GDP (US$ Billion)

24.44 (2018)

World Ranking 109/193

GDP Per Capita (US$)

1,504 (2018)

World Ranking 155/192

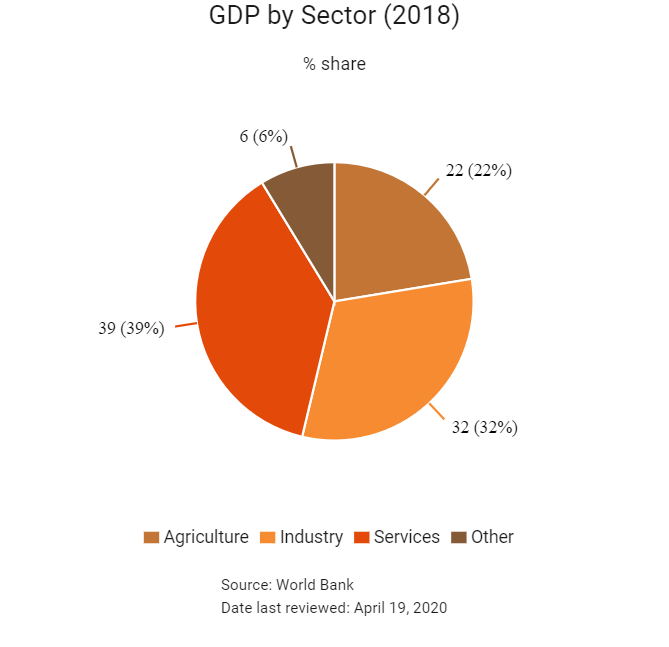

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

124.9 (2018)

Currency (Period Average)

Cambodian Riel

4061.15per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

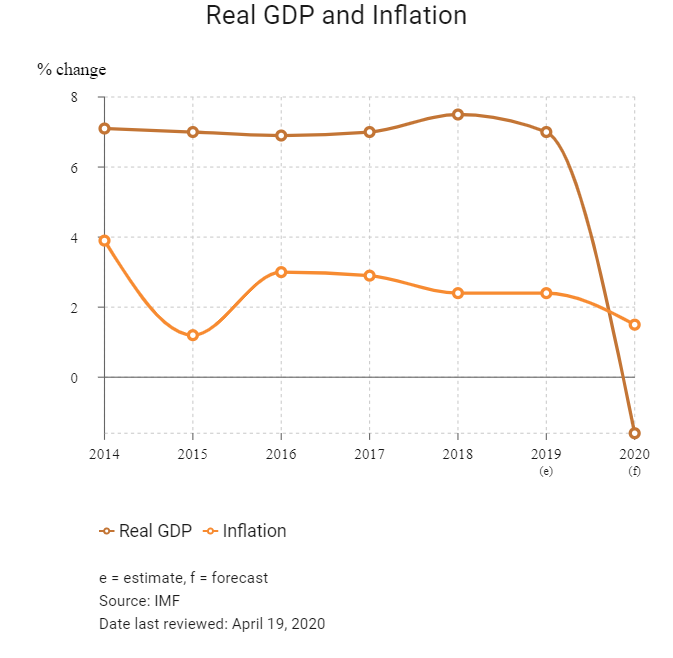

Cambodia attained lower-middle-income status in 2017, having sustained an average growth rate above 7% in the previous decade, mainly driven by garment exports and tourism. The country aspires to attain upper middle-income status by 2030. Maintaining macroeconomic stability and enhancing economic diversification, export competitiveness and the quality of public service delivery will be key to sustaining growth. That said, a lack of adequate education, the underdeveloped transport network and limited property rights pose a significant risk to the country's continued economic development.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

January 2018

The Asian Development Bank signed three financing agreements with the government of Cambodia to finance the improvement of roads, provincial water supply and sanitation, and small farms. Part of this includes a USD50 million loan to expand and improve water supplies and sanitation in Battambang, Kampong Cham, Siem Reap and Sihanoukville and to build wastewater treatment systems.

February 2018

The Cambodian People's Party (CPP) won all 58 seats in the Senate.

February 2018

Transport officials from Cambodia and Vietnam had agreed to push ahead with the Phnom Penh (Cambodia) to Binh Phuoc Province (Vietnam) Rail Line. The link will also be part of a region-wide railway project which will connect Singapore to Mainland China's Yunnan Province via Malaysia, Thailand, Cambodia and Vietnam.

June 2018

Casino and water park project Wisney World was announced. The estimated USD1.1 billion resort situated in Sihanoukville was expected to be completed in 2022.

July 2018

Cambodia received a loan of USD351 million from Mainland China to build a new road in the Cambodian capital city Phnom Penh.

July 2018

The Cambodian National Assembly election was held on July 29, 2018. The ruling CPP won all 125 National Assembly seats.

September 2018

Chinese developer Union Development Group announced that it was investing USD1.2 billion to build the Tourism Vacation City, situated in Cambodia's Koh Kong province. Construction was expected to start in 2019.

October 2018

On October 5, 2018, the European Union (EU) announced that it would conduct a six-month review on Cambodia's special trade access to the world's largest trading bloc.

October 2018

The World Bank's latest economic data revealed that Cambodia's efforts to attract tourists were paying off, with arrivals reached three million during the first six months of 2018. Tourists from Mainland China ranked first, followed by those from Vietnam, Laos and South Korea.

January 2019

The EU reinstated three-year duties on rice from Cambodia, arguing that the cheaper imports had harmed European producers and caused them to lose some of their market share. Cambodian exports of rice to the EU had increased from 8,000 tonnes in 2009 to 345,000 tonnes in 2016.

January 2019

During a state visit to Mainland China, Cambodia's Prime Minister Hun Sen urged President Xi Jinping to enter into a free trade agreement (FTA) with Cambodia. Any such relaxation on trade restrictions might help to transition the Cambodian economy away from textiles.

February 2019

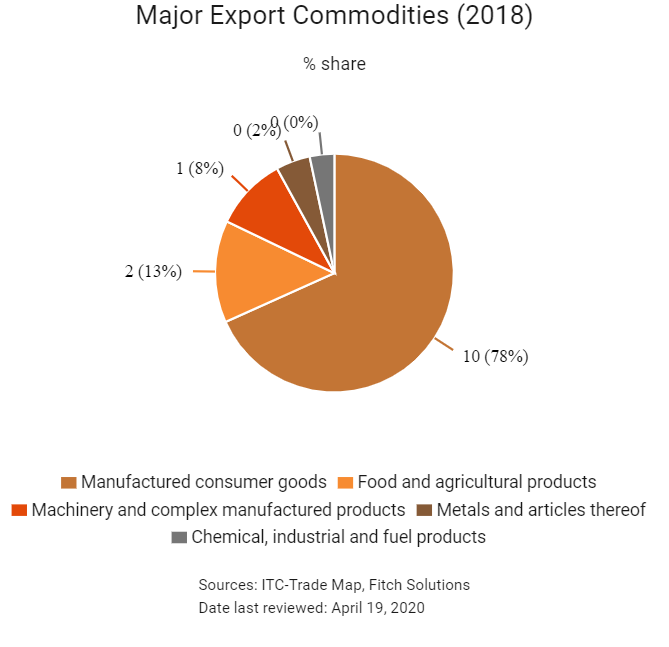

The EU announced that it was to start the process for withdrawing Cambodia's 'Everything but Arms' preferential trade scheme. Textile exports remain a vital part of the economy, and because approximately 80% of Cambodian goods exported to the EU are textiles, this development could have a negative impact on the industry in the short term. Although any withdrawal of the scheme would not occur until 2020 at the earliest, EU-based companies may pre-emptively move their textiles manufacturing bases away from Cambodia in the meantime.

March 2019

Cambodia's Ministry of Tourism announced that foreign tourist numbers had increased by 10% for the first two months of 2019 compared with the year before. Although the number of tourists from Mainland China had increased by 31.7%, the Ministry said that Cambodia still attracts fewer Chinese tourists than other countries – two million in 2018 out of 125 million Chinese tourists worldwide. Cambodia attracted 6.2 million foreign tourists in 2018, an increase of 10.7% from 2017.

March 2019

Cambodia's Minister of Economy and Finance announced that the government is developing a strategic framework for developing Cambodia's digital economy. Priority areas include supporting the availability of digital payments and e-commerce in the country.

April 2019

The Cambodian government approved the construction of a hydroelectric dam and supplemental solar power stations with a total electrical capacity of 220MW to try to deal with a national 400MW power shortage. The developments were described as moves towards strengthening energy security. At the same time, a draft of the Law on Oil and Petroleum Products Management, designed to promote the development of a sustainable oil and gas sector, was approved. The first oil extraction in Cambodian history is expected in 2019.

