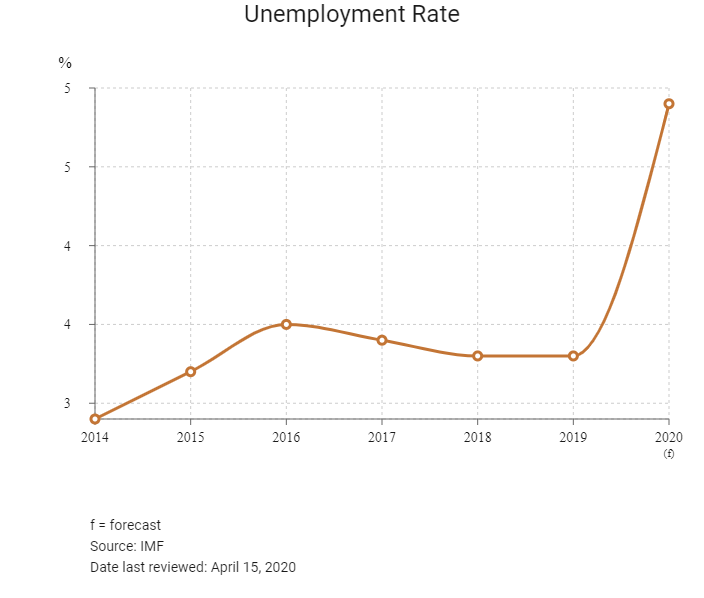

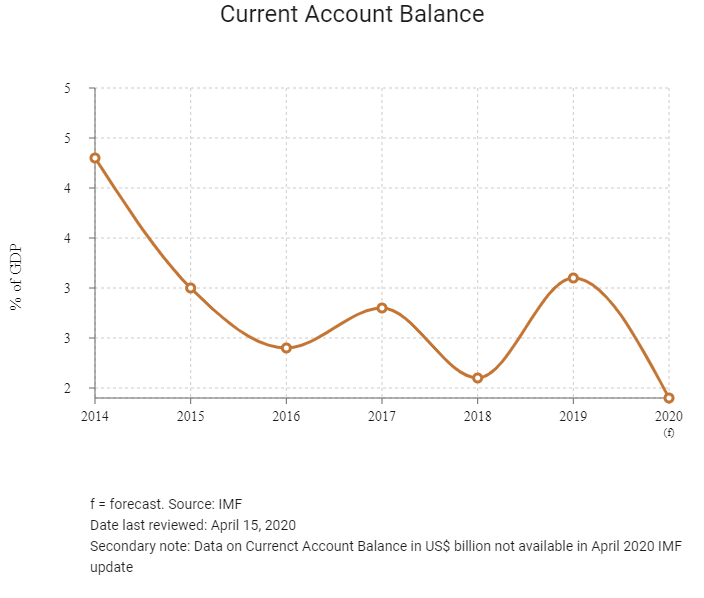

Malaysia is one of the most open markets in the world. Its economy is well diversified and has successfully weathered the impact of external shocks. This has been bolstered by strong macroeconomic management, with low and stable inflation and on-track fiscal consolidation. The financial system remains well-functioning and regulated, boasting a well-capitalised banking system and deep capital markets. An increasingly challenging external environment will reduce opportunities for export-led growth in the short term. However, domestic demand is expected to continue to anchor economic growth, supported by continued income growth and a stable labour market. In the longer term, growth will be driven by rising productivity levels.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

December 2016

Sultan Muhammad V was sworn in as the new king, succeeding Sultan Abdul Halim Mu'adzam Shah.

May 2018

An alliance of opposition parties, led by Mahathir Mohamad, won the general election and Mahathir became the Prime Minister.

January 2019

Sultan Abdullah of Pahang was sworn in, succeeding Sultan Muhammad V.

July 2019

The Ministry of Transport in Malaysia sanctioned the 29.9km Komtar-Bayan Lepas Light Rail Transit (LRT) project with 30 conditions, after reviewing a detailed project study submitted to the ministry by Penang Economic Planning Unit. The conditions included a Detailed Environmental Impact Assessment for the project and the Penang South Reclamation, a social impact assessment, a heritage impact assessment and traffic impact assessment. The MYR8.4 billion (over USD2 billion) project was part of the MYR46 billion (almost USD11.2 billion) Penang Transport Masterplan.

September 2019

Vsolar Group's wholly-owned Solar Interactive had entered a collaboration and alliance agreement with Genbayu Gemilang for the construction of a solar energy generation facility in Negeri Sembilan, Malaysia. The photovoltaic (PV) facility, with an installed capacity of up to 90MW, would be built on a nearly 1.2sq km site owned by Genbayu at Setul in Seremban.

November 2019

UK-based medical device maker Smith & Nephew unveiled plans to build its new manufacturing facility in Penang, Malaysia. The facility, which would mainly support the company's orthopaedics franchise, would come up at Batu Kawan Industrial Park. Construction was likely to start in early 2020, while the first production batches were expected to be shipped before end-2022.

January 2020

Bank Negara, Malaysia’s central bank cut the overnight policy rate by 25bps to 2.75% to bolster the economy amid signs of global slowdown.

February 2020

Malaysia’s Prime Minister Mahathir Mohamad stepped down.

March 2020

Muhyiddin Yassin was sworn in as Prime Minister on March 1.

Malaysia put a Movement Control Order (MCO) in place from March 18 and would be effective until at least April 28, 2020. All public gatherings were closed; borders were closed; schools, universities and non-essential businesses were closed.

To reduce the effect of Covid-19 in the state, Malaysia released a stimulus package of MYR25 billion (1.7% of GDP) on March 27, including additional health spending; wage subsidies to help employers retain workers; and infrastructure spending in East Malaysia. The government also setup a RM50 billion fund for working capital loan guarantees for all Covid-19 affected businesses.

