GDP (US$ Billion)

80.29 (2018)

World Ranking 69/193

GDP Per Capita (US$)

853 (2018)

World Ranking 172/192

Economic Structure

(in terms of GDP composition, 2019)

External Trade (% of GDP)

28.7 (2019)

Currency (Period Average)

Ethiopian Birr

29.07per US$ (2019)

Political System

Federal republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

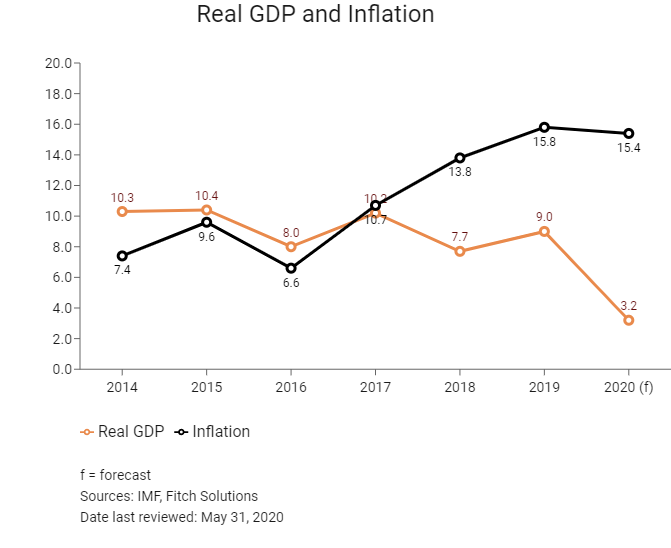

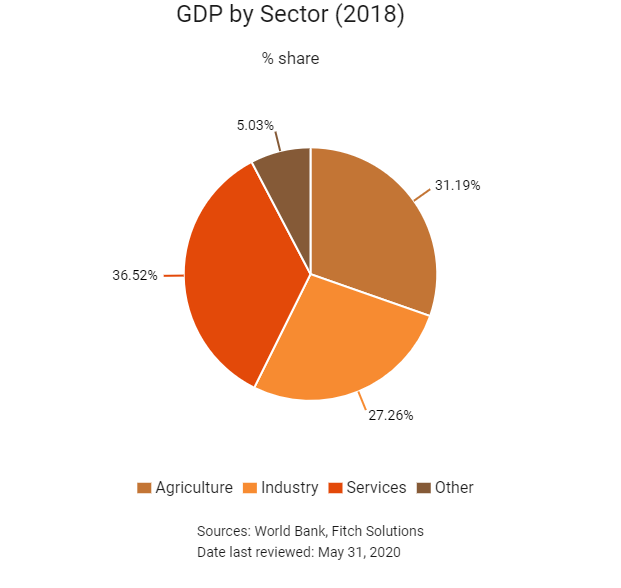

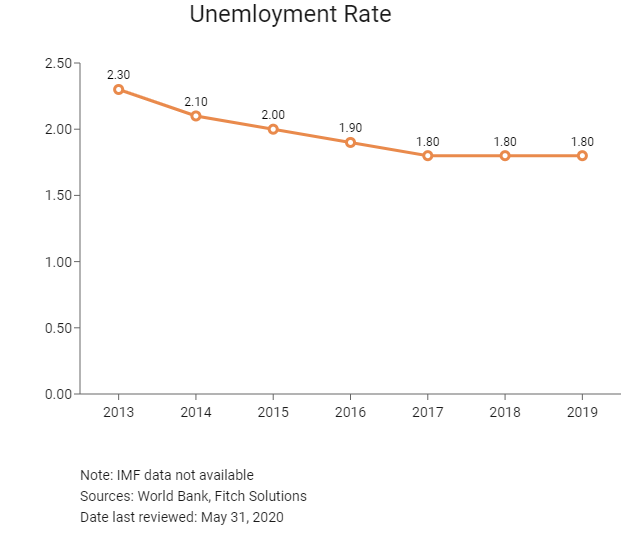

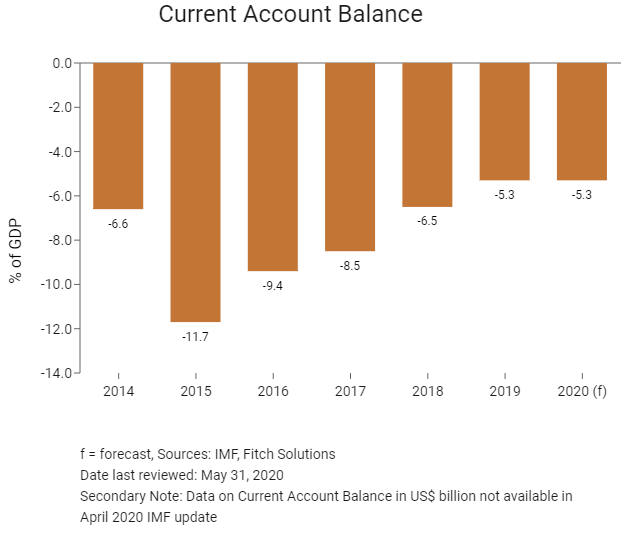

Ethiopia has one of the fastest growing economies in the world, and the its location gives it strategic dominance as a business and manufacturing hub in the Horn of Africa region as it is close to the Middle East and its markets. Ethiopia is landlocked and has been using neighbouring Djibouti's main port for the last two decades. Improving relations between Ethiopia and its regional neighbour Eritrea bode well for businesses in both countries. In particular, improved bilateral relations could give landlocked Ethiopia access to maritime routes through the Eritrean seaports of Assab and Massawa for international trade. Ethiopia's huge population of more than 102 million people makes it the second most populous nation in Africa, and the Abiy Ahmed-led government aims to reach lower middle-income status by 2025 by implementing the second phase of its Growth and Transformation Plan (GTP II). GTP II, which will run to 2020, aims to continue work on physical infrastructure through public investment projects and to transform Ethiopia into a manufacturing hub. Ethiopia's main challenges are sustaining its positive economic growth by diversifying its economy and strengthening drought resilience, mechanisation and value addition in agriculture, which will help accelerate poverty reduction. Important measures have been taken to address birr overvaluation, large external imbalances, foreign exchange shortages and rising external debt in recent quarters.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

October 2018

The Ethiopian government announced 17 infrastructure projects which it intends to develop using public-private partnership contracts. The projects are all in the power and transport sectors, and comprise five hydropower plants, eight solar projects and three roads, with a total value of approximately USD7 billion.

