GDP (US$ Billion)

1,022.45 (2018)

World Ranking 16/193

GDP Per Capita (US$)

3,871 (2018)

World Ranking 120/192

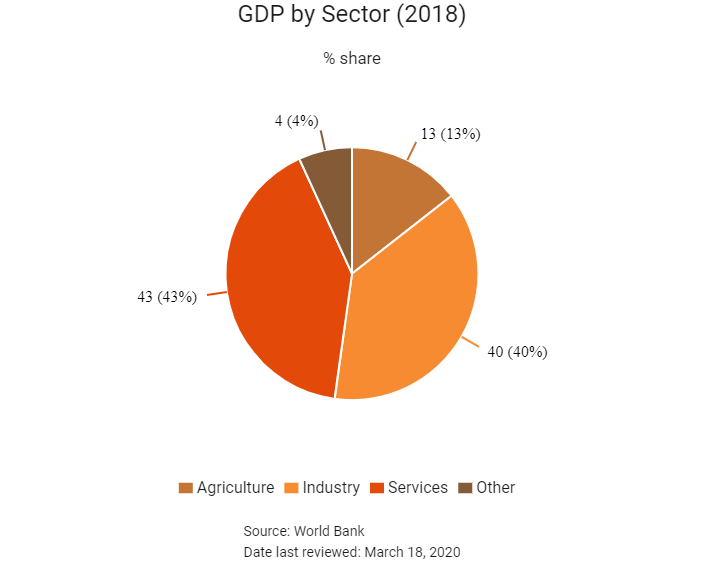

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

37.3 (2019)

Currency (Period Average)

Indonesian Rupiah

14147.67per US$ (2019)

Political System

Multiparty republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Indonesia is a sovereign archipelago in South East Asia and the fourth most populous country after Mainland China, India and the United States. It has maintained political stability and is one of Asia Pacific's most vibrant middle-income economies. The country's economic planning follows a 20-year development plan (2005 to 2025). It is segmented into five-year medium-term plans called the Rencana Pembangunan Jangka Menengah Nasional, each with different development priorities. The current medium-term development plan – the third phase of the long-term plan – runs from 2015 to 2020. It focuses on infrastructure development and social assistance programmes related to education and healthcare, among other areas. To strengthen the country's economic growth, the government continues to pursue trade agreements with various countries and economic blocs. Indonesia also continues to carry out policy reforms intended to cut red tape and make it easier to conduct business in order to improve the investment climate of the country.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

June 2018

Regional and local elections were held on June 27, 2018 to elect 17 governors, 39 mayors and 115 regents across the country. The elections included gubernatorial elections for Indonesia's four most populous provinces: West Java, East Java, Central Java and North Sumatra.

September 2018

A major earthquake and tsunami killed more than 2,000 people on the island of Sulawesi, around the city of Palu.

December 2018

The eruption of the Anak Krakatau caused a tsunami, killed more than 420 people and displaced an additional 40,000.

April 2019

Parliamentary and presidential elections were held. It was the first time in the country's history that the president, the vice president, members of the People's Representative Council (DPR), members of the People's Consultative Assembly and members of local legislative bodies were elected on the same day. Both candidates, Joko 'Jokowi' Widodo and Prabowo Subianto, promoted a mix of business-friendly, populist and protectionist policies.

May 2019

On May 21, 2019, the General Elections Commission declared Joko Widodo victorious in the presidential election, with more than 55% of the vote. Widodo's Indonesian Democratic Party of Struggle finished first in the DPR election, with 19.33% votes, followed by Prabowo's Gerindra with 12.57% and Golkar Party with 12.31% votes.

August 2019

The government revealed Borneo as the proposed site for the new capital of the country. Indonesia was seeking to move its capital away from the flood-prone city of Jakarta, parts of which have permanently sunk in water owing to constant flooding. The new capital was estimated to cost upwards of USD33 billion to build. An Indonesian unit of the management consulting company McKinsey had been appointed to do feasibility studies, including the exact funding needs and transport links with nearby cities.

October 2019

PT Borneo Alumina Indonesia selected a consortium led by Black & Veatch to manage the development of an alumina refinery in West Kalimantan. The facility would feature 1 million tonne per annum smelter-grade alumina refinery, a coal gasification plant and a coal-fired power plant. Black & Veatch is responsible for design review, equipment inspection, and providing power and coal gasification subject matter proficiency.

November 2019

Hyundai Motor Company entered into a memorandum of understanding with the Government of Indonesia to build its first car manufacturing plant in Jakarta. The project will involve an investment of around USD1.5 billion until 2030, including product development and operation costs. The facility, which was expected to become operational in the second half of 2021, would have an initial production capacity of 150,000 units annually. This was expected to reach nearly 250,000 vehicles when the plant became fully operational.

February 2020

The Indonesian Consulate General stated that the business community of Karachi, Pakistan, was trading and in consultation with Indonesian counterparts to boost bilateral trade and economic cooperation between the two states.

President Joko Widodo announced that the National Development Agency would submit a bill to accelerate the relocation of the capital city to Borneo for parliamentary approval. The government planned to move the capital in phases commencing in 2024 and anticipates it would become home to between 6 million and 7 million people.

March 2020

The government moved to relax the constitutional deficit cap of 3% of GDP and launched a number of fiscal stimulus packages to support the economy through the Covid-19 pandemic.

April 2020

The government raised USD4.3 billion through the issuing of pandemic bonds of up to 50-year dollar debt – the first of its kind in the region. The bonds would be used to fund the economy’s Covid-19 relief and recovery efforts.

