GDP (US$ Billion)

37.75 (2018)

World Ranking 98/193

GDP Per Capita (US$)

25,483 (2018)

World Ranking 37/192

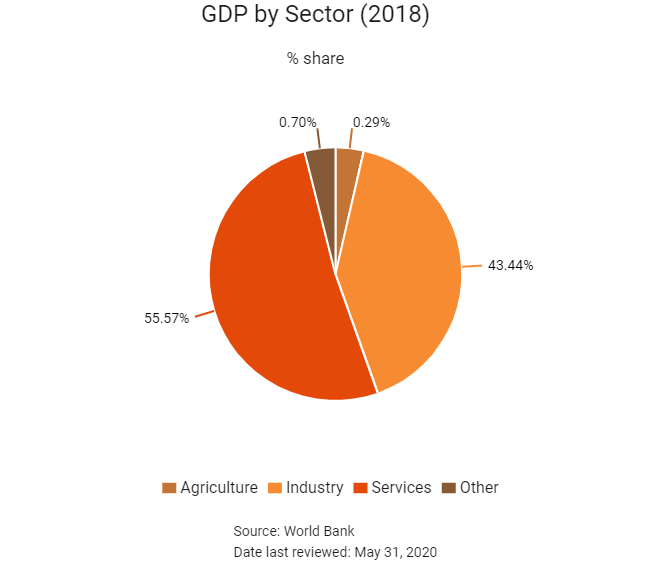

Economic Structure

(in terms of GDP composition, 2018)

External Trade (% of GDP)

151.6 (2018)

Currency (Period Average)

Bahrain Dinar

0.38per US$ (2019)

Political System

Constitutional monarchy

Sources: CIA World Factbook, Encyclopædia Britannica, IMF, Pew Research Center, United Nations, World Bank

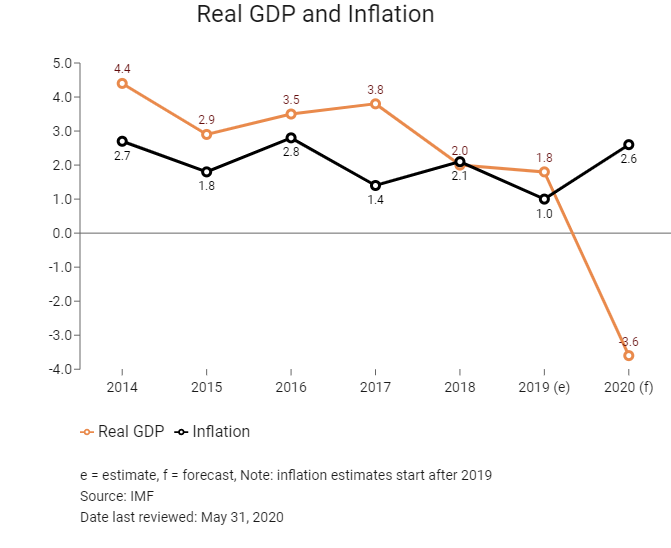

Overview

Oil has been the main force behind economic growth in Bahrain, accounting for more than 70% of GDP and 80% of government revenue. While the hydrocarbons sector remains the dominant industry in Bahrain, continuing efforts to boost trade growth and industrial diversification bode well for the economy in the medium-to-long term. Bahrain is looking to increase efforts to expand the renewables sector over the coming decade in order to curb an increasing gas import reliance. Non-oil industrial development is still at an early stage, but the country’s strong logistics profile and supportive industrial policies may provide a base for stronger manufacturing growth and less reliance on oil revenue. The Bahraini government's development plan for the country's future, Economic Vision 2030, is based on three guiding principles: sustainability, fairness and competitiveness. The Economic Development Board has led a programme of co-ordinated economic and institutional reform intended to transform Bahrain from a regional pioneer to a global contender. The ultimate aim of the plan is to ensure that every Bahraini household has at least twice as much disposable income in real terms by 2030.

Sources: World Bank, Ministry of Industry, Commerce and Tourism, Fitch Solutions

Major Economic/Political Events and Upcoming Elections

November 2018

The EDB and FinTech Consortium announced the launch of Bahrain FinTech Bay, which was the largest dedicated fintech hub in the Middle East and Africa.

November 2018

A high-level business delegation organised by the EDB conducted a nine-day visit to Mainland China. The long-term aim was to strengthen economic and trade ties between the two countries.

November 2018

Parliamentary and municipal elections held on November 24, 2018, were notable for greater participation of women and youth candidates. Turnout was reportedly 67%, which is up from the 53% reported at the last elections in 2014.

February 2019

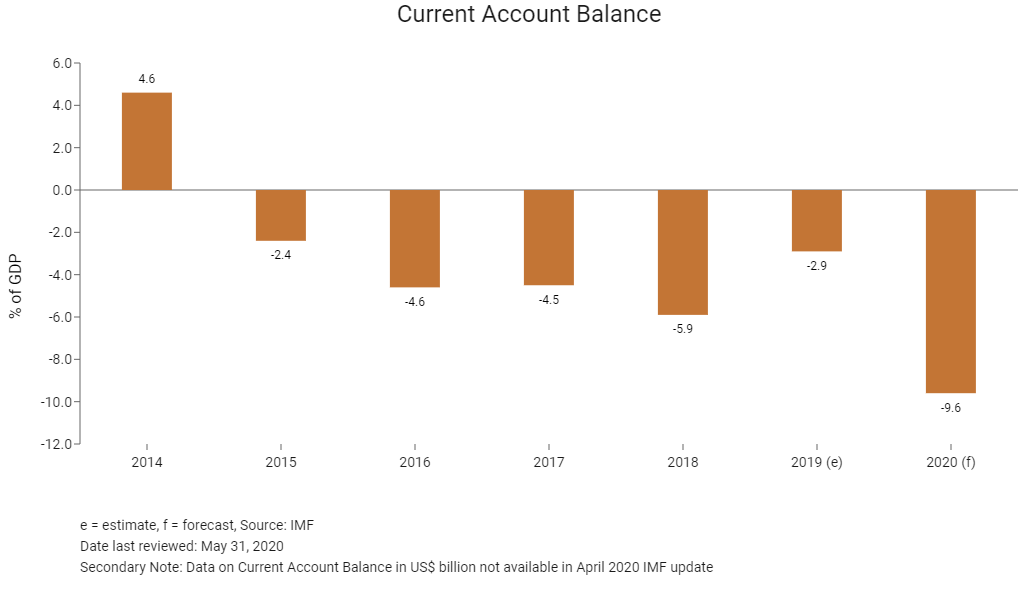

Bahrain's budget deficit dropped by 35% in 2018.

February 2019

Bahrain's sovereign wealth fund successfully raised USD600 million in Islamic bonds, marking a turnaround in credit conditions.

February 2019

The government published consultancy tenders for the Bahrain Metro project, having completed a feasibility study. The metro project included the introduction of driverless trains, cover 109 kilometres via six lines and had the capacity to transport 43,000 passengers an hour.