October 2018

The government signed a peace deal with the separatist Ogaden National Liberation Front, ending a 34-year armed rebellion.

October 2018

Parliament elected Sahle-Work Zewde as Ethiopia's first woman president and the first female head of state since Empress Zawditu (1916-1930).

February 2019

The Ethiopian cabinet ratified the country's membership to the African Continental Free Trade Area (AfCFTA) on February 4, 2019. AfCFTA technically entered into force on May 30, 2019.

April 2019

State Grid Corporation of China (SGCC) signed a USD1.8 billion investment deal to provide electric power transmission and distribution lines to Ethiopia. The works would help supply power to up to 16 industrial parks, the Addis Ababa to Djibouti second railway line and four different cities in the country.

Mainland China and Ethiopia have also signed agreements including a financing agreement for the development of a plaza and 12km of the Beautifying Sheger river bank project. The agreements cover the provision of grants for technical cooperation and food aid, a Belt and Road Initiative five-year cooperation plan and a memorandum of understanding operationalising cooperation under the Forum on China–Africa Cooperation.

June 2019

In June 2019, Ethiotel and Djibouti’s state-owned incumbent Djibouti Telecom agreed to utilise their fibre-optic railway infrastructure between Addis Ababa and Djibouti City to boost their respective broadband capabilities. The two countries are also planning greater collaboration in areas such as telecoms service interconnection and roaming.

May 2020

Parliamentary elections will be held in Ethiopia in 2020.

January 2020

Ethiopian Airlines announced plans to invest USD5 billion to build a new airport in Bishoftu, south east of Addis Ababa. The new airport would be located 70km from the existing Bole International Airport in the capital Addis Ababa. It was expected to be built over an area covering 35sq km of land. When completed, it would be able to accommodate nearly 100 million passengers annually.

March 2020

Ethiopia's electoral body, the National Election Board of Ethiopia postponed the August 2020 presidential and parliamentary elections due to the Covid-19 outbreak.

April 2020

On April 30, the Council of Ministers approved a new set of economic measures to support firms and employment amid the Covid-19 pandemic. These include forgiveness of all tax debt prior to 2014/2015, a tax amnesty on interest and penalties for tax debt pertaining to 2015/2016-2018/2019, and exemption from personal income tax withholding for four months for firms who keep paying employee salaries despite not being able to operate due to Covid-19. Furthermore, a broader set of measures including further support to enterprises and job protection in urban areas and industrial parks was under discussion with the donor community but has not been formalised.

April 2020

The central bank provided ETB15 billion (0.45% of GDP) of additional liquidity to private banks to facilitate debt restructuring and prevent bankruptcies. It has also provided 17 billion birr of additional liquidity to the Commercial Bank of Ethiopia.

Sources: BBC Country Profile – Timeline, Tralac, IMF, national sources, Fitch Solutions