Sources: BBC Country Profile – Timeline, IMF, The Strait Times, Fitch Solutions

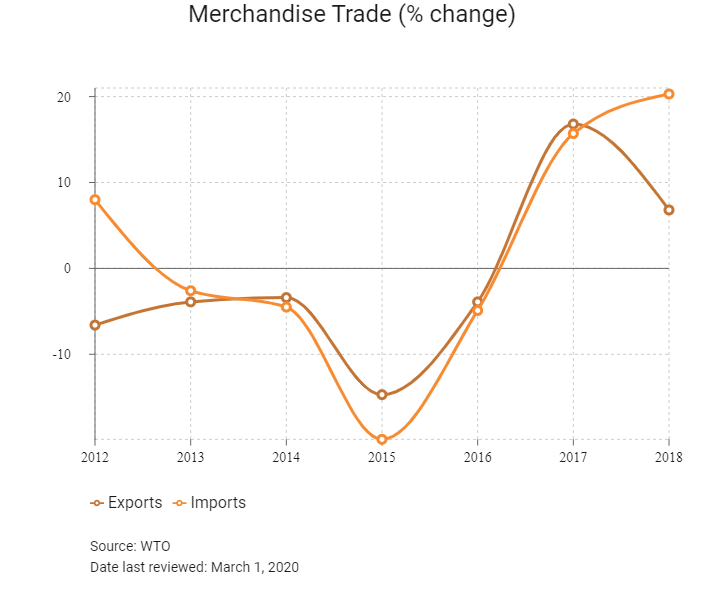

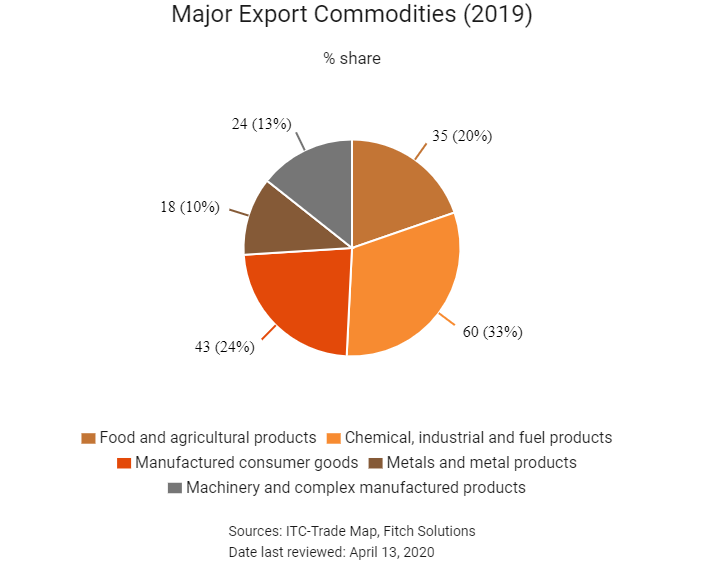

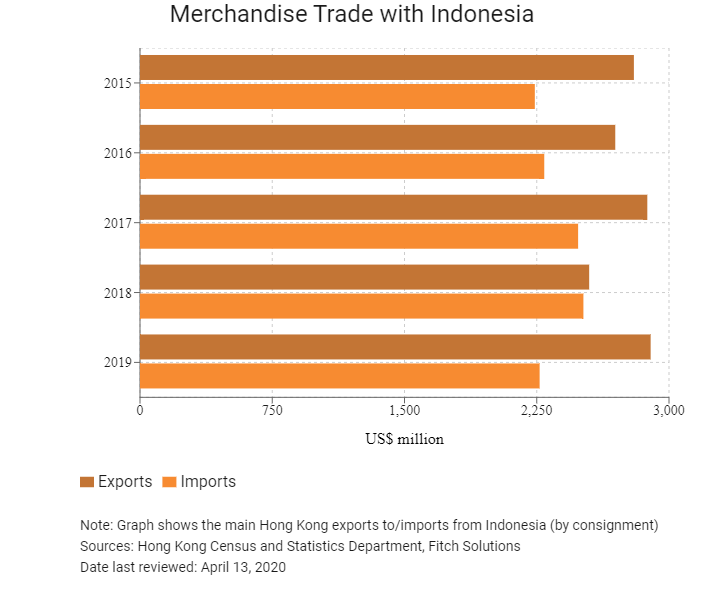

Merchandise Trade

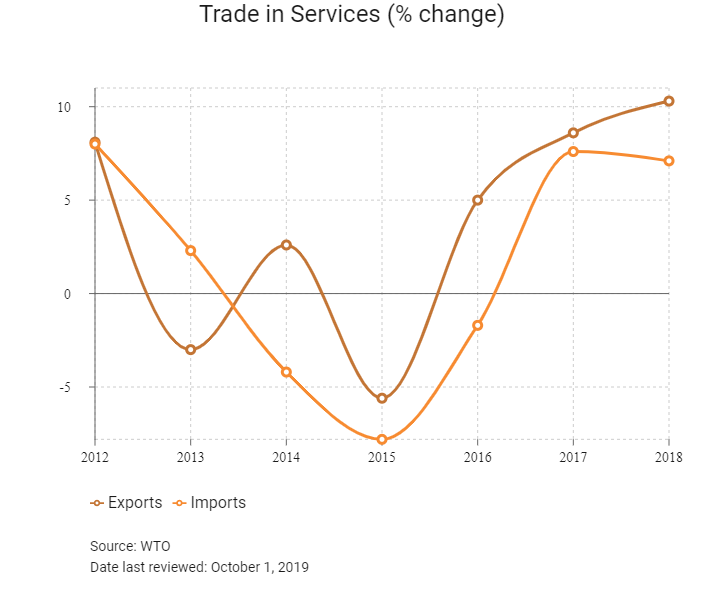

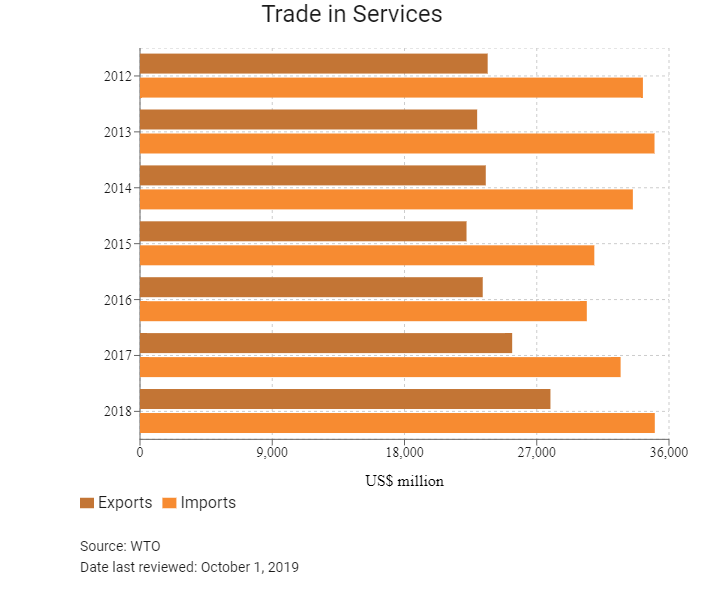

Trade in Services

- Indonesia has been a member of the World Trade Organization (WTO) since January 1, 1995 and a member of the General Agreement on Tariffs and Trade since February 24, 1950.

- Indonesia is a member of the ASEAN and a signatory to the ASEAN Free Trade Agreement (FTA) which aims to reduce tariff and non-tariff barriers to trade between member states. ASEAN has also negotiated FTAs with Australia, New Zealand, Mainland China, India, South Korea and Japan. Japan has a separate bilateral FTA with Indonesia.

- In 2015, the ASEAN Economic Community (AEC) was launched, with member states Indonesia, Malaysia, the Philippines, Singapore, Thailand, Brunei, Cambodia, Laos, Myanmar and Vietnam. The AEC aims to integrate ASEAN member states into a single market, which will provide a base for facilitating freer flows of goods, services, investment, educated labour and capital flow between members.

- While Indonesia's membership of numerous regional and economic blocs and FTAs has resulted in the country having a very low applied average tariff rate of 2.3% (the sixth lowest in East and South East Asia), there are numerous other barriers to trading with the country. There is significant trade bureaucracy (time and costs) involved for supply chains when exporting out of and importing into Indonesia, with various permit and licensing requirements.

- The Indonesian government provides various subsidies and tax incentives to local businesses and farms as it seeks to make local agriculture, manufacturing and labour-intensive industries more competitive. Indonesia has 20 different subsidy or subsidy-like protective measure in place, affecting trade with 64 states.

- Indonesia has imposed a variety of import bans on foreign companies, including bans on alcohol and foodstuff such as meat and corn. Import quotas have also been imposed on other agricultural products, such as fruits and vegetables.

- Indonesia has implemented anti-dumping duties on imports of polyester staple fibre from Mainland China, Taiwan and India and on imports of cold-rolled coil/sheet from Mainland China, Taiwan, Japan, South Korea and Vietnam.

- Value Added Tax (VAT) is applicable on deliveries (sales) of goods and services within Indonesia at a rate of 10%. VAT on exported goods is zero-rated, while imported goods are subject to VAT at a rate of 10%.

- In January 2017, Indonesia relaxed the ban on unprocessed mineral exports in an attempt to boost the economy and ease budgetary pressures. The ban was implemented in 2014 to promote the domestic mineral processing industry and encourage exports of high value-added mineral products.