April 2019

NagaCorp, the owner of NagaWorld, Phnom Penh's only licensed casino, announced the construction of a USD4 billion integrated entertainment complex to be called Naga 3. In 2018, NagaWorld saw its net profit increase by 53% to USD390.6 million.

June 2019

Cambodia's state-run electricity supplier Electricite Du Cambodge (EDC) had signed an agreement with two Chinese firms to build a power facility fuelled by heavy fuel oil and liquefied natural gas that would be able to generate 400MW. The construction timeline was unclear; however, EDC representatives said that the facility would be ready within 10 months.

September 2019

Cambodian officials announced that they would travel to Moscow in October to discuss the possibility of an FTA with the Eurasian Economic Union.

September 2019

Cambodian developer ING Holdings, Hong Kong-based Causeway Bay Group and SINO BAY Construction Investment signed a deal for the Dragon City project in ING City in Cambodia. The 54,000sq m commercial complex, located in Beong Cheung Ek and Tum Pun ar, would include a commercial complex, apartments and international food courts. It would later be expanded to up to 250,000sq m. The project was scheduled to start in 2020.

September 2019

Cambodia announced that it was raising the 2020 legal minimum wage for workers in its crucial textiles and footwear industry to USD190 per month, an increase of 4.4%, amid pressure from the EU.

November 2019

Japan-based power producer erex Co announced it planned to invest USD23.5 million to acquire a 34% stake in the 80MW The Stung Pursat #1 Hydroelectric Project in the Cambodian province of Pursat, according to a company's press release. Each of Asia Energy Power Co and Singapore-based ISDN Energy would invest USD22.8 million to buy the remaining stakes. The hydropower plant was planned to be operational in February 2023.

December 2019

The Royal Group, in a joint venture with Royal Galaxy Group, announced plans to invest USD285 million for the construction of a resort project on Koh Rong Island in the Cambodian province of Preah Sihanouk. The project involved construction of a five-star hotel, international convention centre, resorts, duty-free shops, supermarkets as well as 600 units of a villa-style resort. The project was part of a concessional contract, which the government of Cambodia awarded Royal Group in 2008 to develop the island.

January 2020

Cambodia Airport Investment, a joint venture between Overseas Cambodia Investment Corporation (OCIC) and State Secretariat of Civil Aviation, shortlisted three Chinese firms for the construction of a USD1.5 billion international airport in Cambodia. The new airport came up in Kandal Steung district of Kandal province, and would be able to handle 27 million passengers by 2030. International banks would provide USD1.1 billion in the form of loans for the project, while USD280 million would come from OCIC. Construction is likely to be approved in July, with completion expected by July 2022.

February 2020

Cambodian and Thai railway authorities planned to start cross-border rail transportation between the two countries in March 2020. Ly Borin, under-secretary of state of the Cambodian Ministry of Public Works and Transport, stated that the flood-damaged tracks have been fixed. The relevant authorities of the two countries met on February 14 to have a final discussion on the issue. The 386km northern rail link starts from Phnom Penh in Cambodia and goes to Poipet on the Thai border.

February 2020

Cambodian Ministry of Land Management, Urban Planning and Construction has unveiled plans to transform Ream Bay in Preah Sihanouk province into a tourism destination. The USD16 billion project, proposed by Canopy Sands Development, includes building hotels, restaurants, resorts, residential buildings and a sports centre on 8.34sq km of land. The project would also involve development of two beaches. Phase one of the project was scheduled to start in 2020.

February 2020

The Council for the Development of Cambodia approved six infrastructure development projects totalling USD677 million, according to Khmer Times. The projects would include the construction of a USD478 million 1,500-bed international hospital project in Phnom Penh by Royal Cambodian Hospital Co and a supermarket by Chip Mong Retail at a cost of USD113.9 million. Another scheme involved an investment of USD71.7 million for the construction of a resort in Siem Reap province by Angkor Wildlife & Aquarium Co. Construction of an equipment-assembly factory, a bottled-water plant and a shoe accessories facility will also be carried out.

March 2020

The Council for the Development of Cambodia approved a USD61.3 million hotel and commercial centre project in Sihanoukville. To be developed by Won Majestic (Cambodia), the development will have 373 rooms. The hotel is currently under construction and is expected to open in early 2021.

March 2020

The Cambodian government planned to build a new road across Banteay Meanchey province, which would connect Battambang with Siem Reap, according to Khmer Times. The route, which would also offer connection with Pailin and Pursat provinces, was scheduled for 2021. Additionally, Cambodia was also building National Road 10 from Battambang to Koh Kong province. The 198km route, expected to cost around USD188 million, is backed by Chinese and Cambodian governments. The road is likely to be completed by December 2023.

March 2020

The Japan International Cooperation Agency (JICA) signed loan agreements with the government of Cambodia to provide up to JPY29.4 billion (USD264.3 million) for two improvement projects on National Road No 5, connecting Phnom Penh with Thailand border. Both the schemes would be executed by the Ministry of Public Works and Transport. A loan amount of JPY11.7 billion (USD105.7 million) would support modernisation of Prek Kdam-Thlea Ma'am section, which is expected to be completed by March 2022. The other JPY17.7 billion (USD159.1 million) loan would be directed towards the overhaul of Thlea Ma'am-Battambang and Sri Sophorn-Poipet sections. The project was expected to be completed in June 2023, according to a press release from JICA.

April 2020

The government announced a package of tax concessions, expenditure support and credit support. Government would support businesses amid the Covid-19 pandemic and would disburse special low-interest loans to specialised banks, in addition to packages issued to small- and medium-sized enterprises and rice producers.

Sources: BBC Country Profile – Timeline, Al Jazeera, Khmer Times, The Guardian, The Phnom Penh Post, IMF, Fitch Solutions

