GDP (US$ Billion)

20.16 (2018)

World Ranking 115/193

GDP Per Capita (US$)

5,755 (2018)

World Ranking 100/192

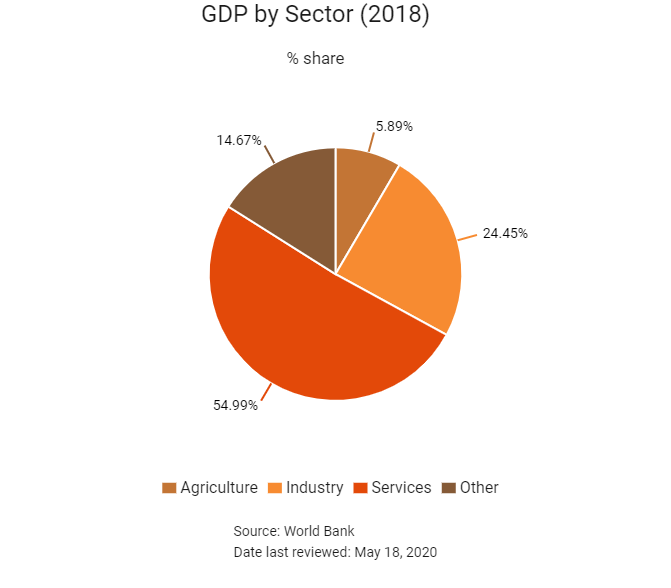

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

96.4 (2018)

Currency (Period Average)

Bosinia and Herzegovina Convertible Mark

1.75per US$ (2019)

Political System

Republic

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

Overview

Bosnia-Herzegovina is an upper middle-income country that has made good progress in terms of its development since the end of the Bosnian War in the mid-1990s. Its complex political system reflects the constitutional provisions made by the Dayton Agreement (to end the ethnic conflict), as well as the subsequent amendments introduced under the auspices of the international community through the Office of the High Representative. It is a European Union (EU) potential candidate country that is embarking on a new growth model. In July 2015, the governments of the respective regions adopted a joint structural reforms programme. The formation of a state-level government 14 months after the general election is a positive step for policymaking and should provide a boost to investor confidence in Bosnia.

Sources: World Bank, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

October 2018

Bosnia held presidential and parliamentary elections on October 7. The new three-person presidency was made up of Bosnian Serb leader Milorad Dodik, Šefik Džaferović from the Party of Democratic Action (the main Islamic party in Bosnia), and Social Democrat Željko Komšić who represented Croat voters.

March 2019

Lawmakers in Bosnia-Herzegovina approved a guarantee for a loan from Mainland China to help the expansion of the Tuzla coal-fired power plant. The approval came after the parliament was assured by the regional government that it had passed measures to prevent any damage to the budget if state power utility Elektroprivreda BiH (EPBiH) fails to service the loan. Under the project, Gezhouba Group and Guandong Electric Power Design will build a 450MW unit in Tuzla at a cost of USD1 billion to replace three ageing units. The project will be financed by a USD687 million loan from the Export-Import Bank of China, with the remaining to be provided by EPBiH.

May 2019

The European Bank of Reconstruction and Development provided a EUR210 million loan to Bosnia-Herzegovina for a new section of Corridor Vc Motorway project. The 14km section will begin at the Rudanka interchange in the Republika Srpska and bypass the town of Doboj at the Medakovo interchange in the Federation of Bosnia and Herzegovina. The motorway will serve as an extension of the Trans-European Transport Networks to the core network of the Western Balkans. The nearly EUR4 billion Corridor Vc is likely to be completed in 2030.

November 2019

The tripartite presidency of Bosnia-Herzegovina appointed Bosnian Serb Zoran Tegeltija as Chairman of the Council of Ministers, effectively the country's Prime Minister. The appointment clears the way for the establishment of the state government.

April 2020

The European Commission had adopted a proposal for a EUR3 billion macro-financial assistance (MFA) package to 10 enlargement and neighbourhood partners to help them limit the economic fallout of the Covid-19 pandemic. The proposal, following a preliminary assessment of financing needs, provides for the MFA funds to be distributed as follows: Albania (EUR18. million), Bosnia-Herzegovina (EUR25 million), Georgia (EUR15 million), Jordan (EUR200 million), Kosovo (EUR10 million), Moldova (EUR10 million), Montenegro (EUR6 million), North Macedonia (EUR16 million), Tunisia (EUR60 million) and Ukraine (EUR1.2 billion).

April 2020

The International Monetary Fund (IMF) had approved an emergency support package for Bosnia-Herzegovina to the tune of USD361 million as the country's economy suffers under the weight of the Covid-19 pandemic. The IMF also stated that given the large and rapid deterioration of external accounts, the rapid financing instrument would help provide support for scaling up priority spending on health and social assistance, while preserving debt sustainability.

May 2020

Bosnia-Herzegovina's state election authority announced that it would hold local elections on October 4, 2020, but Mostar, an ethnically divided town in the south of the Balkan country where no vote has been held since 2008, would be exempted again.