- In August 2018, the Indonesian government announced an increase in tariffs on over 500 consumer goods to 7.5% in order to reduce imports and improve the current account. Since the announcement, the planned number of goods affected by the tariffs has increased from 500 to 900, and some tariffs have increased to 10%. Affected products are primarily consumer goods, as opposed to raw materials, as imported consumer goods can easily be substituted for domestic ones.

Sources: WTO – Trade Policy Review, Global Trade Alert, Fitch Solutions

Multinational Trade Agreements

Active

- ASEAN Free Trade Area (AFTA): AFTA entered into force on January 1, 1993. AFTA reduces tariff and non-tariff barriers between member states. The 10 members of AFTA are Brunei, Indonesia, Malaysia, the Philippines, Singapore, Vietnam, Laos, Myanmar, Indonesia and Cambodia. AFTA particularly boosts Indonesia's trade with Malaysia and Singapore. Since January 1, 2010, the original ASEAN-6 (Malaysia, Thailand, Indonesia, Brunei Darussalam, Singapore and the Philippines) have largely established a FTA, eliminating import duties on 99% of products on the ASEAN Inclusion List. For Cambodia, Laos, Myanmar and Vietnam, collectively referred to as CLMV, 49.27% of the tariff lines in the inclusion list are already at 0%.

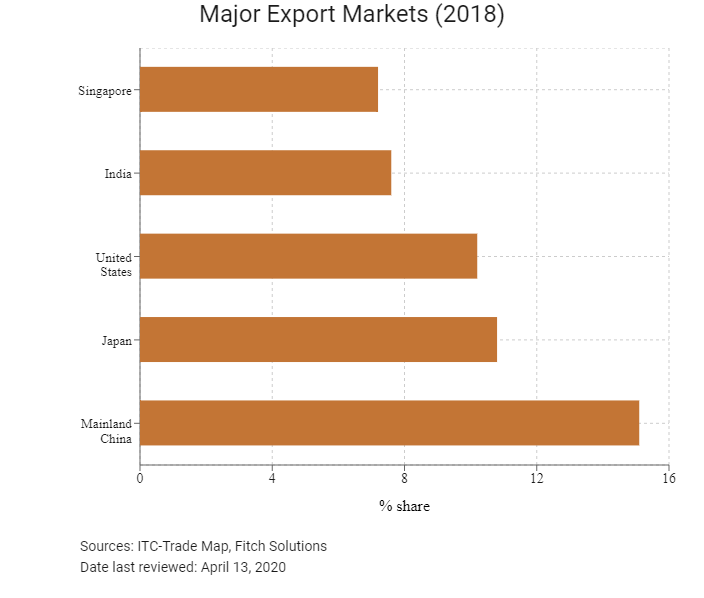

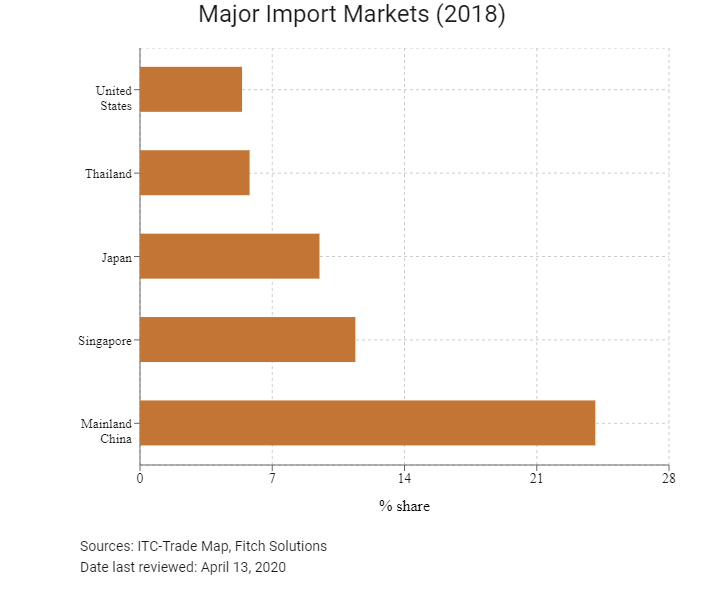

- ASEAN-Mainland China FTA and Economic Integration Agreement (EIA): The FTA, which came into effect in January 2005 for goods and July 2007 for services, is a comprehensive economic cooperation agreement (CECA) between ASEAN member states and Mainland China. The goal of the agreement is to eliminate tariffs and address behind-the-border barriers that impede the flow of goods and services. Mainland China is Indonesia's second largest export and largest import partner. The FTA is a major boost to trade between these countries.

- Indonesia-Japan FTA and EIA: The FTA came into effect on July 1, 2008 and is aimed at facilitating, promoting and liberalising trade in goods and services between the parties. Japan is Indonesia's third largest export and import partner. This FTA provides a strong boost to trade ties and helps the country balance its reliance on Mainland China.

- ASEAN-South Korea FTA and EIA: The FTA, which came into force on October 14, 2010, allows 90% of the products traded between ASEAN and South Korea to enjoy duty-free treatment. The agreement is significant given the high trade flows between the countries.

- ASEAN-India FTA: The FTA entered into force on January 1, 2010 and involves the liberalisation of tariffs on over 90% of products traded between the two regions, including the so-called special products, such as palm oil (crude and refined), coffee, black tea and pepper.

- ASEAN-Hong Kong FTA: The agreement came into force on January 1, 2019 but it will take time for all members of ASEAN to comply as implementation is subject to completion of the necessary procedures. The deal aims to cover all aspects of trade in goods, such as tariffs, rules of origin, non-tariff measures, customs procedures and trade facilitation, trade remedies, technical barriers to trade, and sanitary and phytosanitary measures. Indonesia will eliminate the customs duties of approximately 75% of its tariff lines within 10 years, whereas Hong Kong will grant tariff-free access to all products originating from ASEAN member states when the FTA takes effect.

Ratified

On February 6 2020, Indonesia ratified its FTA with Australia. Under the deal, Indonesian goods will enter Australia tariff free, while tariffs on 94% of Australian goods exported to Indonesia will be gradually eliminated. Increased trade between the two states boosts trade opportunities for businesses and will expand supply chains, which will increase and diversify revenue streams.

Waiting To Be Signed

Regional Comprehensive Economic Partnership (RCEP): A regional economic agreement that involves the 10-member ASEAN bloc and their FTA partners: Australia, Mainland China, Japan, New Zealand and South Korea. RCEP is envisioned to be a modern, comprehensive, high-quality and mutually beneficial economic partnership agreement that aims to advance economic cooperation and broaden and deepen integration in the region. The RCEP will lower tariffs and other barriers to the trade of goods among the 15 countries that are in the agreement or have existing trade deals with ASEAN. The agreement was finalised in November 2019 and is expected to be signed in November 2020. Businesses face increased trade flows and opportunities once the agreement enters into force, further enhancing Indonesia’s investment attractiveness.

Under Negotiation

- India-Indonesia CECA: The arrangement seeks to expand and develop bilateral relations and cooperation in the fields of trade, industry, investment and other economic fields.

- Indonesia-European Union (EU): Negotiations for an FTA between Indonesia and the EU were launched in April 2016, with six rounds held to date. The EU is Indonesia’s fourth largest trade partner. Indonesia already benefits from the EU’s Generalised Scheme of Preferences (GSP), with about 30% of Indonesia’s exports to the bloc subject to lower duties. Indonesia currently has a partnership and cooperation agreement with the EU, which has been in force since 2014.