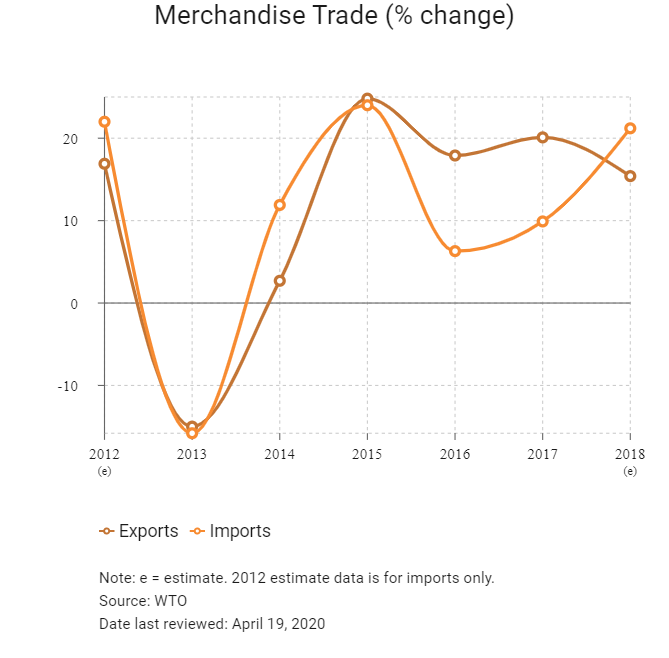

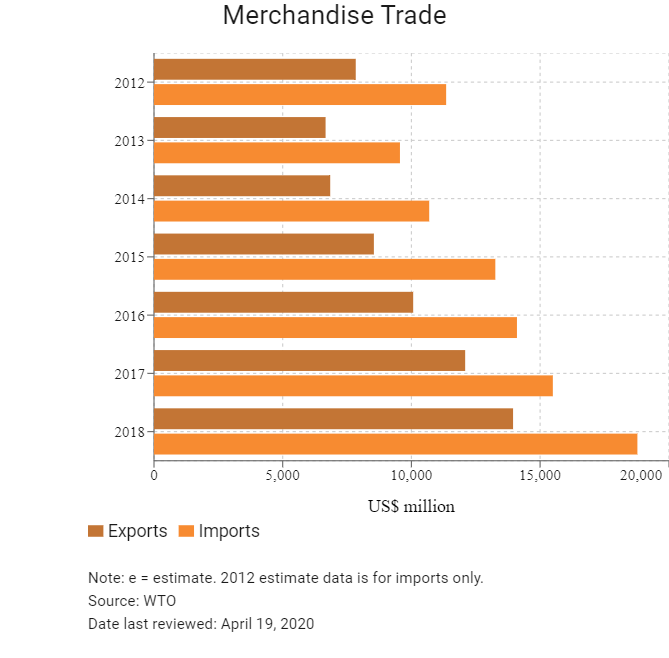

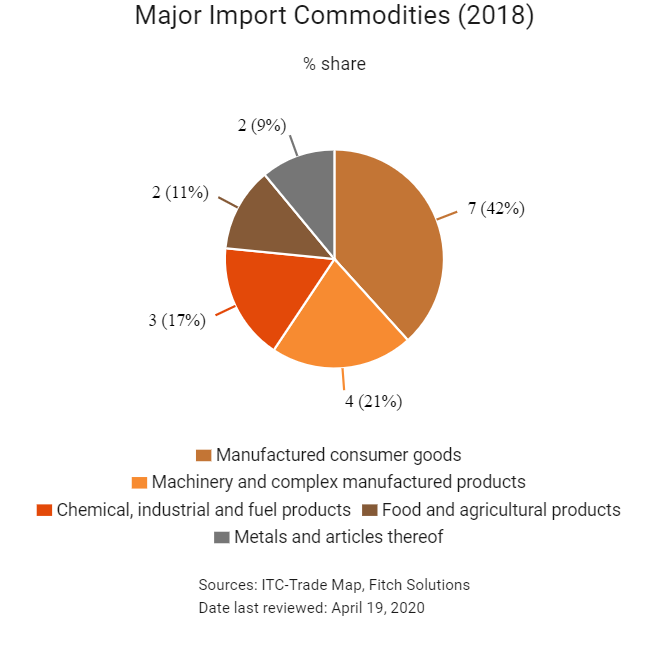

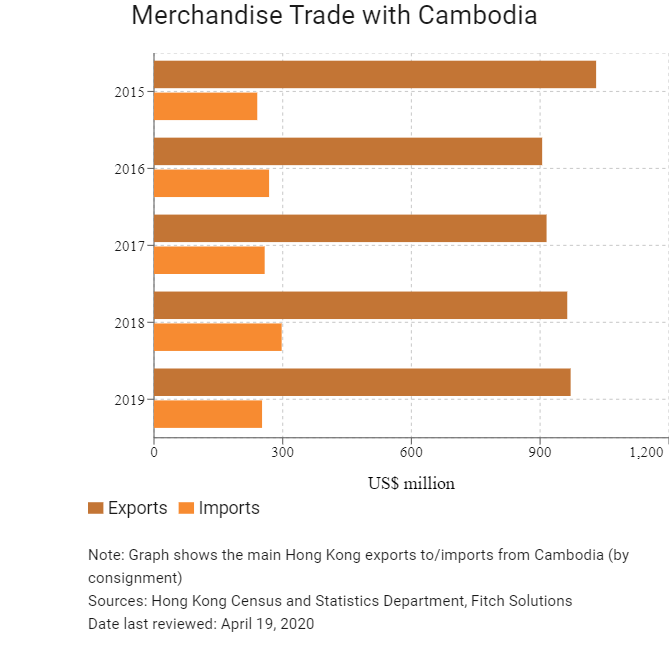

Merchandise Trade

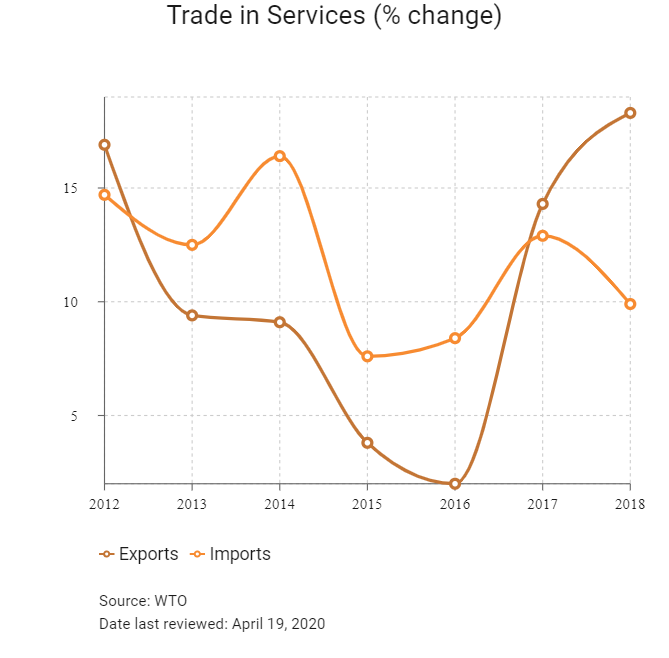

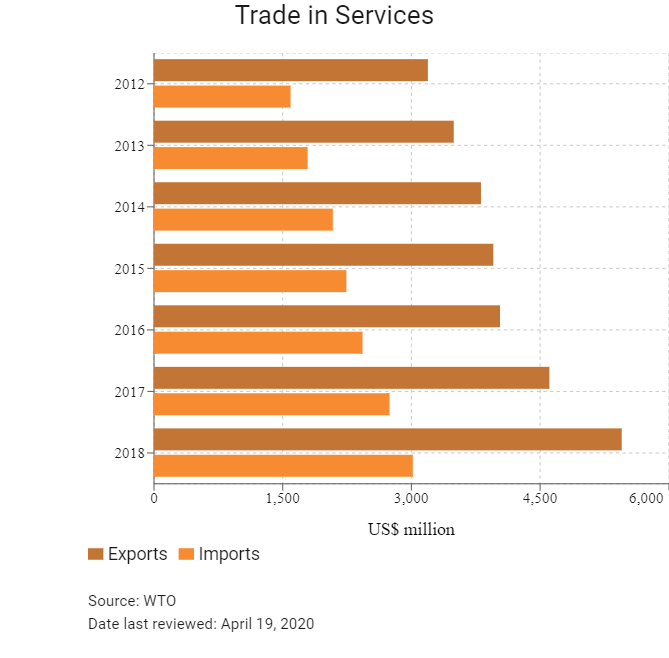

Trade in Services

- In April 2001, Cambodia joined the World Customs Organization and in October 2004 it became a member of the World Trade Organization (WTO). In February 2016, Cambodia ratified the WTO Trade Facilitation Agreement. Cambodia has been awarded preferential most favoured nation status by Mainland China, France, Germany, the United Kingdom and the United States.

- Cambodia joined the ASEAN in April 1999 and served as the ASEAN chair in 2012. The ASEAN members have agreed to lower intra-regional trade tariffs through the Common Effective Preferential Tariff Scheme for the ASEAN Free Trade Area. New members, such as Cambodia, have already gone a long way towards removing such tariffs, with almost 80% of their products being tariff-free, helping drive trade with Cambodia and the rest of the region.

- Since 2015, many tariffs between the ASEAN member states have been removed. The ASEAN is aiming for eventual customs unification. The rewards of lower tariffs within the area have been seen, with regional trade booming in recent years, especially as Singapore is a major exporting partner. The import tariff rates, however, are high in Cambodia. The country's average import tariff rate of 4.85% is the second highest in the East and South East Asia region.

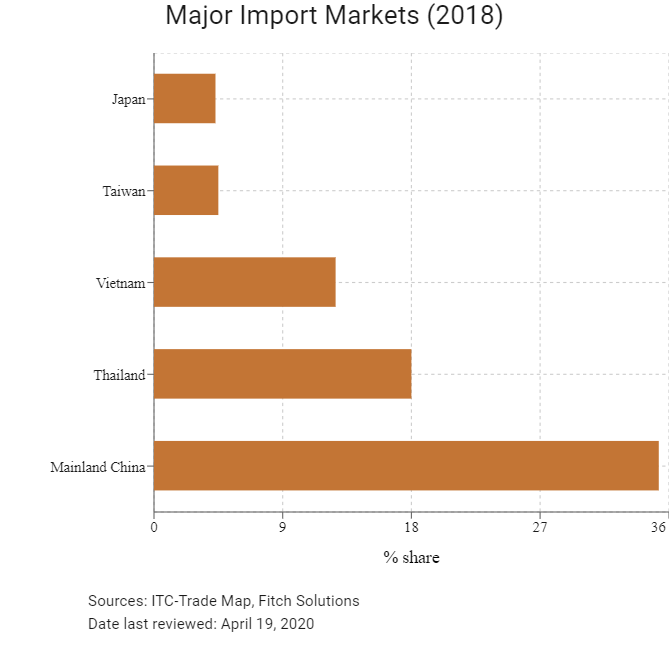

- Cambodia imposes the most number of tariffs on transport equipment and vehicles, agricultural machinery or parts, petroleum and oils (other than crude), and pulp, paper and paperboard. Mainland China has the most Cambodian tariffs applied to its goods, followed by Malaysia, Japan, Vietnam, South Korea and Thailand, representing three out of five of Cambodia's largest import destinations.

- Cambodia imposes tax, such as value added tax (VAT) and special tax on certain imports (among which include gasoline and diesel). The highest ad valorem rate of 35% applies to finished agricultural products (including processed meat, processed fruit and vegetables and dairy products), finished industrial products and petroleum products.

- In addition to customs duties, Cambodia prohibits or restricts the importation of certain goods for a number of reasons, such as national security, public order, cultural, environmental, health and safety. Over 1,500 tariff lines are subject to import prohibition or licensing.