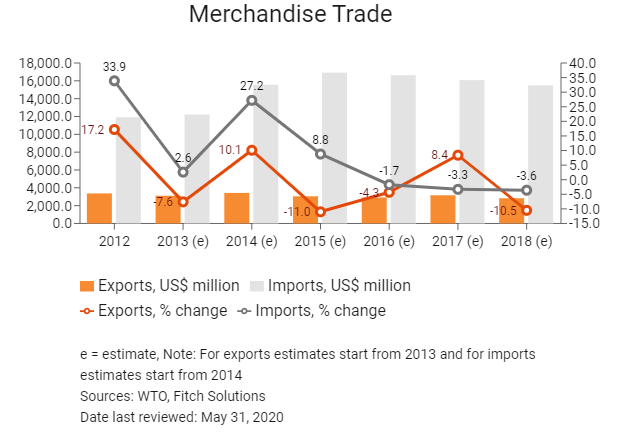

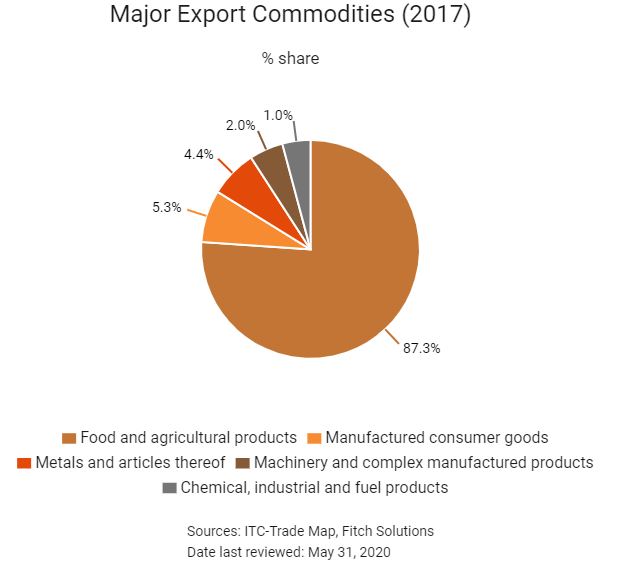

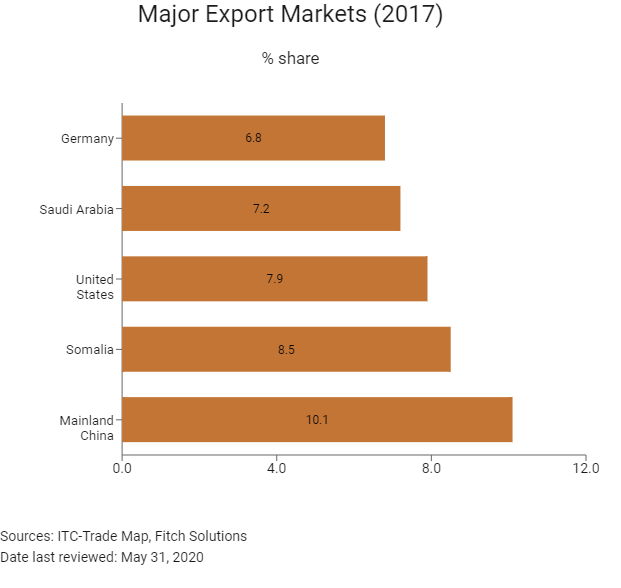

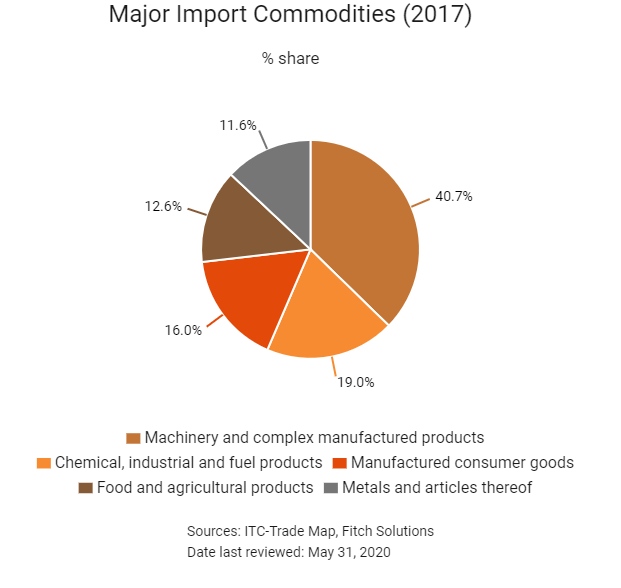

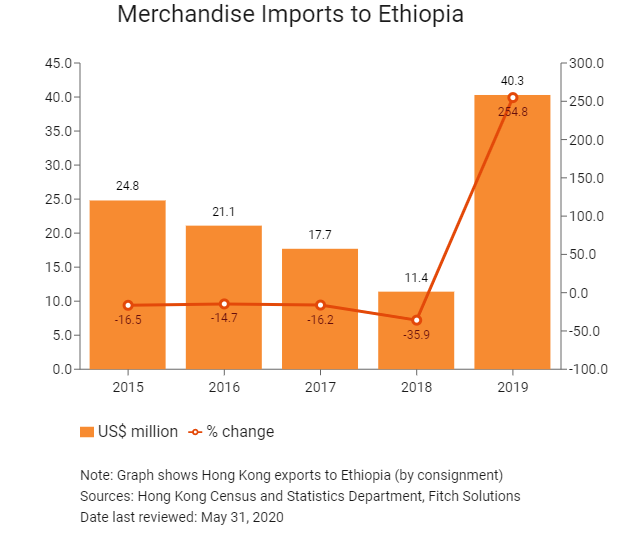

Merchandise Trade

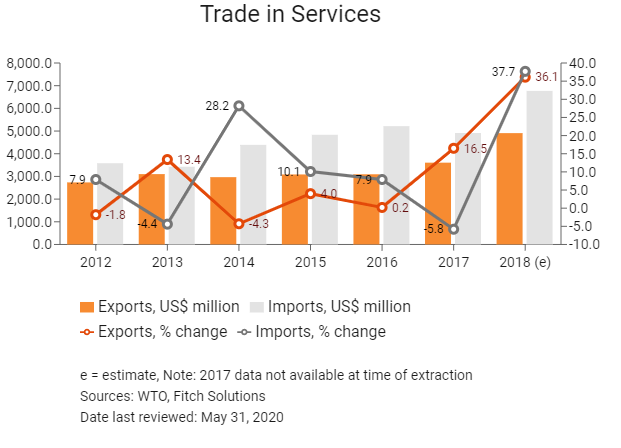

Trade in Services

- A number of export incentives are available, including facilitation of access to working capital finance. The government-dominated banking sector allocates financial resources to priority areas (agriculture, industrial activities, trade and infrastructure) in line with the government's strategic objectives.

- The National Bank of Ethiopia (NBE) administers a strict foreign currency control regime, and the Ethiopian birr (ETB) is not freely convertible. As a result, some importers face delays in arranging cross-border payments.

- Unless exempt by law, items imported into Ethiopia are subject to a number of taxes. The government levies five kinds of taxes on import items. These taxes are assigned priority levels and are calculated in a sequential order. In their sequential order these taxes are customs duty, excise tax, VAT, surtax and withholding tax. Taxes on imported goods are collected by the Ethiopian Revenues and Customs Authority.

- Ethiopia is a member of the Customs Co-operation Council. Ethiopia has reduced customs duties on a wide range of imports and duties are levied at rates ranging from 0% to 35%. Rates on category one goods (such as raw materials, semi-finished goods, producers' goods and items imported for public use, such as minibuses, buses ) range from 0% to 10%. The rates are 20% to 35% for category two goods (consumer or finished goods imported for personal use or for a non-productive purpose). Visitors are allowed to import items up to a specified value duty free. Excise tax applies on a variety of goods.

- All importers and exporters must be registered with the Ministry of Trade and obtain a trading licence. The ministry regulates imports. Foreign exchange permits are required for all importers. Highly protective tariffs are applied on certain items, such as textile products and leather goods, to protect local industries.

- In May 2019, the Ethiopian Ministry of Finance approved the tax-free imports of agricultural mechanisation, irrigation and animal feed technologies.

- The Ethiopian government has banned exports of raw cotton owing to a rise in demand from local textile and garment manufacturers.

- The NBE must approve all foreign currency transactions, and importers need to apply for an import permit and obtain a letter of credit for the total value of the imports before orders can be made.