April 2019

Bahrain formalised the October 2018 agreement with Kuwait to support the Bahraini economy and King Salman of Saudi Arabia travelled to the state to discuss regional developments. The agreement related to a five-year USD10 billion pledge of financial aid package from Kuwait, Saudi Arabia and the United Arab Emirates (UAE) to rescue Bahrain from a potential debt crisis, partly caused by interruptions to oil output.

April 2019

Bahrain signed 12 agreements and MOUs worth USD2 billion with French companies, including Total and CFM International.

May 2019

Eagle Hills Dayar signed a finance agreement worth USD374 million with a syndicate of banks from the UAE and Bahrain for the construction of a shopping complex dubbed 'Marassi Galleria' and two hotels in Bahrain.

October 2019

A new 207,000sq m passenger terminal building at Bahrain International Airport was slated to open in March 2020. The BHD414.1 million (USD1.1 billion) project is being built by a joint venture of Arabtec and TAV Construction. The new terminal is expected to boost the capacity of the airport to around 14 million passengers annually.

March 2020

Bahrain announced its plans to launch a tender for the King Hamad Causeway project, which would connect Bahrain with Saudi Arabia, in 18-24 months. The project comprised a 25km road and rail offshore section adjacent to the existing King Fahad Causeway and a further 25km rail-only section.

May 2020

To contain the rapid spread of Covid-19, the authorities launched an USD11 billion stimulus package in effort to provide the private sector with short-term relief against virus-related disruptions to business activity. The stimulus package was largely composed of liquidity injections and also includes exemptions for businesses on industrial land rental and municipal fees for three months.

Sources: BBC Country Profile – Timeline, The Independent, Bridgeweb.com, Khaleej Times, The National, Independent, Al Jazeera, Reuters, Fitch Solutions

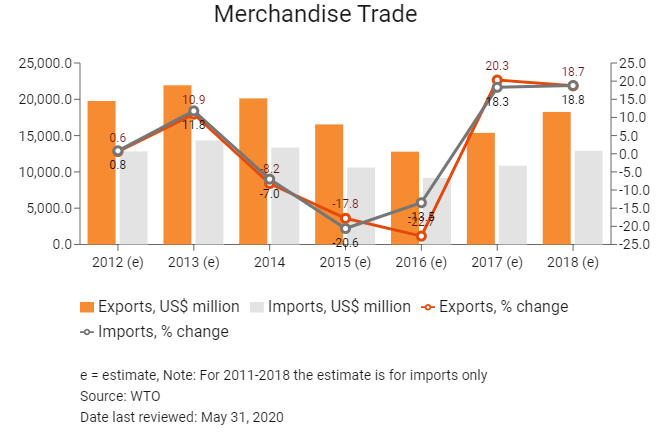

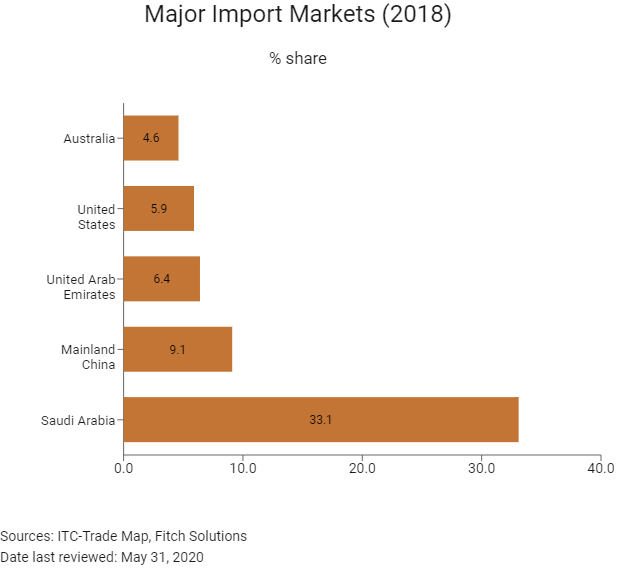

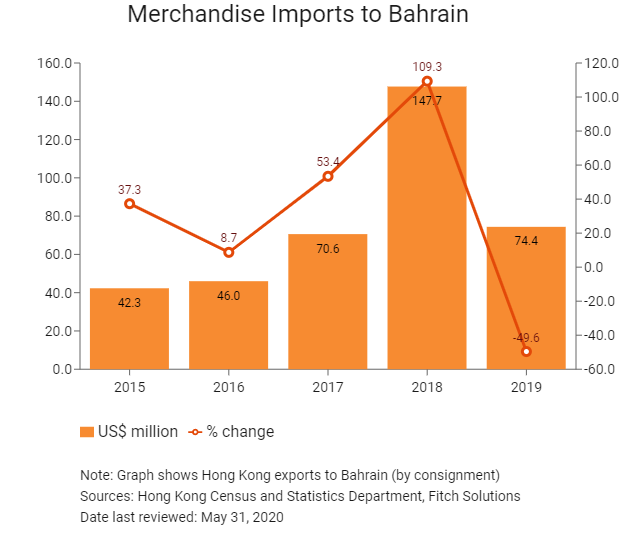

Merchandise Trade

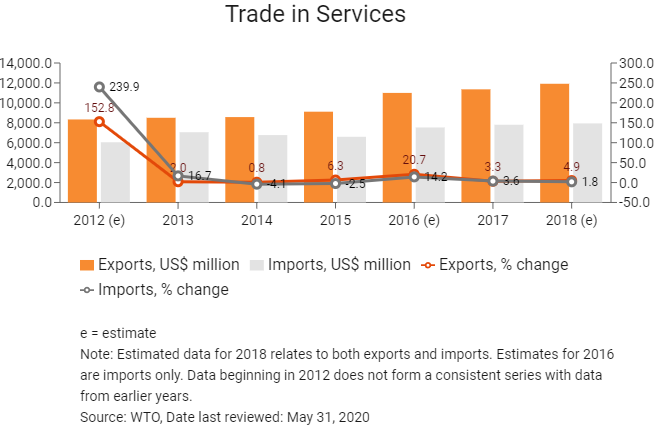

Trade in Services

- Bahrain has been a World Trade Organization (WTO) member since January 1, 1995, and a member of the General Agreement on Tariffs and Trade (GATT) since December 13, 1993. Bahrain is a signatory of the WTO Rule of Origin Agreement, the WTO Trade Facilitation Agreement and the WTO Protocol Amending the Marrakesh Agreement. Bahrain is also a signatory to the Istanbul Temporary Admission Convention, the Harmonised System Convention, and the International Convention on the Simplification and Harmonisation of Customs Procedures.

- Bahrain has a relaxed trade regime with minimal tariff and non-tariff trade barriers for the majority of its trading partners.

