GDP (US$ Billion)

370.59 (2018)

World Ranking 33/193

GDP Per Capita (US$)

41,728 (2018)

World Ranking 23/192

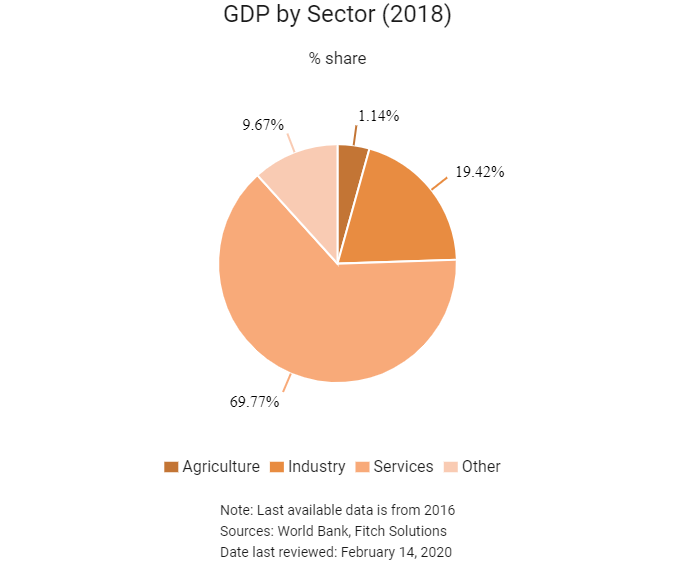

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

58.5 (2018)

Currency (Period Average)