- The NBE must approve all foreign currency transactions, and importers need to apply for an import permit and obtain a letter of credit for the total value of the imports before orders can be made. Ethiopia is currently not a member of any customs unions and has observer status with the World Trade Organization. Ethiopia is also a member of the Common Market for Eastern and Southern Africa (COMESA) and is in the final negotiation stages to join the COMESA Free Trade Area.

Sources: WTO – Trade Policy Review, Fitch Solutions

Multinational Trade Agreements

Active

- Ethiopia-Sudan: Ethiopia and Sudan signed a preferential trade agreement (PTA) which entered into force on February 6, 2003. In 2017 Ethiopia and Sudan agreed to launch a free trade zone, a railway line and to promote equitable use of the water of the Nile. Ethiopia and Sudan have also agreed on a deal allowing Ethiopia to take a stake in Sudan's largest sea gateway port – port Sudan. Nevertheless, trade with Sudan accounts for a small share of Ethiopia's total trade.

- African Continental Free Trade Area (AfCFTA): AfCFTA entered into force on May 30, 2019, for the 24 countries that had deposited their instruments of ratification. This agreement has the goal of creating a single continental market for goods and services, with free movement of business persons and investments. Better market access creates economies of scale, which is a boon for Africa's small producers, particularly in the agriculture space as many smallholder and commercial farmers in Ethiopia would benefit. The AfCFTA will bring together all 55 member states of the African Union, covering a market of more than 1.2 billion people, including a growing middle class and a combined gross domestic product (GDP) of more than USD3.4 trillion. In terms of the number of participating countries, AfCFTA will be the world’s largest free trade area since the formation of the World Trade Organisation. Estimates from the Economic Commission for Africa suggest that the AfCFTA has the potential both to boost intra-African trade by 52.3% by eliminating import duties and to double this trade if non-tariff barriers are also reduced.

Under Negotiation

- The Common Market for Eastern and Southern Africa (COMESA): COMESA is a free trade area with 21 member states stretching from Tunisia to Eswatini. COMESA was formed in December 1994, replacing a PTA which had existed since 1981. Ethiopia played a significant role in establishing COMESA, but it is still not part of its free trade agreement (FTA). As a first step towards joining the FTA, Ethiopia reduced tariffs for products originating in COMESA by 10% in 1989. In 2014 a study on the competitiveness of Ethiopian firms participating in the COMESA FTA was undertaken. The study recommended a phase down of products on which tariffs could be reduced to zero by 2019. The country is consulting on effecting further reductions.

- Ethiopia-Egypt FTA: While this agreement is still under negotiation, the removal of trade barriers would benefit investors and regional trade.

Sources: WTO Regional Trade Agreements database, COMESA, Fitch Solutions

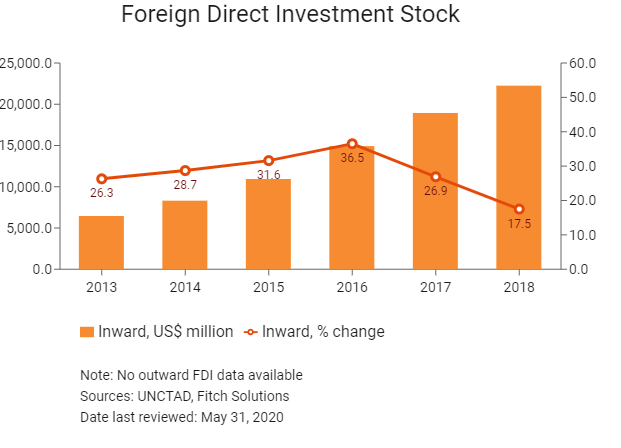

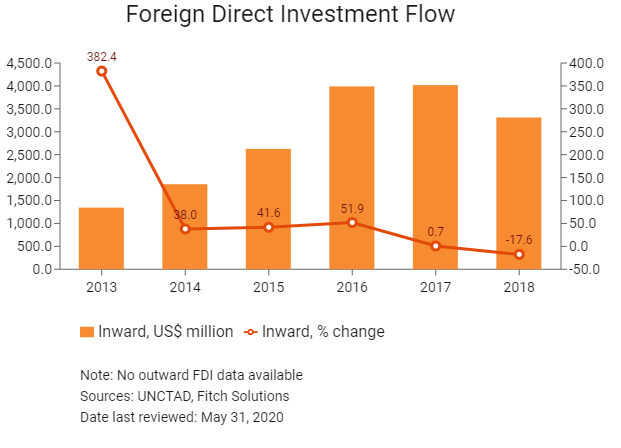

Foreign Direct Investment

Foreign Direct Investment Policy

- Attracting foreign investment is a key objective of the Ethiopian government, embedded within its current (2016-2020) five-year Growth and Transformation Plan II (GTP II). The government is seeking to attract investment in the high-priority sectors of heavy and light manufacturing, agribusiness, textiles, sugar, chemicals, pharmaceuticals, and mineral and metals processing. The government is taking steps to streamline the investment process by developing a more efficient one-stop-shop facility for foreign investors.

- Ethiopia's investment code provides incentives for development-related investments, reduces capital entry requirements for joint ventures, permits the duty-free import of some capital goods and opens the real estate sector to foreign investors, among other incentives.

- Overall economic growth targets are an annual average GDP growth of 11%. In line with its manufacturing strategy, the country hopes the industrial sector will grow by an average of 20%, thereby creating more jobs. Over a multi-year time horizon, rising manufactured goods exports will continue to bolster export growth. Industrial parks in Melle, Dire Dawa, Adama and several other locations are set to come online by the end of 2019 in line with the government's plans for Ethiopia to become a larger regional manufacturing hub in the long term. With a devaluation of the birr going some way towards boosting export competitiveness, this will further facilitate a rise in the trade of manufactured goods over time.

- The Ethiopian government is aggressively mobilising capital into new power projects, with GTP II outlining a robust power projects pipeline that will strengthen the capacity for electricity generation over the next decade. Under GTP II the government plans to mobilise USD20 billion of investment in order to build 10-12 new power generation facilities.