Sources: BBC Country Profile – Timeline, IMF, Fitch Solutions

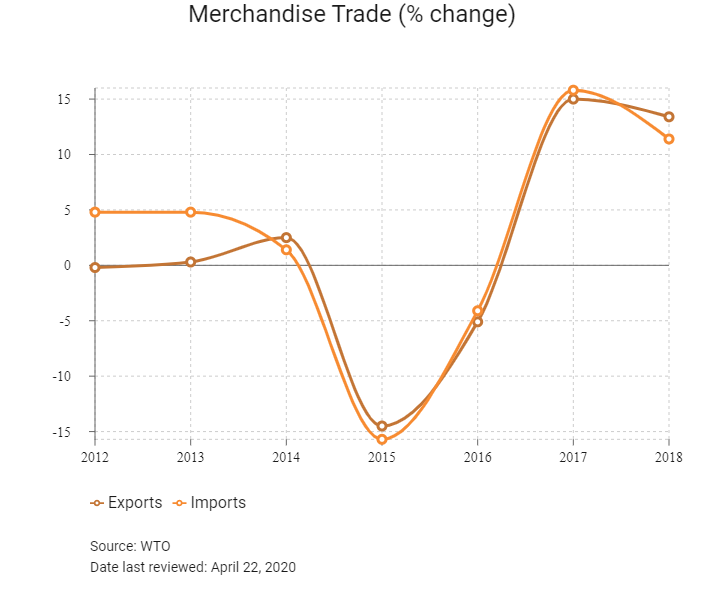

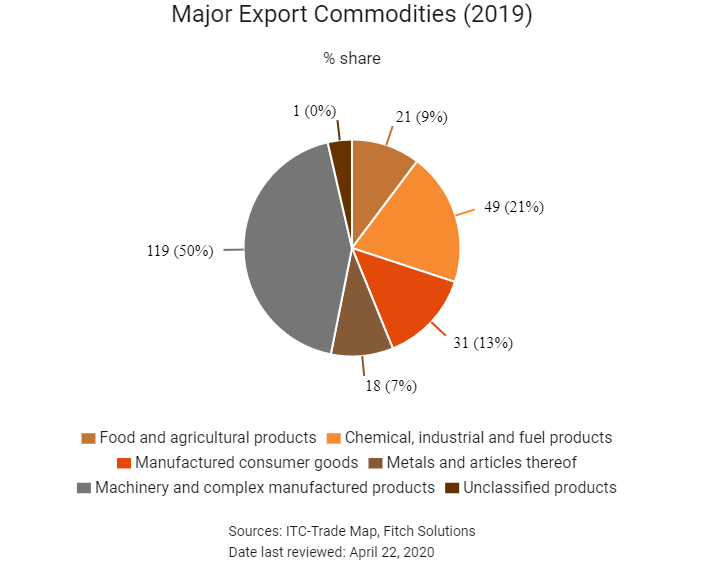

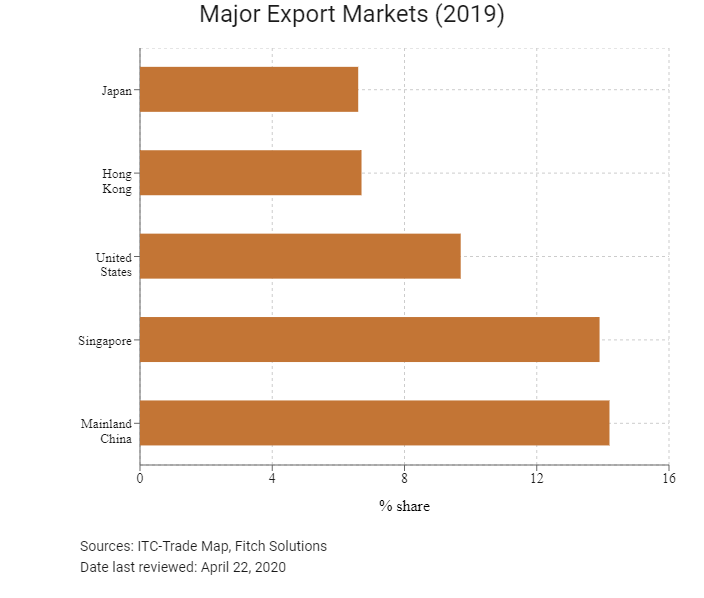

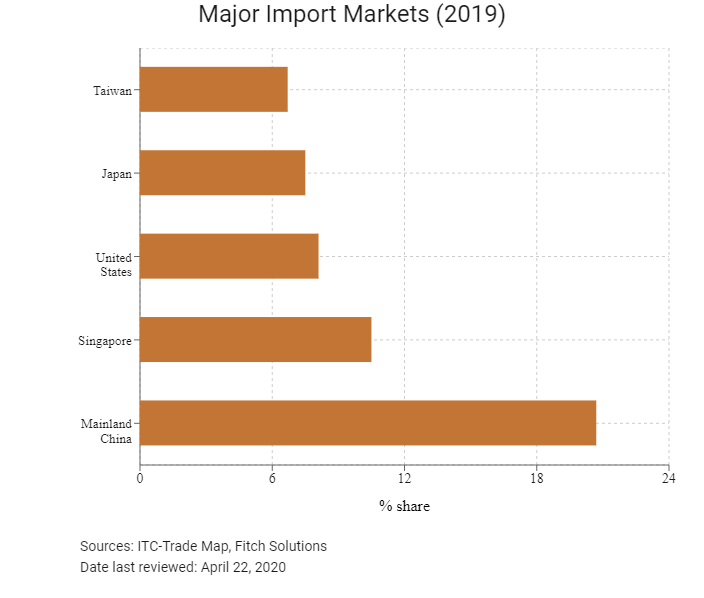

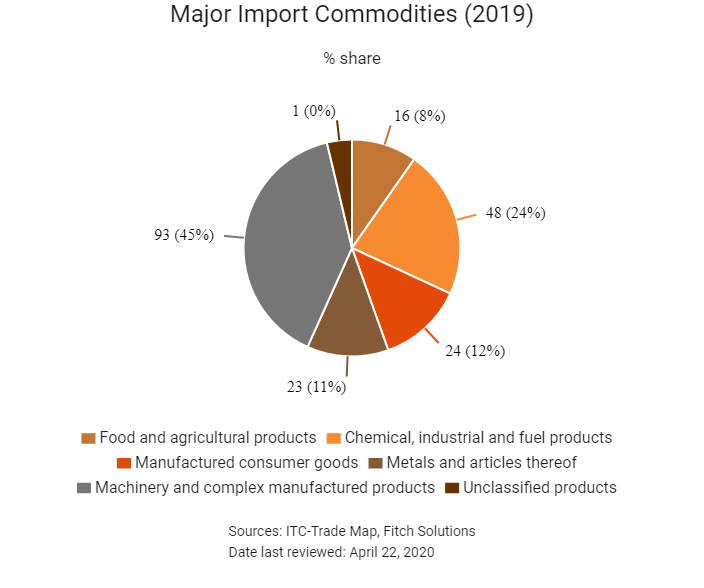

Merchandise Trade

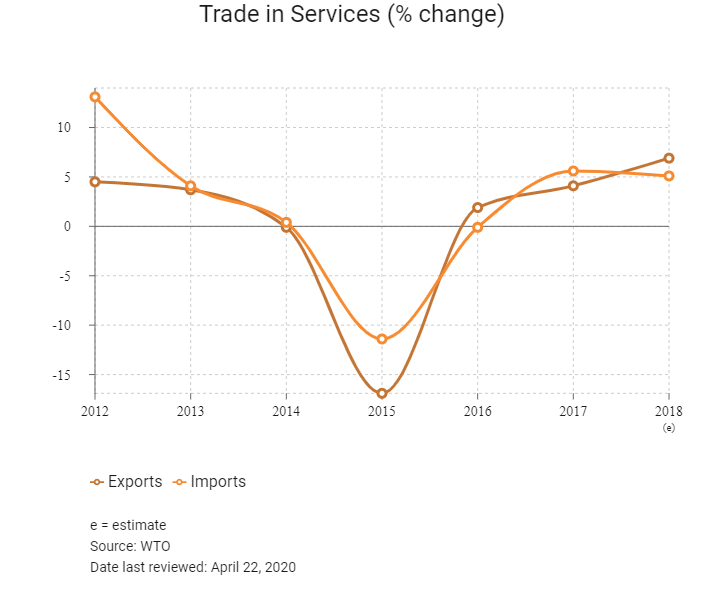

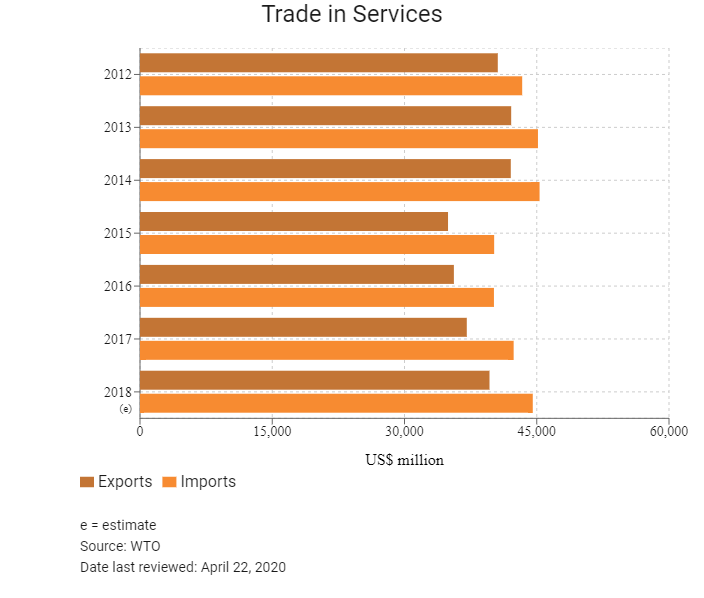

Trade in Services

- Malaysia has been a member of the World Trade Organization (WTO) since January 1, 1995.