Sources: BBC Country Profile – Timeline, EBRD, Fitch Solutions

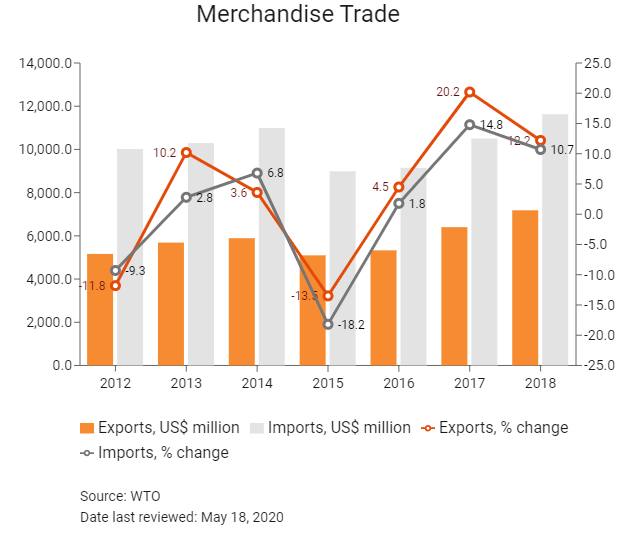

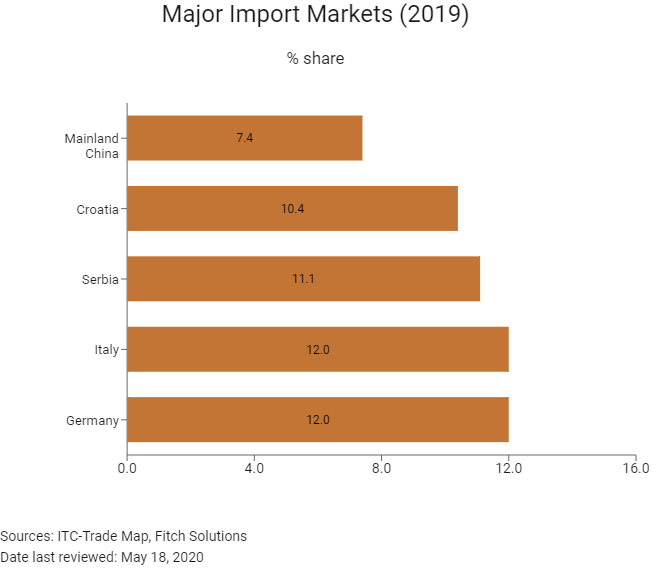

Merchandise Trade

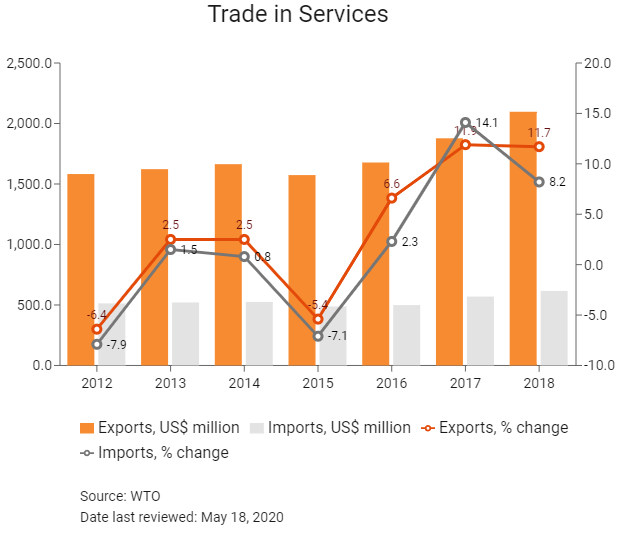

4.2 Trade in Services

- Bosnia and Herzegovina is not yet a member of the World Trade Organization (WTO). The Working Party was established on July 15, 1999, when the country started its accession negotiations for the WTO. In February 2018, the 13th meeting of the Working Party on the Accession of Bosnia was held, where WTO members supported the prompt conclusion of negotiations and welcomed the commitment by Sarajevo to finalise its accession process over the course of 2018. As of May 2019, this is ongoing.

- The customs policy law and the rates of customs tariffs to be applied are largely based on EU standards. Bosnia has signed the SAA and the Central European Free Trade Agreement (CEFTA).

- The tariff rate on imports to Bosnia averages a comparatively low 1.1% of the value of goods (for international trade), which is the lowest figure regionally and the third-lowest figure in the wider Emerging Europe region. Bosnia’s import tariffs are harmonised each year with the combined imported nomenclature of EU and legislative regulations.

- Customs duties on all commodities into Bosnia are also paid ad valorem at rates of 0%, 5%, 10% and 15%.

- An excise tax is paid on certain imported and domestic goods, including coffee, oil derivatives, tobacco, beverages and alcoholic drinks.

- In 2009, Bosnia introduced a law for the protection of domestic products against imports from Croatia and Serbia. The law stipulates that safeguard measures were necessary owing to the influx of imports and the dumping of agricultural products (in particular) from Croatia and Serbia, as well as a conceivable decrease in exports from Bosnia to Serbia.

- As a result of Bosnia not having EU member status, even though the majority of its trading partners are EU member states, export and import supply chains will face more onerous border and documentary times and costs when compared with those of EU states. The most salient risk is the high cost associated with the import border compliance process, which is higher than that of countries such as North Macedonia, and contributes to Bosnia's status as regional underperformer in relation to customs burdens.

Sources: WTO – Trade Policy Review, Fitch Solutions

Trade Updates

Bosnia-Herzegovina formally applied for EU membership in February 2016. Accession would open up trade, investment and growth opportunities for the economy. The country has already made great strides in establishing free trade and preliminary agreements to speed up the process of EU accession, and as of May 2020,but the process is currently ongoing. Bosnia is also currently discussing the possibility of the creation of a Western Balkans Customs Union with its South East European counterparts. The customs union would look to build on the current Central European FTA by eliminating existing non-tariff trade barriers between member states.

Multinational Trade Agreements

Active

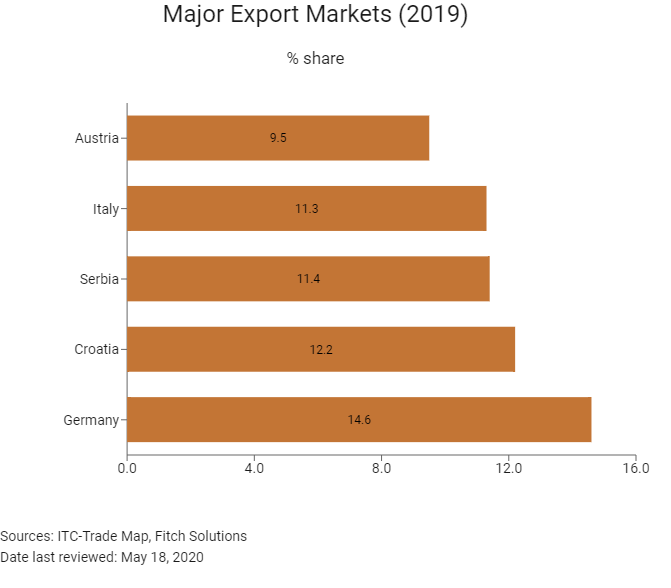

- Bosnia and Herzegovina-EU: The SAA between the EU and Bosnia entered into force on June 1, 2015, and has caused a shift in the latter's export and import partners and goods. The SAA establishes a close partnership between the EU and Bosnia and deepens the political, economic and trade ties between the two parties. It is from now on the main framework for relations between the EU and Bosnia, further preparing the latter for future EU membership. The entry into force of the SAA has also increased the confidence of domestic and international investors in Bosnia. It allows both Bosnian and EU companies to access their respective markets. This is conducive to enhanced business opportunities for the EU and Bosnia-based companies and would stimulate economic growth and employment. The SAA will also contribute to the progressive alignment of Bosnian norms and legislation with EU legislation, thus benefitting Bosnian citizens through better quality, healthier and safer goods. The EU accounts for approximately 50% of imports and exports.