Israeli Shekel

3.56per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

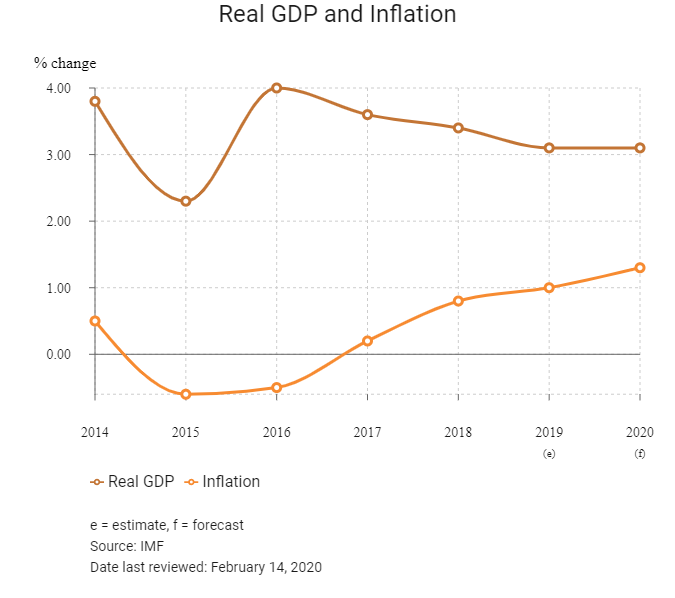

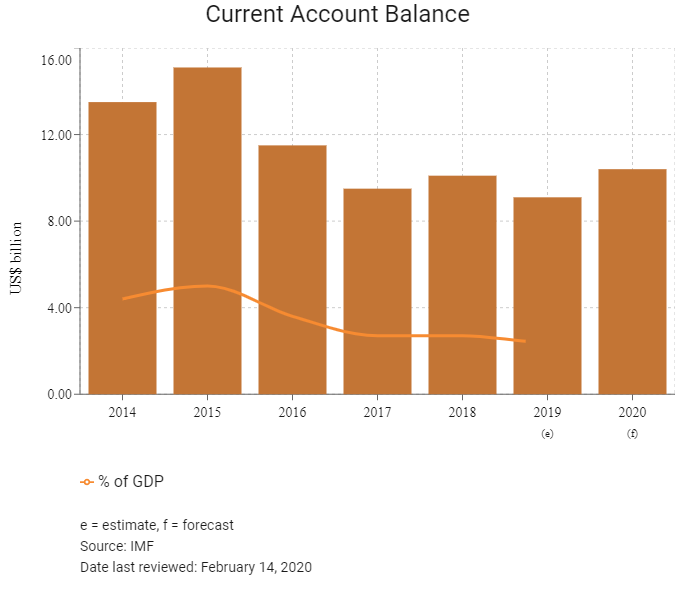

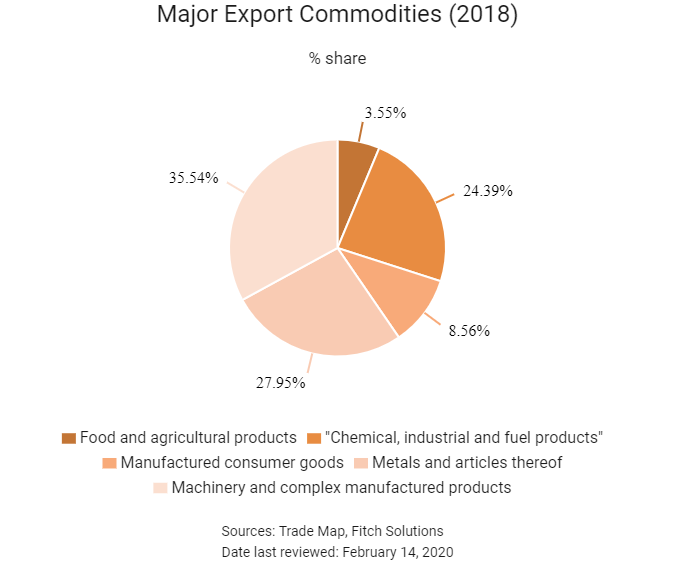

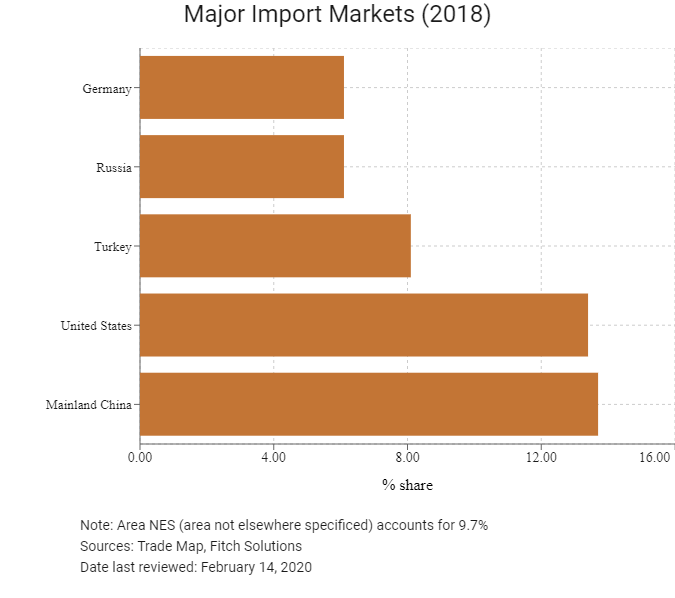

Israel has a technologically advanced market economy that relies on imports of crude oil, grains, raw materials and military equipment. Recent natural gas discoveries off the coast of Israel have been a positive development for the country, which otherwise has limited natural resources. Israel has also intensively developed its agricultural and industrial sectors over the past two decades. Cut diamonds, high-tech equipment and agricultural products (fruits and vegetables) are the leading exports. Economic growth in the medium term will receive support from strong domestic demand, increased levels of fixed investment and an export rebound. Over the long term, Israel's trade deficit is likely to narrow noticeably as rising gas exports from the Leviathan field come online.

Source: Fitch Solutions

Major Economic/Political Events and Upcoming Elections

September 2016

The United States agreed on a military aid package worth USD38 billion over the next 10 years for Israel, the largest such deal in the United States history.

February 2017

The Knesset, the Israeli parliament, passed a law which retroactively legalised dozens of Jewish settlements built on private Palestinian land in the West Bank.

June 2017

Work began on the first new Jewish settlement in the West Bank in 25 years.

December 2018

Prime Minister Benjamin Netanyahu announced snap elections on December 24, moving the scheduled general elections forward by six months. Elections for the 21st Knesset were announced for April 9, 2019.

January 2019

The governments of Israel and Egypt held talks for the construction of a new underwater gas pipeline between the two countries. The pipeline would transport gas from Israel's offshore Leviathan and Tamar fields to existing liquefied natural gas plants in Egypt for processing and re-export. Construction on the new pipeline was expected to begin in 2020, subject to the materialisation of plans.

April 2019

Israel held legislative elections for the 120 seats in the Knesset. Incumbent Prime Minister Benjamin Netanyahu’s Likud party and the Blue and White party (comprised of the Israeli Resilience Party, the Yesh Atid party and the Telem party) each secured 35 seats in the legislature. Netanyahu’s potential Likud-led collation government was not approved by the Knesset, resulting in the body’s dissolution and in snap elections due to be held in September of 2019.

September 2019

Snap legislative elections were held in Israel on September 17, 2019 to elect the 120 members of the 22nd Knesset. Following the previous elections in April, incumbent Prime Minister Benjamin Netanyahu failed to form a governing coalition.

March 2020

Israel will hold its third consecutive round of Knesset elections on March 2, which will likely feature a similar field of candidates, with Prime Minister Netanyahu, affirmed as Likud party leader, leading the ruling right-wing bloc and Benny Gantz leading the opposition.