- Malaysia is a member of the ASEAN, alongside Brunei Darussalam, Cambodia, Indonesia, Laos, Myanmar, Philippines, Singapore, Thailand and Vietnam. Malaysia has preferential tariffs for imports from ASEAN members (these cover textiles, textile products, wheat flour, wood products and iron and steel products), as well as being more informal on certification procedures and rules of origin from the bloc.

- Malaysia's average applied most-favoured-nation tariff increased from 5.6% in 2013 to 7.5% in 2017.

- Almost all rates (99% of tariff lines) are ad valorem, while duty-free lines account for 56.2% of all tariff lines. The number of different tariff rates increased from 19 in 2013 to 25 in 2017.

- Ad valorem tariff rates range from zero to 60% for industrial products and 0-90% for agricultural products. Among different product groups, average tariffs are highest for transport equipment (the simple average tariff rate was 21.5% in 2017).

- Import duty exemptions are applied to local and foreign manufacturing companies on raw materials and components used in the manufacture of goods for export and for machinery and equipment not available in Malaysia, but used directly in the manufacturing process.

- Malaysia requires import licenses for imports of "sensitive" or strategic industries (mainly construction equipment, autos, agriculture, meat and basic machinery).

- Export duties range from 5-30% and apply to 217 tariff lines (mainly crude oil, palm oil and wood).

- The export of products such as rubber, timber, palm oil and tin requires special permission from relevant government agencies and, in order to encourage domestic processing, these may be subjected to additional taxation.

- Malaysia's average tariff rate stands at 4.4%. Import duties levied on goods imported into Malaysia generally range from 0-50%. Goods such as raw materials, machinery, essential foodstuffs and pharmaceutical products are not dutiable or are subject to lower tariffs.

- Importers of meat and poultry products must meet halaal certification standards. The import of pork is subject to an additional permit requirement and a valid import permit issued by the Malaysian Quarantine and Inspection Services must be obtained for every consignment of pork.

- Alcohol beverages are subject to an effective tariff rate of up to 500% of their value when import duties and excise taxes are combined.

- Malaysia has imposed various anti-dumping measures on a wide range of products, predominantly in the areas of machine parts, steel, iron and machinery on goods coming from Mainland China and a few other Asian nations to protect domestic industries.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

In October 2019, India announced that it was considering restricting the import of certain goods from Malaysia. India is the largest importer of Malaysian palm oil and Malaysia’s seventh largest import partner overall. In January 2020, India imposed restrictions on refined palm oil from Malaysia.

Multinational Trade Agreements

Active

- Malaysia is a member of the WTO (effective date: January 1, 1995).

- ASEAN Free Trade Area (AFTA – effective as of January 1993): AFTA reduces tariff and non-tariff barriers between member states. The 10 members of the AFTA are Brunei Darussalam, Cambodia, Indonesia, Laos, Myanmar, Philippines, Singapore, Thailand and Vietnam. Five of the member states are significant trading partners of Malaysia. Advantages will also accrue from the planned integration of the ASEAN Economic Community AEC) which will provide a significant advantage to Malaysia, reinforcing its position as a manufacturing hub.

- ASEAN-Mainland China Free Trade Agreement (FTA) and Economic Integration Agreement (effective date: January 2005 for goods and July 2007 for services): The FTA is a comprehensive economic co-operation between ASEAN member states and Mainland China. The goal of the agreement is not only to eliminate tariffs, but also to address behind-the-border barriers that impede the flow of goods and services. Mainland China is Malaysia’s largest trade partner, accounting for 13.9% of Malaysia’s exports and supplying 19.9% of imports.

- ASEAN-South Korea FTA (AKFTA - effective date: July 2007 for goods, May 2009 for services): AKFTA aims to create more liberal, facilitative market access and investment regimes between South Korea and ASEAN. A business council was set up in December 2014 to enhance economic cooperation between parties and boost total trade to USD200 billion by 2020. The agreement allows 90% of the products being traded between the ASEAN and South Korea to enjoy duty-free treatment. South Korea is one of Malaysia’s top 10 trade partners.

- ASEAN-India Comprehensive Economic Cooperation Agreement (effective date: January 2010): The agreement involves the liberalisation of tariffs on over 90% of products traded between the two regions, including the so-called 'special products', such as palm oil (crude and refined), coffee, black tea and pepper.

- ASEAN-Australia-New Zealand FTA (AANZFTA - effective date: January 2010): The agreement aims to eliminate tariffs on 99% of exports to key ASEAN markets by 2020. AANZFTA aims to decrease barriers to trade in both goods and services, allowing for greater market access. The agreement covers nearly 700 million people.

- ASEAN-Japan FTA: The ASEAN-Japan FTA is for goods only and came into force on December 1, 2008. The agreement will lead to the progressive elimination of tariffs on all goods and creates a potential regional market of over 750 million people. The FTA benefits a number of important sectors, including manufacturing, mining and agriculture.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and the ASEAN commenced negotiations of an FTA and an Investment Agreement in July 2014. After 10 rounds of negotiations, Hong Kong and ASEAN announced the conclusion of the negotiations in September 2017 and forged the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods, trade in services, investment, economic and technical co-operation, dispute settlement mechanism and other related areas. The agreements will bring legal certainty, better market access and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flow between Hong Kong and the ASEAN. The agreements will also extend Hong Kong's FTA and Investment Agreement network to cover all major economies in South East Asia. The agreement came into force on January 1, 2019 but will take time for all members of the ASEAN to comply as implementation is subject to completion of the necessary procedures. Hong Kong is a key export market and the reduction of tariffs will ease the trading process; Hong Kong's potential as a key export market increases the importance of AHKFTA.

- Comprehensive and Progressive Trans-Pacific Partnership (CPTPP – effective date: March 8, 2018): The agreement comprises Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. The agreement was ratified in Q418, with the deal representing 13.4% of global GDP, making it the third-largest trade agreement after the North American FTA (the USMCA) and the European Union (EU). The agreement aims to cut tariffs, improve access to markets and set common ground on labour and environmental standards and intellectual property protections. The deal is particularly positive for Malaysia, as the United States’ increasingly protectionist stance will have negative implications for its main trading partners.

- Malaysia-Chile FTA (effective date: April 18, 2012): The agreement aims to progressively reduce or eliminate tariffs on their respective industrial and agricultural products. As part of the agreement, Malaysia undertook to fully eliminate import duties on 9,311 tariff lines on date of entry into force. Chile undertook to fully eliminate import duties for 6,960 tariff lines from the date of entry for products that include video recording apparatus and data processing machines (electrical and electronic items), vulcanised rubber thread and cord, surgical gloves, vegetable fats, cocoa butter, fats and oil and parts of aircraft. A number of these measures have been superseded by the CPTPP.

- Preferential Tariff Arrangement-Group of Eight Developing Countries (effective date: August 2011): The agreement involves countries that are members of the D-8 Organization for Economic Co-operation, namely Indonesia, Malaysia, Bangladesh, Pakistan, Iran, Egypt, Turkey and Nigeria. Objectives of the member countries are to reach a preferential trade agreement to enhance intra-trade and an agreement on administrative assistance in customs matters.