- Bosnia and Herzegovina-European Free Trade Association (EFTA): The EFTA consists of Switzerland, Norway, Iceland and Liechtenstein. The main focus of this FTA, which came into force in January 2015, is the liberalisation of trade in goods. The agreement abolishes all customs duties on industrial products as of its entry into force. Additional agricultural agreements between individual EFTA states and Bosnia form an integral part of the instruments establishing the FTA.

- The CEFTA: CEFTA consists of Albania, Bosnia and Herzegovina, Serbia, Moldova, Montenegro, North Macedonia and Kosovo. It came into force in May 2007 and helps increase trade between regional counterparts as well as foster non-EU bilateral relations.

- Bosnia and Herzegovina-Turkey: An FTA with Turkey, which came into force in July 2003, provides additional free access to a consumer market of 80 million people. In May 2019, the two parties signed a new revised FTA.

Under Negotiation

Bosnia and Herzegovina-Malaysia: The agreement, which is expected to materialise by 2020, will help businesses exploit opportunities in manufacturing and the import and export of halal products owing to the large population of Muslim consumers in both markets. This will also boost service exports in terms of tourism in both countries.

Source: WTO Regional Trade Agreements database

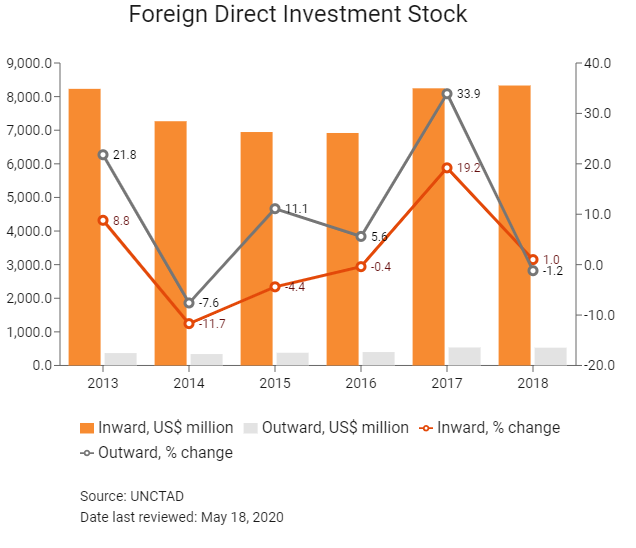

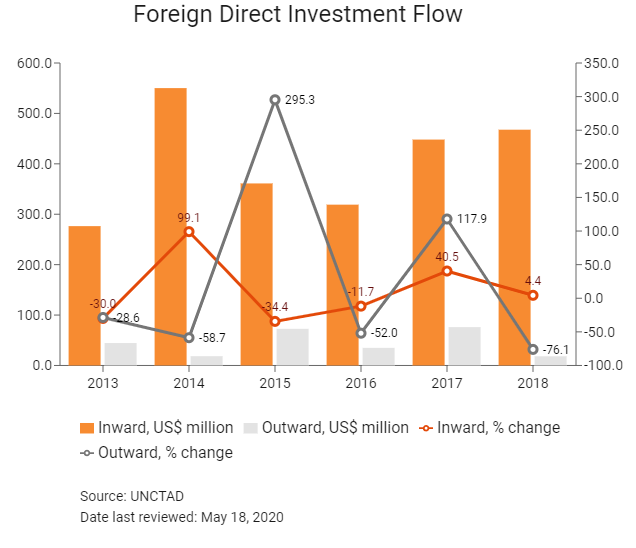

Foreign Direct Investment

Foreign Direct Investment Policy

- The Foreign Investment Promotion Agency (FIPA) of Bosnia and Herzegovina works to attract foreign direct investment (FDI) and encourage existing investors to expand their businesses in Bosnia. FIPA has identified sectors such as manufacturing, energy and wood processing as key industries that are likely to see high investment growth in the coming years.

- Overall, there are no restrictions on foreign investment or ownership, with the exception of the defence and media sectors, where foreign control is capped at 49%.

- FDI has mostly gone into the manufacturing sector and supported the privatisation of many key industries after the Bosnian War, such as the metals, agriculture, food processing, textile and chemical industries. FDI also contributed to the rapid development of banking and financial services in Bosnia.

- Currently, there are 20 energy projects, valued at more than EUR2 billion, under development in Bosnia. The estimated value of investment in the development and rehabilitation of the electricity transmission network is expected to reach EUR279 million by 2020. Projects worth more than EUR1.5 billion for new coal-fired power plants were signed in May 2016.

- The Corridor Vc project in Bosnia will receive EUR930mn (USD1.05 billion) from the EU and the European Bank for Reconstruction and Development (EBRD. Since 2015, the EU has allocated a total of EUR110 million (USD124.2 million) in grants for the construction of the eight planned sections of the corridor in the country. Of the EU grant, EUR15 million (USD16.9 million) will be spent on the ongoing construction of the 5.65km Johovac-Rudanka section, the first stretch of Corridor Vc to be built in Bosnia's Serb Republic. EBRD's overall credit arrangements for Corridor Vc projects in Bosnia total EUR820 million (USD925.8 million). State-run highways company Autoputevi Republike Srpske has hired Integral Inzenjering and North Macedonia's Granit to build the Johovac-Rudanka section at a cost of EUR62.5 million (USD70.6 million). The 335km Bosnian section of the Corridor Vc will link key cities in the country, from south to the north east, and is likely to be built until 2030 (Xinhua). Currently, 35% of the project in Bosnia is either complete or under construction.