Sources: Source: BBC Country Profile – Timeline, Fitch Solutions

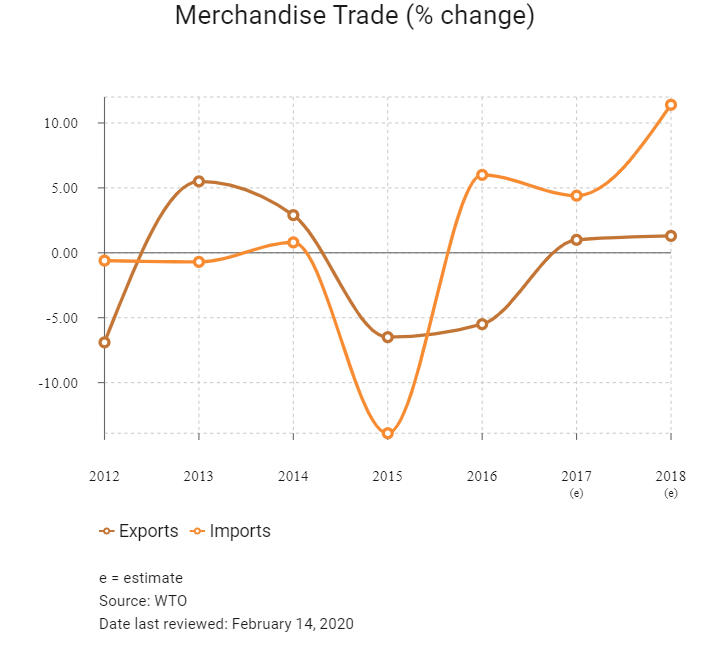

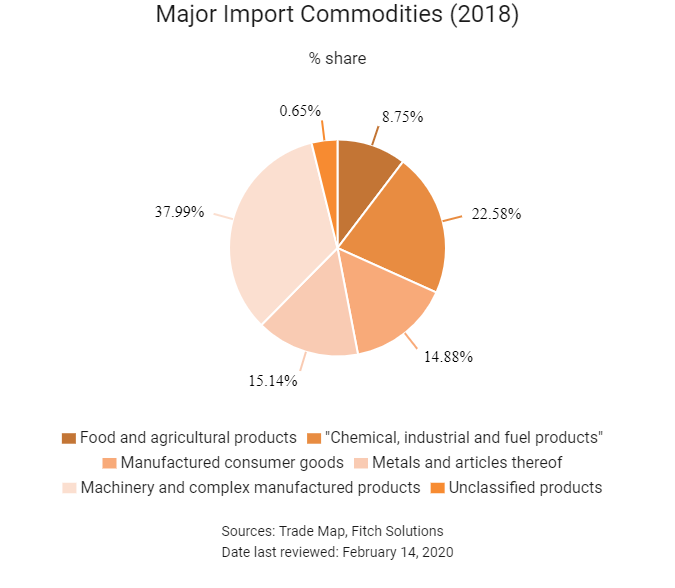

Merchandise Trade

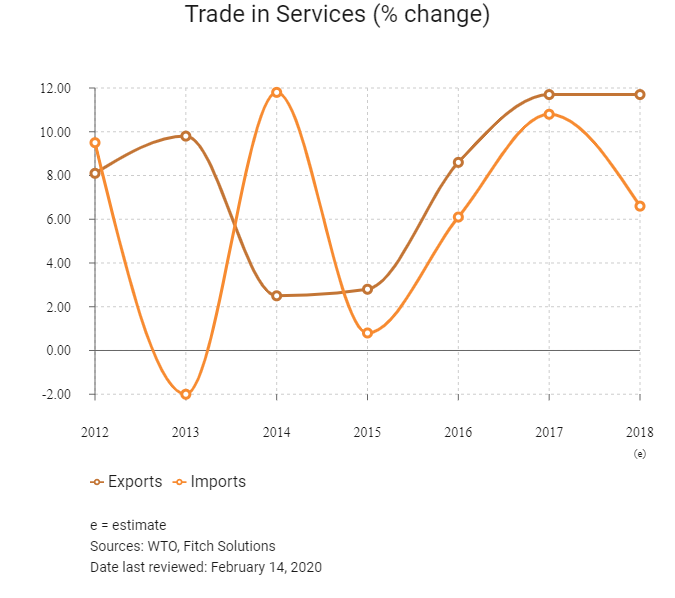

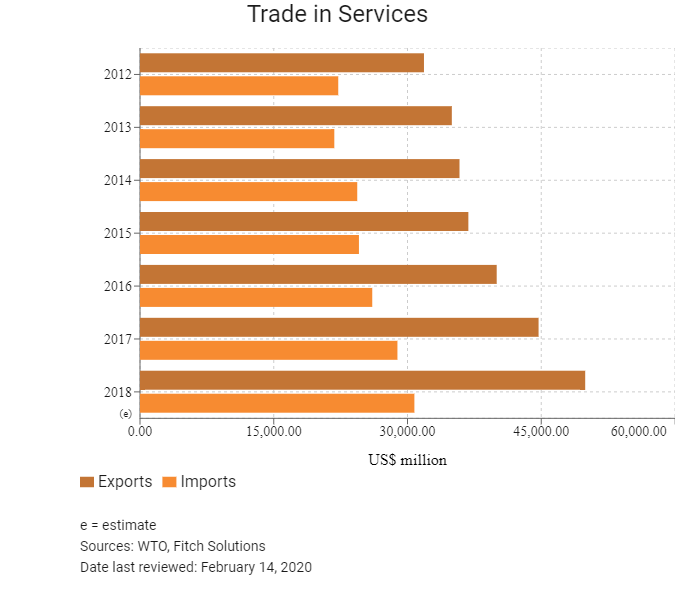

Trade in Services

- Israel has been a member of the World Trade Organization (WTO) since April 21, 1995 and a member of the General Agreement on Tariffs and Trade (GATT) since July 5, 1962.

- The average import tariff rate in Israel is 1%. This rate is among the lowest in the world and is indicative of the country's welcoming environment for international trade.

- Exports of goods, certain services and various other transactions are zero rated and certain transactions are exempt. Banks and other financial institutions pay value added tax (VAT) equivalent taxes at a rate of 17% based on their total payroll and profits. Non-profit organisations pay VAT-equivalent tax (wage tax) at a rate of 7.5% of their total payroll.

- Israel's WTO tariff schedule indicates higher rates for agricultural products but relatively low rates for intermediate inputs. Most of Israel's main trade partners, including the United States and the European Union (EU), are covered by free trade agreements (FTAs) which have eliminated the vast majority of tariffs.

- Trade relationships with major partners are reinforced by Israel's wide range of FTAs, with agreements in place with the EU, the United States, the European Free Trade Association (EFTA), Mexico, Turkey, Canada, Jordan, Egypt, Colombia and Mercosur (Southern Common Market).

- Customs duty is imposed on certain products imported into Israel. The rates of duty depend on their classification according to the Harmonised Customs Tariff and the country of origin.

- Israel imposes excise taxes on a variety of goods (such as gasoline and diesel fuel used for transport, as well as tobacco and alcohol). The excise taxes are levied item-by-item and the rates vary.

- Most goods can be freely imported into Israel, although licences are required for defence-related items. When applying for an import licence, the importer must either be an Israeli resident, a corporation or a non-profit organisation registered in Israel.

- Israel's import tariffs are classified under the Harmonised System codes. Ad valorem duties are imposed on imports' transaction value (declared by importers). On top of custom duties, a VAT is applied to almost all imported and domestically produced goods and services. For imports, VAT is levied based on the cost, insurance and freight value, plus custom duties.

- Israel maintains strict regulations on product labelling and country of origin marking. All imports into Israel must have a label showing the country of origin, the name and address of the manufacturer, the name and address of the Israeli importer and the contents, and the weight and volume in metric units. All labels must be in Hebrew. English may be added, but the printed letters must not be larger than the Hebrew ones.

- Customs procedures are streamlined and do not require excessive documentation or lengthy delays, and the risk of businesses being solicited for bribes by customs officials is low. There are few additional non-tariff trade barriers as the government is committed to supporting free trade.

Sources: WTO – Trade Policy Review, National Sources, Fitch Solutions

Trade Updates

The Israeli government is pursuing an FTA with India.