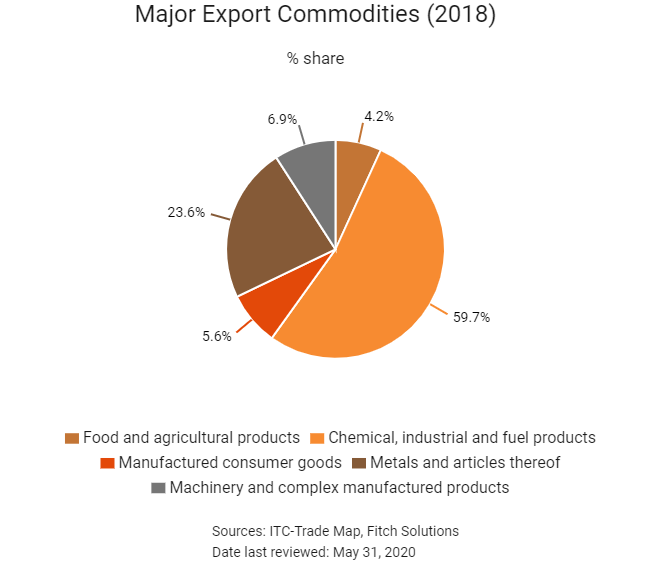

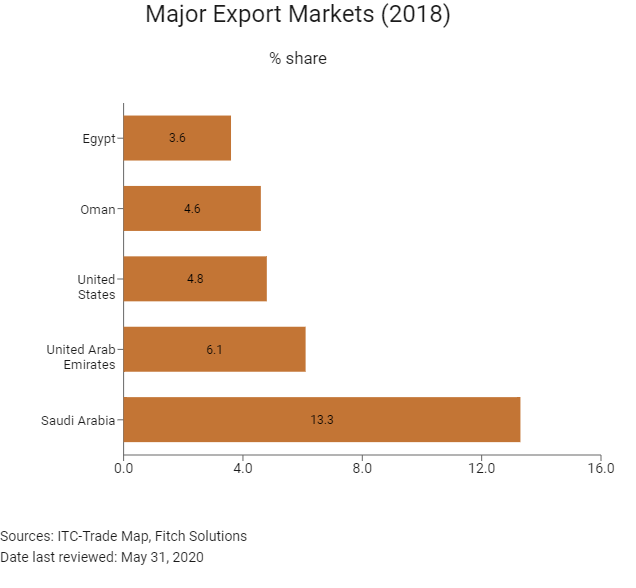

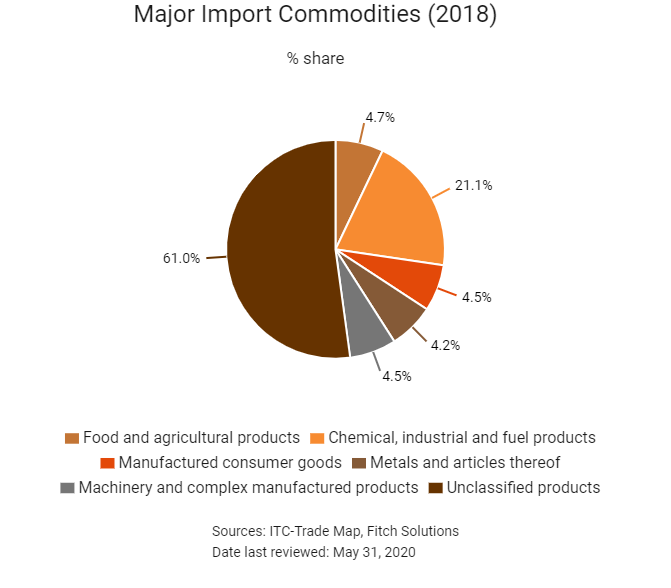

- In light of the global slump in crude prices, Bahrain's trade balance was shielded by the kingdom's growing export revenue from services. For example, when Bahrain's total export revenue decreased by about 17.8% between 2014 and 2015 and by another 22.7% between 2015 and 2016, export revenue derived from services increased by 6.3% between 2014 and 2015 and by around 20% between 2015 and 2016. In 2018 revenue derived from services exports amounted to around USD11.9 billion. In 2018 (latest available data), the main service which Bahrain derived export revenue from was telecommunications services. However, secondary sector industries such as refined fuel production, metal product manufacturing (mainly aluminium) and machinery play the most significant role in terms of the country's exports and imports.

- Bahrain is a member of the Gulf Cooperation Council (GCC), along with Saudi Arabia, the United Arab Emirates, Oman, Kuwait and Qatar. The GCC is a political and economic organisation that was created in the 1980s, but since 2015 a customs union has also been launched between the six member states. The country's GCC membership means that it is part of a single market and customs union with a common external tariff.

- A tariff of only 5% is imposed on the majority of items imported to Bahrain from non-GCC countries and there is a single point of entry where tariffs are collected once imports enter the GCC. Only certain sensitive goods imported from GCC countries face tariffs and there is freedom of movement between GCC countries without customs or non-customs restrictions.

- In June 2016, the GCC nations approved plans to double the tariff on imported tobacco from 100% to 200% in mid-2016. United States tobacco importers are exempt owing to pre-existing free trade agreements.

- Bahrain implemented excise tax on December 30, 2017, pursuant to the GCC's unified law on selective excise taxes.

- There are signed bilateral investment treaties (BITs) between Bahrain and the following areas: Algeria, Belarus, Brunei, Mainland China, Czech Republic, Egypt, France, Germany, Iran, Italy, Jordan, Lebanon, Malaysia, Mexico, Morocco, the Netherlands, Pakistan, Russia, Singapore, Spain, Syria, Thailand, Turkey, the United Kingdom and the United States. BITs with the Belgium-Luxembourg Economic Union, Bulgaria, Sudan, Turkmenistan, Uzbekistan and Yemen are signed but not yet in force.

Sources: WTO – Trade Policy Review, World Bank, UNCTAD, Fitch Solutions

Multinational Trade Agreements

Active

- GCC Customs Union: This customs union, which entered into force on January 1, 2003, seeks to enhance ties between member countries. The customs union also seeks to harmonise member countries' economic, financial and monetary policies, and commercial and industrial legislation and customs laws. The union also seeks to lay the steps towards building a common market and an economic and monetary union between the member states. Because two out of five of Bahrain's top export and top import partners are all members of the GCC, all of Bahrain's trade with these countries is tariff free. All members benefit from having a common external customs tariff, common customs regulations and procedures and unified standards and specifications for all products. There is freedom of movement between the GCC countries for the vast majority of goods without restrictions. This reduces the overall time and cost burdens for supply chains.

- Pan-Arab Free Trade Area (PAFTA): PAFTA was established in order to create an Arab economic bloc that could effectively compete with other countries while ensuring that member countries increased trade with each other. PAFTA entered into force on January 1, 1998. The most important aspect of the agreement was that over the next 10 years (to 2008), each member country would seek to reduce customs fees by 10% per annum as well as gradually eliminate trade barriers. In March 2001, the member countries decided to reduce the period over which the reductions in tariffs could be made so as to speed up the process, and, in January 2005 the elimination of most tariffs among PAFTA members was enforced. Two out of five of Bahrain's top export markets are members of PAFTA, as well as many of its smaller trading partners.

- The GCC and European Free Trade Association (EFTA): This agreement, which applies to the trade in goods and services, was signed on June 22, 2009, and entered into force on July 1, 2014. The signatories to the agreement seek to liberalise their markets. The non-trade aspects seek to enhance the economic relations between the member countries. While EFTA member states (Norway, Switzerland, Iceland and Lichtenstein) are far removed from Bahrain and there is no considerable trade between the countries, it may promote further trade in the future.