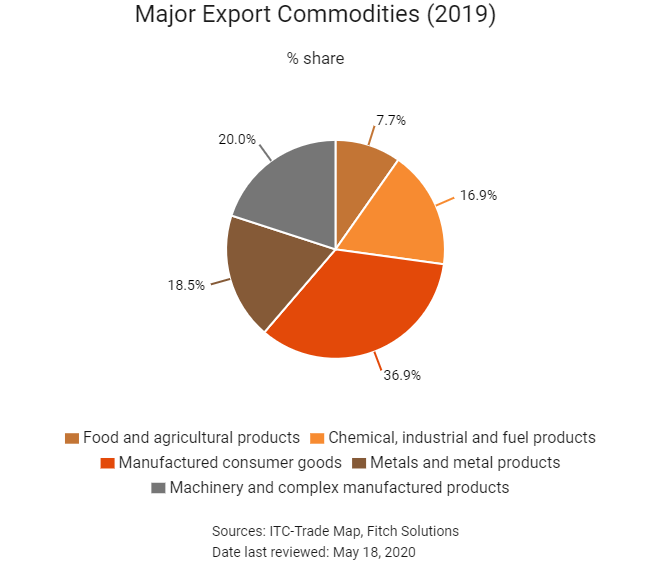

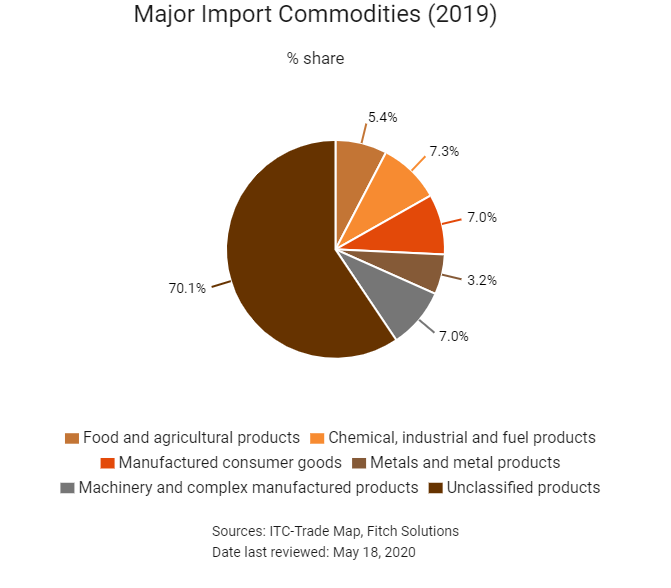

- Businesses operating in Bosnia face a high import burden as infrastructure development, industrial capacity and diversification remain weak owing to a dearth of fixed capital formation and the lack of political resolve in the country. Imports are, therefore, driven by the country's need for complex machinery and manufactured goods that cannot be produced locally, as well as some of its energy requirements, such as oil and gas.

- A bonus to foreign investors is the Law on the Policy of FDI, which accords foreign investors the same rights as domestic investors, including during the bidding process for privatisation tenders. Existing investors are also granted protection from amendments to the Law on Foreign Investment. If the Bosnian government were to make changes to this law, the individual investor may select the most favourable version of regulations to apply.

- Despite the various investment incentives of the Bosnian market, some short-term risks as well as long-term barriers to FDI still exist. State-owned enterprises (SOEs) – which affect sectors such as defence, media and telecommunications – are mostly owned by the sub-national governments and are thus controlled by various political parties. By law, private enterprises can compete under the same conditions as public ones, but in practice, SOEs have the upper hand as some of them hold a near-monopoly and make large profits due to their dominant market position.

- Corporate income tax laws are rather complicated owing to the fragmentation of Bosnia into two territorial entities. The Federation of Bosnia and Herzegovina (FBiH) distinguishes between resident business entities (whereby actual management or supervision is in the FBiH), which have to pay corporate income tax on their worldwide income, and non-resident businesses (whereby actual management and supervision is based outside the FBiH), which pay taxes on income realised in the FBiH only.

- Although Bosnian law states that foreign investors will have the same ownership rights of real estate as domestic persons, the Law on Agricultural Land prohibits foreigners from acquiring ownership of agricultural land unless international agreements state otherwise. The rights of foreigners to own real estate in Bosnia may also be subject to reciprocity. This may present risks to investors or simply dissuade them from investing or seeking ownership of property in the country.

Sources: WTO – Trade Policy Review, ITA, US Department of Commerce, Fitch Solutions

Free Trade Zones and Investment Incentives

|

Free Trade Zone/Incentive Programme |

Main Incentives Available |

|

Bosnia and Herzegovina operates a number of Free Trade Zones (FTZs) which offer a range of incentives for investment. There are six FTZs which are located at Vogošća, Sarajevo, Holc, Lukavac, Mostar and Visoko. |

- Investors in these zones do not pay taxes or contributions, and are free to invest and re-transfer capital, as well as transfer their profits |

Sources: US Department of Commerce, Fitch Solutions

- Value Added Tax: 17%

- Corporate Income Tax: 10%

Sources: Indirect Taxation Authority of Bosnia and Herzegovina, Fitch Solutions

Important Updates to Taxation Information

Bosnia and Herzegovina has a complex tax system owing to the fragmentation of the state into semi-autonomous entities. Despite a generally low corporate tax rate and an array of tax exemption schemes, the country has a high VAT rate and prohibitive payment procedures.