Multinational Trade Agreements

Active

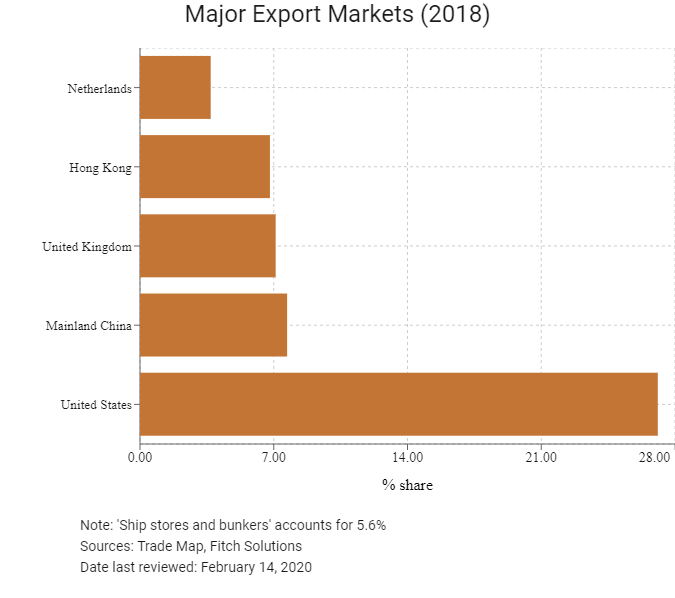

- United States-Israel FTA: The United States is Israel's single largest export partner and second-largest import partner, a situation which has been encouraged by the FTA between the two countries. This trade pact was established in 1985 to lower the trade barriers facing certain goods. The agreement reduces rates of duty and, in some case, eliminates all duties on merchandise exported from Israel to the United States. The agreement also covers merchandise exported from Israel, the Gaza Strip and the West Bank. This pact confers major advantages on Israeli businesses, which are able to access the United States market with negligible tariff or non-tariff barriers.

- EU-Israel Association Agreement: The legal basis for EU trade relations with Israel is the EU-Israel Association Agreement, which entered into force in June 2000. The aim of this agreement is to provide an appropriate framework for political dialogue and economic cooperation between the EU and Israel. Trade between the EU and Israel is substantial and some of the country's main trade partners, including Germany, Belgium and Italy, are members of the bloc.

- Israel-EFTA: Israel has an FTA with members of the EFTA, which includes Iceland, Liechtenstein, Norway and Switzerland.

- Israel-Turkey FTA: Turkey is an important trade partner and the two countries are seeking to boost economic ties. Sometimes fractious relations between the two countries have limited potential trade, but energy links are being mooted as Israel plans to exploit its offshore natural gas fields.

- MERCOSUR-Israel FTA: MERCOSUR (Southern Common Market), consists of Argentina, Brazil, Paraguay and Uruguay. The Israeli government is attempting to boost trade ties with Latin America as part of its diversification efforts to reduce reliance on the United States and EU markets. However, trade between Israel and Latin American countries remains relatively low.

- Canada-Israel FTA (CIFTA): In 2014, Canada and Israel agreed to modernise the CIFTA, a goods-only agreement in force since January 1, 1997. A modernised CIFTA will improve access to the Israeli market for Canadian companies through further elimination and reduction of tariffs on agricultural and fisheries products. With the inclusion of new progressive elements on gender, small- and medium-sized enterprises and corporate social responsibility, as well as labour and environmental protections, the modernised CIFTA will signal the importance of progressive trade and ensure that the benefits and opportunities that flow from trade and investment are more widely shared.

- Israel-Jordan Trade Agreement: A bilateral agreement exists between Israel and Jordan, which aims to boost economic ties between Israel and the Arab state with which it has established diplomatic relations. Nevertheless, trade flows between the two countries remain limited at present.

Under Negotiation

Israel-India FTA: An FTA with India is being negotiated. In 2018, India was Israel's seventh-largest export partner and 10th largest import partner. The bulk of products traded between the two countries are natural or cultured pearls, precious or semi-precious stones and precious metals. A future FTA between the two countries is expected to boost such trade further.