Note: Only major FTAs cited

Sources: WTO Regional Trade Agreements database, government websites, Fitch Solutions

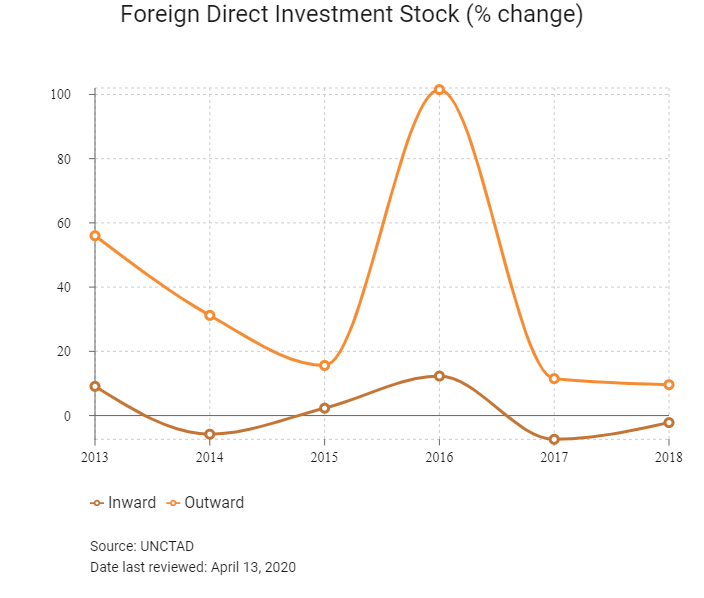

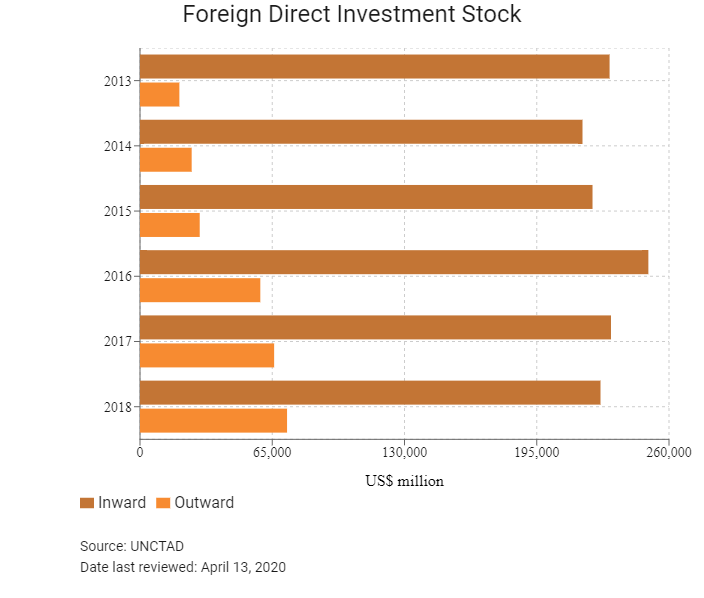

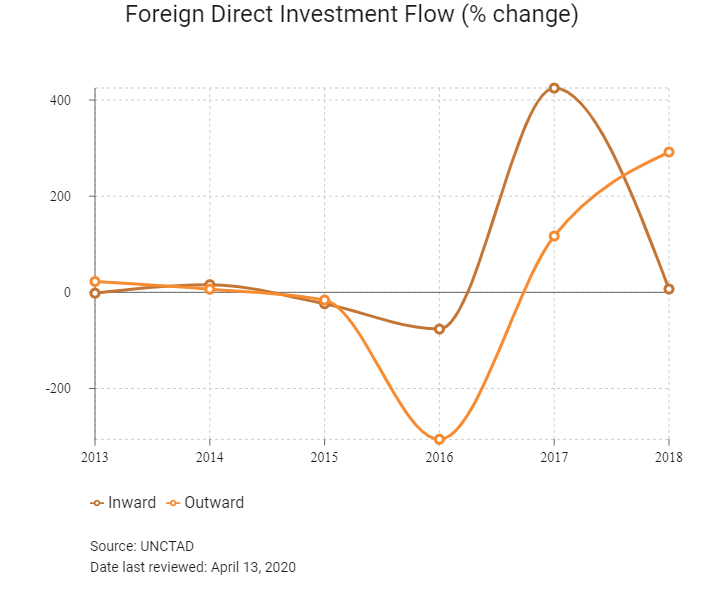

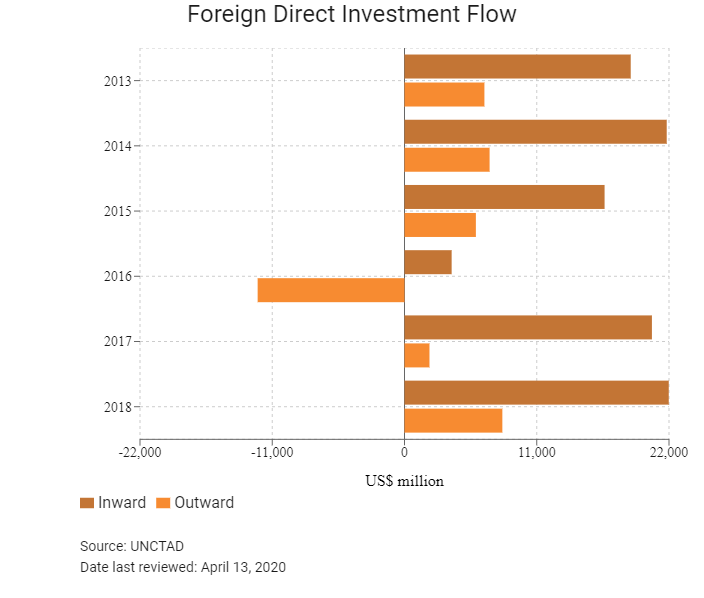

Foreign Direct Investment

Foreign Direct Investment Policy

- Since coming into power in 2014, the incumbent Indonesian President Joko 'Jokowi' Widodo has taken a pro-investment approach by seeking to attract foreign investment in order to boost the country's manufacturing sector and infrastructure. The Indonesian government has promoted some policies and initiatives to encourage foreign direct investment (FDI), particularly those that assist in developing the country's economy and skills base.

- The Foreign Investment Law regulates FDI in the country by granting licensing procedures principally controlled by the Indonesia Investment Coordinating Board (BKPM). It specifies that foreign investment should be in the form of a limited liability foreign investment company incorporated in Indonesia in which the investor goes into partnership with an Indonesian person or entity as a shareholder. The BKPM oversees FDI in Indonesia and is responsible for issuing investment licences to foreign entities. It opened an online portal in 2012 to streamline bureaucratic procedures associated with investment and opening a business. The BKPM is intended to act as a one-stop shop for business licences, but investment in the mining, oil and gas, and plantation sectors, among others, requires further authorisation from relevant ministries.

- The government encourages FDI by offering a number of fiscal and non-fiscal incentives, including tax holidays, tax allowances, and the exemption of import duties for capital goods and raw materials required for investment. However, the economy remains significantly closed to foreign investment as a result of the multitude of barriers which exist for foreign investors.

- Foreigners cannot effectively own land in Indonesia in both urban and rural settings. They can, however, obtain formal rights to use the land for a certain period for purposes such as mineral expropriation, agriculture, and building and commercial purposes by forming a legal entity (company) incorporated according to Indonesian law and domiciled in Indonesia. Businesses can purchase apartments and office space in Indonesia valid for a period of time if various stringent stipulations are complied with. It is a difficult and time-consuming process. There is also the possibility of land expropriation.