- There are Bilateral Investment Treaties (BITs) between Cambodia and the following 14 countries: Mainland China, Croatia, the Czech Republic, France, Germany, Japan, South Korea, Malaysia, the Netherlands, the Russia, Singapore, Switzerland, Thailand and Vietnam. Twelve others are signed but not yet in force.

- In January 2020, Cambodia signed a Double Taxation Agreement (DTA) with South Korea. The DTA is similar to those Cambodia has already signed with other countries, which include Singapore, Thailand, Brunei, Mainland China, Vietnam, Indonesia, Hong Kong, and more recently Malaysia. The DTAs are for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

Sources: WTO – Trade Policy Review, UNCTAD, General Department of Taxation of Cambodia, Fitch Solutions

Trade Updates

On February 12 2020, the EU announced the suspension of some of the trade preferences Cambodia enjoys with the EU under the Everything But Arms programme. Cambodia will lose about 20% of its preferential trade rights which amounts to roughly USD1.1 billion. According to the European Commission, standard tariffs for certain garments and footwear, sugar and all travel good will replace zero duties currently in place. The changes are expected to take place on August 12 2020.

Multinational Trade Agreements

Active

- Cambodia is a member of the Association of South East Asian Nations (ASEAN), alongside Brunei Darussalam, Indonesia, Laos, Myanmar, the Philippines, Singapore, Malaysia, Thailand and Vietnam. The ASEAN Free Trade Area was signed on January 28, 1992, and entered into force on January 1, 1993. In 2018, the ASEAN accounted for 39.4% of Cambodia's imports and 7.5% of Cambodia's exports (latest data available), making the group Cambodia's key trading partner. A number of FTAs have been signed by the ASEAN.

- ASEAN-Mainland China: The ASEAN-Mainland China FTA covers goods and services. The FTA for goods came into force on January 1, 2005, and the FTA for services came into force on July 1, 2007. The agreement aims to eliminate tariffs, encourage investment and address the barriers that impede the flow of goods and services. The ASEAN-Mainland China FTA was amended in August 2019, simplifying trade and investment. In 2018, the ASEAN was the recipient of 12.9% of Mainland China's exports and the source of 12.3% of imports. Total merchandise trade between the ASEAN and Mainland China hit a record high of USD587.9 billion in 2018.

- AASEAN-India: The ASEAN-India FTA came into force on January 1, 2010 for goods and on July 1, 2015 for services, with the aim of minimising barriers and deepening the economic links between the parties. Cambodia joined the agreement in July 2011. The agreement will lead to the progressive elimination of tariffs on all goods. The ASEAN accounted for 12% of India's imports and 10.6% of India's total exports in 2019.

- ASEAN-South Korea: The ASEAN-South Korea FTA came into force in January and October 2010 for goods and services respectively. The investment agreement entered into force on September 1, 2009. The agreements aim to create more liberal, facilitative market access and investment regimes between South Korea and the ASEAN. A business council was set up in December 2014 to enhance economic cooperation between the parties and boost total trade to USD200 billion by 2020. ASEAN was the recipient of 17.5% of South Korea's exports in 2019 and the source for 11.2% of imports. Total trade between the ASEAN and South Korea has more than doubled between 2007 and 2019.

- ASEAN-Japan: The ASEAN-Japan FTA is for goods only and came into force on December 1, 2008. Cambodia joined the agreement in December 2009. This will lead to the progressive elimination of tariffs on all goods.

- ASEAN-Australia-New Zealand: The ASEAN-Australia-New Zealand FTA and Economic Integration Agreement for goods and services came into force on January 1, 2010. Cambodia joined the agreement on January 4, 2011.

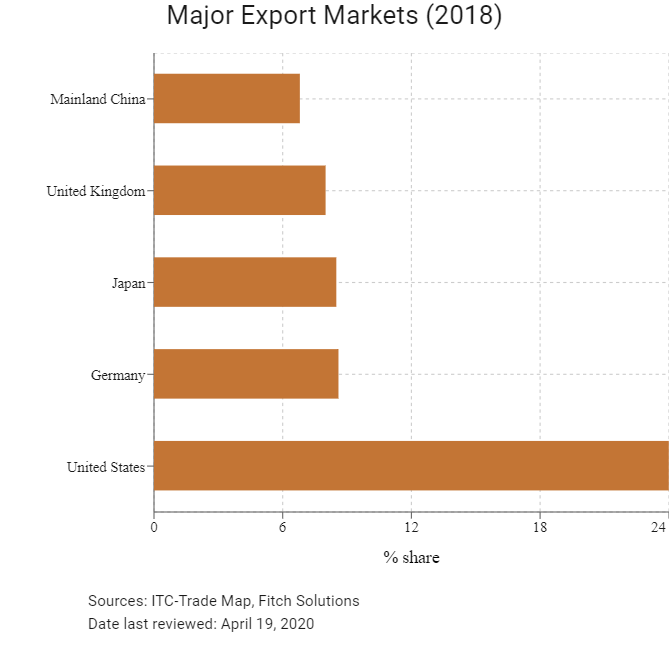

- United States-Cambodia: A bilateral Trade and Investment Framework Agreement (TIFA) between the United States and Cambodia was signed and entered into force on July 14, 2006. The TIFA allows favourable trade terms with the United States, which is Cambodia's largest exporting partner, accounting for 21.3% of Cambodia's exports in 2016 (latest data available). The TIFA provides a forum to address bilateral trade issues and allows Cambodia and the United States to coordinate on regional and multilateral issues. As Cambodia forms part of the United States' Generalized System of Preferences (GSP), many of its exports to the United States are exempt from tariffs.

- EU-Cambodia: Cambodia has been a major beneficiary of the EU's GSP, which grants virtually all products – except arms and ammunition from less-developed countries – duty-free and quota-free access to the EU market. EU trade accounts for approximately 42% overall of Cambodia's footwear and garments exports. In October 2018, the EU notified Cambodia that it would start the process for the withdrawal of their Everything but Arms preferential trade scheme. In February 2019 the EU launched the process that could lead to the suspension of Cambodia's preferential access to the EU market. On February 12 2020, the EU announced the suspension of some of the trade preferences Cambodia enjoys with the EU under the Everything But Arms programme. Cambodia will lose about 20% of its preferential trade rights which amounts to roughly USD1.1 billion.

- ASEAN-Hong Kong FTA (AHKFTA): Hong Kong and the ASEAN began negotiating an FTA and an Investment Agreement in July 2014. After 10 rounds of negotiations, Hong Kong and the ASEAN announced the conclusion of the negotiations in September 2017 and forged the agreements on November 12, 2017. The agreements are comprehensive in scope, encompassing trade in goods, trade in services, investment, economic and technical cooperation, a dispute-settlement mechanism and other related areas. The agreements will bring legal certainty, better market access and fair and equitable treatment in trade and investment, thus creating new business opportunities and further enhancing trade and investment flows between Hong Kong and ASEAN. The agreements will also extend Hong Kong's FTA and Investment Agreement network to cover all major economies in South East Asia. The agreement came into force on January 1, 2019, but will take time for all members of ASEAN to comply because implementation is subject to completion of the necessary procedures. Hong Kong is a key export market and the reduction of tariffs will ease the trading process; Hong Kong's potential as a key export market increases the importance of AHKFTA.

Under Negotiation

Negotiations for an EU-ASEAN region-to-region FTA were launched in 2007. Talks were put on hold in 2009 to allow for bilateral FTA negotiations as building blocks towards a region-to-region agreement. ASEAN as a whole represents the EU's third-largest trading partner outside Europe.

Sources: WTO Regional Trade Agreements database, ASEAN, UNCTAD, ASEAN, European Commission, Fitch Solutions