Sources: WTO Regional Trade Agreements database, Fitch Solutions

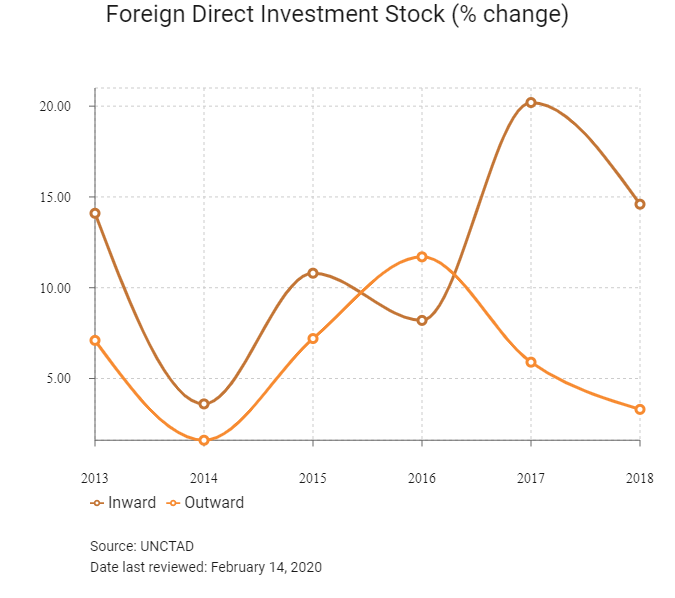

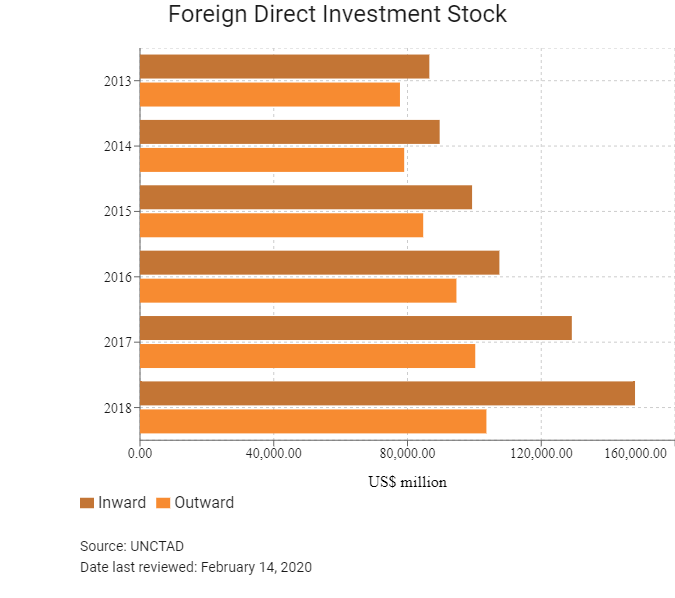

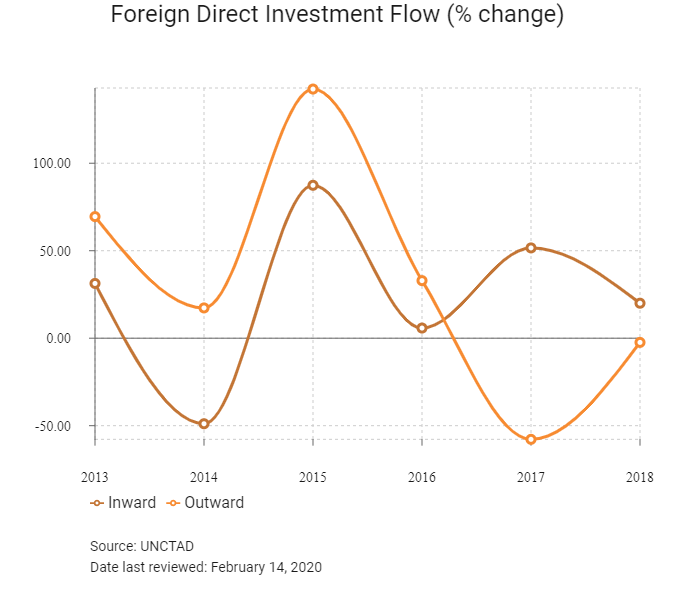

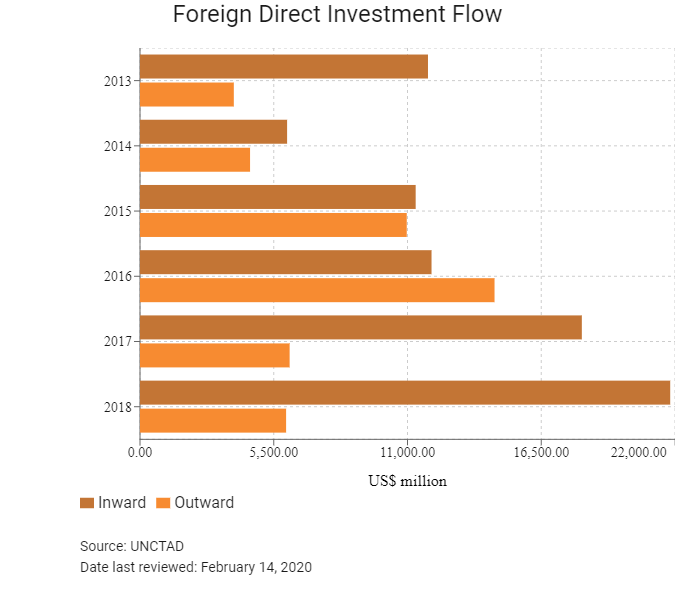

Foreign Direct Investment

Foreign Direct Investment Policy

- The Israeli government aims to foster supportive conditions for companies looking for business opportunities in the country. To promote foreign direct investment (FDI), the government has set up Invest in Israel, an investment promotion centre under the Ministry of Economy to aid investment growth across Israel's industries. A wide range of incentives and benefits are offered to investors in industry, tourism and real estate, while special focus is given to high-tech companies and research and development (R&D) activities. Investment incentives, outlined under the Law for the Encouragement of Capital Investment, are divided into two main parts: the grants programme and the automatic tax benefits programme.

- As part of its infrastructure development plans, the government will seek to leverage greater private sector finance and foreign investment. This will be achieved through the use of public-private partnership contracts and the planned launch of publicly traded infrastructure investment funds on the Tel Aviv Stock Exchange.

- Israel is actively promoting co-operation with Mainland China and other parties under the Belt and Road Initiative, welcoming Chinese enterprises to participate in various infrastructure projects in Israel, as the latter is attempting to add sea ports and new railroad networks. Mainland China Harbour is building a new port next to Ashdod's existing one, and the Shanghai International Port Group has won a 25-year licence to operate another deep-sea private port planned in Haifa. It is reported that Israel would like to Mainland China to participate in the building of a railroad connection between the ports in Eilat and Ashdod, connecting the Red Sea to the Mediterranean Sea.

- Government procurement laws require foreign companies to offset any foreign goods or services provided by investing in local production, entering partnerships with local companies, or sourcing goods and services from domestic firms. Offset requirements can vary from 20-50% of the value of the contract. This can raise the costs associated with participating in government contracts and deter foreign firms from applying for tenders.

- The Israeli government encourages investment by offering a wide range of incentives to investors under the Law for the Encouragement of Capital Investment. To meet the qualifying standard for these incentives a company must be internationally competitive, although the scheme favours high-tech and R&D industries. These incentives include grants for industrial enterprises with export capabilities and operating in a designated National Priority Region (mostly in Israel's north and south). Priority enterprises and special priority enterprises established in the same National Priority Areas can avail themselves of reduced corporate tax rates of 9% and 5% respectively. In addition, the Office of the Chief Scientist of the Ministry of Industry and Trade operates a range of support programmes on a yearly budget of USD300 million.

- Capital gains on real estate are subject to the Land Appreciation Tax Law. The law relates to any real estate in Israel, including houses, buildings and anything permanently fixed to land, real estate rights and leases for 25 years or more. Tax calculations closely follow the calculation of corporate tax on capital gains.

- In 2019, Israel made paying taxes easier by introducing an electronic system for filing and paying value added tax and social security contributions. Israel made paying taxes less costly by reducing the corporate income tax rate. In addition, Israel made starting a business easier by allowing joint registration of corporate tax and value added tax.

- In order to promote foreign investment in the Israeli corporate bonds market, there is an exemption from tax with respect to interest income received by foreign investors on their commercial investments in Israeli corporate bonds traded on the Tel Aviv Stock Exchange. The exemption is not granted to a foreign investor which has a private equity firm in Israel, or is related to or holds 10% more of the means of control in, the investee company. In addition, in order for the exemption to apply to a foreign investor that has 'special relations' with the investee company, regularly sells products to or provides services for the investee company, or who is employed by the investee company, the investor must prove that the interest rate on the corporate bond was determined in good faith.