- Malaysia-India Comprehensive Economic Co-operation Agreement (effective date: July 2011): This comprehensive agreement covers trade in goods, services, investments and the movement of natural persons. The items on which India has obtained market access from Malaysia include basmati rice, mangoes, eggs, trucks, motorcycles and cotton garments, all of which are items of considerable export interest to India. At the same time, adequate protection has been provided by the Indian side for sensitive sectors, such as agriculture, fisheries, textiles, chemicals and autos. This agreement covers a number of categories without provisions in the ASEAN-India Comprehensive Economic Co-operation Agreement.

- Malaysia-Australia FTA (effective date: January 2013): The agreement is a comprehensive agreement comprising 21 chapters encompassing trade in goods, services, investment and economic co-operation. It also covers intellectual property rights, e-commerce and competition policy and covers certain areas without provisions in the AANZFTA.

- Malaysia-New Zealand FTA (effective date: August 2010): This comprehensive agreement covers the liberalisation of trade in goods, services, investment and economic co-operation. As part of the agreement, Malaysia and New Zealand will progressively reduce or eliminate tariffs on respective industrial and agricultural products. Malaysian exporters will enjoy free duty on cocoa products, carpets, tyres, margarine, steel wire, iron products and wood furniture. Imports from New Zealand into Malaysia will enjoy zero or lower duties for paper, plastics, automotive components and veneer and chemical products. Certain areas without provisions are covered in the AANZFTA.

- Malaysia-Turkey FTA (effective date: August 2015): The agreement eliminates and binds duties on 70% of the tariff lines. Malaysia and Turkey will progressively reduce or eliminate tariffs on a substantial number of products traded between both countries, with expected duty-free imports by 2022.

- Japan-Malaysia Economic Partnership Agreement (effective date: July 2006): The agreement covers trade in industrial and agricultural goods, trade in services, investment, rules of origin, customs procedures, standards and conformance, intellectual property, competition policy, enhancement of business environment, safeguard measures and dispute settlement. The agreement will result in tariff elimination of about 97% of trade in goods between the two countries on a trade volume basis, which will considerably promote trade in agricultural, forestry and fishery products, as well as industrial products between the two countries. The agreement has been somewhat superseded by the ASEAN-Japan FTA.

- Malaysia-Pakistan Closer Economic Partnership Agreement (effective date: January 2008): The agreement encompasses liberalisation in trade in goods, services, investment, as well as bilateral technical co-operation and capacity building in areas such as sanitary and phytosanitary measures, intellectual property protection, construction, tourism, healthcare and telecommunications.

Waiting To Be Signed

Regional Comprehensive Economic Partnership (RCEP): A regional economic agreement that involves the 10-member ASEAN bloc and their FTA partners: Australia, Mainland China, Japan, New Zealand and South Korea. While India withdrew from the agreement in November 2019, in April 2020, member states of RCEP offered India a package to return to the negotiating table. The RCEP is envisioned to be a modern, comprehensive, high-quality and mutually beneficial economic partnership agreement that aims to advance economic cooperation, and broaden and deepen integration in the region. The RCEP will lower tariffs and other barriers to the trade of goods among the 15 countries that are in the agreement, or have existing trade deals with ASEAN. The agreement was finalised in November 2019 and is expected to be signed in November 2020.

Under Negotiation

- Malaysia-United States FTA: Malaysia and the United States are negotiating an FTA. Areas of particular interest to United States' exporters include a reduction of Malaysian trade barriers to automobiles and certain agricultural products, provisions for the enforcement of intellectual property rights and broader access to Malaysia's service sectors, such as financial services, telecommunications and professional services.

- Malaysia-EU FTA: Malaysia and the EU are negotiating an FTA. The EU is one of Malaysia's largest palm oil markets, importing MYR10 billion worth of palm products in 2016. Bilateral trade between the EU and Malaysia is dominated by industrial products. The EU mainly imports machinery and appliances and mainly exports electrical equipment and machinery (both ways industrial products account for more than 90% of trade). Other sectors of relevance in terms of EU imports from Malaysia are plastics, rubber, animal and vegetable fats and oils and, in terms of exports, mechanical products.

- Malaysia-European Free Trade Association FTA: Malaysia and the European Free Trade Association (EFTA), consisting of Iceland, Liechtenstein, Norway and Switzerland, are negotiating an FTA. Exports from EFTA states consist mainly of precious stones, machinery and pharmaceutical products. Imports from Malaysia consist mainly of cellular phones and electrical equipment.