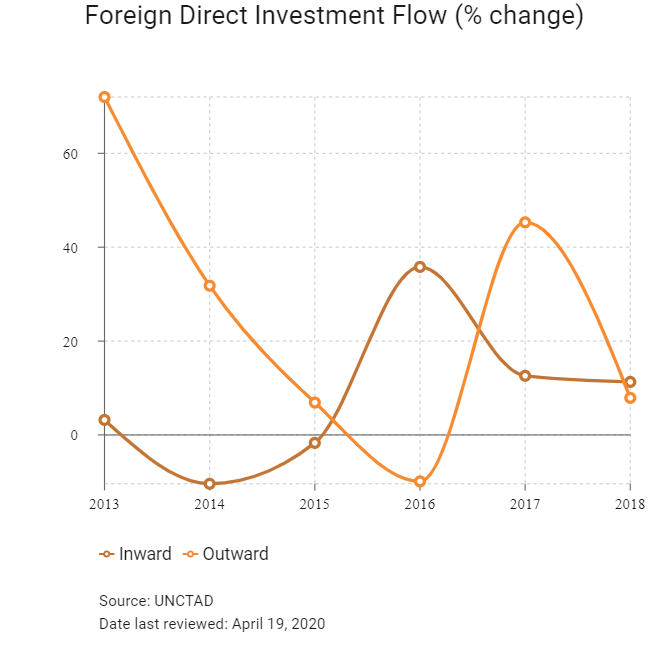

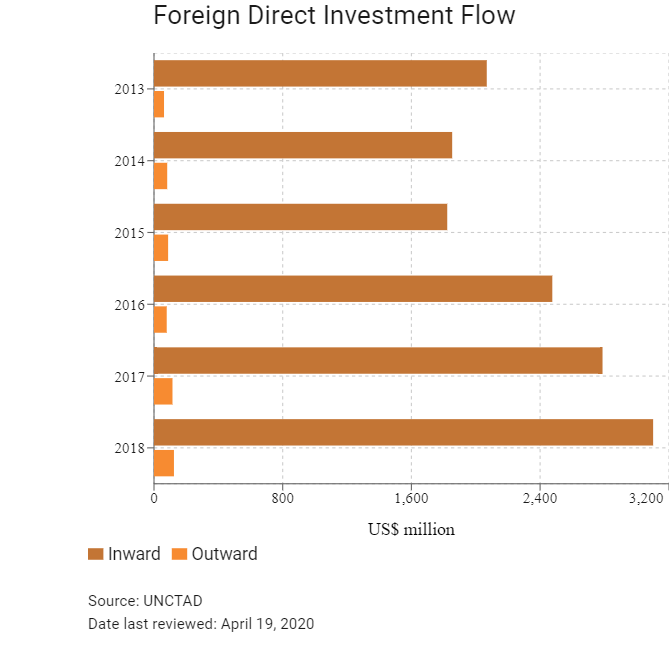

Foreign Direct Investment

Foreign Direct Investment Policy

- Cambodia's Law on Investment (1994) established an open and liberal foreign investment regime. All sectors of the economy are open to foreign investment and 100% foreign ownership is permitted in most sectors. In a few sectors, foreign investment is subject to conditions, local equity participation, or prior authorisation from authorities. The Cambodian government has prioritised foreign investment in the export sector and has a relatively pro-investor policy and legal framework.

- Cambodia has no restriction on foreign ownership of companies and boasts a number of incentives such as a corporate tax holiday of up to eight years, a 20% corporate tax rate after the incentive period ends, duty-free imports of capital goods and no restrictions on capital repatriation.

- Under the Law on Investment (1994), foreigners are restricted from owning land, but are allowed to hold long-term leases for up to 50 years, renewable for another 50 years, as well as freehold ownership of specified condominiums.

- The most popular sectors for foreign investment include garment manufacturing, agriculture, the services industry and tourism (which is one of Cambodia's key growth areas). The country's biggest investors tend to come from within the Asia region, with Mainland China, Malaysia, Vietnam and Thailand being major sources of foreign investment, together with the United States.

- Cigarette manufacturing, movie production, rice milling, gemstone mining and processing, publishing and printing, radio and television, wood and stone-carving production and silk-weaving are some of the sectors that are subject to conditions such as local equity participation, or prior authorisation from authorities.

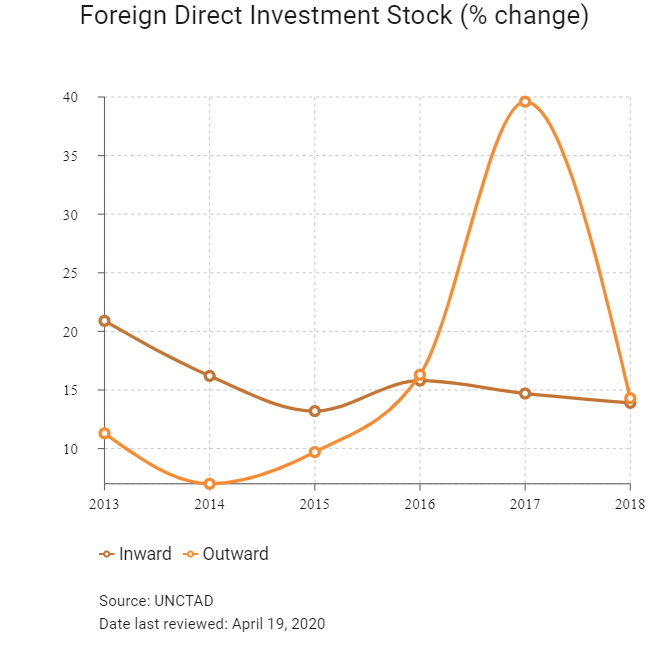

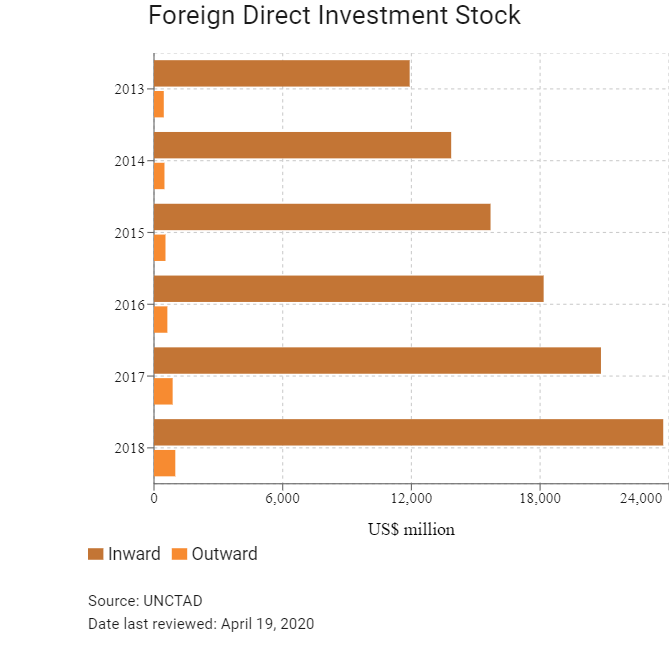

- FDI plays a critical role in the Cambodian economy. Based on 2018 data (the latest available), FDI stocks are equivalent to 96.6% of the country's GDP, with only three other countries in the region having higher ratios.

Sources: WTO – Trade Policy Review, Council for the Development of Cambodia, United States Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

The Council for the Development of Cambodia (CDC) is the main authority on all strategic and regulatory aspects of stimulating investment in Cambodia. A company registered as a Qualified Investment Project (QIP) is entitled to certain incentives. The CDC requires a QIP to apply annually for a Certificate of Compliance to enable it to continue to receive the investment incentive granted under its investment licence. |

- An exemption from corporate income tax (CIT) on profit, which could be for a maximum of up to nine years (provided each of the three three-year increments is approved). |

|

The Cambodia SEZ Board has approved 25 SEZs, of which nine are in operation. These SEZs are located near the borders of Thailand and Vietnam, as well as in Phnom Penh, Kampot and Sihanoukville, facilitating regional trade. Others are still at different stages of development and some remain undeveloped. |

- As with QIPs, companies located in SEZs can be exempt from taxes on their profits for a maximum period of nine years. |

|

Zone investors and developers |

- SEZ developers, investors or foreign employees have the right to transfer all the income derived from investments and salaries received in the zone to banks located in other countries after the payment of any tax due. |

Source: Council for the Development of Cambodia

- Value Added Tax: 10%

- Corporate Income Tax: 20%

Sources: General Department of Taxation of Ministry of Economy and Finance, Fitch Solutions

Important Updates to Taxation Information

In January 2020, Cambodia signed a DTA with South Korea. The DTA is similar to those Cambodia has already signed with other countries, which include Singapore, Thailand, Brunei, Mainland China, Vietnam, Indonesia, Hong Kong, and more recently Malaysia. The DTAs are for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

Business Taxes

|

Type of Tax |

Tax Rate and Base |

|

CIT |

- The standard rate of CIT is 20%. |

|

Capital Gains Tax |

- Taxed as part of business income; capital gains derived from the disposal of fixed assets are treated as ordinary income and generally taxed at the standard tax on income rate of 20%. |

|

VAT |

- Taxable supplies attract VAT at either the standard rate of 10% or the zero rate. Exempt supplies not subject to VAT include: medical services and goods; primary financial services; supply of unprocessed agricultural products; supply of electricity; and the exports of goods and services and the international transportation of passengers and goods. |

|

Registration Tax |

- Levied at a rate of 4% on the transfer of ownership of property or the transfer of occupancy right of land without buildings in the form of a sale, exchange, receiving of a gift or putting capital into a company. It is also levied at 4% on the transfer of ownership of all kinds of means of transportation, such as trucks, vehicles and motorcycles, boats, ferries and ships. |

|

Accommodation Tax |

- An indirect tax at a rate of 2% levied on accommodation in hotels and guest houses. The person supplying accommodation services is responsible for payment of the tax. |

|

Property Tax |

- Tax levied annually at a rate of 0.1% applies to immovable property valued in excess of 100 million riels. Property refers to land, houses, buildings and other constructions built on the land. The tax base is the value of the property after deducting CHR100 million, based on market prices set by the property evaluation committee established by the Prakas of the Minister of Economy and Finance. |

|

Property Rental Tax |

- The tax rate is 10% of the gross rental and should be written in a contract or an agreement with lessees. The tax is collected from proprietors or assignees and applies to buildings such as houses, factories, warehouses, offices, floating houses, ships used as accommodation or miscellaneous business services, and free land (land without buildings) with areas of stone, mine and coal extraction, lakes and salt pan fields. |

|

Withholding Tax |

- The rate for non-residents is 14% each on dividend income, royalties, interest and property rental income unless modified by the existence of a treaty: for example, for corporations and individuals from Hong Kong, the rate is 10% for each (15% on dividends if the equity ownership is less than 25%). |

Sources: General Department of Taxation of Ministry of Economy and Finance, Fitch Solutions

Date last reviewed: April 19, 2020

Localisation Requirements

The percentage of foreign workers is capped at 10% of all the staff working for an enterprise. The Ministry of Labour may approve a request for an exemption to the 10% limit, particularly if the business is in need of specific skills currently unavailable in Cambodia.