- GCC-Singapore FTA (GSFTA): GSFTA was signed on December 15, 2008, and the agreement entered into force on September 1, 2013. GSFTA is a comprehensive free trade agreement (FTA) between Singapore and the GCC countries that includes the trade in goods and services. The FTA also includes provision to foster greater investment between the signatories. In the case of trade, the rules of origin and customs procedures for goods between the countries have been simplified. Furthermore, the agreement seeks to create a level playing field as far as government procurement is concerned. Singapore is one of Bahrain's import suppliers and, therefore, Bahrain has benefitted from tariff eliminations on 99% of Singaporean domestic exports to the GCC.

- Bahrain-United States FTA: This agreement entered into force on August 1, 2006. On the first day the agreement took effect, 100% of the two-way trade in industrial and consumer products began to flow without tariffs. The United States is one of Bahrain's top five exporting partners and import suppliers. The removal of tariffs on all bilateral trade between the countries in terms of industrial and consumer products (with the exception of a few agricultural items) has been highly beneficial. The FTA also promotes economic reforms and liberalisation in the Middle East. The United States-Bahrain BIT, which entered into force on May 30, 2001, covers investment issues between the two countries.

Under Negotiation

- Australia-GCC FTA: Negotiations with the GCC commenced in July 2007. These negotiations were preceded by bilateral FTA negotiations with the United Arab Emirates, which were abandoned following a decision by GCC ministers to only negotiate FTAs as a group. To date, there have been four rounds of Australia-GCC FTA negotiations, with the last one held in June 2009. Australia and the GCC share a significant economic relationship, encompassing trade and investment across a broad range of goods and services. The GCC is a key market for agricultural exports such as livestock, meat, dairy products, vegetables, sugar, wheat and other grains. The agreement provides an opportunity to address a range of tariff and non-tariff barriers. An Australia-GCC FTA would provide an opportunity to reduce barriers to trade in mineral commodities and automotive parts. Provisions on investment would encourage inward investment from the GCC and enhance security for Australian investments in GCC countries themselves, including in such areas as mining or the development of educational campuses. No progress is expected on an FTA with the GCC while the intra-Gulf tensions, which commenced in June 2017, remain unresolved.

- Mainland China-GCC FTA: In July 2004, the launch of Mainland China-GCC FTA negotiations was announced. Thus far, the two parties have held nine rounds of negotiations and have reached an agreement on the majority of issues concerning trade in goods. Negotiations on trade in services have also been launched. Greater trade liberalisation will help to develop the industrial and service sectors.

- India-GCC FTA: The agreement is expected to remove restrictive duties, push down tariffs on goods and pave the way for more intensive economic engagement between the nations. More than 50% of India's oil and gas comes from GCC states.

Postponed/Suspended

Japan-GCC FTA: This agreement will seek to reduce tariffs and the liberalisation of services trade and investment. Japan mainly imports aluminium, natural gas, liquid natural gas and petroleum products from the GCC, while Japan mainly exports electronics, vehicles, machinery and other industrial products to the GCC.

Sources: WTO Regional Trade Agreements database, European Commission, Australian Government Department of Foreign Affairs and Trade, BH-US Free Trade Agreement, State Department, United States Trade Representative, UNCTAD, Fitch Solutions

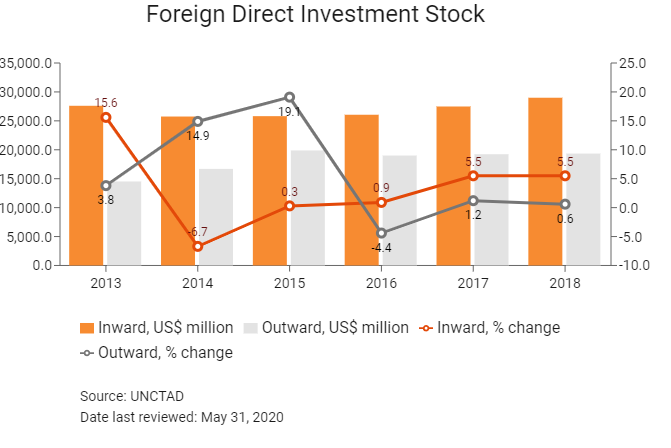

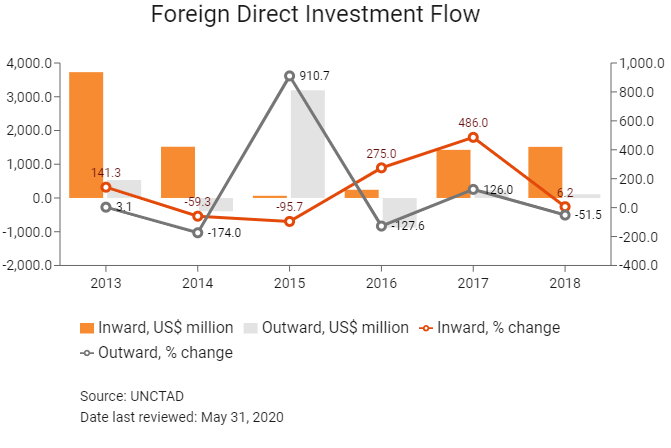

Foreign Direct Investment

Foreign Direct Investment Policy

- The government actively encourages investment in sectors that are export oriented and do not compete with established local companies. Bahrain provides a free, open and transparent environment for businesses and has a globally competitive value-creation story that focuses on sustainability, skills and good governance. There is no requirement for foreign businesses to gain local sponsorship in order to be able to gain entry into the domestic market.

- State-owned enterprises only dominate the oil and gas market, and the Bahraini government encourages private investment in all other critical sectors through significant tax breaks, various special economic zones (SEZs) and industrial parks, and a sound legal environment. There is an increasing trend towards privatisation. No industry is closed to foreign investors.

- To carry out any commercial activity in Bahrain, a legal vehicle should be established in accordance with the Bahrain Commercial Companies Law No. 21 of 2001. Foreign investors are able to establish a 100% foreign-owned entity in Bahrain under certain conditions. However, for some business activities (such as trading) there is a limitation on foreign ownership and a local partner would be required. Since 2001 the kingdom has been heavily inclined towards increasing privatisation across all sectors, with the state holding company being mandated to reduce its shares in any company to less than 50%. If an international company wishes to establish a branch office in Bahrain, no local sponsor or partner is required.

- There are no exchange control restrictions on converting or transferring funds. Bahrain has no withholding or thin capitalisation rules in relation to the financing arrangements in Bahrain.

- Bahrain has signed the Gulf Cooperation Council (GCC) VAT Framework Agreement in relation to implementing a VAT from 2018, and in January 2019 Bahrain introduced VAT at a standard rate of 5%. Previously, VAT was not applicable to goods and services in Bahrain with the exception of hotels, short-term lease apartment rental rates and certain restaurants, which were subject to a 10% tourism levy on the gross income and a 12% sales tax on gasoline included in the price.