- Industrial parks will be particularly beneficial to the manufacturing sector, with tax and duty incentives set by the government to accompany investment in the textile and garment industry, leather and leather products, sugar and sugar-related products, cement, metal and engineering, chemicals, pharmaceuticals, and agro-processing. Incentives for developers include a tax holiday of as long as 15 years and duty-free privileges, with further advantages for building done outside the capital. Incentives for manufacturers include tax exemptions of 10 years if they export all their products from a site not in Addis Ababa.

- State-owned enterprises (SOEs) dominate major sectors of the economy and preference is given to them for investment, access to credit, foreign exchange, land, procurement contracts and import duties. Traditionally, very few SOEs release detailed financial statements, which makes it difficult to scrutinise their financial data. Corporate governance of SOEs is monitored by a board of directors comprising senior government officials. That said, the Ministry of Public Enterprises has begun streamlining governance and financial management of SOEs as well as improving transparency.

- Ethiopia's foreign ownership restrictions are above average for the region, particularly in the service industries. Certain sectors are reserved to domestic investors. Reserved sectors include broadcasting, retail and wholesale trade (except in petroleum and locally produced goods), import trade, export trade of local agricultural products, small- and medium-scale construction, bars and nightclubs, small hotels and restaurants, travel agencies, car and taxi services, bakery products, grinding mills, barber shops and beauty salons, goldsmith shops, tailoring services, building and vehicle maintenance services, saw-milling, customs clearance, museums and theatres, and printing.

- A comparatively large number of sectors are dominated by government entities, including telecommunications, defence, financial services, media, transport and retail. Notable additional sectors dominated by publicly owned enterprises include electricity and transport.

- The government in Ethiopia is now committed to selling minority stakes in a number of state-owned enterprises in order to address foreign-exchange shortages, with Ethio Telecom, Ethiopian Airlines and the Ethiopian Electric Power Company likely to be early candidates. In addition, the authorities have taken initial steps towards liberalising the country’s financial sector – previously tightly controlled, and considered largely off-limits to foreign investors. Parliament is considering measures that would allow the private sector to operate digital-based financial services, and in July 2019 approved legislation allowing foreign nationals of Ethiopian origin to buy shares in local banks and start lending businesses. While this will have little material impact on the sector – the diaspora comprises some 5mn people, but only a small proportion are likely to be in a position to invest in the banking industry – it is part of a positive trajectory, underscored by the granting in August 2019 of a business licence to a foreign-owned financial services company. Ethio Lease, a wholly-owned subsidiary of US-based Africa Asset Finance Company, will lease imported equipment, ranging from farm machinery to medical and IT equipment, to Ethiopian companies under local currency contracts, so helping firms bypass acute foreign currency shortages.

- All foreigners are required to open accounts denominated in Ethiopian birr with one of the commercial banks or authorised dealers or with special permission from the National Bank of Ethiopia (NBE). Credits to the accounts can be made only with foreign exchange receipts from abroad or checks from other similar accounts. Credits between two locally based accounts are not permitted.

- All foreign currency transactions must be approved by the NBE. The birr usually operates under a managed float regime, which sometimes raises risks of foreign currency liquidity constraints.

- The Ethiopian authorities announced in April 2019 that they would undertake a study on financial sector liberalisation in conjunction with the World Bank. A number of foreign financial firms – including Egypt’s Commercial International Bank, Kenya’s Equity Bank Group and South Africa’s ABSA – have publicly announced their interest in expanding into Ethiopia, although sporadic political instability may act as a constraint on investor interest.

- There are no discriminatory or excessively onerous visa, residence or work permit requirements applicable to foreign investors.

- Foreign currency exceeding the equivalent of USD3,000 must be declared to customs upon arrival in the country. The exchange of foreign currency is permitted only via authorised banks. Currency up to the equivalent of USD40,000 may be exported.

- The Ethiopian government's policy shift in mid-2018 to allow private and foreign investment in two of its key SOEs, the state telecommunications company Ethio Telecom and air carrier Ethiopian Airlines, suggests upside risks for further economic reforms in the quarters ahead. This will open more opportunities for foreign investors as in September 2018 the government further announced that foreign ownership will be allowed up to 49% in the logistics businesses. Previously, foreign participation was not allowed.

- The Banking and Financial Services sector, which is dominated by SOEs, remains closed off to foreign investors. At present, foreign banks are only allowed to have liaison offices in the capital city of Addis Ababa, mainly to facilitate credit to companies from their home countries and not to provide financial services for the domestic market. Ethiopia's state-owned banks represent one of the most important lenders to the government and other SOEs. This allows the government to allocate resources to its priority areas (agriculture, industrial activities, trade and infrastructure) in line with its strategic objectives.

Sources: Ethiopia Ministry of Revenues, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Investment incentives (general) |

Ethiopia's investment code outlines the following: |

|

State-owned special economic zones (SEZs) in operation include Bole-Lemi I and Addis Industrial Park, located near Addis Ababa, as well as Hawassa Industrial Park in the south, Kombolcha and Mekelle. |

These zones hold numerous benefits for apparel industry, including tax exemptions, duty-free privileges and fewer bureaucratic procedures. Specifically, investors benefit from: |

|

SEZs under construction across the country or recently opened include Bole Lemi II, Kilinto, Dire Dawa, Adama, Bahir Dar, Jimma, Areti, Debre Birhan and Air Lines Logistics Park. |

Benefits for the textile, leather, sugar, cement, metal, chemical, pharmaceutical and agro-processing industries, including tax exemptions, duty-free privileges and fewer bureaucratic procedures. |

Source: Fitch Solutions

- Value Added Tax: 15%

- Corporate Income Tax: 30%

Source: Ethiopian Ministry of Revenues

Important Updates to Taxation Information

- The Government of Ethiopia is set to introduce an excise tax on more goods in a bid to collect an additional USD1 billion in revenue annually. The new excise tax will be implemented on a number of goods, although the complete list has not been announced yet. The ministry is also going to introduce a single treasury account to modernise the finance system, which will enable the government to utilise collected taxes in a more efficient manner.