The application for a 'foreign quota approval' from the Ministry of Labour must be submitted between September 1 and November 30 every year if the 10% limit is exceeded.

Failure to comply with the foreign employee quota and work permit requirements could (among other things) result in the imposition of fines of up to USD180 and retroactive penalties in the amount of USD100 for each year that a foreigner has worked in Cambodia without a valid work permit.

Obtaining Foreign Worker Permits for Skilled Workers

No foreigner is allowed to work in Cambodia without a valid work permit and an employment card issued by the Ministry of Labour. Under current practice, foreign nationals working or doing business in Cambodia and holding either an e-Visa (also known as a 'business visa' or 'ordinary visa') or a K visa (also known as a 'permanent visa') are required to have a work permit and an employment card.

There are two types of work permits in Cambodia: a temporary work permit (which lasts for the duration of the individual's visa) and a permanent work permit (which is reserved for major investors). A work permit usually costs USD100.

Furthermore, foreign nationals wishing to work in Cambodia must also meet additional conditions, such as not having communicable diseases.

In October 2019, the Cambodian Labour Ministry reversed its previous ban on foreign nationals working as taxi drivers, street vendors and a handful of other jobs in the informal sector.

Visa/Travel Restrictions

Nationals of most countries can be issued with a visa on arrival – except citizens of Brunei Darussalam, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam, who do not require a visa before travelling to Cambodia for a stay of between 14 and 30 days (two weeks for citizens from the Seychelles). All foreign nationals are legally required to have a work permit if intending to work in Cambodia.

Sources: Council for the Development of Cambodia, Kingdom of Cambodia Ministry of Foreign Affairs and International Cooperation, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B2 (Stable) |

04/10/2019 |

|

Standard & Poor's |

Not rated |

Not rated |

|

Fitch Ratings |

Not rated |

Not rated |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

135/190 |

138/190 |

144/190 |

|

Ease of Paying Taxes Index |

136/190 |

137/190 |

138/190 |

|

Logistics Performance Index |

98/160 |

N/A |

N/A |

|

Corruption Perception Index |

161/180 |

162/180 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, IMD, Transparency International