- Foreigners and nationals of other GCC states are permitted to own land and real estate in areas designated by the Bahraini government. The areas designated are all located within significant commercial or manufacturing or residential districts, specialised industrial zones or near key transport hubs.

- The Bahraini government prohibits foreign business ownership in press and publications, Islamic pilgrimage services, clearance offices, and workforce agencies.

- The Bahraini government maintains complete ownership over all oil reserves, refineries and related services. Private investment is allowed and encouraged in other state-dominated industries, such as transport, aluminium manufacturing, telecommunications and construction.

- Tax rates in Bahrain, as in the rest of the GCC, continue to be highly favourable because the country does not charge any corporate tax for companies in non-oil sectors. There is no personal income tax for residents and non-residents in Bahrain and there are no capital gains or estate duty taxes.

- In January 2019, the Bahrain Economic Development Board announced that it had attracted investments worth US$830.0 million in 2018.

Source: WTO – Trade Policy Review, Bahrain Economic Development Board, Fitch Solutions

Free Trade Zones and Investment Incentives

Free Trade Zone/Incentive Programme | Main Incentives Available |

| The Bahrain International Investment Park (BIIP), located five minutes from the Bahrain International Airport and Khalifa Bin Salman Port, was established in 2005 by the Ministry of Industry, Commerce and Tourism as the country's flagship business park. BIIP is a key driver in developing Bahrain's economy, approximately 80% of investment in BIIP comes from international businesses. The BIIP is not a free zone but rather an integral part of the GCC. | - 100% foreign ownership 0% corporate tax (with a 10 year guarantee) - Exemption from import duties on raw materials, plant machinery and spare parts imported for manufacturing - Duty-free access to all GCC markets, the United States, Singapore, Norway, Switzerland, Iceland and Lichtenstein. Products manufactured in Bahrain and sold into GCC countries and other Arab markets are free of import duties - 100% repatriation of capital, profits and dividends - No recruitment restrictions for the first five years - No minimum capital required - Access to financial grants and training support - Competitively low operating costs |

| The Bahrain Logistics Zone (BLZ) | - The BLZ is operated by ports and maritime affairs at the Ministry of Transportation and Communications. The zone is designed to offer local, regional and international companies a base from which to operate in a bonded area in order to take advantage of Bahrain's highly advantageous position to access GCC and regional markets quickly and economically

|

Sources: Kingdom of Bahrain Ministry of Industry, Commerce and Tourism, Bahrain Logistics Zone, Bahrain International Investment Park, Fitch Solutions

- Value Added Tax: 5%

- Corporate Income Tax: 0%

Sources: National Bureau for Revenue, Kingdom of Bahrain Ministry of Finance and National Economy, National Bureau for Revenue

Important Updates to Taxation Information

Bahrain began to implement VAT as of January 1, 2019, in line with some GCC peers. The GCC unified VAT and excise treaties outlined that a uniform VAT standard rate of 5%, with some limited exceptions, will be applicable when each GCC member state implements VAT and that the implementation had to take place before January 1, 2019. The mandatory threshold for businesses in Bahrain has been set at BHD37,500, which will be adjusted up in June 2019.

Business Taxes

Type of Tax | Tax Rate and Base |

| Corporate Tax | - There is no base corporate tax applicable in Bahrain - Only oil and gas companies pay a corporate tax of 46% on profits from sales of oil, gas and secondary products |

| Social Security Contributions | The employer's social security contribution is 12% for Bahraini workers and 3% for non-Bahraini workers, applicable up to an income ceiling of BHD4,000 per month |

| VAT | 5%, generally. However, zero rating applies to: basic food items in the GCC list; primary, secondary and higher educational institutions; general health services, vaccinations and medicines; interest payments on loans and life insurance contracts; vehicle fuel, motor oil and cooking gas; building materials and photovoltaic cells and equipmet to produce electricity and hot water; sale and rental of real estate; airplane tickets and buses and taxis |

| Municipal Tax | 10% municipality tax levied on the rental of commercial and residential property to expatriates |

| Stamp Duty | Stamp duty at 2% is applied to the transfer or registration of real estate; If payment is made within two months following the transaction date, the rate is reduced to 1.7% |

Sources: National Bureau for Revenue, Kingdom of Bahrain Ministry of Finance and National Economy

Date last reviewed: March 15, 2020

Foreign Worker Permits

All foreign workers – except for GCC nationals – require a work permit to work in Bahrain. In general, if all the paperwork is correctly submitted and the foreign worker has a company willing to sponsor them and pay additional fees, then this process is not exceptionally time consuming or costly. The Labour Market Regulatory Authority regulates the granting of work visas to foreign nationals wanting to work in Bahrain. A work permit may only be obtained once the applicant has a formal letter of an offer of employment from an employer in Bahrain, which must be submitted with the work permit application. Reforms enacted in August 2017 mean that a 'flexible' work permit can now be applied for that does not link a foreign worker to one particular sponsor and enables a foreign worker to have multiple employers for a period of up to two years. This should improve the availability of labour in the kingdom, but the cost of such permits is high.

Localisation Requirements

The Bahraini government is attempting to increase the employment of its citizens in the private sector. This is known as the Bahrainisation policy and employers have to pay fees in order to obtain employment visas for their foreign employees. Currently, the fee for a two-year employment visa is BHD200. All public and private companies are required to pay a monthly levy with respect to each expatriate that is employed. The levy is charged at a rate of BHD5 per employee for the first five expatriate employees and BHD10 for each expatriate employee thereafter. Since January 2015, an additional fee of BHD72 for health insurance when issuing or renewing a visa for an expat has been introduced. This fee may not be applicable if the employer provides compulsory health insurance for the employee.

Businesses are expected to prioritise the employment of Bahraini nationals. Some sectors have various ratios of local to foreign worker numbers with which they must comply. The Bahraini public sector has been one of the larger employers of Bahraini nationals in the past, but with state revenue significantly decreased, the government is enforcing stronger compliance of its Bahrainisation policy in order to account for the shortfall. This is demonstrated by the recent proposal by Bahrain's parliament to make amendments to Article 11 of the 2010 Civil Service Law, which stipulates who is eligible to hold a government job. The proposal is to have 100% Bahrainisation in the public sector. This includes all companies in which the Bahraini government owns a majority stake (51% and above). Some members of parliament called to have all expats currently holding public sector positions replaced by Bahrainis by October 2019. Longer-serving members of parliament have suggested that replacement take place over a four-year period to allow for adequate skills transfer. On implementation, firms in the public sector will not be able to hire foreign workers, limiting their skills and production potential in the future. The online Bahrainisation Calculator enables employers to check if they meet the minimum threshold for the employment of Bahrainis in their establishment.

Visa/Travel Restrictions

All business visitors to Bahrain who are not nationals of other GCC states need to obtain a visa to visit the country. This can be done on arrival or in advance. Although visitors to the country who have stamps in their passports from Israel will experience less trouble when attempting to enter Bahrain than in other Gulf States, it is up to Bahraini officials to determine whether that visitor is permitted to enter the country.

Bahrain claims to have the most flexible visa policies in the region, with residence permits easy to obtain for anyone establishing a company in the country. A visa on arrival can be issued to citizens from 67 countries and 114 nationalities are eligible for online visas.