- Preferred Enterprise regime status, which provides for cash and tax benefits, may be granted under the Law of Encouragement of Capital Investments to enterprises that meet relevant criteria. In general, the law provides that projects are considered 'preferred' if the enterprise will contribute to the development of the productive capacity of the economy, the absorption of immigrants, the creation of employment opportunities, or an improvement in the balance of payments.

- The Special Preferred Enterprise (SPFE) regime is intended for very large companies with material investments in productive assets, R&D, or in providing new employment opportunities. A company must demonstrate that it will greatly contribute to the Israeli economy to qualify for the SPFE regime. To qualify, an Israeli company must meet certain conditions, such as having SPFE annual revenue greater than or equal to ILS1 billion and being part of a group of companies that generates annual revenues greater than or equal to ILS10 billion in the same industrial sector in which the Israeli company operates.

- There are generally few regulatory barriers to investment in Israel and the government adopts a consistently welcoming approach to FDI in almost all sectors of the economy. Among the few existing restrictions is foreign investment in parts of the defence industry, which is off limits for national security reasons, while FDI in regulated industries such as banking and insurance require government approval. In addition, some key industries, including transport and utilities remain dominated by state-owned enterprises, which hold monopolies in electricity generation and distribution, port operation, aerospace, railways and energy.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Fitch Solutions, national sources

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Port of Eilat free trade zone (FTZ) |

The FTZ located at the Red Sea port of Eilat offers exemption from customs duties, trade tariffs and tax. |

|

Office of the Chief Scientist of the Ministry of Industry and Trade support programmes |

Israel operates around 30 industrial parks and areas, as well as a cross-border zone with Jordan. This is a novel enterprise and aims to fulfil Jordan's requirements for Qualified Industrial Zones (QIZ). The QIZ scheme is a United States initiative, whereby goods exported from certain areas in Jordan and Egypt are exempt from United States tariffs, provided they contain at least 8% Israeli input. |

Sources: National Sources, Fitch Solutions

- Value Added Tax: 17%

- Corporate Income Tax: 23%

Source: Israel Tax Authority

Important Updates to Taxation Information

As of January 1, 2018, the standard corporate income tax rate was lowered from 24% to 23%, following another reduction in 2017 which had brought it down from 25%. This lower tax rate reduces operational costs for businesses and aims to encourage growth and competitiveness in Israeli industries. Nevertheless, the tax burden on businesses remains higher than that experienced in Gulf Cooperation Council states, where no corporate income tax is charged.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Corporate Income Tax |

23% on profits |

|

Capital gains |

23% on real gain |

|

Transfer Tax |

Maximum of 10% on the purchase of real estate |

|

Witholding Tax for resident corporations: dividends |

Maximum of 10% on the purchase of real estate |

|

Witholding Tax for resident corporations: interest |

23% |

|

Witholding Tax for resident corporations: royalties |

30% |

|

Witholding Tax for non-resident corporations (which are not part of a tax treaty with Israel): royalties |

23% |

|

Witholding Tax for non-resident corporations (which are not part of a tax treaty with Israel): interest |

23% |

|

Witholding Tax for non-resident corporations (which are not part of a tax treaty with Israel): dividends |

25% or 30%; the 30% rate applies in the case of a ‘substantial shareholder’, which is, in general, a shareholder that holds 10% or more of the rights of the company. |

|

Employer paid - social security contributions |

For Israeli-resident employees rates are 3.55%, up to monthly income of ILS6,331, and 7.6% on the difference between ILS6,331 and the maximum monthly income of ILS44,020.

For non-resident employees, the employer rates are 0.59%, up to monthly income of ILS6,331, and 2.65% on the difference between ILS6,331 and the maximum monthly income of ILS44,020. |

|

VAT |

17% on sale of goods and services |

Source: Israel Tax Authority, World Bank Doing Business 2020

Date last reviewed: February 14, 2020

Localisation Requirements

A notable risk to businesses in Israel that need to employ foreign staff is the difficulty of obtaining foreign worker visas. Although any Jewish person wanting to live and work in Israel is eligible to apply for a right of return visa, other foreign workers must apply for a B-1 visa and are subject to the provisions laid out by the ministry.

The candidate must be sponsored by a business and can only work for that organisation while domiciled in Israel. An applicant and his or her employer can apply for a work permit that will be valid for two years, one year, three months or 45 days. As part of the process, a candidate must first receive a recommendation from the Ministry of Interior to work in Israel. This requires convincing the ministry that the employee is an expert in their field, is earning more than twice the average salary in the market and that there is no available Israeli citizen who can perform the same task. The application process usually takes up to 90 days and the cost is USD2,925.

Visa/Travel Restrictions

Most business travellers can enter Israel visa-free with a right to stay in the country for three months. Nationals of some Muslim-majority countries in the Middle East, North Africa and Asia require confirmation from the Israeli government before travel, but this should not cause major delays. Israel has visa exemption agreements with many jurisdictions. Tourist visa exemption applies to national and official passports only, and not to other travel documents. Citizens of some jurisdictions, including Hong Kong, are exempt from obtaining transit and class B-2 visas.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