Sources: WTO Regional Trade Agreements Database, Fitch Solutions

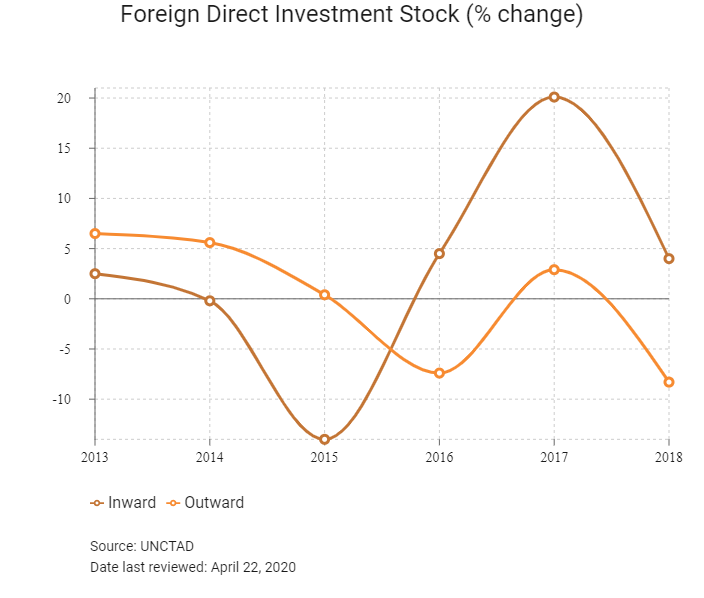

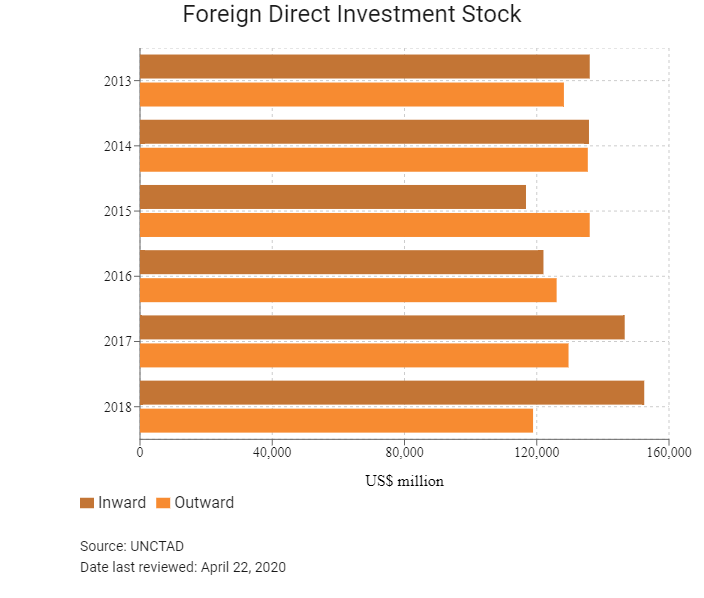

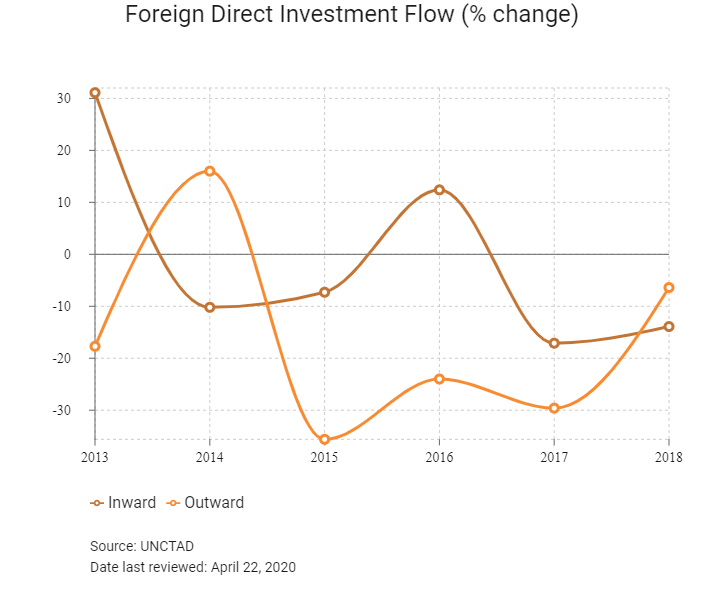

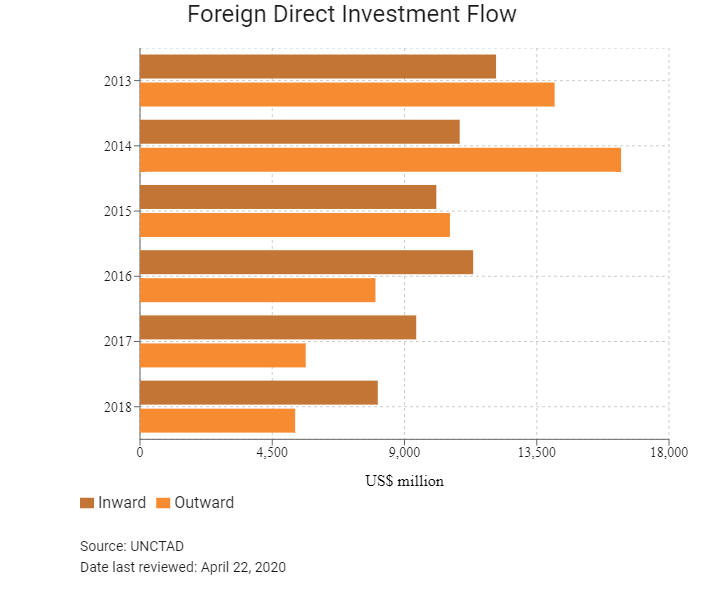

Foreign Direct Investment

Foreign Direct Investment Policy

- The Malaysian Investment Development Authority (MIDA) is a government body which promotes local and foreign investments in the country’s manufacturing and services sectors and assists in the implementation of projects. In this role, MIDA also makes policy and strategy recommendations regarding industrial development to the Minister of International Trade and Industry. Manufacturing investments must be approved by the MIDA, which will consider various factors including the size of an investment, the share of exported products and the type of financing required and the potential for technology transfer into the local economy and the existence of a local or foreign market for the output. If both local and foreign companies are competing to establish similar projects, the local firm will be given preference.

- The government of Malaysia is open to FDI, particularly in the economically important manufacturing industry. In recent years, it has aimed to liberalise the country's foreign investment regime through the Economic Transformation Plan (ETP), removing legal obstacles, introducing targeted areas for investment and establishing special economic zones and targeted 'growth corridors'.

- In terms of FDI controls, the Malaysian government has the authority to review and approve all investments, foreign and domestic. The investment review is connected to the government's responsibility for granting licenses for business to engage in intended activities, whether in the provision of goods or services. This process also serves as a means for the government to assess whether the proposed investment meets the criteria for the various incentives available in target sectors and regions. The process itself is not seen as a barrier or extremely time-consuming for foreign investors.

- In order to operate in Malaysia, foreign firms must acquire a licence. The Malaysian government extends a full tax exemption incentive of 15 years for firms with 'Pioneer Status' (companies promoting products or activities in industries or parts of Malaysia to which the government places a high priority) and ten years for companies with 'Investment Tax Allowance' status (those on which the government places a priority, but not as high as pioneer status).

- The Foreign Investment Committee (FIC)'s primary role is to review investments related to distributive trade (such as retail distributors) as a means of ensuring 30% of the equity in this economic segment is held by the Bumiputera (ethnic Malays and other indigenous ethnicities in Malaysia).

- Foreign investment in services, whether in sectors with no foreign equity limits or controlled sub-sectors, remain subject to review and approval by ministries and agencies with jurisdiction over the relevant sectors. A key function of this review and approval process is to determine whether proposed investments meet the government's qualifications for the various incentives in place to promote economic development goals.

- The Malaysian government allows 100% foreign ownership across the following sectors: healthcare, retail, education as well as professional, environmental and courier services. Export-dependent Malaysia is keen to attract FDI and promote high-value manufacturing. Investment incentives, including corporate income tax exemption and tax allowance, are provided in industries such as advanced electronics, medical devices, bio-technologies and green technologies.

- Restrictions on foreign investment remain in fisheries, energy, telecommunications, finance and transport services and foreign participation in public-private-partnership projects is limited to a ceiling of 25% of share capital.

- In the oil and gas sector, foreign participation tends to take the form of production sharing contracts. Petroleum Nasional Berhad (Petronas) regularly requires its PSC partners to work with Malaysian firms for many tenders. Non-Malaysian firms are permitted to participate in oil services in partnership with local firms and are restricted to a 49% equity stake if the foreign party is the principal shareholder. Petronas sets the terms of upstream projects with foreign participation on a case-by-case basis.

- In the telecommunications industry, there is a 70% cap on foreign capital for investments in network facilities providers and network service providers. Non-Malaysians are limited to 70% equity in shipping and logistics companies. These regulatory restrictions on FDI are at odds with the government's otherwise welcoming attitude to foreign investors.

- Bank Negara Malaysia (BNM), Malaysia's central bank, allows a greater foreign ownership stake if the investment is determined to facilitate the consolidation of the financial industry. BNM currently allows foreign banks to open up to four new branches throughout Malaysia, subject to restrictions, which include designating where the branches can be set up (ie, in market centres, semi-urban areas and non-urban areas). The policies do not allow foreign banks to set up new branches within 1.5km of an existing local bank. BNM has also conditioned foreign banks' ability to offer certain services on commitments to undertake certain back office activities in Malaysia.

- In the long term, the government intends to gradually eliminate most of the fiscal incentives now offered to foreign and domestic manufacturing investors. Malaysia seeks to attract foreign investment in the information technology industry, particularly in the Multimedia Super Corridor (MSC), a government scheme to foster the growth of research, development and other high technology activities in Malaysia. Foreign investors who obtain MSC status receive tax and regulatory exemptions, as well as commitments by Malaysia to provide advanced telecommunications infrastructure in exchange for a commitment of substantial technology transfer.

- The Free Zone Act of 1990 authorised the Minister of Finance to designate any suitable area as either a Free Industrial Zone (FIZ), where manufacturing and assembly take place or a Free Commercial Zone (FCZ), generally for warehousing commercial stock. Currently, there are 13 FIZs and 12 FCZs in Malaysia. Raw materials, products and equipment may be imported duty-free into these zones with minimum customs formalities. Companies that export more than 80% of their output and depend on imported goods, raw materials and components may be located in these FZs. Ports; shipping and maritime-related services play an important role in Malaysia since 90% of its international trade by volume is seaborne. Malaysia is also a major transhipment centre.