Religious/Cultural Barriers

The Bahraini labour authorities strictly regulate female participation in the workplace for various cultural and religious reasons. In certain cases, women are not allowed to work at night (determined on a case-by-case basis) and the labour authority is allowed to prohibit certain types of work for women.

Kafala Sponsorship System

In 2009 Bahrain announced that it would begin dismantling the sponsorship system known as the kafala system that governs foreign labourers. Bahrain established the Labour Market Regulatory Authority and said that new legislation would permit migrant workers in Bahrain to change employers without their employer's consent. However, while the system has been improved, in practice it is still difficult for migrant workers to change employers. For example, an amendment that was made in 2011 – in response to recruitment agencies lobbying against the changes – means that a worker needs to wait one year before legally being able to change to a new employer. This means that it may be easier for employers to recruit foreign workers from outside Bahrain rather than recruit from the country's large pool of migrant workers.

Sources: Labour Market Regulatory Authority, Migrant Forum in Asia, Nationality, Passports & Residence Affairs, Bahrainisation Calculator, Fitch Solutions

Sovereign Credit Ratings

Rating (Outlook) | Rating Date | |

| Moody's | B2 (Stable) | 17/12/2018 |

| Standard & Poor's | B+ (Stable) | 26/03/2020 |

| Fitch Ratings | BB- (Stable) | 12/11/2019 |

Sources: Moody's, Standard & Poor's, Fitch Ratings

Competitiveness and Efficiency Indicators

World Ranking | |||

2018 | 2019 | 2020 | |

| Ease of Doing Business Index | 66/190 | 62/190 | 43/190 |

| Ease of Paying Taxes Index | 5/190 | 5/190 | 1/190 |

| Logistics Performance Index | 59/160 | N/A | N/A |

| Corruption Perception Index | 99/180 | 77/180 | N/A |

| IMD World Competitiveness | N/A | N/A | N/A |

Sources: World Bank, IMD, Transparency International

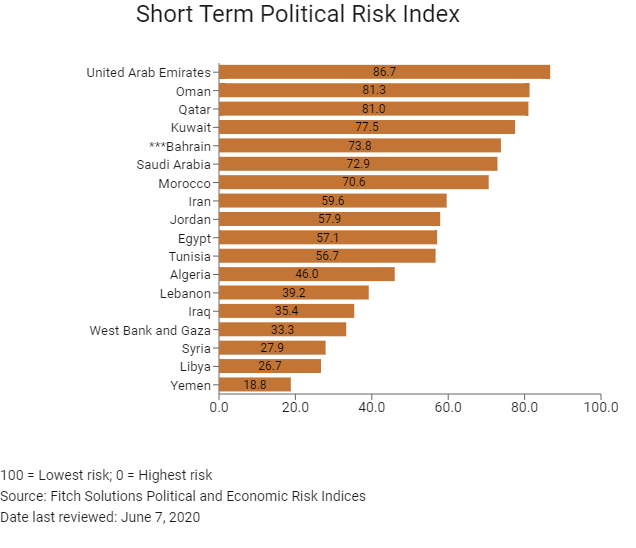

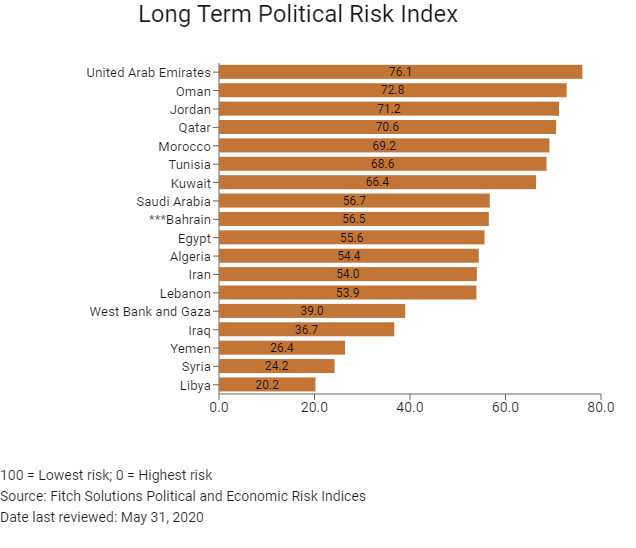

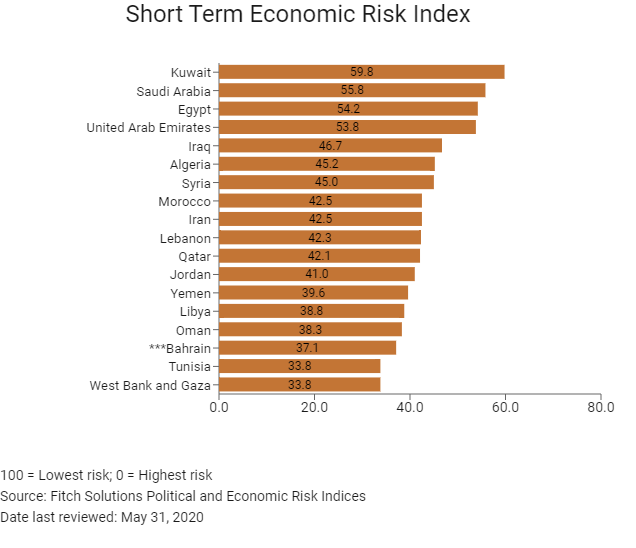

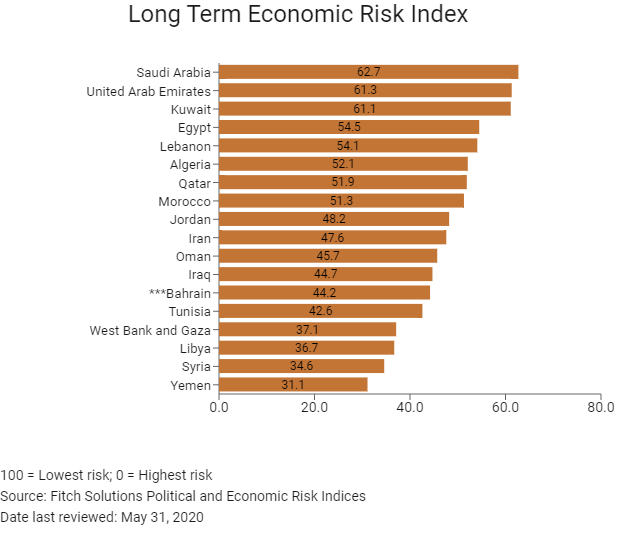

Fitch Solutions Risk Indices

World Ranking | |||

2018 | 2019 | 2020 | |

| Economic Risk Index Rank | 109/202 | 134/201 | 148/201 |

| Short-Term Economic Risk Score | 42.1 | 44.2 | 37.1 |

| Long-Term Economic Risk Score | 50.8 | 47.2 | 44.2 |

| Political Risk Index Rank | 122/202 | 127/201 | 126/201 |

| Short-Term Political Risk Score | 71.7 | 73.8 | 73.8 |

| Long-Term Political Risk Score | 57.5 | 56.5 | 56.5 |

| Operational Risk Index Rank | 38/201 | 40/201 | 35/201 |

| Operational Risk Score | 64.6 | 64.4 | 66.5 |

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Risk Summary

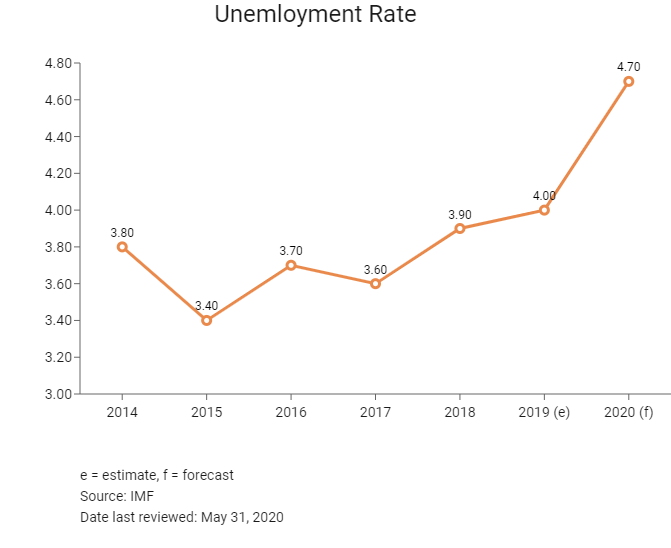

ECONOMIC RISK