- As part of modernising its services, the Ministry of Revenue of Ethiopia is set to start collecting tax from large tax payers using electronic payment system. The e-tax payment system is planned to be fully operational in the 2019 fiscal year. The e-tax payment has been tested on the system of Commercial Bank of Ethiopia, the state financial institution which has over half market share of the banking business in Ethiopia.

Ethiopia – Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

Resident company: Corporate Tax Rates |

30% on profits |

|

Turnover Tax |

2% and 10% on goods and services |

|

Excise Tax |

35-100% on specified goods manufactured in Ethiopia and on imports |

|

Customs duties |

0-35% on imports |

|

Social Security Contributions |

- The employer must contribute to the social security scheme on behalf of the employee at a rate of 11% of basic salary |

|

VAT/GST (standard) |

15% on sale of goods and services |

Source: Ethiopian Ministry of Revenues

Date last reviewed: May 31, 2020

Localisation Requirements

Companies encounter few barriers when hiring expatriate workers. All foreigners wishing to engage in employment in Ethiopia are required to obtain a work permit, which will be granted if the employer can prove that the job cannot be performed by a local.

Foreign Worker Permits

Expatriates and work permit visas may be secured via an application to an Ethiopian diplomatic or consular mission abroad. The eligibility criteria for obtaining a work permit are set by the Ethiopian Ministry of Labour and Social Affairs. The requirements may differ depending on the type of organisation that intends to hire the expatriate worker or depending on the type of permit sought (for example, a new work permit, renewal of an existing permit or clearance for a permit). A work permit for expatriates working for a foreign investor upon submission of an investment permit is issued by the Ministry of Labour and Social Affairs. Spouses and children are entitled to stay in the country on special passes, the validity of which depends on the corresponding work permit.

Visa/Travel Restrictions

Only citizens of Djibouti and Kenya can travel visa free to Ethiopia. Forty countries, including South Africa, the United States, Canada, Australia, India and Mainland China, are issued visas on arrival that are valid for up to three months. Most other African, Middle Eastern and Latin American countries require visas before arrival.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B2 ('RUR') |

07/05/2020 |

|

Standard & Poor's |

B (Negative) |

10/04/2020 |

|

Fitch Ratings |

B (Negative) |

01/10/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

161/190 |

159/190 |

159/190 |

|

Ease of Paying Taxes Index |

133/190 |

130/190 |

132/190 |

|

Logistics Performance Index |

N/A |

N/A |

N/A |

|

Corruption Perception Index |

114/180 |

96/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International, Fitch Solutions