- Indonesia restricts foreign investment in some sectors through the Negative Investment List. The Negative Investment List aims to consolidate FDI restrictions from numerous decrees and regulations in order to create greater certainty for foreign and domestic investors. There are a number of business operations in which foreigners are explicitly barred from participating. These include the production of alcoholic beverages as well as the ownership of public museums, historical sites and casinos. In addition, FDI in other sectors faces a variety of restrictions, most of which include requirements for special licences and/or caps on foreign ownership. Some of these more restricted industries include mining and finance. The negative list was last revised in 2016 and is set for an update in 2020.

- In order to conduct business in Indonesia, foreign investors must be incorporated as a foreign-owned limited liability company in Indonesia. Investors are also required to participate in the Workers Social Security Programme.

- The Indonesian government is attempting to ensure that it maintains a stake in the exploitation of the country's national resources by maintaining that foreign-owned mining companies must gradually divest 51% of its shares to Indonesian interests over 10 years, with the price of divested shares determined based on fair market value and not taking into account existing reserves. Under new proposed oil and gas laws, the state's national oil company will have the right of first refusal over any new oil and gas contracts in Indonesia.

- High regulatory uncertainty exists in the mining, oil and gas, and construction industries. Indonesia regularly issues and reverses various policies on export bans, taxes and licensing requirements, which creates significant investor uncertainty in these sectors.

- Various incentives are offered to companies which are located in bonded zones throughout the country, the largest of which is based on the island of Batam, south of Singapore. These include acceptance of 100% foreign ownership; exemption from import duties, income tax, VAT and sales tax; and fewer required permits and licences.

- Indonesia has several special economic zones (SEZs) and industrial zones, although development is sometimes limited. These provide further incentives for foreign investment.

Sources: WTO – Trade Policy Review, Indonesia Investment Coordinating Board, International Trade Administration, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| Batam Island Free Trade Zone (FTZ) | • Largest FTZ located just south of Singapore (bonded zone) • Investors are not required to apply for additional implementation licenses (location, construction, and nuisance act permits; and land titles) • Foreign companies allowed 100% ownership • Import duty, income tax, VAT and sales tax exemption on imported capital goods |

Sources: US Department of Commerce, Indonesia Investment Coordinating Board, Fitch Solutions

- Value Added Tax: 10%

- Corporate Income Tax: 22%

Source: Indonesia's Directorate General of Taxes

Important Updates to Taxation Information

- Foreign taxpayers that are entitled to tax treaty protection are no longer required to submit a form DGT to each tax withholder every month. Under the new regulation, during the validity period of form DGT, foreign taxpayers are only required to submit one form DGT for all of the taxpayer's transactions. The new regulation came into effect on January 1, 2019.

- A 57% excise tax on e-cigarettes was effective from July 1, 2018.

- In line with Indonesia's commitment to implement Base Erosion and Profit Shifting Action 13, Indonesian parent entities or Indonesian subsidiaries of multinational enterprises which meet certain conditions are required to prepare and file a country-by-country Report to the DGT starting with the 2016 tax year.

- In March 2020, Indonesia decided to cut the corporate income tax (CIT) rate, a move which was previously to be included in the omnibus bill on taxation. CIT will be reduced to 22% for 2020 and 2021, further decreasing to 20% in 2022. Publicly listed companies that meet certain criteria will also get an additional 3% cut below the general rate. Digital companies such as Netflix and Spotify, with a significant economic presence, regardless of where they are based, will be considered permanent establishments and will be subject to local rules. This means that digital companies will have to charge their customers 10% VAT for buying or using their products or services as well as pay income tax to the government. According to the bill’s draft, the government will unify regional taxes and impose fiscal punishments on regional administrations that impose by-laws deemed not to be in line with the national policy. The omnibus bill on taxation will ease tax requirements for expatriates and overseas Indonesians as they will no longer be taxed on income earned outside the country’s borders. The omnibus bill will also remove tax on dividends gained from home and abroad as long as they are reinvested in Indonesia, according to the bill’s draft.

Source: Indonesia's Directorate General of Taxes

Business Taxes

Type of Tax | Tax Rate and Base |

CIT | - 22% |

Capital Gains Tax | 25% on profits |

Withholding Tax (dividends) | Dividends: 15%, dividends remitted to overseas shareholders are subject to a final 20% withholding tax, unless a tax treaty provides a lower rate Branch Profits Tax: 20% |

VAT | 10% standard rate; VAT on export of goods is zero-rated while the import of goods is subject to VAT at a rate of 10% |

Transfer duty on land and buildings | maximum rate of 5%, charged to the seller |

Sources: Indonesia's Directorate General of Taxes, Fitch Solutions

Date last reviewed: April 13, 2020

Localisation Requirements

There are stringent localisation requirements in terms of workforce and supply chain partners in a wide variety of sectors in Indonesia. This makes it much harder and more expensive, and presents higher risks for businesses wishing to hire foreign workers. Given the low levels of skills present in the Indonesian labour market, which makes the hiring of foreign workers for highly and technically skilled positions a necessity in many cases, this is a significantly risk for business operation.

A company can hire foreigners only for positions which the government has deemed open to non-Indonesians. Employers must have training programmes aimed at replacing foreign workers with Indonesians. The foreign worker must meet education, work experience and Indonesian language requirements and commit to the transfer of knowledge to an Indonesian counterpart.

Obtaining Foreign Worker Permits for Skilled Workers

Staying in Indonesia for work purposes for a long period (more than five weeks) requires the approval of the immigration office in Indonesia. Foreign workers must have the necessary visa and work and stay permits, all of which can be applied for at the immigration office by a sponsor or counterpart in Indonesia. Foreigners can only be issued with limited or temporary resident visas for a maximum period of 12 months, with the possibility of extension; subject to approval from the immigration office. The process of obtaining a visa and work permit for foreigners in Indonesia is lengthy, taking an average of three months. It is also a bureaucratically complex process. The temporary resident visa can only be obtained if the applicant has a sponsor or counterpart in Indonesia to help them obtain the visa by applying to the immigration office.

Visa/Travel Restrictions

Given that Indonesia has a significant tourism industry, there are many countries (such as those in the EU and those party to the Asia-Pacific Economic Cooperation Agreement) whose citizens can obtain visas on arrival in order to enter Indonesia for a periods of 30-60 days.