The implementation of a VAT and tighter government finances will weigh on private consumption and fixed capital formation; however, the effects will soon dissipate. Growth is expected to moderate in the near term owing to constrained government spending and weaker household spending growth, while volatile oil prices cloud the outlook. Nonetheless, financial support from Gulf allies, the completion of Alba’s Line 6 expansion project and continued infrastructure spending will underpin growth. Bahrain's heavy reliance on regional peers such as Saudi Arabia and the United Arab Emirates as key export markets is a vulnerability, as these markets are highly exposed to fluctuations in crude prices. Economic growth will likely accelerate in 2020 owing to support from the country’s Gulf allies, the expansion of the non-oil sector and low interest rates. Moreover, the commencement of operations at Bahrain’s first LNG regasification terminal should provide the energy sector with some impetus, although potential sharper OPEC+ production cuts are a downside risk.

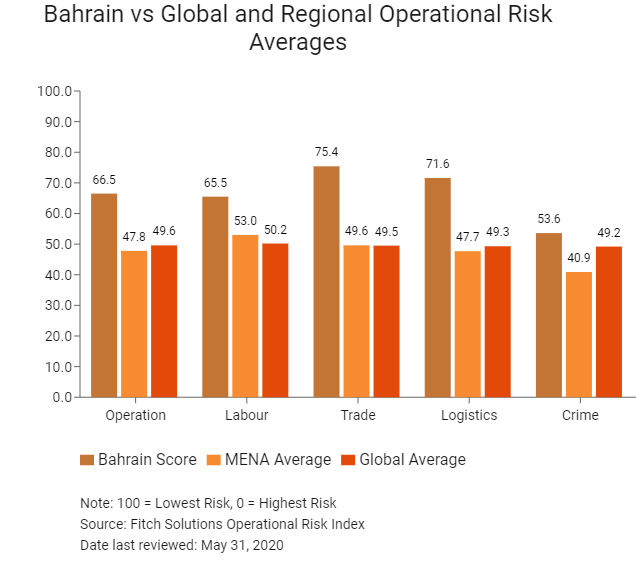

OPERATIONAL RISK

Bahrain is one of the top GCC and Middle East and North Africa regional outperformers in terms of its operating environment. The kingdom's key strengths lie in its logistical profile and trade and investment environment. With Bahrain's modern and well-connected utilities and transport infrastructure, businesses and their supply chains will find few risks of any type of utilities shortages or outages or poor-quality transport systems causing them headwinds. Bahrain has a relatively streamlined regulatory framework while allowing 100% foreign ownership in most sectors. The absence of a national minimum wage, low labour contributions and flexible labour regulations offer firms a low-cost labour environment and improve the ability of companies to adjust their labour in response to market shocks. However, Bahrain has a small pool of local labour, both skilled and unskilled, thus necessitating the import of foreign workers in a broad range of industries. Overall, with good availability, the low cost of utilities, and a highly receptive trade and investment environment, Bahrain is one of the least expensive places in the world to set up certain business ventures.

Source: Fitch Solutions

Date last reviewed: May 31, 2020

Fitch Solutions Political and Economic Risk Indices

Fitch Solutions Operational Risk Index

Operational Risk | Labour Market Risk | Trade and Investment Risk | Logistics Risk | Crime and Security Risk | |

| Bahrain Score | 66.5 | 65.5 | 75.4 | 71.6 | 53.6 |

| MENA Average | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

| MENA Position (out of 18) | 2 | 4 | 2 | 2 | 6 |

| Global Average | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

| Global Position (out of 201) | 35 | 21 | 12 | 31 | 84 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Country/Region | Operational Risk Index | Labour Market Risk Index | Trade and Investment Risk Index | Logistics Risk | Crime and Security Risk Index |