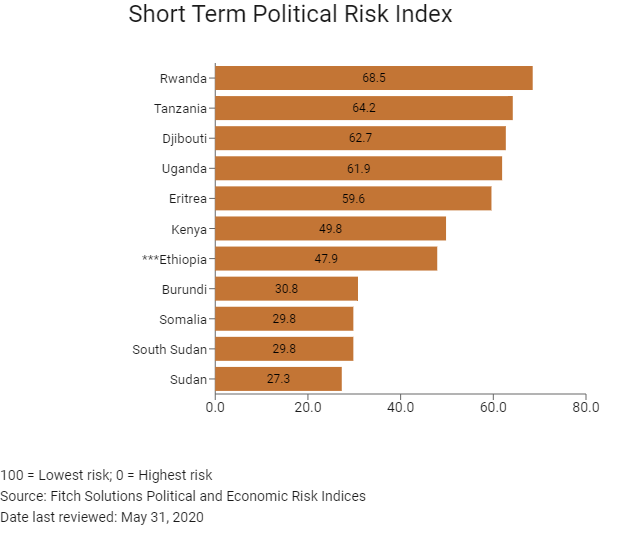

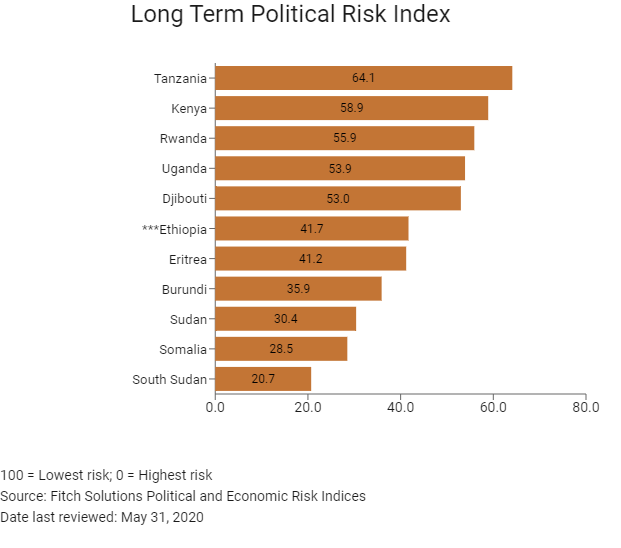

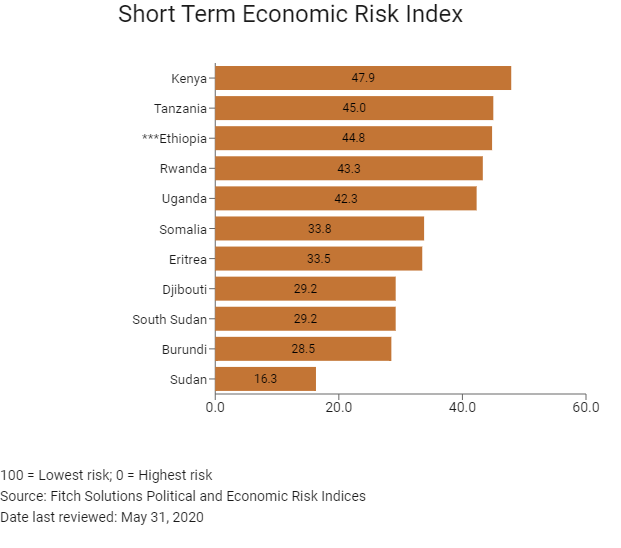

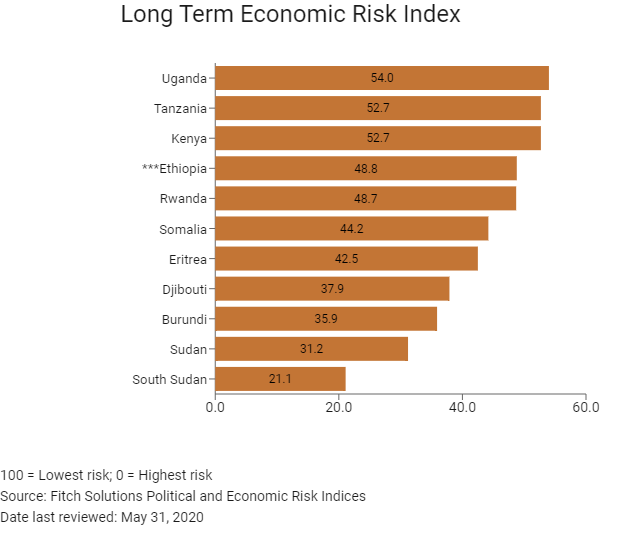

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

128/202 |

124/201 |

119/201 |

|

Short-Term Economic Risk Score |

41.7 |

42.5 |

44.8 |

|

Long-Term Economic Risk Score |

47.0 |

49.1 |

48.8 |

|

Political Risk Index Rank |

180/202 |

179/201 |

179/201 |

|

Short-Term Political Risk Score |

47.9 |

47.9 |

47.9 |

|

Long-Term Political Risk Score |

41.7 |

41.7 |

41.7 |

|

Operational Risk Index Rank |

161/201 |

165/201 |

164/201 |

|

Operational Risk Score |

34.9 |

34.1 |

33.9 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

The Ethiopian economy will remain on a strong growth trajectory over the next few years despite internal political challenges. With the country's sizeable population, improving logistics and low electricity prices, the country will increasingly position itself as a regional manufacturing hub over the next decade. However, economic growth will slow to a two-decade low in 2020 as a result of the global Covid-19 pandemic. Uncertainty regarding how long it will take to contain the global Covid-19 pandemic is the largest risk to Ethiopia's economy. Another risk is the ramp up in government debt that will occur in 2020 as the government increases spending to support the economy. The debt burden has risen quickly over the past few years, and this could be exacerbated by the large amount of government-guaranteed debt held by public enterprises.

OPERATIONAL RISK

Ethiopia is one of the most attractive investment markets in East Africa and one of the brightest stories emerging in Sub-Sahara Africa on account of its vast investment opportunities, driven by infrastructure-led growth, reforms to the business environment, a large pool of available labour and abundant natural resources. The country has second largest population in Africa, which underlines immense opportunities for consumer-facing businesses. However, Ethiopia is currently operating well below potential and is constrained by its underdeveloped infrastructure, limited access to credit, over-reliance on foreign aid and a largely low-skilled labour pool. In addition, Ethiopian businesses are exposed to regional insecurity, particularly the threat of terrorism in the Horn of Africa and violent inter-ethnic tensions.