- Goods sold into the Malaysian economy by companies within the FZs must pay import duties. If a company wants to enjoy Common External Preferential Tariff (CEPT) rates within the ASEAN FTA, 40% of a product's content must be ASEAN-sourced. In addition to the FZs, Malaysia permits the establishment of licensed manufacturing warehouses outside of free zones, which give companies greater freedom of location while allowing them to enjoy privileges similar to firms operating in an FZ. Companies operating in these zones require approval/license for each activity. The time needed to obtain licenses depends on the type of approval and ranges from two to eight weeks.

Sources: WTO – Trade Policy Review, MIDA, ITA, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Peninsular and East Malaysia, including Iskandar Malaysia, Northern Corridor Economic Region, East Coast Economic Region, Sabah Development Corridor and Sarawak Corridor of Renewable Energy |

-The Iskandar Malaysia zone in Johor is focused on attracting creative industries, educational sector groups, financial advisers and consultancies. In addition, healthcare services, tourism and logistics services are also offered inducements. These include 10-year exemptions from corporate tax, a royalty withholding tax exemption, freedom to source capital internationally, unrestricted foreign worker quotas and flexible foreign exchange rules. |

|

MSC |

-MSC is a special zone between Kuala Lumpur City and the Kuala Lumpur International Airport, which is focused on promoting Malaysia's IT and multimedia sectors. |

Sources: US Department of Commerce, Fitch Solutions

- Sales and Services Tax (SST): 5%, 10% or 6%

- Corporate Income Tax: 24%

Source: Inland Revenue Board of Malaysia

Important Updates to Taxation Information

- The Malaysian tax authorities recently issued a practice note to state their position that payments for use of applications to create advertising campaigns constitute royalty under the domestic law.

- In March 2018, Malaysia's tax agency announced that businesses can newly challenge late-payment penalties in respect of goods and services tax (GST) via the tax agency's online portal.

- The Withholding Tax (WHT) exemption provided to non-resident companies for income received from MSC Malaysia companies has been revoked with effect from January 1, 2020. Effective the same date, the following income received by non-residents from MSC Malaysia companies will be subject to WHT: (i) fee for technical advice or technical services, (ii) licensing fee in relation to technology development, and (iii) interest on loans for technology development.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

- 24% on non-resident companies |

|

Petroleum income tax (CIT on petroleum operations) |

- 38% on income from petroleum operations in Malaysia -effective petroleum income tax rate of 25% applies on income from petroleum operations in marginal fields |

|

SST |

- 5% or 10% standard sales tax rates |

|

Branch Tax Rate |

24%; no tax is withheld on transfer of profits to a foreign head office |

|

Real Property Gains Tax |

30% for a holding period of up to three years from the date of acquisition on gains derived from disposals of real property or shares in real property companies. |

|

Social security contributions for labour |

12% of employer contribution if the employee's monthly wages are above MYR5,000 per month or 13% if the employee's monthly wages are below MYR5,000 per month. Employees' contribution rate is fixed at 11% of monthly wages – regardless of income level. |

|

Withholding Tax |

Interest: 15% |

|

Technical service fees (withholding tax) |

10% withholding tax applies to servie fees paid to a nonresident (both technical and non-technical services) |

|

Stamp duty |

Rates between 1% and 4% on the value of property transfers |

Source: Inland Revenue Board of Malaysia

Date last reviewed: April 22, 2020

Localisation Requirements

The employment of foreign nationals is not encouraged in Malaysia with the 11th Malaysia Plan (2016-2020) aiming to limit the ratio of foreign labour at not more than 15% of total labour. Registered local job seekers are given priority over foreigners in filling job vacancies in the country.

Companies are granted a preapproved quota for the number of workers to be imported to Malaysia under the outsourcing licence. The price could range from MYR800 to MYR1,800 per year, on top of the levy, insurance, medical examination and cost of a banker's guarantee, which significantly add to high overheads, particularly for small businesses.

Employers seeking to employ foreign workers must notify the Department of Labour of vacancies by registering at Jobs Malaysia to ensure registered local job seekers are given priority. Foreign workers are employed for a period of 10 years in five permissible sectors (manufacturing, agriculture, plantation, construction and services) and, depending on the categorisation of their employment pass, they may or may not marry or bring their family members, dependants and foreign aides into Malaysia.

Obtaining Foreign Worker Permits for Skilled Workers

The entry of foreign nationals in Malaysia is governed by the Immigration Act of 1963 which also determines the types of employment passes that can be applied for by those aspiring to work in the country. Three types of permits are generally issued by Malaysian authorities which depend on the duration of contract of employment, position to be filled and minimum/maximum salary. They include the employment pass, the temporary employment pass and the professional visit pass permits. Foreign workers who wish to be employed by a company within Malaysia will have to have their application reviewed by the relevant government agencies, such as the Ministry of Manpower. The application for foreign workers by employers is, however, made easier in that it can be done at the One Stop Centre at the Foreign Workers Management Division of the Ministry of Home Affairs where various government agencies (departments and ministries) process the application for recruitment of foreign workers under one roof.

Visa/Travel Restrictions

Visa free access for citizens of North Korea has been discontinued as of March 6, 2017. Nationals of other countries are allowed to enter Malaysia for a maximum stay not exceeding a specified period of days, weeks or months (depending on country of origin). Generally, no visa is required for Commonwealth countries.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A3 (Stable) |