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

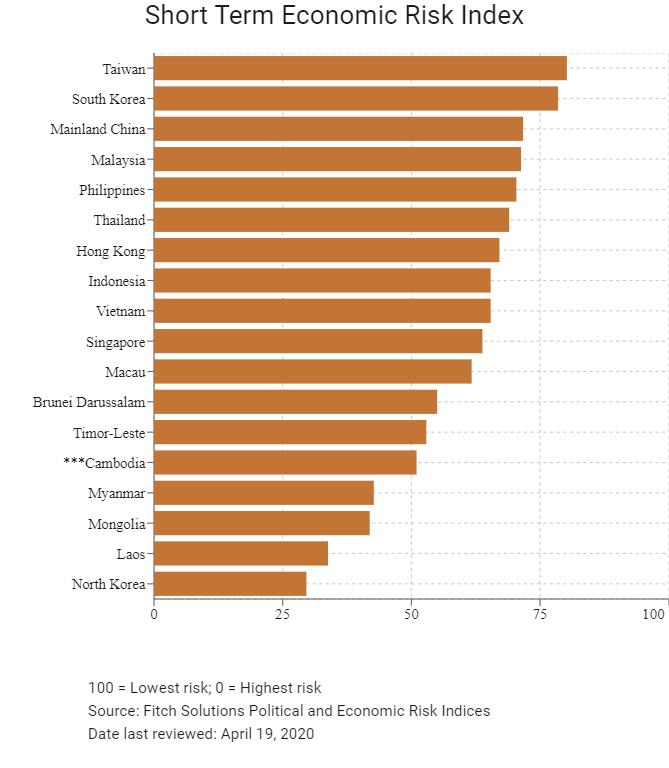

Economic Risk Index Rank |

122/202 |

127/201 |

136/201 |

|

Short-Term Economic Risk Score |

49.8 |

45.6 |

51.0 |

|

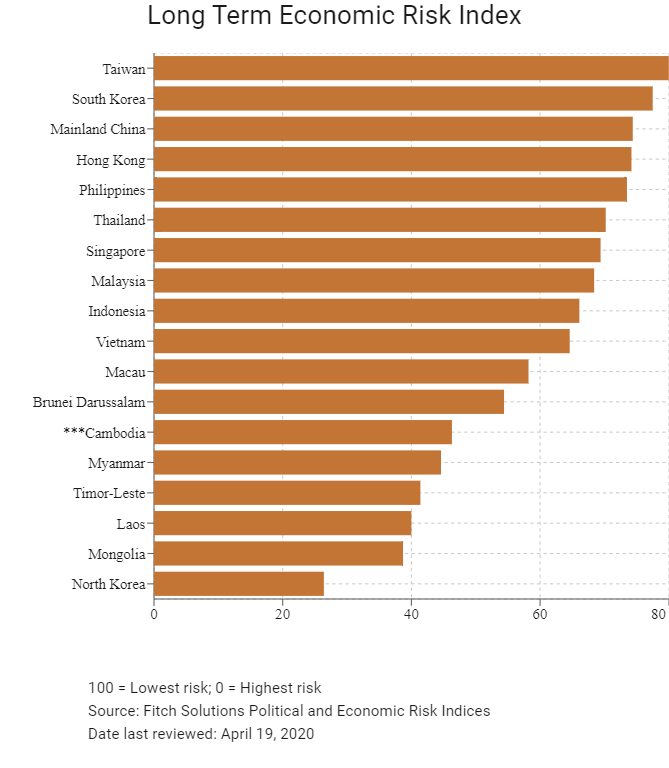

Long-Term Economic Risk Score |

47.8 |

48.2 |

46.3 |

|

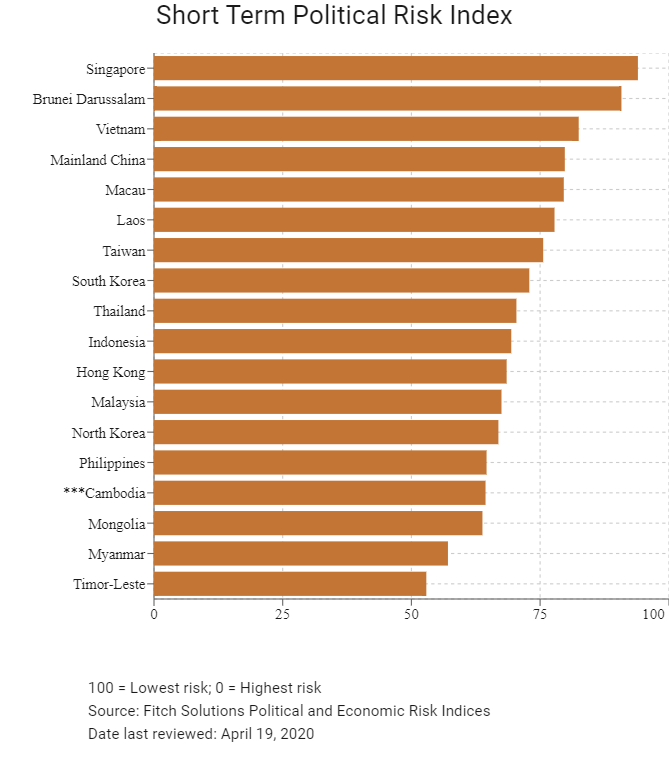

Political Risk Index Rank |

123/202 |

120/201 |

120/201 |

|

Short-Term Political Risk Score |

62.1 |

62.1 |

64.4 |

|

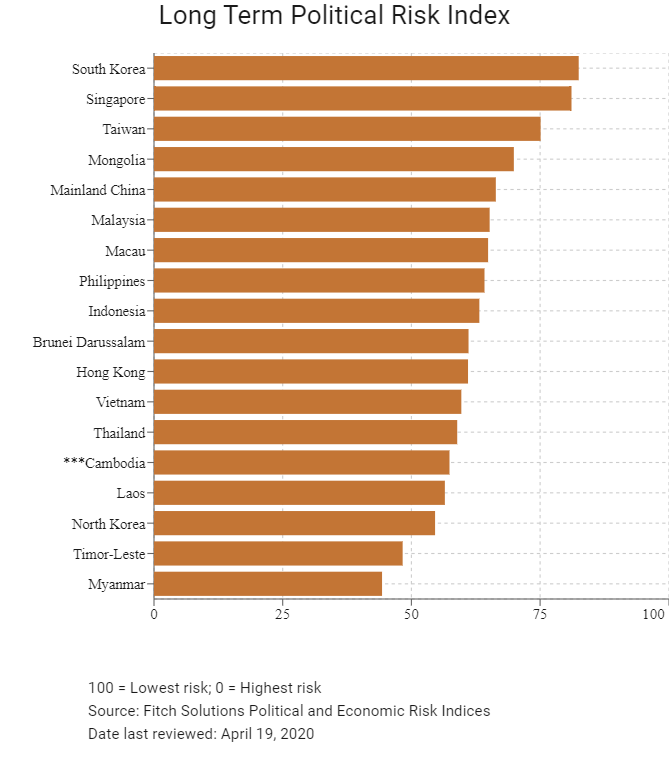

Long-Term Political Risk Score |

57.4 |

57.4 |

57.4 |

|

Operational Risk Index Rank |

129/201 |

135/201 |

135/201 |

|

Operational Risk Score |

42.5 |

40.8 |

40.6 |

Source: Fitch Solutions

Date last reviewed: April 19, 2020

Fitch Solutions Risk Summary

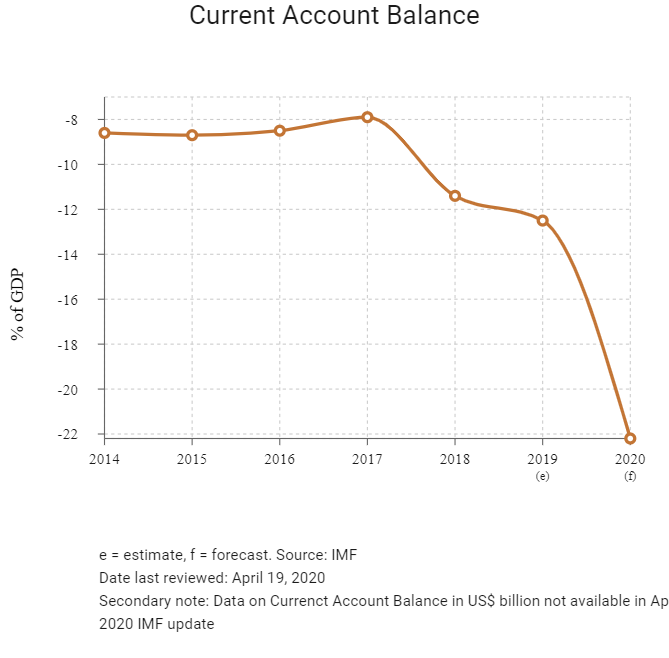

ECONOMIC RISK

Cambodia continues to rely on external financing, through robust growth momentum in the tourism and construction sectors. The long-term economic risk is weighed down by an undeveloped capital market, concerns over central bank independence and wide current account deficits. The currency peg with the US dollar affords some stability in monetary policy but acts as a restriction in terms of policymakers' ability to respond to economic shocks. The risks to economic growth will rise considerably in 2020 as the EU has partially suspended its Everything But Arms trade concessions for Cambodia. The global shock triggered by the Covid-19 pandemic has also significantly impacted Cambodia's economy, and the outbreak has caused a sharp deceleration in most of Cambodia's main engines of growth in the first quarter of 2020, including weakened tourism and construction activity. The Covid-19 outbreak and slow recovery in global economic activity alongside prolonged financial market turmoil therefore pose risks to Cambodia's growth outlook.

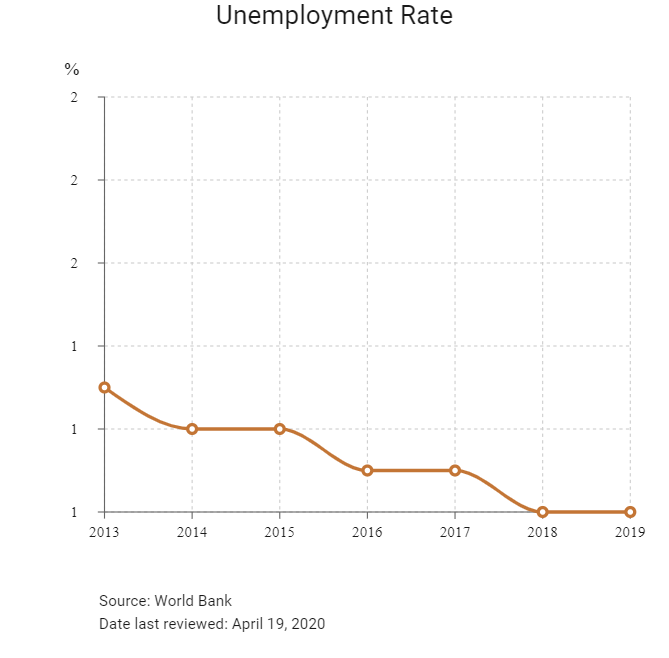

OPERATIONAL RISK

Cambodia has emerged as one of the fastest-growing markets in the East and South East Asia region after decades of internal conflict and international isolation. Investors stand to benefit from the large labour pool, low wages and openness to foreign direct investment, which help to make the country an attractive investment destination. That said, there are considerable risks posed by a lack of adequate education, the underdeveloped transport network, legal risks and limited property rights.

Source: Fitch Solutions

Date last reviewed: April 20, 2020

Fitch Solutions Political and Economic Risk Indices

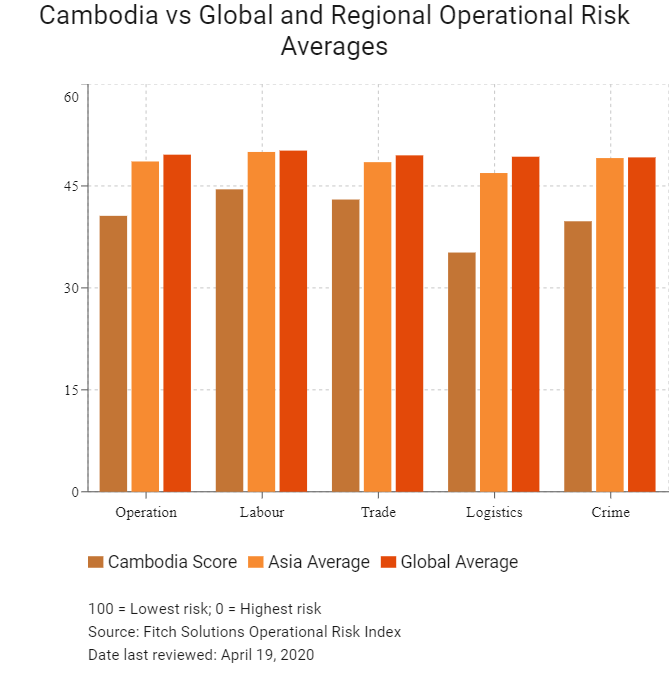

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Cambodia Score |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

East and Southeast Asia Average |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