Language/Cultural barriers

Indonesian (Bahasa) is the official language of Indonesia and is widely spoken across the country. Javanese is also spoken throughout Java Island and some provinces in Sumatra and Kalimantan Island. While it is possible to conduct business in English, a little understanding of local languages is helpful for forging successful business relationships in the country. Hierarchy in business is respected a lot more in Indonesian culture in comparison with the United States and Western Europe.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

Moody's | Baa2 (Stable) | 10/2/2020 |

Standard & Poor’s | BBB (Negative) | 17/4/2020 |

Fitch Ratings | BBB (Stable) | 24/1/2020 |

Sources: Moody's, S&P Global, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

Ease of Doing Business Index | 72/190 | 73/190 | 73/190 |

Ease of Paying Taxes Index | 114/190 | 112/190 | 81/190 |

Logistics Performance Index | 46/160 | N/A | N/A |

Corruption Perception Index | 89/180 | 85/180 | N/A |

IMD World Competitiveness | 43/63 | 32/63 | N/A |

Sources: World Bank, IMD, Transparency International

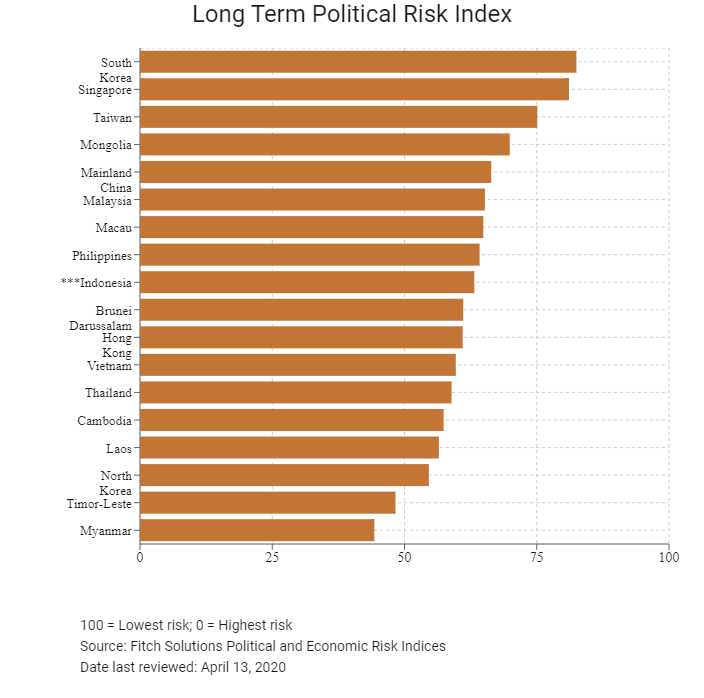

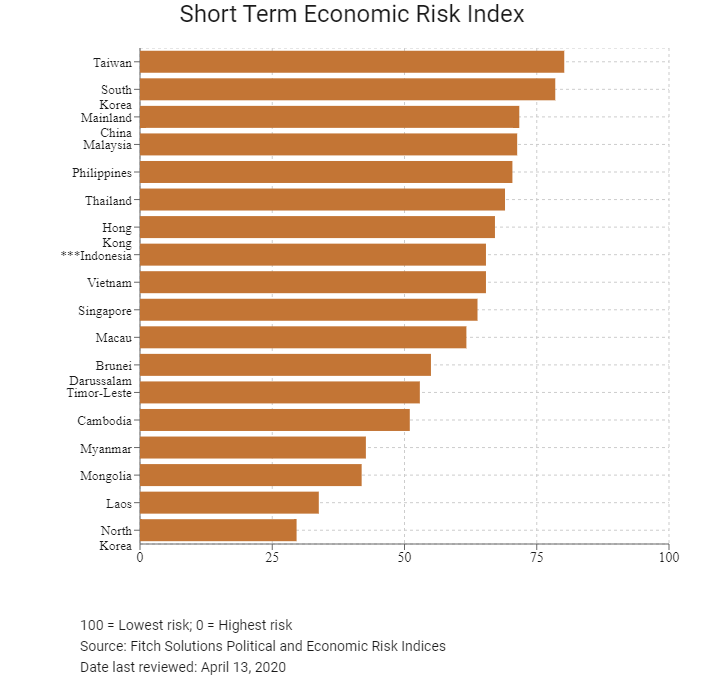

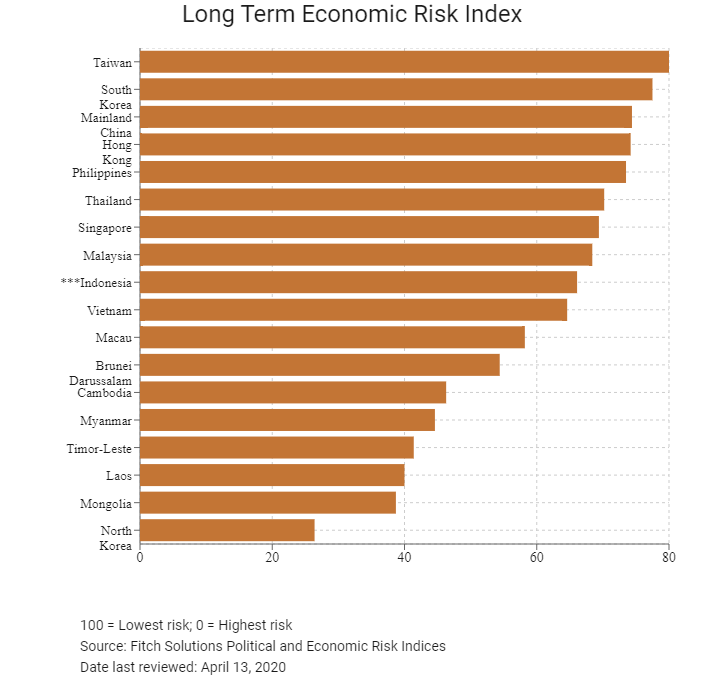

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

Economic Risk Index | 37/202 | 42/201 | 47/201 |

Short-Term Economic Risk Score | 69.2 | 70.0 | 65.4 |

Long-Term Economic Risk Score | 69.0 | 67.8 | 66.1 |

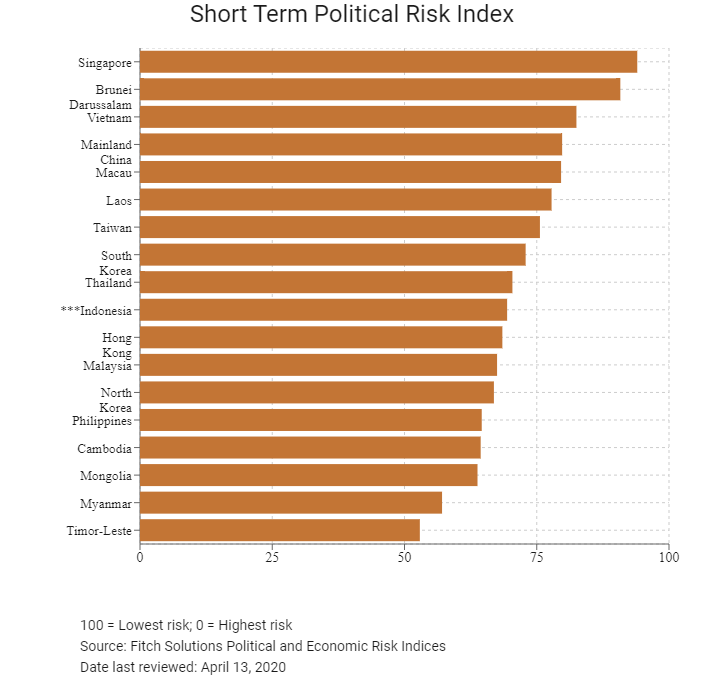

Political Risk Index | 94/202 | 91/201 | 92/201 |

Short-Term Political Risk Score | 70.6 | 71.0 | 69.4 |

Long-Term Political Risk Score | 63.2 | 63.2 | 63.2 |

Operational Risk Index | 83/201 | 77/201 | 76/201 |

Operational Risk Score | 52.6 | 53.8 | 54.4 |

Source: Fitch Solutions

Date last reviewed: April 13, 2020

Fitch Solutions Risk Summary

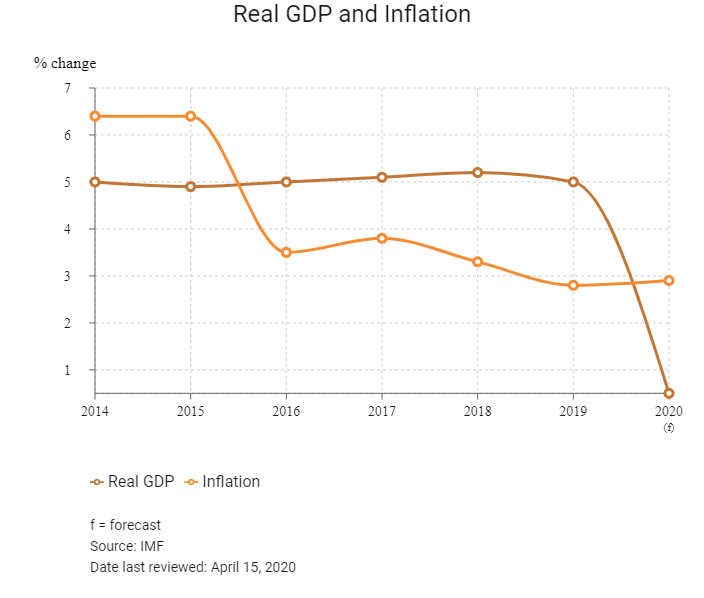

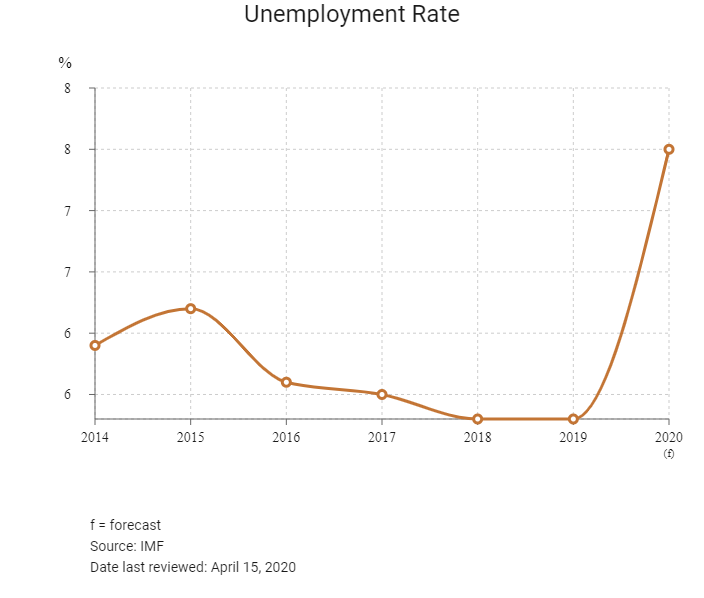

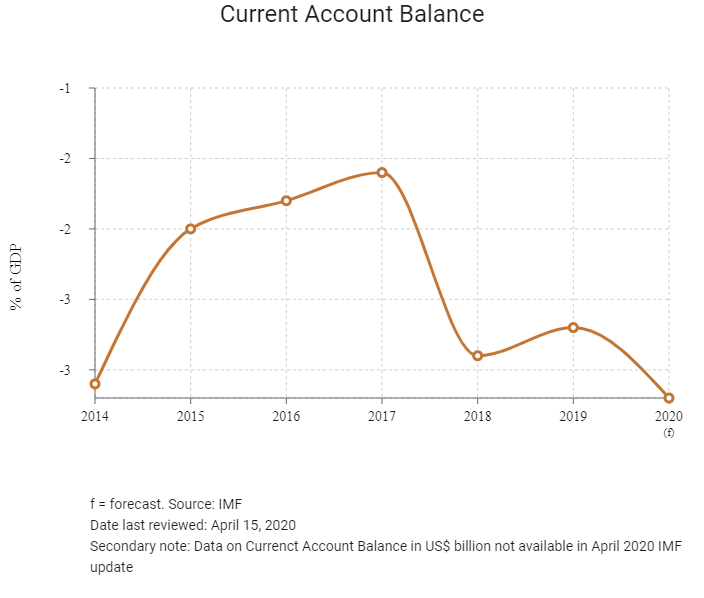