Business Taxes

|

Type of Tax |

Tax Rate and Base in Federation of Bosnia and Herzegovina |

Tax Rate and Base in Republika Srpska |

Tax Rate and Base in District of Brčko |

|

Corporate Income Tax (standard) |

10% on operating profits |

10% on operating profits |

10% on operating profits |

|

Capital Gains Tax |

Taxable as part of operating profits at 10% |

Taxable as part of operating profits at 10% |

Taxable as part of operating profits at 10% |

|

VAT |

17% on value of the products in all regions |

17% on value of the products in all regions |

17% on value of the products in all regions |

|

Dividends |

5% withholding tax |

10% withholding tax |

10% withholding tax |

|

Property Tax |

Not applicable for corporate entities |

0.05% to 0.5% of property value |

0.05% to 1.0% of property value |

|

Social security contributions |

Total rate 41.5% applicable to gross salary; out of that, 31% is employee contribution and 10.5% is paid by employer |

Total rate 33.0% applicable to gross salary – all payable by employee; no employer contribution |

Total rate 31.5% applicable to gross salary – 25.5% is payable by employee; 6% employer contribution |

Source: Indirect Taxation Authority of Bosnia and Herzegovina

Date last reviewed: May 18, 2020

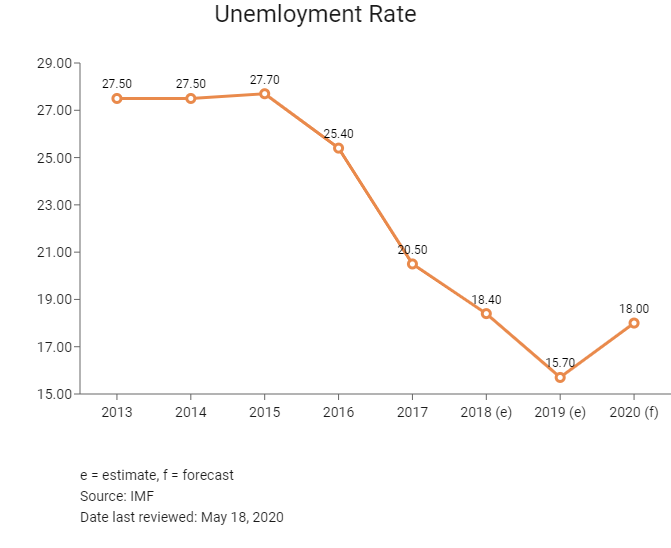

Localisation Requirements

Since unemployment in Bosnia-Herzegovina is high, requirements for businesses to hire foreign workers are rigorous. Quotas on the number of work permits which may be issued to foreign workers for each sector of the economy are decided on an annual basis by the Council of Ministers. Only the highest level of educational degrees are accepted as a legitimate reason to hire a foreigner instead of a local.

Foreign Worker Permits

The permit application process is lengthy, with 45-50 days required for a work permit and 30 days for a residence permit. Work permits are valid for a period up to one year and are only valid for the specific job and specific employer for which they are originally issued. The risks associated with such rigorous demands and lengthy visa processes will deter businesses requiring highly skilled workers from setting up in Bosnia, as the low skill level of the domestic labour force means that foreign labour will often be required.

Visa/Travel Restrictions

A visa application will take approximately 30 days, and citizens of all African, some Latin American and most Asian and Middle Eastern states require a visa before arrival. Owing to various visa arrangements foreign nationals from 101 jurisdictions that include Europe (except Belarus), North America, Australia, New Zealand and some parts of Latin America and the Middle East enjoy access to Bosnia without a visa for up to 90 days.

Sources: Government websites, Fitch Solutions

Sovereign Credit Ratings

|

Rating (Outlook) |

Rating Date |

|

|

Moody's |

B3 (Stable) |

16/02/2018 |

|

Standard & Poor's |

B (Stable) |

30/04/2020 |

|

Fitch Ratings |

Not Rated |

Not Rated |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Ease of Doing Business Index |