A1 (Positive) |

20/07/2018 |

|

Standard & Poor's |

AA- (Stable) |

03/08/2018 |

|

Fitch Ratings |

A+ (Stable) |

29/08/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

54/190 |

49/190 |

35/190 |

|

Ease of Paying Taxes Index |

99/190 |

90/190 |

90/190 |

|

Logistics Performance Index |

37/160 |

N/A |

N/A |

|

Corruption Perception Index |

34/180 |

35/180 |

N/A |

|

IMD World Competitiveness |

21/63 |

24/63 |

N/A |

Sources: World Bank, IMD, Transparency International

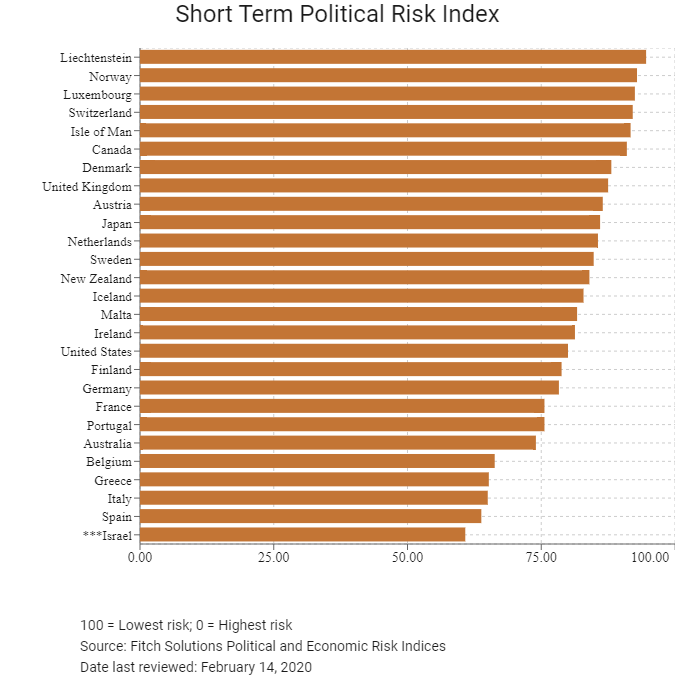

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index |

4/202 |

12/201 |

14/201 |

|

Short-Term Economic Risk Score |

80.8 |

77.9 |

77.9 |

|

Long-Term Economic Risk Score |

79.3 |

77.0 |

77.4 |

|

Political Risk Index |

75/202 |

76/201 |

75/201 |

|

Short-Term Political Risk Score |

65.8 |

66.7 |

60.8 |

|

Long-Term Political Risk Score |

69.2 |

69.2 |

69.2 |

|

Operational Risk Index |

34/201 |

35/201 |

34/201 |

|

Operational Risk Score |

67.2 |

67.2 |

67.2 |

Source: Fitch Solutions

Date last reviewed: February 14, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

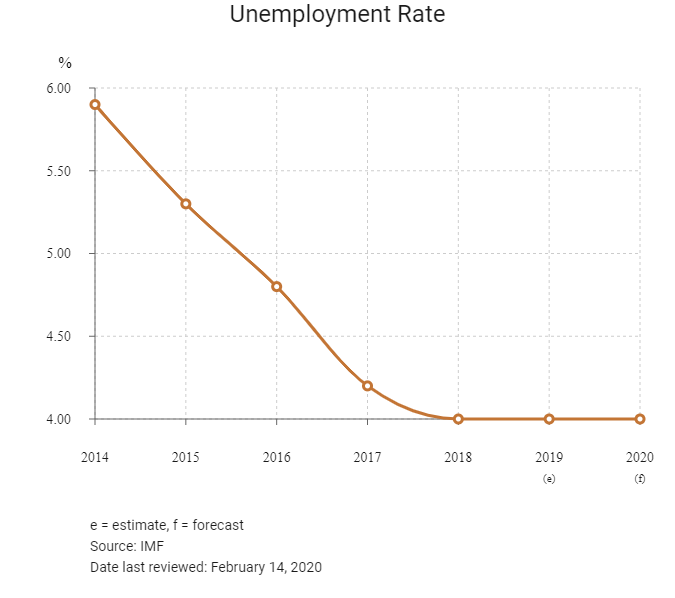

In 2020, the Israeli economy should perform fairly well underpinned by a healthy labour market, population growth and gas exports from the new Leviathan field. Additionally, a lower tax burden and still-favourable financial conditions should support private consumption, while fixed investment levels remain healthy. However, weaker global trade volatile regional geopolitics and a large fiscal shortfall pose downside risks. The export sector in Israel makes up around a third of the economy such that a further strengthening of the shekel could impact the country's economic output significantly.

OPERATIONAL RISK

Israel possesses many qualities which make it an attractive destination for investment, particularly among its direct neighbours in the Middle East. The country's open market, few investment restrictions, well-educated labour force and developed logistics network create the necessary conditions for private enterprises to thrive. The primary concern for investors is the security situation, which poses risks to the safety of personnel and assets, but the development of a comprehensive defence apparatus has made Israel one of the more secure countries in the Middle East.

Source: Fitch Solutions

Date last reviewed: February 20, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Israel Score |