ECONOMIC RISK

Indonesia's short-term economic risk is constrained by an inefficient tax system and reliance on resource revenue, and its long-term economic risk is dragged down by the risks associated with government expenditure and the high volatility of its currency. We anticipate a contraction in 2020 as the Covid-19 pandemic affects economic activity in Indonesia. Monetary and fiscal policy is expected to be supportive in 2020 as the country tries to limit the negative effects of the coronavirus, with some monetary policy tightening factored in for 2021. A sluggish recovery in the second half of the year will reflect the continued uncertainty around how quickly the virus can be contained both in Indonesia as well as around the world. Indonesia's ability to attract foreign investment to the government's ambitious infrastructure development plan will be contingent on the administration's ability to push through key reforms.

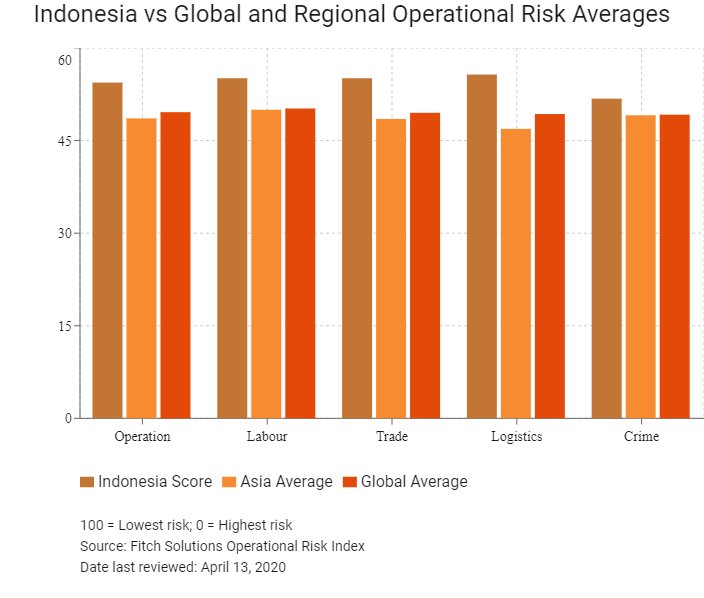

OPERATIONAL RISK

There are various opportunities for investment in Indonesia, which is South East Asia's largest economy. The manufacturing, information and communications technology, financial services, oil and gas, and infrastructure sectors represent attractive options for FDI, and portfolio investment, through increasingly sophisticated local financial markets, is a key source of capital inflows. Restrictions on FDI and excessive red tape in setting up a business pose a number of challenges. Nonetheless, businesses in Indonesia are able to make use of the country's strategic location on vital global shipping lanes, which bodes well for the future, especially when considered with the various port projects currently under way. Connections to international maritime trade routes facilitate efficient export times and very low-cost trade procedures. An expanding pool of technical workers and staff with specialised degrees in science and engineering can be found in Indonesia's larger cities.