86/190 |

89/190 |

90/190 |

|

Ease of Paying Taxes Index |

137/190 |

139/190 |

141/190 |

|

Logistics Performance Index |

72/160 |

N/A |

N/A |

|

Corruption Perception Index |

89/190 |

101/190 |

N/A |

|

IMD World Competitiveness |

N/A |

N/A |

N/A |

Sources: World Bank, Transparency International

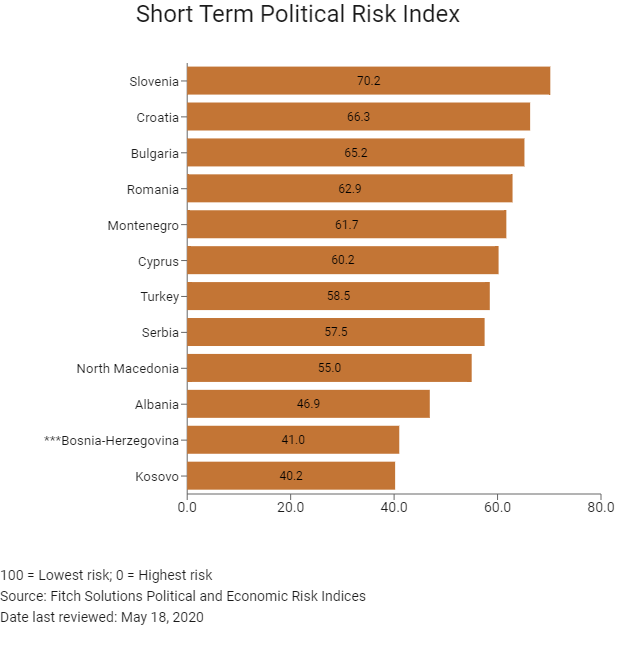

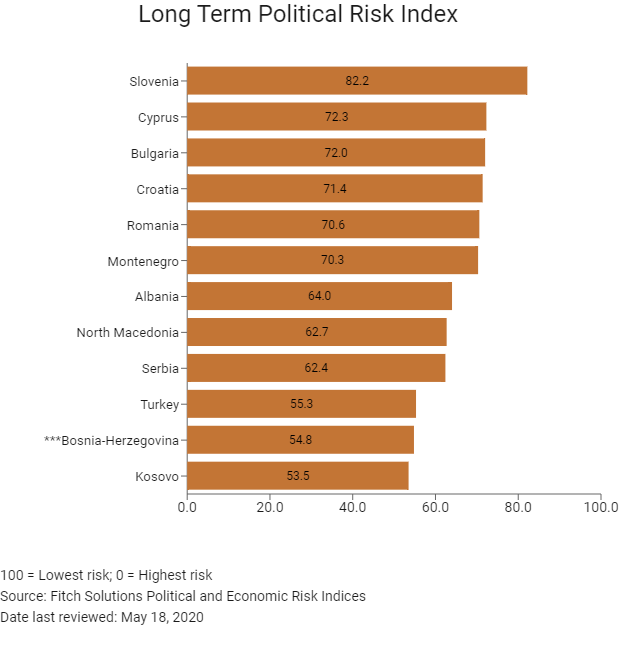

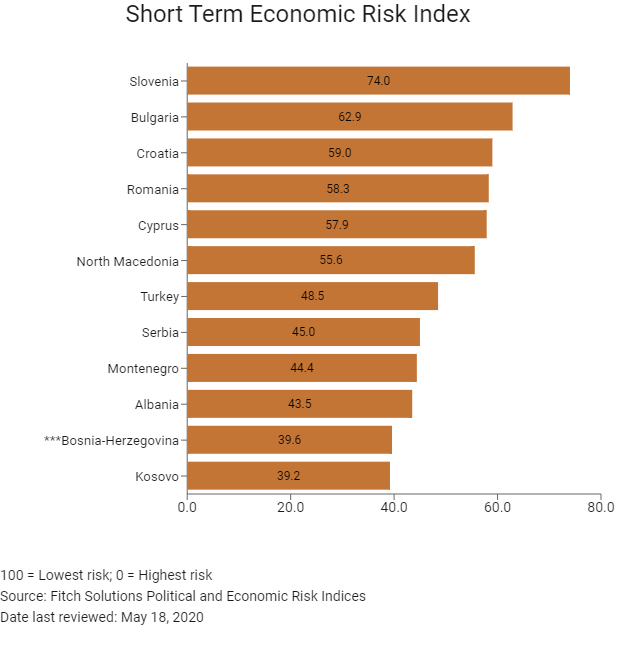

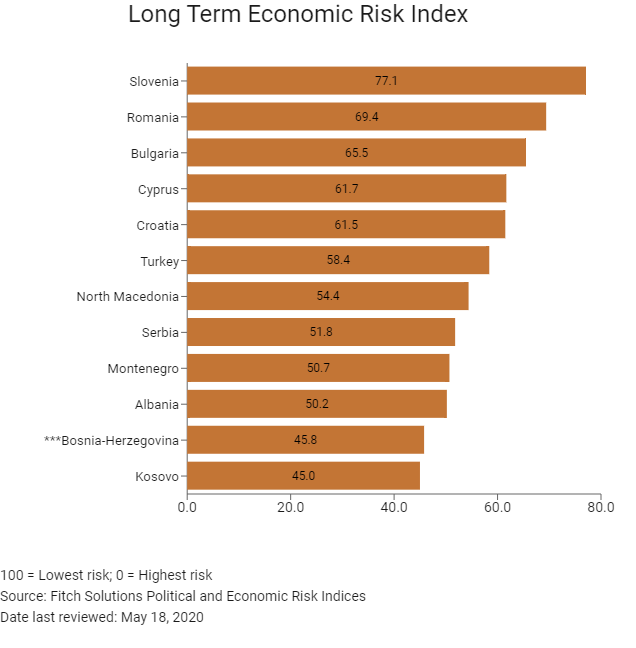

Fitch Solutions Risk Indices

|

World Ranking |

|||

|

2018 |

2019 |

2020 |

|

|

Economic Risk Index Rank |

132/202 |

142/201 |

138/201 |

|

Short-Term Economic Risk Score |

36.5 |

38.8 |

39.6 |

|

Long-Term Economic Risk Score |

46.3 |

45.5 |

45.8 |

|

Political Risk Index Rank |

132/202 |

132/201 |

136/201 |

|

Short-Term Political Risk Score |

41.0 |

38.5 |

41.0 |

|

Long-Term Political Risk Score |

55.8 |

55.8 |

54.8 |

|

Operational Risk Index Rank |

116/201 |

109/201 |

108/201 |

|

Operational Risk Score |

46.0 |

48.1 |

47.5 |

Source: Fitch Solutions

Date last reviewed: May 18, 2020

Fitch Solutions Risk Summary

ECONOMIC RISK

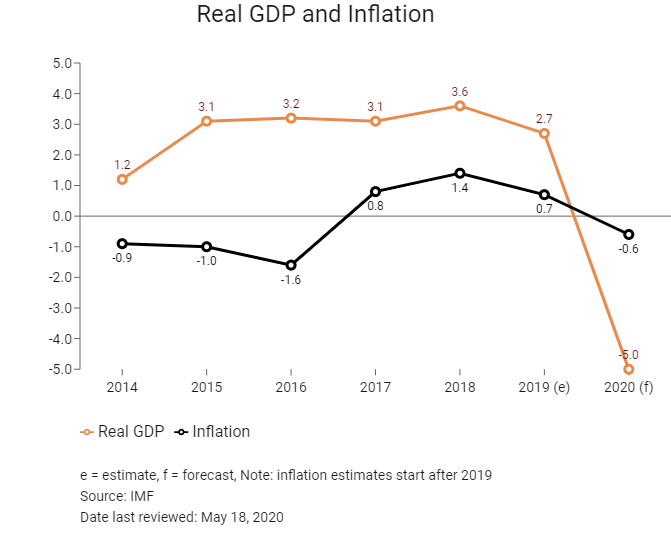

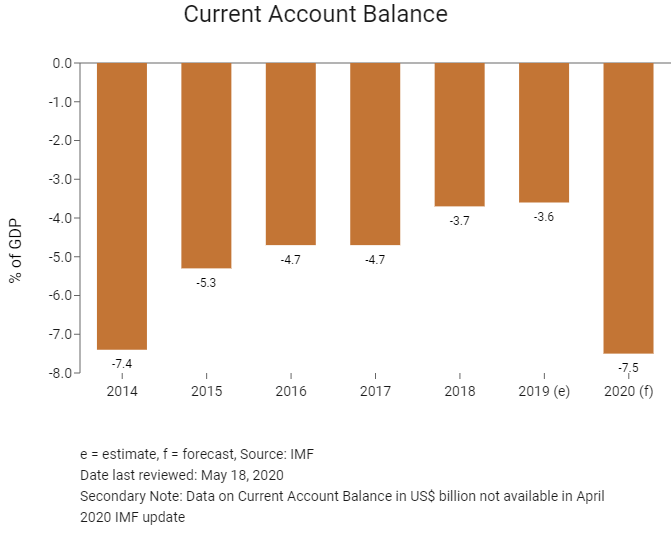

Economic activity continues to show resilience despite political uncertainty, and GDP growth is expected to accelerate slightly over the coming years. Household consumption will be the main driver of the expansion, and investment activity has strong potential, but remains highly vulnerable to political and funding risks. External headwinds from a regional slowdown will weigh on export growth and on Bosnia and Herzegovina’s industrial sector, although the impact on headline growth should be modest. Economic growth is likely to remain moderate in 2020. Private consumption should remain solid on the back of declining unemployment and higher wages. However, slowing investment growth will weigh on the economy together with external headwinds from slowing regional growth and the risk of an escalation in global trade tensions.

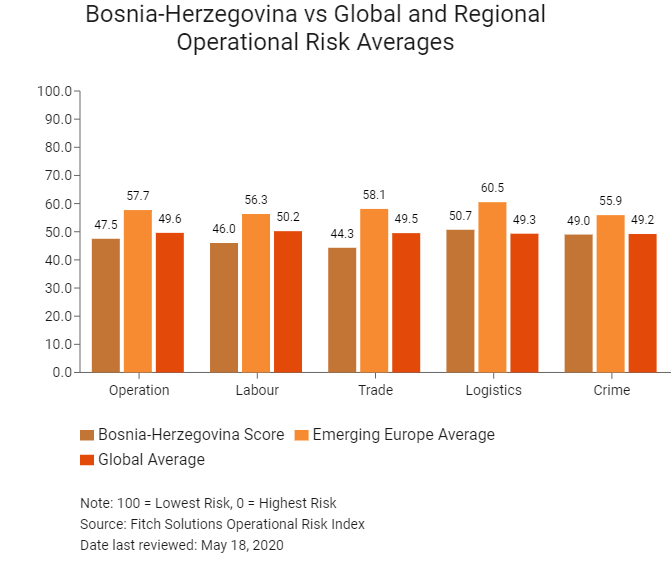

OPERATIONAL RISK