Source: Fitch Solutions

Date last reviewed: June 1, 2020

Fitch Solutions Political and Economic Risk Indices

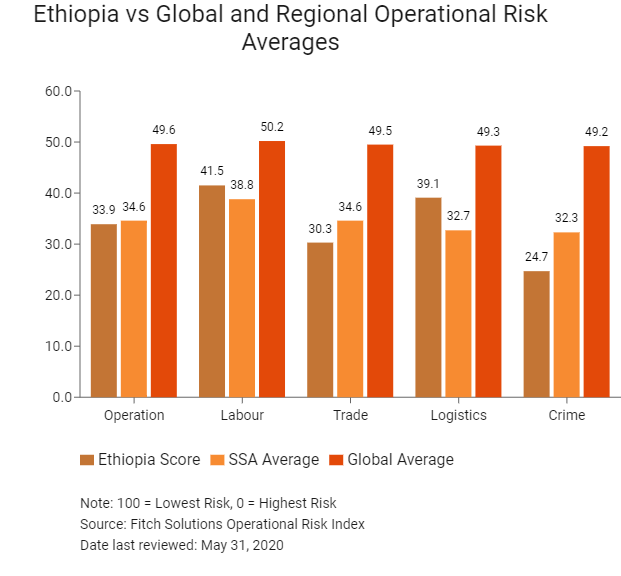

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Ethiopia Score |

33.9 |

41.5 |

30.3 |

39.1 |

24.7 |

|

East Africa Average |

32.0 |

40.4 |

32.9 |

31.1 |

23.5 |

|

East Africa Position (out of 11) |

5 |

6 |

6 |

3 |

6 |

|

SSA Average |

34.6 |

38.8 |

34.5 |

32.7 |

32.3 |

|

SSA Position (out of 48) |

23 |

15 |

32 |

10 |

34 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

164 |

152 |

171 |

136 |

179 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Rwanda |

49.2 |

49.5 |

52.8 |

44.3 |

50.1 |

|

Kenya |

43.7 |

45.5 |

46.1 |

49.5 |

33.8 |

|

Uganda |

36.7 |

46.9 |

39.2 |

31.1 |

29.7 |

|

Tanzania |

35.5 |

42.3 |

37.2 |

30.2 |

32.4 |

|

Ethiopia |

33.9 |

41.5 |

30.3 |

39.1 |

24.7 |

|

Djibouti |

32.7 |

32.1 |

39.2 |

32.1 |

27.4 |

|

Sudan |

28.8 |

44.4 |

29.3 |

28.7 |

12.8 |

|

Burundi |

27.1 |

39.3 |

27.0 |

24.1 |

18.0 |

|

Eritrea |

23.4 |

36.5 |

14.2 |

24.0 |

18.9 |

|

Somalia |

21.4 |

33.8 |

23.0 |

22.6 |

6.4 |

|

South Sudan |

19.5 |

33.0 |

23.5 |

16.9 |

4.8 |

|

Regional Averages |

32.0 |

40.4 |

32.9 |

31.1 |

23.5 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

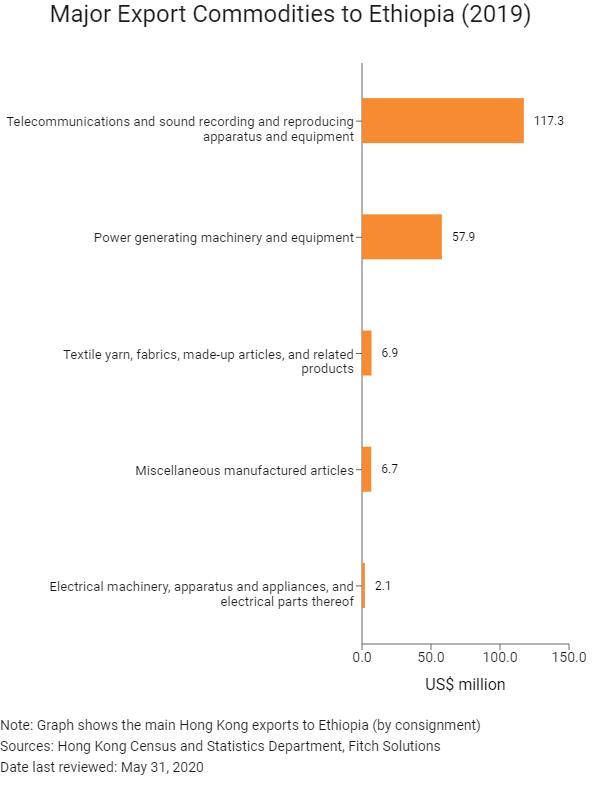

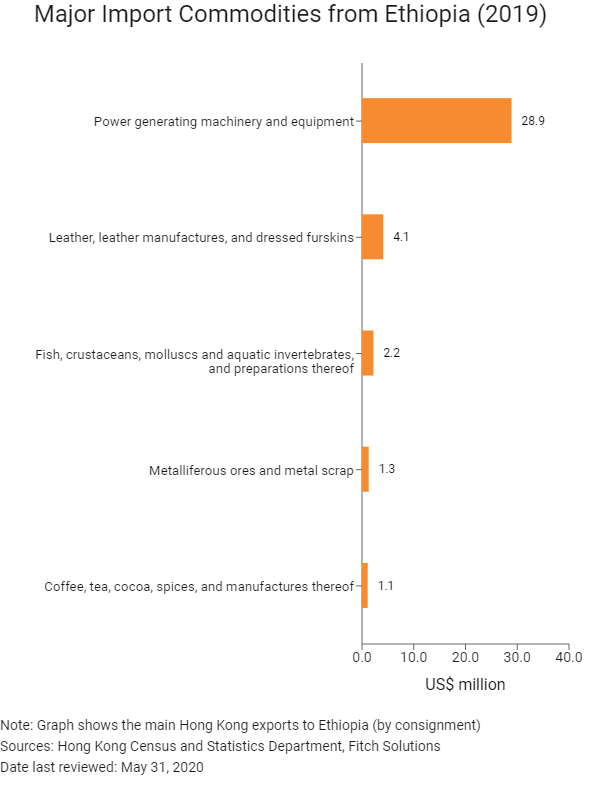

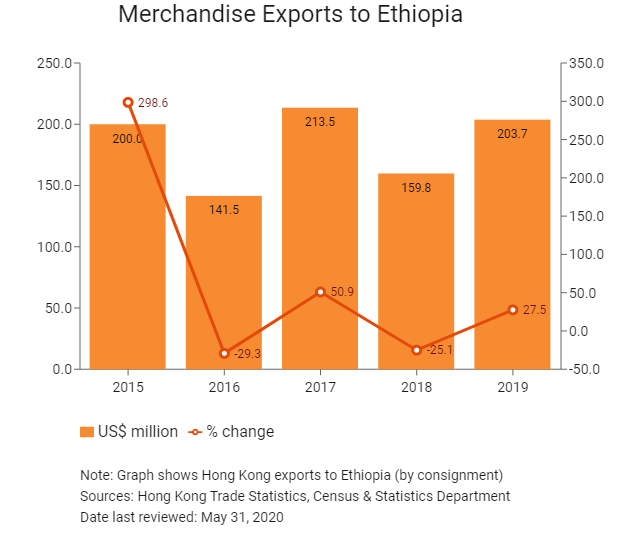

Hong Kong’s Trade with Ethiopia

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Ethiopian residents visiting Hong Kong |

340 |

-56.2 |

|

Number of African residents visiting Hong Kong |

123,656 |

-10.9 |

Sources: Hong Kong Tourism Board, Fitch Solutions

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Ethiopian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Ethiopia

- There is a bilateral investment treaty agreement between Ethiopia and mainland China signed in 1998, and which came into effect in 2000.

- In May 2010, the agreement between Ethiopia and Hong Kong governing the avoidance of double taxation from exercise of international air transportation activities came into force.

Sources: UNCTAD, Hong Kong Inland Revenue Department

Chamber of Commerce (or Related Organisations) in Hong Kong

Consulate of Ethiopia in Hong Kong

Address: Room 1204, 12/F, Harbour Crystal Centre, 100 Granville Road, Tsim Sha Tsui, Kowloon

Email: ethiopia_consulate@hotmail.com

Tel: (852) 2363 0200

Fax: (852) 3579 2722

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

Hong Kong residents may obtain a tourist visa valid for up to three months on arrival at Addis Ababa (Bole) International airport, at a cost of approximately USD52 for one month and USD72 for three months. To get a visa on arrival, travellers need to also have two passport photographs. In June 2018, Ethiopia launched an 'e-visa'. This allows Hong Kong residents to easily apply for tourist visas (more visa categories will be added in future). All other categories of visitors must get a visa from the Ethiopian Embassy closest to their place of legal residence before travelling.

Source: Main Department for Immigration and Nationality Affairs, Ethiopia

Date last reviewed: May 31, 2020

Ethiopia

Ethiopia