Source: Fitch Solutions

Date last reviewed: April 14, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

Indonesia Score | 54.4 | 55.1 | 55.1 | 55.7 | 51.8 |

East and Southeast Asia average | 55.9 | 56.4 | 57.8 | 55.6 | 53.6 |

East and Southeast Asia position (out of 18) | 10 | 11 | 11 | 11 | 9 |

Asia average | 48.6 | 50.0 | 48.5 | 46.9 | 49.1 |

Asia position (out of 35) | 10 | 12 | 11 | 13 | 14 |

Global average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

Global Position (out of 201) | 76 | 67 | 82 | 72 | 91 |

Country/Region | Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk |

Singapore | 83.3 | 77.5 | 90.3 | 79.0 | 86.3 |

Hong Kong | 81.5 | 72.0 | 89.0 | 80.7 | 84.5 |

Taiwan | 73.0 | 68.3 | 75.3 | 76.3 | 71.9 |

South Korea | 70.8 | 62.4 | 70.5 | 79.7 | 70.4 |

Malaysia | 69.6 | 62.6 | 74.9 | 74.0 | 66.8 |

Macau | 63.9 | 60.9 | 69.5 | 56.2 | 69.1 |

Brunei Darussalam | 61.3 | 59.1 | 59.1 | 60.1 | 67.0 |

Thailand | 60.7 | 56.6 | 67.7 | 69.2 | 49.4 |

Mainland China | 58.8 | 54.9 | 61.4 | 71.8 | 47.3 |

Indonesia | 54.4 | 55.1 | 55.1 | 55.7 | 51.8 |

Vietnam | 53.4 | 49.3 | 57.5 | 57.8 | 49.0 |

Mongolia | 51.1 | 55.3 | 52.5 | 41.0 | 55.6 |

Philippines | 47.3 | 57.5 | 49.7 | 45.5 | 36.2 |

Cambodia | 40.6 | 44.5 | 43.0 | 35.2 | 39.8 |

Laos | 38.4 | 39.5 | 35.5 | 41.0 | 37.6 |

Myanmar | 33.1 | 47.8 | 39.1 | 27.8 | 17.8 |

North Korea | 32.4 | 51.1 | 18.5 | 27.8 | 32.3 |

Timor-Leste | 31.9 | 40.3 | 32.5 | 22.5 | 32.3 |

Regional Averages | 55.9 | 56.4 | 57.8 | 55.6 | 53.6 |

Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 13, 2020

Hong Kong’s Trade with Indonesia

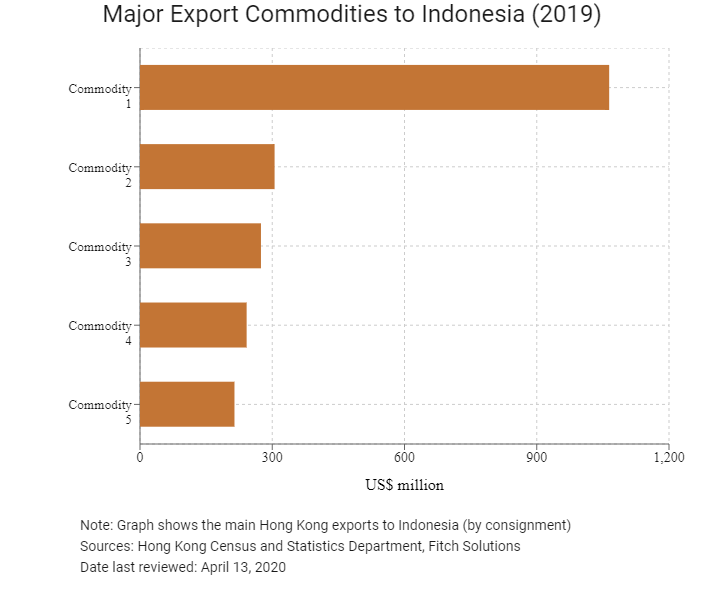

| Export Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Telecommunications and sound recording and reproducing apparatus and equipment | 1,064.30 |

| Commodity 2 | Textile yarn, fabrics, made-up articles, and related products | 305.3 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 274.4 |

| Commodity 4 | Miscellaneous manufactured articles | 241.9 |

| Commodity 5 | Office machines and automatic data processing machines | 214.3 |

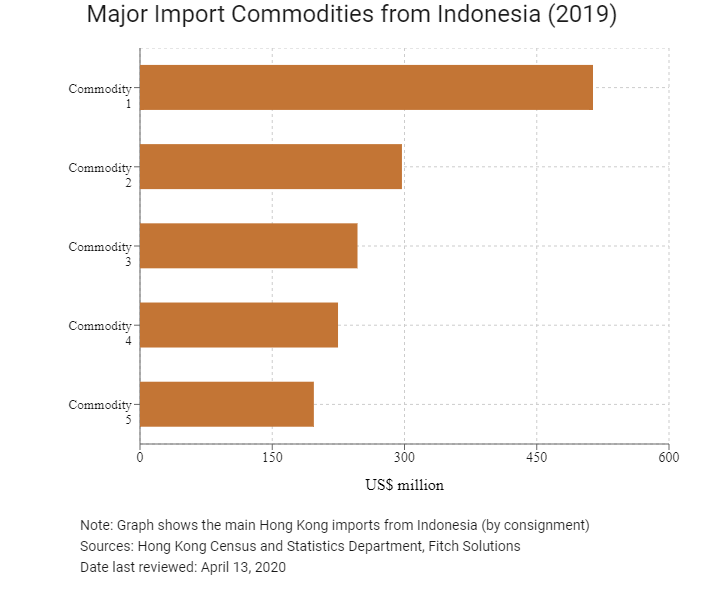

| Import Commodity | Commodity Detail | Value (US$ million) |

| Commodity 1 | Coal, coke and briquettes | 513.8 |

| Commodity 2 | Miscellaneous manufactured articles | 297.1 |

| Commodity 3 | Electrical machinery, apparatus and appliances, and electrical parts thereof | 246.7 |

| Commodity 4 | Tobacco and tobacco manufactures | 224..6 |

| Commodity 5 | Telecommunications and sound recording and reproducing apparatus and equipment | 197.2 |

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Indonesia residents visiting Hong Kong | 375,781 | -12.0 |

| Number of Asia Pacific residents visiting Hong Kong | 52,326,248 | -14.3 |

Sources: Hong Kong Tourism Board, Fitch Solutions

2019 | Growth rate (%) | |

| Number of Indonesians residing in Hong Kong | 174,380 | 29.6 |

| Number of East Asians and South Asians residing in Hong Kong | 2,834,871 | 3.4 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for intermediate years.

Sources: United Nations Department of Economic and Social Affairs – Population Division , Fitch Solutions

Date last reviewed: April 13, 2020

Commercial Presence in Hong Kong

2018 | Growth rate (%) | |

| Number of Indonesian companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and agreements between Mainland China/Hong Kong and Indonesia

- Indonesia has a double taxation agreement with Hong Kong that entered into force in March 2012.

- Hong Kong has an air service agreement with Indonesia that entered into force on June 27, 1997.

- Indonesia has a double taxation agreement with Mainland China that came into force in August 2003 and was amended in March 2016.

Source: Inland Revenue Department, Government of Hong Kong

Chamber of Commerce or Related Organisations

Indonesia Chamber of Commerce in Hong Kong

Address: 11/F, Nanyang Plaza, 57 Hung To Road, Kwun Tong, Hong Kong

Email: info@inachamhk.com

Tel: (852) 2110 1645

Fax : (852) 2110 1649

Source: Indonesia Chamber of Commerce in Hong Kong

Consulate General of the Republic of Indonesia in Hong Kong

Address: 127-129 Leighton Road, 6-8 Keswick Street, Causeway Bay, Hong Kong

Email: info@cgrihk.com

Tel: (852) 3651 0200

Fax: (852) 2895 0139

Source: Consulate General of the Republic of Indonesia in Hong Kong

Visa Requirements for Hong Kong Residents

Visa-free access valid for 30 days.

Source: Visa on Demand

Date last reviewed: April 13, 2020

Indonesia

Indonesia