Bosnia offers an operating environment with significant operational risks, mainly relating to weak transport infrastructure, the limited size of the labour force, a fractured political environment and weak cross-border relationships. Even though the country has a relatively open investment climate with no restrictions on foreign direct investment and a low rate of corporate income tax, its small market size, shortage of skilled workers, complicated regulatory barriers and legal risks weigh down investor confidence. The transport network's poor coverage and quality increase the costs of freight transport and the risk of supply chain disruption. However, there are several ongoing projects with the aim to bring Bosnia's railway network up to par with EU railway legislation guidelines, including plans to build a high-speed rail connection between Sarajevo and Belgrade.

Source: Fitch Solutions

Date last reviewed: May 18, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

|

Operational Risk |

Labour Market Risk |

Trade and Investment Risk |

Logistics Risk |

Crime and Security Risk |

|

|

Bosnia and Herzegovina Score |

47.5 |

46.0 |

44.3 |

50.7 |

49.0 |

|

Southeast Europe Average |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Southeast Europe Position (out of 12) |

11 |

9 |

11 |

11 |

10 |

|

Emerging Europe Average |

57.7 |

56.3 |

58.1 |

60.5 |

55.9 |

|

Emerging Europe Position (out of 31) |

26 |

26 |

27 |

26 |

23 |

|

Global Average |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

|

Global Position (out of 201) |

108 |

124 |

120 |

90 |

103 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

|

Country/Region |

Operational Risk Index |

Labour Market Risk Index |

Trade and Investment Risk Index |

Logistics Risk Index |

Crime and Security Risk Index |

|

Slovenia |

69.2 |

57.7 |

63.5 |

74.1 |

81.4 |

|

Romania |

63.7 |

60.0 |

60.8 |

66.1 |

67.8 |

|

Cyprus |

62.7 |

56.0 |

66.0 |

63.0 |

65.8 |

|

Croatia |

62.5 |

53.2 |

56.9 |

70.3 |

69.5 |

|

Bulgaria |

61.7 |

58.2 |

63.6 |

60.9 |

64.1 |

|

Serbia |

58.2 |

59.6 |

60.1 |

60.7 |

52.4 |

|

Montenegro |

58.1 |

56.7 |

59.8 |

57.7 |

58.0 |

|

North Macedonia |

56.3 |

44.9 |

62.7 |

59.8 |

57.8 |

|

Turkey |

56.1 |

53.2 |

59.9 |

65.2 |

46.1 |

|

Albania |

48.3 |

44.2 |

43.3 |

48.3 |

57.4 |

|

Bosnia-Herzegovina |

47.5 |

46.0 |

44.3 |

50.7 |

49.0 |

|

Kosovo |

46.0 |

45.1 |

54.0 |

51.6 |

33.2 |

|

Regional Averages |

57.5 |

52.9 |

57.9 |

60.7 |

58.5 |

|

Emerging Markets Averages |

46.9 |

48.5 |

47.2 |

45.8 |

46.0 |

|

Global Markets Averages |

49.6 |

50.2 |

49.5 |

49.3 |

49.2 |

100 = Lowest risk; 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 18, 2020