| United Arab Emirates | 71.6 | 70.6 | 77.5 | 68.0 | 70.5 |

| Bahrain | 66.5 | 65.5 | 75.4 | 71.6 | 53.6 |

| Qatar | 66.0 | 66.7 | 62.3 | 73.7 | 61.2 |

| Oman | 64.9 | 62.7 | 63.4 | 64.2 | 69.2 |

| Saudi Arabia | 63.6 | 68.3 | 65.8 | 62.5 | 57.7 |

| Jordan | 57.1 | 58.4 | 62.9 | 54.8 | 52.3 |

| Kuwait | 55.5 | 58.7 | 56.2 | 50.8 | 56.2 |

| Morocco | 54.6 | 45.0 | 65.3 | 54.9 | 53.2 |

| Egypt | 49.4 | 50.7 | 48.8 | 55.2 | 42.9 |

| Tunisia | 47.1 | 41.0 | 58.5 | 46.7 | 42.3 |

| Lebanon | 43.6 | 54.0 | 49.8 | 40.9 | 29.7 |

| Iran | 43.1 | 48.7 | 36.4 | 52.8 | 34.4 |

| Algeria | 39.6 | 48.6 | 32.7 | 41.0 | 36.2 |

| West Bank and Gaza | 31.6 | 48.3 | 34.1 | 27.1 | 17.0 |

| Libya | 29.3 | 43.4 | 29.9 | 26.6 | 17.1 |

| Syria | 28.6 | 42.6 | 29.2 | 27.6 | 15.0 |

| Iraq | 26.7 | 43.5 | 24.1 | 26.9 | 12.4 |

| Yemen | 21.8 | 37.8 | 19.6 | 13.9 | 16.1 |

| Regional Averages | 47.8 | 53.0 | 49.6 | 47.7 | 40.9 |

| Emerging Markets Averages | 46.9 | 48.5 | 47.2 | 45.8 | 46.0 |

| Global Markets Averages | 49.6 | 50.2 | 49.5 | 49.3 | 49.2 |

100 = Lowest risk, 0 = Highest risk

Source: Fitch Solutions Operational Risk Index

Date last reviewed: May 31, 2020

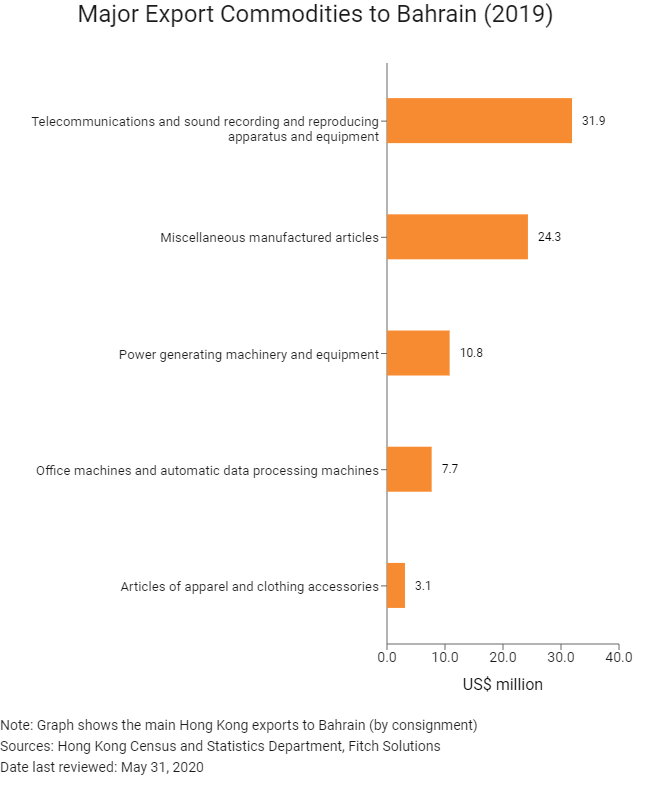

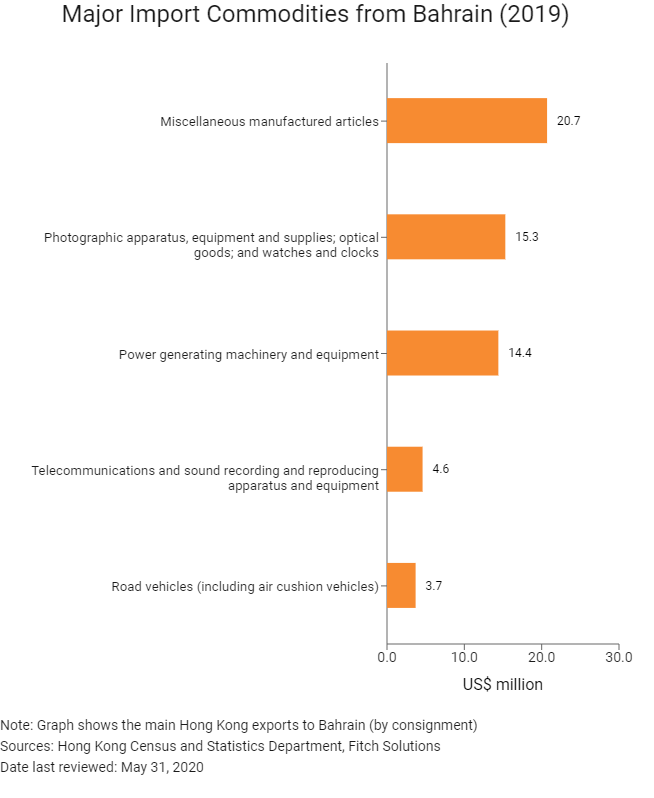

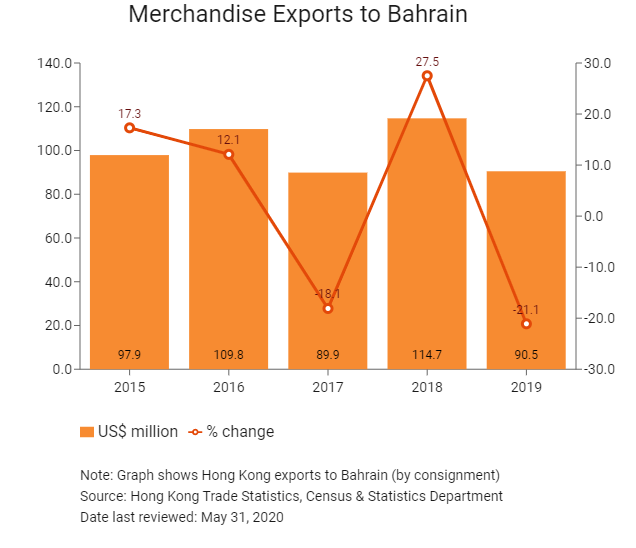

Hong Kong’s Trade with Bahrain

Exchange Rate HK$/US$, average

7.75 (2015)

7.76 (2016)

7.79 (2017)

7.83 (2018)

7.77 (2019)

2019 | Growth rate (%) | |

| Number of Bahrain citizens visiting Hong Kong | 1,132 | -14.5 |

| Number of Middle East residents visiting Hong Kong | 113,849 | -12.8 |

Source: Hong Kong Tourism Board

Date last reviewed: May 31, 2020

Commercial Presence in Hong Kong

2019 | Growth rate (%) | |

| Number of Bahraini companies in Hong Kong | N/A | N/A |

| - Regional headquarters | ||

| - Regional offices | ||

| - Local offices |

Treaties and Agreements between Hong Kong and Bahrain

- There is a BIT between Bahrain and Mainland China that entered into force on April 27, 2000.

- Bahrain has a Tax Treaty with Mainland China that has been applicable since January 1, 2003.

- In April 2019, Hong Kong and Bahrain signed an Investment Promotion and Protection Agreement.

Sources: Inland Revenue Department, Hong Kong Trade and Industry Department

Chamber of Commerce (or Related Organisations) in Hong Kong

Arab Chamber of Commerce & Industry

The Arab Chamber of Commerce & Industry (ARABCCI) was established in Hong Kong in 2006 to promote commercial ties between Hong Kong, Mainland China and the Arab World.

Address: 20/F, Central Tower, 28 Queens Road, Central, Hong Kong

Email: info@arabcci.org, secretariat@arabcci.org

Tel: (852) 2159 9170

Fax: (852) 2159 9688

Source: The Arab Chamber of Commerce & Industry, Hong Kong

Bahrain Consulate in Hong Kong

Address: 22/F, Chevalier Commercial Centre, 8 Wang Hoi Road, Kowloon Bay, Hong Kong

Email: info@bahrainconsulate.org.hk

Tel: (852) 3171 1199

Fax: (852) 2368 2399

Source: Visa on Demand

Visa Requirements for Hong Kong Residents

A Bahrain tourist visa is required for HKSAR passport holders. Nine visa types are available, with a one-year, multiple-entry visa permitting stays of up to 90 days.

Source: Visa on Demand

Date last reviewed: May 31, 2020

Bahrain

Bahrain