East and Southeast Asia Position (out of 18) |

14 |

16 |

14 |

15 |

13 |

|

Asia Average |

48.6 |

50.0 |

48.5 |

46.9 |

49.1 |

|

Asia Position (out of 35) |

22 |

23 |

20 |

25 |

25 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

135 |

135 |

129 |

150 |

136 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

Singapore |

83.3 |

77.5 |

90.3 |

79.0 |

86.3 |

|

Hong Kong |

81.5 |

72.0 |

89.0 |

80.7 |

84.5 |

|

Taiwan |

73.0 |

68.3 |

75.3 |

76.3 |

71.9 |

|

South Korea |

70.8 |

62.4 |

70.5 |

79.7 |

70.4 |

|

Malaysia |

69.6 |

62.6 |

74.9 |

74.0 |

66.8 |

|

Macau |

63.9 |

60.9 |

69.5 |

56.2 |

69.1 |

|

Brunei Darussalam |

61.3 |

59.1 |

59.1 |

60.1 |

67.0 |

|

Thailand |

60.7 |

56.6 |

67.7 |

69.2 |

49.4 |

|

Mainland China |

58.8 |

54.9 |

61.4 |

71.8 |

47.3 |

|

Indonesia |

54.4 |

55.1 |

55.1 |

55.7 |

51.8 |

|

Vietnam |

53.4 |

49.3 |

57.5 |

57.8 |

49.0 |

|

Mongolia |

51.1 |

55.3 |

52.5 |

41.0 |

55.6 |

|

Philippines |

47.3 |

57.5 |

49.7 |

45.5 |

36.2 |

|

Cambodia |

40.6 |

44.5 |

43.0 |

35.2 |

39.8 |

|

Laos |

38.4 |

39.5 |

35.5 |

41.0 |

37.6 |

|

Myanmar |

33.1 |

47.8 |

39.1 |

27.8 |

17.8 |

|

North Korea |

32.4 |

51.1 |

18.5 |

27.8 |

32.3 |

|

Timor-Leste |

31.9 |

40.3 |

32.5 |

22.5 |

32.3 |

|

Regional Averages |

55.9 |

56.4 |

57.8 |

55.6 |

53.6 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: April 19, 2020

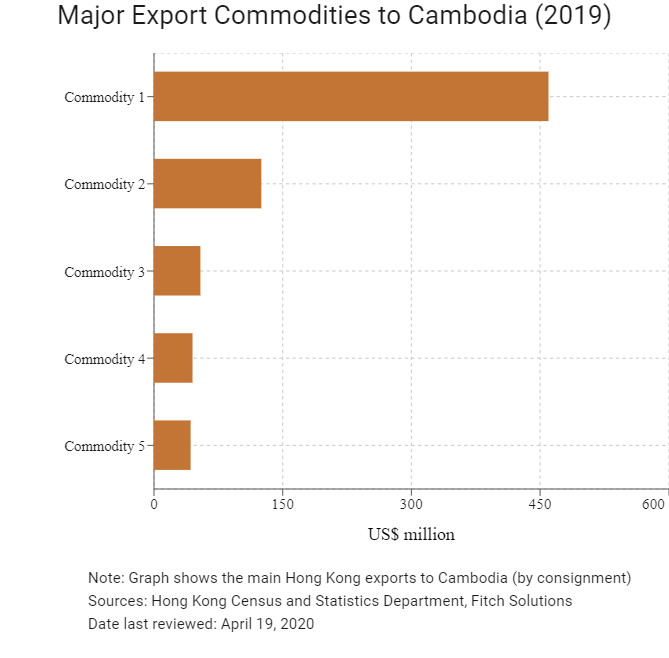

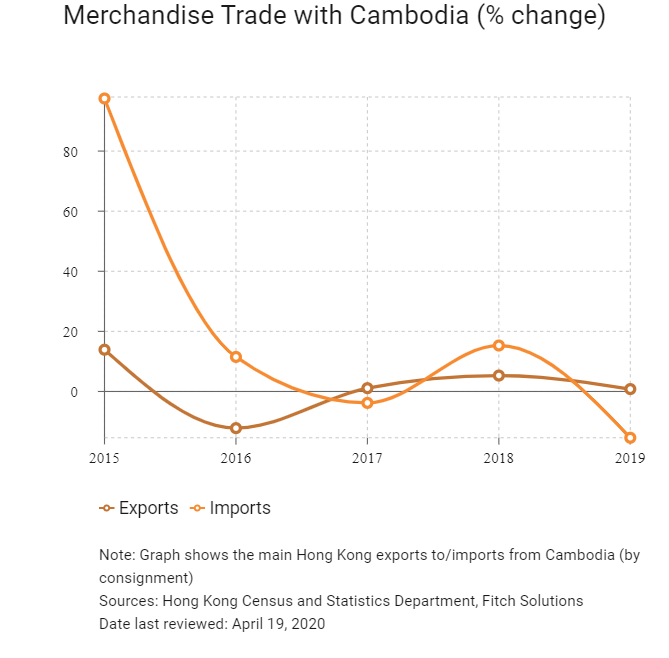

Hong Kong’s Trade with Cambodia

|

Export Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Textile yarn, fabrics, made-up articles and related products |

459.8 |

|

Commodity 2 |

Miscellaneous manufactured articles |

125.1 |

|

Commodity 3 |

Telecommunications and sound recording and reproducing apparatus and equipment |

54.1 |

|

Commodity 4 |

Electrical machinery, apparatus and appliances, and electrical parts thereof |

44.9 |

|

Commodity 5 |

Manufactures of metals |

42.7 |

|

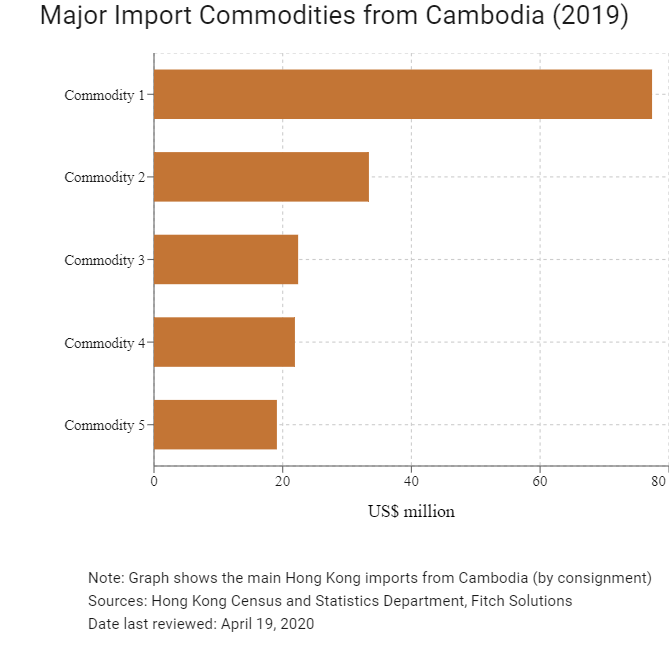

Import Commodity |

Commodity Detail |

Value (US$ million) |

|

Commodity 1 |

Articles of apparel and clothing accessories |

77.4 |

|

Commodity 2 |

Leather, leather manufactures and dressed furskins |

33.4 |

|

Commodity 3 |

Electrical machinery, apparatus and appliances and electrical parts thereof |

22.4 |

|

Commodity 4 |

Travel goods, handbags and similar containers |

21.9 |

|

Commodity 5 |

Power generating machinery and equipment |

19.1 |

Exchange rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Asia Pacific residents visiting Hong Kong |

52,326,248 |

-14.3 |

|

Number of Cambodian residents visiting Hong Kong |

25,650 |

-36.1 |

Sources: Hong Kong Tourism Board

|

2019 |

Growth rate (%) |

|

|

Number of East Asian citizens residing in Hong Kong |

2,788,077 |

3.0 |

Note: Growth rate for resident data is from 2015 to 2019. No UN data available for internediate years.

Source: United Nations Department of Economic and Social Affairs – Population Division

Date last reviewed: April 19, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Cambodian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Cambodia

- On January 1, 2020, the DTA agreement between Cambodia and Hong Kong came into force, promoting further bilateral investment and trade between the two jurisdictions.

- Hong Kong and ASEAN signed a FTA and an investment agreement on November 12, 2017.

- Mainland China and Cambodia signed an Agreement for the DTA on October 13, 2016, and Investment Promotion and Protection Agreements which came into effect on February 12, 2000.

Sources: Hong Kong Trade and Industry Department, State Administration of Taxation of the People's Republic of China

Chamber of Commerce or Related Organisations

Hong Kong-ASEAN Economic Cooperation Foundation Limited

The main activities of HKAECF are to contribute to the fostering, promoting and facilitating of economic cooperation between Hong Kong and the 10 member countries of ASEAN ('1+10'), and between the ASEAN region and mainland China ('10+1') with Hong Kong serving as a high value-adding and facilitating key international hub, bridge, connector, promotor and investor.

Address: Hong Kong-ASEAN Economic Cooperation Foundation Limited, G.P.O. Box 12779, Hong Kong

Email: secretariat@hk-asean.com

Source: Hong Kong-ASEAN Economic Cooperation Foundation

Hong Kong Business Association of Cambodia

Email: info@hkbac.org

Tel: (855) 12 888 855

Fax: (855) 23 216 880

Website: www.hkbac.org

Please click to view more information.

Source: Federation of Hong Kong Business Associations Worldwide

Royal Consulate General of Cambodia in Hong Kong SAR and Macao SAR

Address: Unit 1218, 12/F, Star House, 3 Salisbury Road, Tsim Sha Tsui, Kowloon, Hong Kong

Email: cacghk@netvigator.com

Tel: (852) 2546 0718

Fax: (852) 2803 0570

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

HKSAR passport holders need a visa to visit Cambodia.

Source: Visa on Demand

Date last reviewed: April 19, 2020

Cambodia

Cambodia