7/12/2018 |

|

Standard & Poor's |

A- (Stable) |

29/6/2018 |

|

Fitch Ratings |

A- (Negative) |

9/4/2020 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

24/190 |

15/190 |

12/190 |

|

Ease of Paying Taxes Index |

73/190 |

72/190 |

80/190 |

|

Logistics Performance Index |

41/160 |

N/A |

N/A |

|

Corruption Perception Index |

61/180 |

51/180 |

N/A |

|

IMD World Competitiveness |

22/63 |

22/63 |

N/A |

Sources: World Bank, IMD, Transparency International

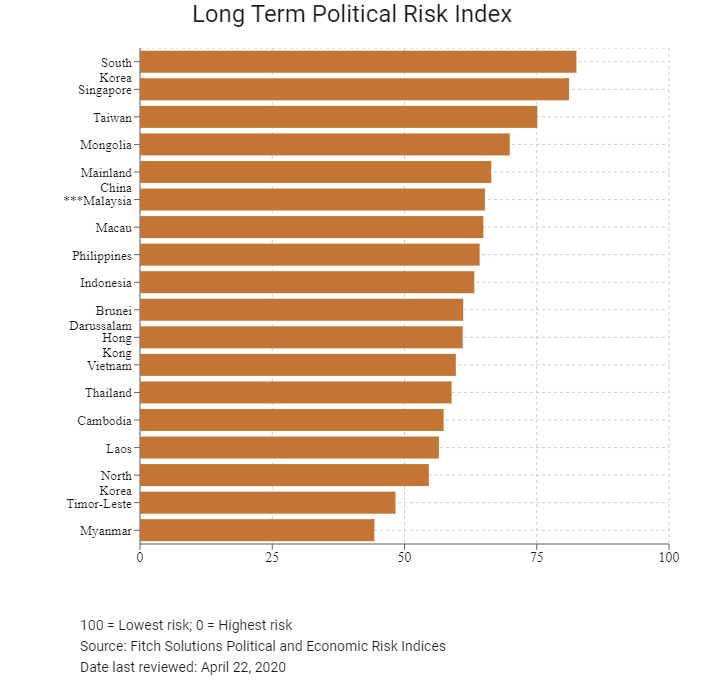

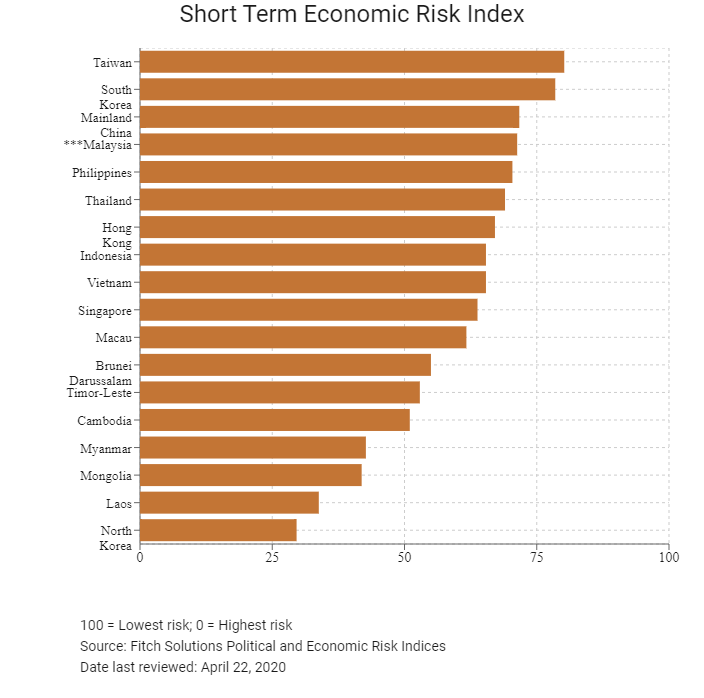

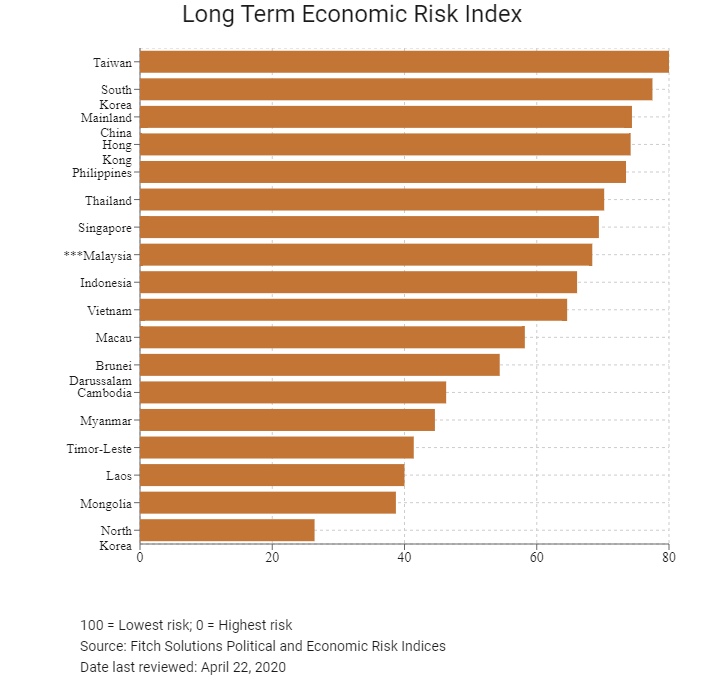

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

27/202 |

30/201 |

41/201 |

|

Short-Term Economic Risk Score |

73.1 |

73.1 |

71.3 |

|

Long-Term Economic Risk Score |

73.0 |

72.6 |

68.4 |

|

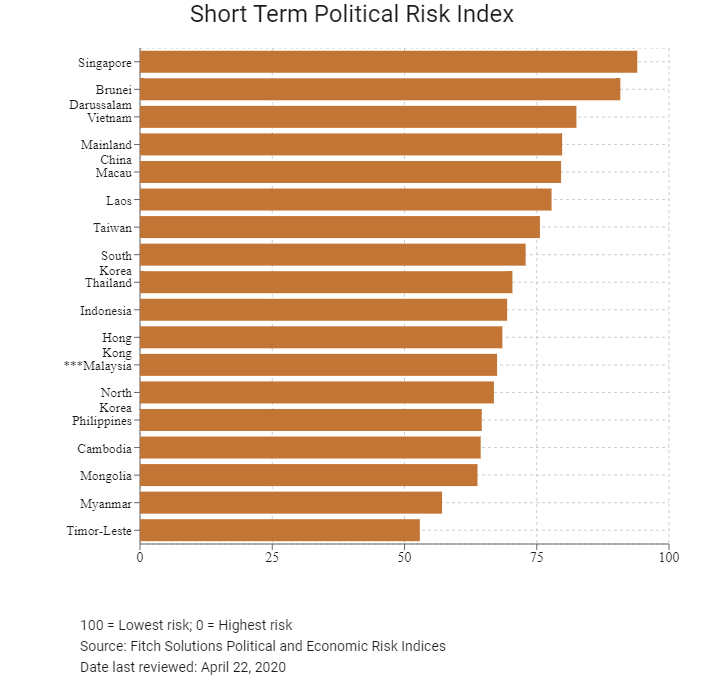

Political Risk Index |

86/202 |

85/201 |

83/201 |

|

Short-Term Political Risk Score |

72.5 |

72.5 |

67.5 |

|

Long-Term Political Risk Score |

65.2 |

65.2 |

65.2 |

|

Operational Risk Index |

33/201 |

29/201 |

28/201 |

|

Operational Risk Score |

67.8 |

69.5 |

69.6 |

Source: Fitch Solutions

Date last reviewed: April 22, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

Malaysia has a highly diversified economy, with numerous investment opportunities across a wide range of sectors, from manufacturing to services. Meanwhile, exports will face headwinds in the coming years, due to a sharp deceleration in global growth owing to the Covid-19 pandemic, and fiscal concerns remain the biggest risk factor to Malaysia's generally positive economic outlook in the next decade. It remains to be seen if Putrajaya will be able manage its fiscal situation and cover the additional expenditures required by its stimulus policies while paying down its debt. However, a combination of cheaper labour costs, compared to some regional peers, such as Mainland China and Singapore, strong export diversification in terms of geography and product type, and strategic geographical proximity to key trading partners, adds to the country’s attractiveness as a foreign investment destination in the region.

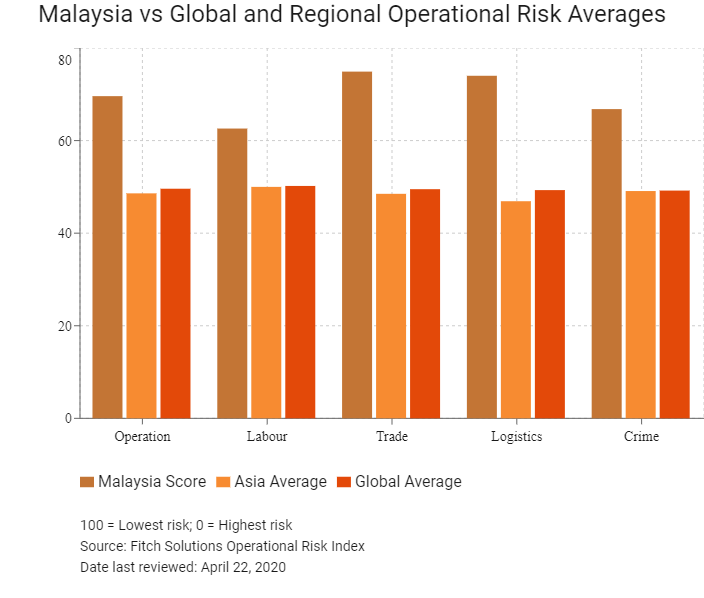

OPERATIONAL RISK

Malaysia’s long track record of relative political stability, developed capital markets, moderate crime rates, efficient bureaucracy and sophisticated financial markets make it one of the most attractive emerging markets for investment in Asia. Businesses operating in the country will benefit from the country’s liberal trade and investment policies, which have been successful in attracting foreign direct investment into industries such as financial services, tourism and manufacturing. Supply chain risks are minimised by the country’s excellent regional and international connectivity that is supported by high quality domestic infrastructure. Key weaknesses in the Malaysian market are the increasing difficulty of employing foreign workers and tight labour market conditions in the long term.