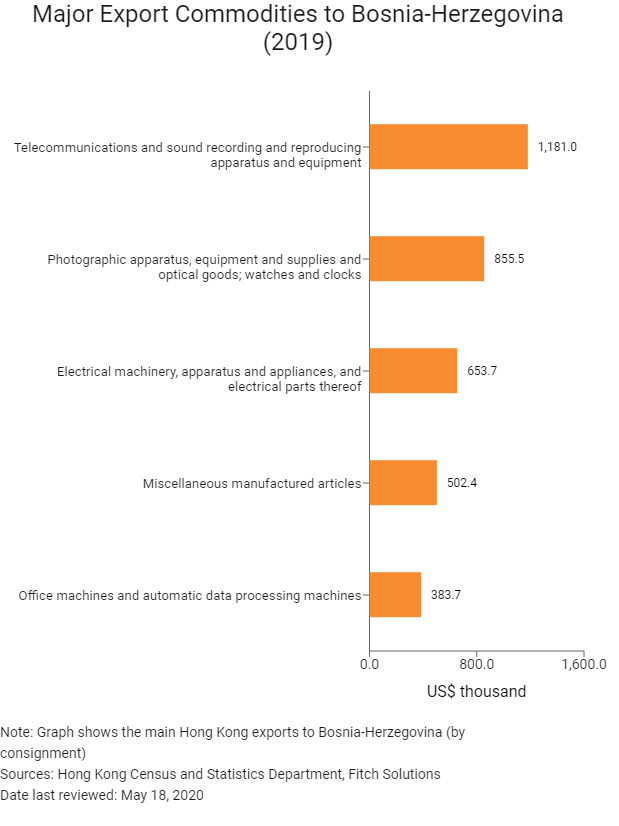

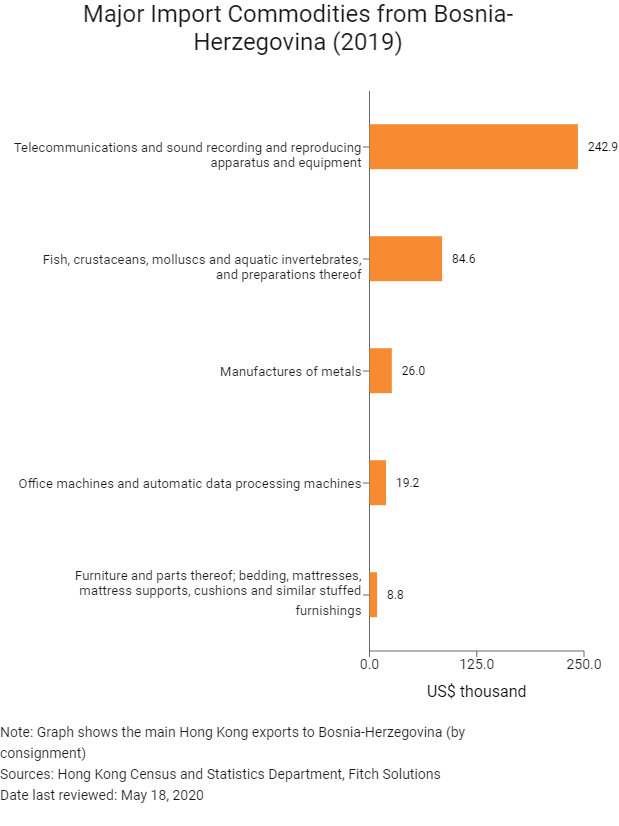

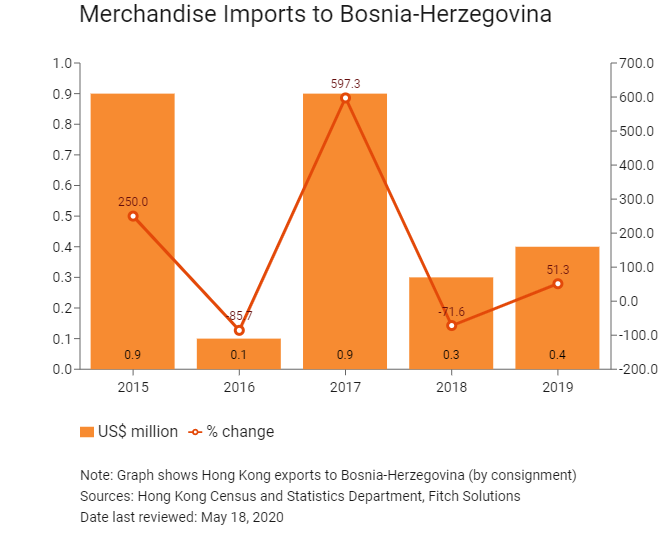

Hong Kong’s Trade with Bosnia and Herzegovina

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

|

2019 |

Growth rate (%) |

|

|

Number of Bosnian residents visiting Hong Kong |

993 |

-3.3 |

|

Number of European residents visiting Hong Kong |

1,747,763 |

-10.9 |

Source: Hong Kong Tourism Board

Date last reviewed: May 18, 2020

Commercial Presence in Hong Kong

|

2019 |

Growth rate (%) |

|

|

Number of Bosnian companies in Hong Kong |

N/A |

N/A |

|

- Regional headquarters |

||

|

- Regional offices |

||

|

- Local offices |

Treaties and Agreements between Hong Kong and Bosnia and Herzegovina

- The agreement between Mainland China and Bosnia and Herzegovina on the Promotion and Protection of Investments entered into force in January 2005. The duration of the initial treaty term is 10 years, with its purpose being to extend and intensify the economic cooperation between the two countries.

- The agreement on the abolition of visa requirements for holders of ordinary passports between Bosnia and Herzegovina and Mainland China was signed by the two countries in November 2017. The agreement stipulates that citizens of Bosnia and Herzegovina and Mainland China who are holders of valid passports will have no obligation to obtain visas for entry, exit, stay or transit through the territory of the other contracting party for up to 90 days within a 180-day period.

- The agreement on agricultural cooperation between Bosnia and Herzegovina and Mainland China was signed in November 2017. The signing of this agreement is opening the process of intensive communication between institutions and business communities in the field of agriculture and rural development in both countries, as well as providing further promotion of economic, scientific and technological cooperation in the aforementioned sectors.

- Bosnia and Herzegovina has a Double Taxation Agreement with Mainland China, which entered into force in December 1989.

Sources: Government Sources, Fitch Solutions

Visa Requirements for Hong Kong Residents

A tourist visa is not required for HKSAR passport holders for a stay up to 90 days. All travelers will need a passport valid for at least 90 days from the date of first entry into the territory of Bosnia and Herzegovina.

Source: Hong Kong Immigration Department

Date last reviewed: May 18, 2020

Bosnia and Herzegovina

Bosnia and Herzegovina