67.2 |

71.3 |

64.6 |

70.2 |

62.7 |

|

Developed States Average |

72.2 |

63.0 |

71.3 |

77.1 |

77.4 |

|

Developed States Position (out of 27) |

23 |

5 |

24 |

21 |

26 |

|

Global Average |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

|

Global Position (out of 201) |

34 |

8 |

44 |

35 |

53 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Denmark |

79.4 |

70.5 |

76.2 |

88.5 |

82.3 |

|

Switzerland |

78.6 |

74.4 |

77.6 |

79.3 |

83.2 |

|

Netherlands |

78.3 |

65.4 |

78.2 |

88.8 |

80.7 |

|

Sweden |

77.6 |

66.8 |

78.1 |

86.7 |

78.6 |

|

United States |

77.6 |

79.7 |

75.3 |

85.9 |

69.3 |

|

New Zealand |

77.2 |

72.0 |

75.7 |

73.0 |

88.3 |

|

Canada |

76.4 |

73.6 |

75.4 |

75.1 |

81.6 |

|

United Kingdom |

76.4 |

70.2 |

79.0 |

78.3 |

78.2 |

|

Norway |

76.3 |

63.8 |

72.2 |

81.2 |

87.9 |

|

Austria |

74.7 |

61.9 |

71.9 |

83.6 |

81.5 |

|

Finland |

74.4 |

54.9 |

74.1 |

84.7 |

83.7 |

|

Ireland |

73.5 |

66.6 |

78.0 |

70.4 |

79.0 |

|

Luxembourg |

73.4 |

54.3 |

77.6 |

82.5 |

79.3 |

|

Germany |

72.4 |

66.1 |

69.0 |

80.8 |

73.6 |

|

Australia |

72.3 |

68.7 |

72.1 |

68.4 |

79.9 |

|

France |

71.8 |

60.7 |

71.1 |

82.6 |

72.8 |

|

Spain |

71.6 |

61.0 |

68.9 |

80.6 |

76.0 |

|

Iceland |

71.3 |

59.8 |

67.2 |

70.0 |

88.1 |

|

Japan |

71.1 |

69.9 |

65.5 |

77.5 |

71.5 |

|

Belgium |

70.8 |

57.1 |

72.8 |

82.3 |

71.1 |

|

Portugal |

69.8 |

52.5 |

66.5 |

81.7 |

78.4 |

|

Liechtenstein |

68.4 |

47.0 |

78.1 |

65.1 |

83.2 |

|

Israel |

67.2 |

71.3 |

64.6 |

70.2 |

62.7 |

|

Malta |

65.0 |

54.3 |

69.0 |

63.0 |

73.7 |

|

Italy |

63.8 |

55.1 |

59.7 |

76.2 |

64.3 |

|

Isle of Man |

62.8 |

49.9 |

62.4 |

56.6 |

82.4 |

|

Greece |

58.0 |

53.2 |

49.2 |

69.9 |

59.6 |

|

Developed Markets Averages |

72.2 |

63.0 |

71.3 |

77.1 |

77.4 |

|

Emerging Markets Averages |

46.2 |

48.2 |

46.5 |

45.0 |

44.9 |

|

Global Markets Averages |

49.7 |

50.2 |

49.8 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: February 14, 2020

Hong Kong’s Trade with Israel

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Non-metallic mineral manufactures |

1,172.8 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

206.2 |

|

Commodity 3 |

Telecommunications and sound recording and reproducing apparatus and equipment |

193.0 |

|

Commodity 4 |

Office machines and automatic data processing machines |

69.8 |

|

Commodity 5 |

Miscellaneous manufactured articles |

37.1 |

|

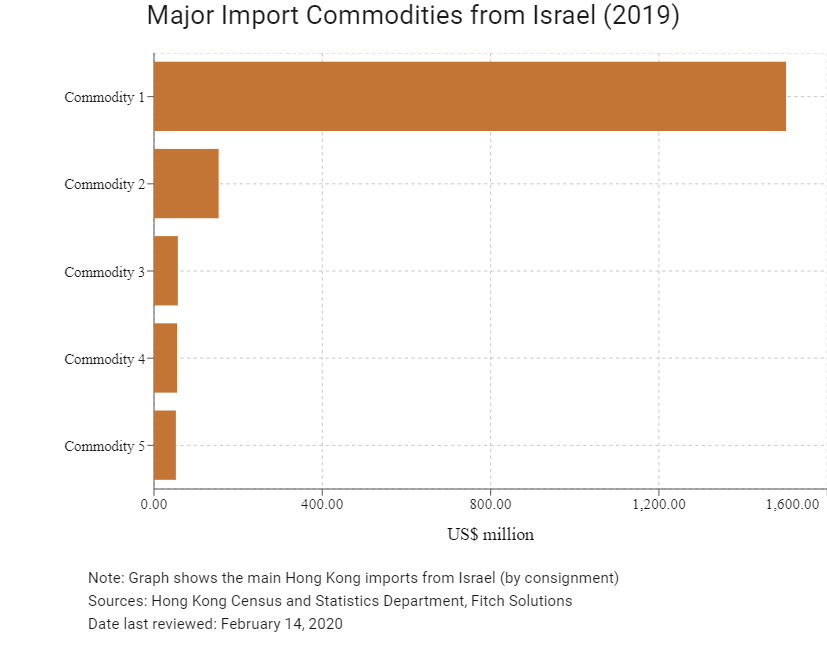

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Non-metallic mineral manufactures |

1,502.3 |

|

Commodity 2 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

153.6 |

|

Commodity 3 |

Telecommunications and sound recording and reproducing apparatus and equipment |

56.7 |

|

Commodity 4 |

Machinery specialized for particular industries |

54.8 |

|

Commodity 5 |

Professional, scientific and controlling instruments and apparatus |

52.0 |

Exchange Rate HK$/US$, average

7.75 (2014)

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Israeli residents visiting Hong Kong |

69,269 |

-10.1 |

Sources: Hong Kong Tourism Board, Fitch Solutions

|

2019 |

Growth rate (%) |

|

|

Number of Middle East residents visiting Hong Kong |

113,849 |

-12.8 |

|

Number of developed state citizens residing in Hong Kong |

83,786 |

29.6 |

Source: United Nations Department of Economic and Social Affairs – Population Division

Note: Growth rate is from 2015 to 2019. No UN data available for intermediate years.

Date last reviewed: February 14, 2020

Commercial Presence in Hong Kong

|

2017 |

Growth rate (%) |

|

|

Number of Israeli companies in Hong Kong |

32 |

N/A |

|

- Regional headquarters |

11 |

|

|

- Regional offices |

10 |

|

|

- Local offices |

11 |

Source: Hong Kong Census and Statistics Department

Treaties and agreements between Hong Kong and Israel

- Israel has concluded a double taxation agreement with Mainland China, which was signed on October 13, 2016.

- Hong Kong has concluded airline income treaties with Israel.

- Israel has a bilateral investment treaty with Mainland China that entered into force on January 13, 2009.

Sources: Israel Ministry of Finance, UNCTAD, Fitch Solutions

Chamber of Commerce (or Related Organisations) in Hong Kong

Israeli Chamber of Commerce in Hong Kong

Email: www.israel-asia.org

Tel: (852) 2857 4107

Fax: (852) 3019 5801

Source: Israel-Asia Chamber of Commerce

Consulate General of Israel in Hong Kong

Address: Room 701, Tower 2, Admiralty Centre, 18 Harcourt Road, Admiralty, Hong Kong

Email: info@hongkong.mfa.gov.il

Tel: (852) 2821 7500

Fax: (852) 2865 0220

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

HKSAR passport holders travelling to Israel have visa-free access or visa-on-arrival for a duration of stay of up to three months.

Source: Visa on Demand

Date last reviewed: February 14, 2020

Israel

Israel