Source: Fitch Solutions

Date last reviewed: April 22, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Malaysia Score |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

East and Southeast Asia average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia position (out of 18) |

5 |

4 |

4 |

5 |

7 |

|

Asia average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia position (out of 35) |

5 |

4 |

4 |

5 |

7 |

|

Global average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

28 |

29 |

16 |

26 |

45 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 22, 2020

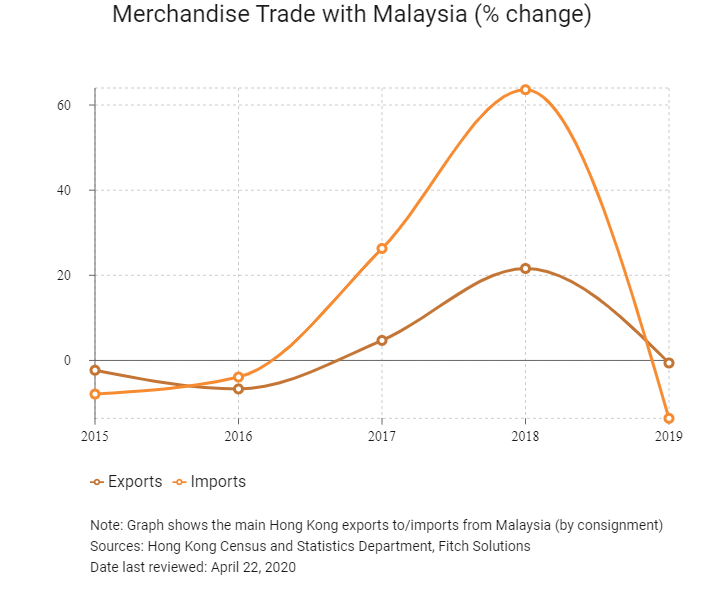

Hong Kong’s Trade with Malaysia

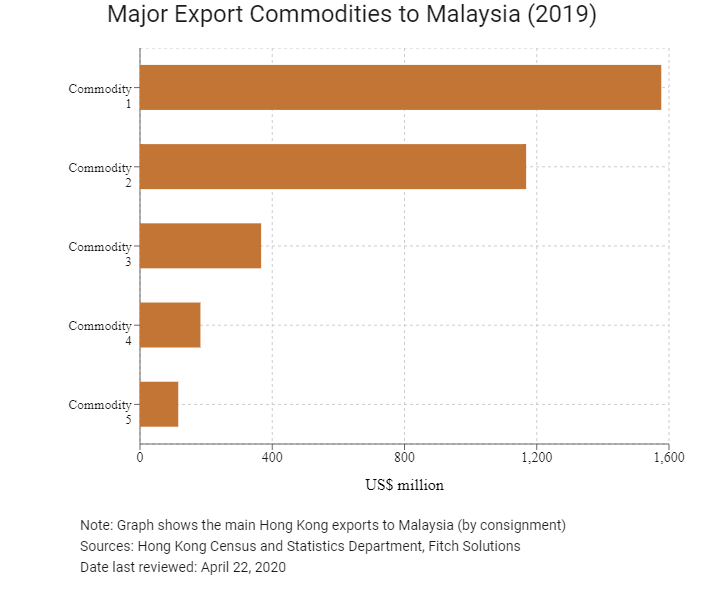

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 1,576.6 |

| Commodity 2 | Telecommunications and sound recording and reproducing apparatus and equipment | 1,167.9 |

| Commodity 3 | Office machines and automatic data processing machines | 366.3 |

| Commodity 4 | Miscellaneous manufactured articles | 182.8 |

| Commodity 5 | Power generating machinery and equipment | 115.7 |

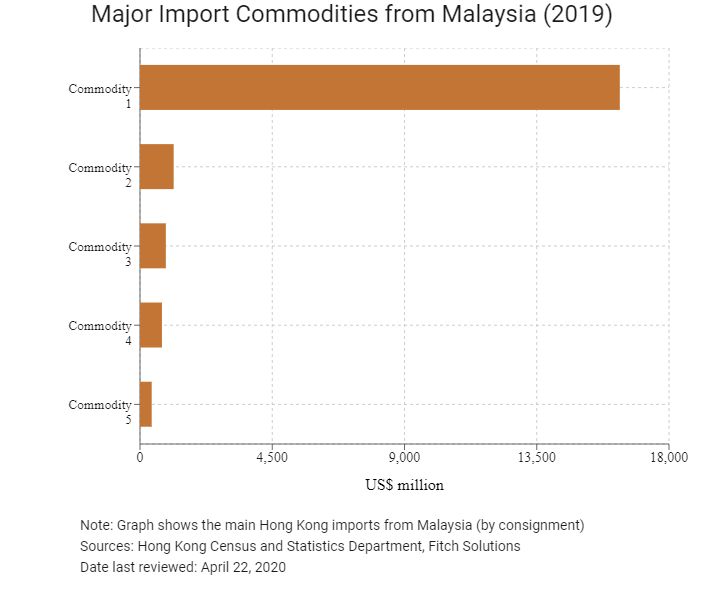

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 16,326.5 |

| Commodity 2 | Office machines and automatic data processing machines | 1,145.3 |

| Commodity 3 | Telecommunications and sound recording and reproducing apparatus and equipment | 879.8 |

| Commodity 4 | Petroleum, petroleum products and related materials | 746.8 |

| Commodity 5 | Miscellaneous manufactured articles | 397.9 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Malaysia residents visiting Hong Kong |

392,562 |

-23.1 |

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

Source: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of Malaysians residing in Hong Kong |

19,787 |

29.6 |

|

Number of East Asians and South Asians residing in Hong Kong |

2,834,871 |

3.4 |

Note: Growth rates for resident data is from 2015 to 2019. No UN data available for intermediate years.

Sources: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: April 22, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Malaysian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

N/A |

N/A |

|

- Regional offices |

N/A |

N/A |

|

- Local offices |

51 |

18.6 |

Source: Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong and Malaysia

- Malaysia has a bilateral investment treaty with Mainland China/Hong Kong that entered into force in 1990.

- Malaysia has signed double taxation avoidance agreements with both Mainland China and Hong Kong which entered into force in September 1986 and December 2012 respectively.

Source: UNCTAD

Chamber of Commerce or Related Organisations

The Malaysian Chamber of Commerce (Hong Kong and Macau)

Address: Unit 1103, 11/F, Malaysia Building, 50 Gloucester Road, Wan Chai, Hong Kong

Tel: (852) 2997 8668

Fax: (852) 2997 8568

Source: The Malaysian Chamber of Commerce (Hong Kong and Macau)

The Hong Kong-Malaysia Business Association

Email: je.hoh@hktdc.org

Tel: (60) 3 2381 1061

Website: www.hkm-businessassociation.org

Please click to view more information.

Source: Federation of Hong Kong Business Assocations Worldwide

Malaysia Consulate in Hong Kong

Address: 24/F, Malaysia Building, 47-50 Gloucester Road, Wan Chai, Hong Kong

Email: mwhongkong@kln.gov.my

Tel: (852) 2821 0800

Fax: (852) 2865 1628

Source: Malaysia Consulate in Hong Kong

Visa Requirements for Hong Kong Residents

Visa is issued upon arrival and valid for one month.

Source: Window Malaysia

Date last reviewed: April 22, 2020

Malaysia

Malaysia